by Don Vialoux, EquityClock.com

Technical Notes for September 21st

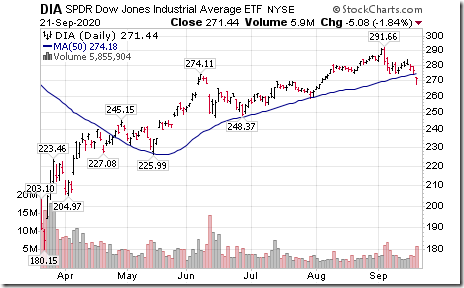

Dow Jones Industrial Average and its related ETF moved below their 50 day moving average at

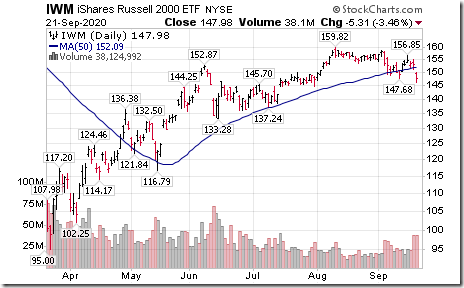

Ditto for the Russell 2000 Index and its related ETF!

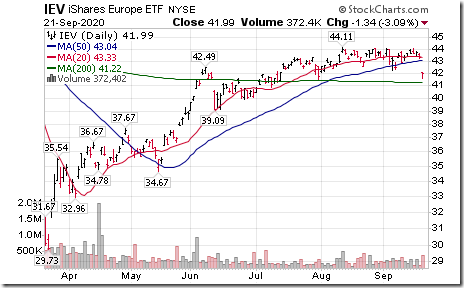

Europe iShares (IEV) moved below $42.30 completing a double top pattern.

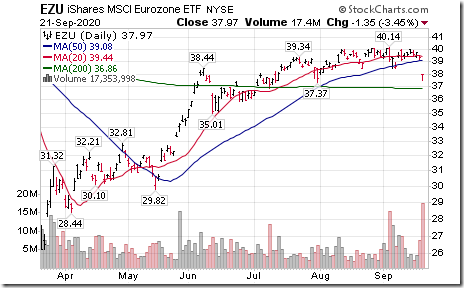

Eurozone iShares (EZU) moved below $38.45 completing a double top pattern.

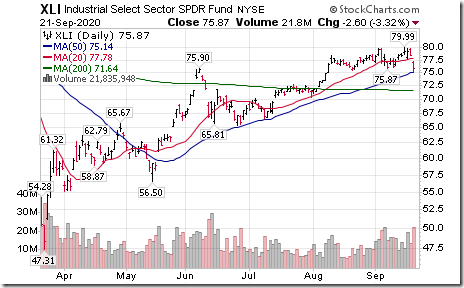

Italy iShares (EWI) moved below $75.87 completing a double top pattern

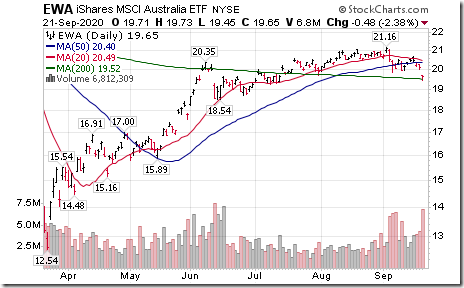

Australia iShares (EWA) moved below $19.69 completing a short term Head & Shoulders pattern.

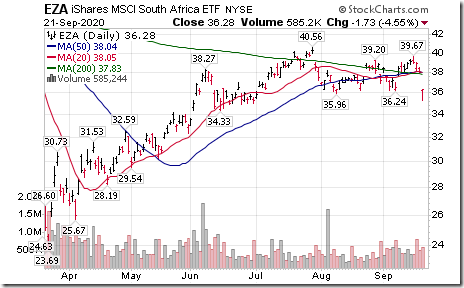

South Africa iShares (EZA) moved below $35.96 completing a double top pattern.

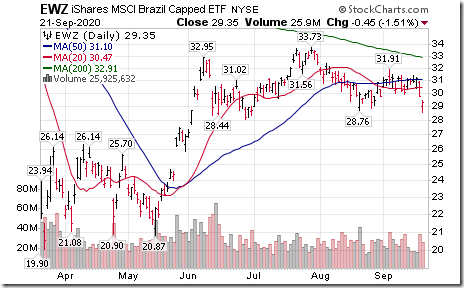

Brazil iShares (EWZ) moved below $28.76 completing a Head & Shoulders pattern

Turkey iShares (TUR) moved below $19.42 setting an intermediate downtrend.

BMO Equal Weight Cdn. Energy ETF (ZEO) moved below $26.35 setting an intermediate downtrend.

Uranium ETF (URA) moved below $11.38 completing a double top pattern.

