by Patrick Hill, RIA

A Tale of Two Economies: One Growing, the Other Declining

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epic of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us…”

Opening Sentence – A Tale of Two Cities, Charles Dickens

In his iconic opening to A Tale of Two Cities, Dickens compares the peace, wisdom, and hope of London to the peril, uncertainty, and desperation of Paris at the time of the French Revolution.

The Professional Economy

Today in a similar way, we have two economies interlocked but in many ways separated by contrasting sets of life experiences; one living in relative peace, prosperity, and health protection while the other is stressed, financially insecure, and virus vulnerable.

Prior to the pandemic, a recent Georgetown University study found that college graduates have twice the yearly income level and accrue a wealth of about $1M more over a lifetime versus high school graduates. The pandemic shaking the economy has magnified the work, financial and health gaps between the two economic segments.

The professional economy is comprised of college-educated adults working from home over the internet with relative ease. They have shelter at home from the virus and can progress in their career. Actually, for some they find it even better than going into their office because now they can spend more time with their families and less time in traffic.

Some employers are offering workers the option to work permanently from home. Many employees in high-cost areas have accepted the option to permanently work from home. So, they have begun to purchase an inexpensive suburban home or move to another state.

The Worker Economy

The worker economy includes high school graduates where their employer requires they work in a factory, restaurant, hotel, or store. Due to close proximity to other workers or customers, they were anxious about coming into contact with infected clients or co-workers. In the spring, workers in factories, and meat processing plants experienced high rates of infection. Travelers were advised by officials to stay home.

Hotels experienced soaring cancellations causing widespread layoffs in the hospitality industry. Workers hoped they would be rehired after the shelter-in-place period of possibly 3 months was over. Some workers were brought back as states began to reopen their economies. But, a surge in virus infections caused many employees to be laid off a second time and for many permanently. Workers already stretched to make rent and car payments began to delay paying their bills with 40% of renters facing eviction in the next few months.