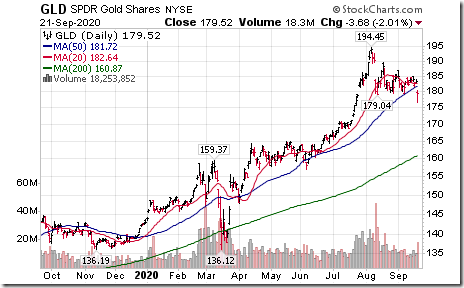

U.S. Gold ETN (GLD) moved below $179.04 setting an intermediate downtrend.

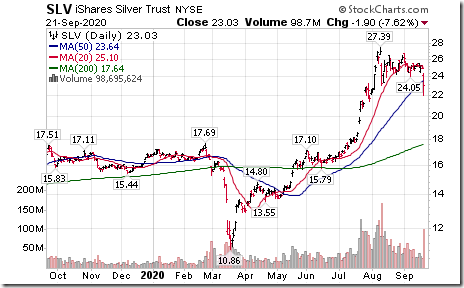

Silver ETN (SLV) moved below $23.06 completing a double top pattern.

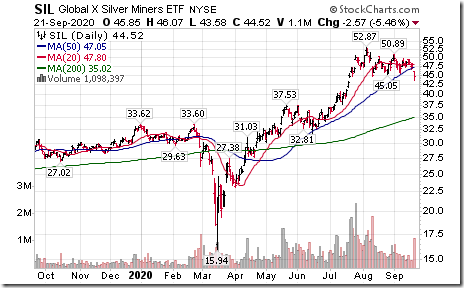

Silver Equity ETF (SIL) moved below $44.63 completing a double top pattern.

American International Group (AIG), an S&P 100 stock moved below $27.67 setting an intermediate downtrend.

Exelon (EXC), an S&P 100 stock moved below $34.15 setting an intermediate downtrend.

Morgan Stanley (MS), an S&P 100 stock moved below intermediate support at $48.27

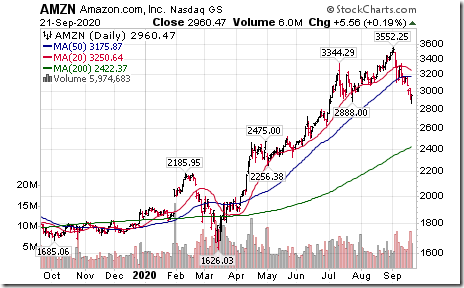

Amazon (AMZN), Dow Jones Industrial stock moved below intermediate support at $2918.23

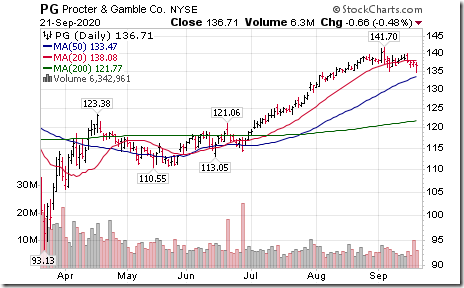

Procter & Gamble (PG), a Dow Jones Industrial Average stock moved below $135.04 completing a short term double top pattern.

Dollar Tree (DLTR), a NASDAQ 100 stock moved below $85.51 setting an intermediate downtrend.

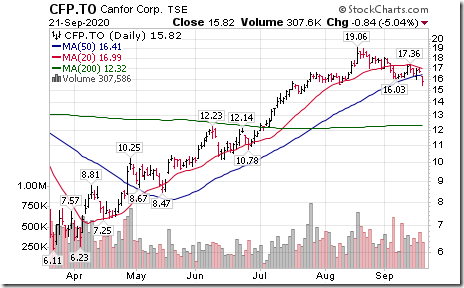

Canadian forest product stocks were under technical pressure. Canfor (CFP) moved below $15.51 completing a short term Head & Shoulders pattern.

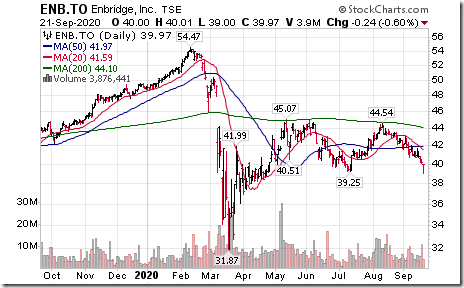

Enbridge (ENB), a TSX 60 stock moved below $39.25 setting an intermediate downtrend.

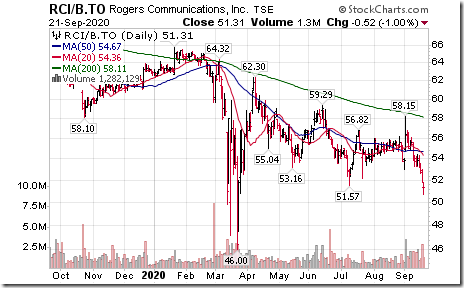

Rogers Communications (RCI.B), a TSX 60 stock moved below $51.57 extending an intermediate downtrend.

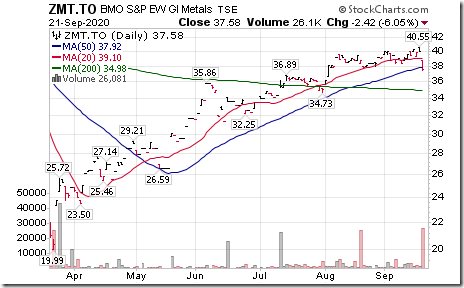

BMO Equal Weight Base Metals ETF (ZMT) moved below $37.81 completing a short term double top pattern.

AT&T (T), an S&P 100 stock moved below $28.43 setting an intermediate downtrend.

Travelers (TRV), a Dow Jones Industrial Average stock moved below $108.27 setting an intermediate downtrend.

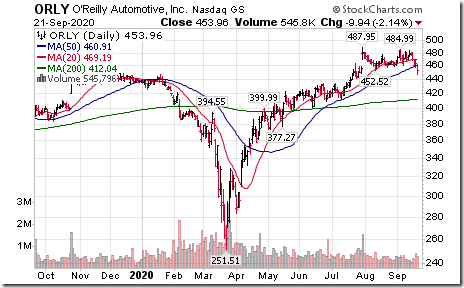

O’ Reilly Automotive (ORLY), a NASDAQ 100 stock moved below $452.52 completing a double top pattern.

General Dynamics (GD), an S&P 100 stock moved below $137.82 setting an intermediate downtrend.

Trader’s Corner

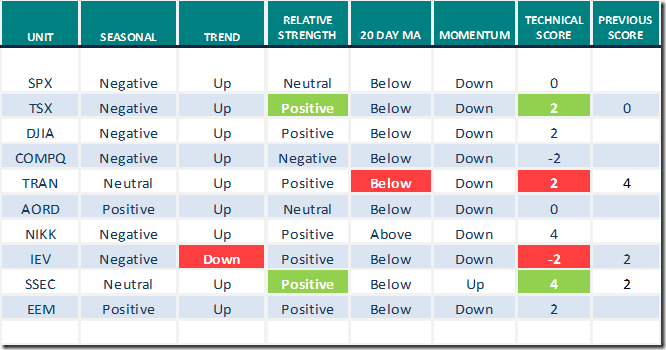

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for September 21st 2020

Green: Increase from previous day

Red: Decrease from previous day

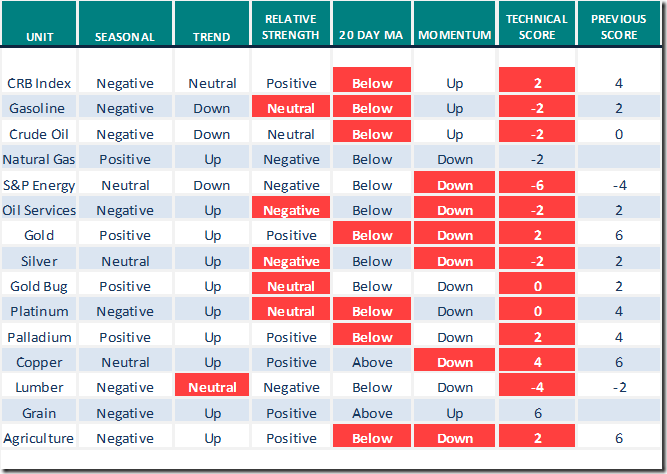

Commodities

Seasonal/Technical Commodities Trends for September 21st 2020

Green: Increase from previous day

Red: Decrease from previous day

Sectors

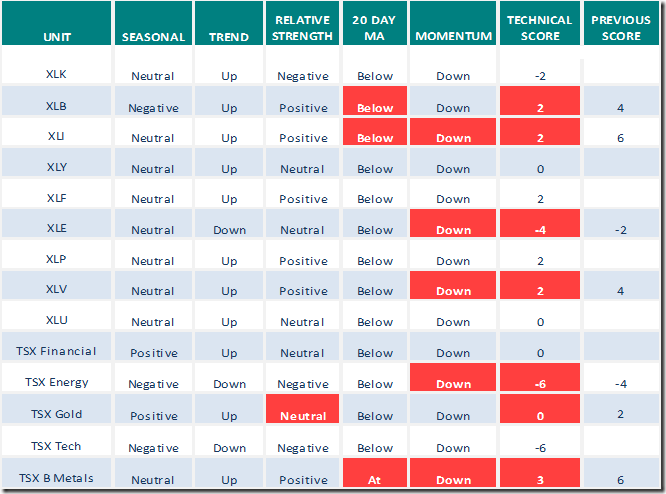

Daily Seasonal/Technical Sector Trends for September 21st 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for the link to their weekly comment. Headline reads, “Election heat, pandemic economy, massive tensions, faltering market, Fed balance, 2023 rates, gold falters”. Following is the link:

S&P 500 Momentum Barometer

The Barometer plunged 18.04 to 34.07 yesterday. It changed from intermediate neutral to intermediate oversold on a move below 40.00, but continues to trend down.

TSX Momentum Barometer

The Barometer plunged 12.14 to 39.05 yesterday. It changed from intermediate neutral to intermediate oversold on a move below 40.00, but continues to trend down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.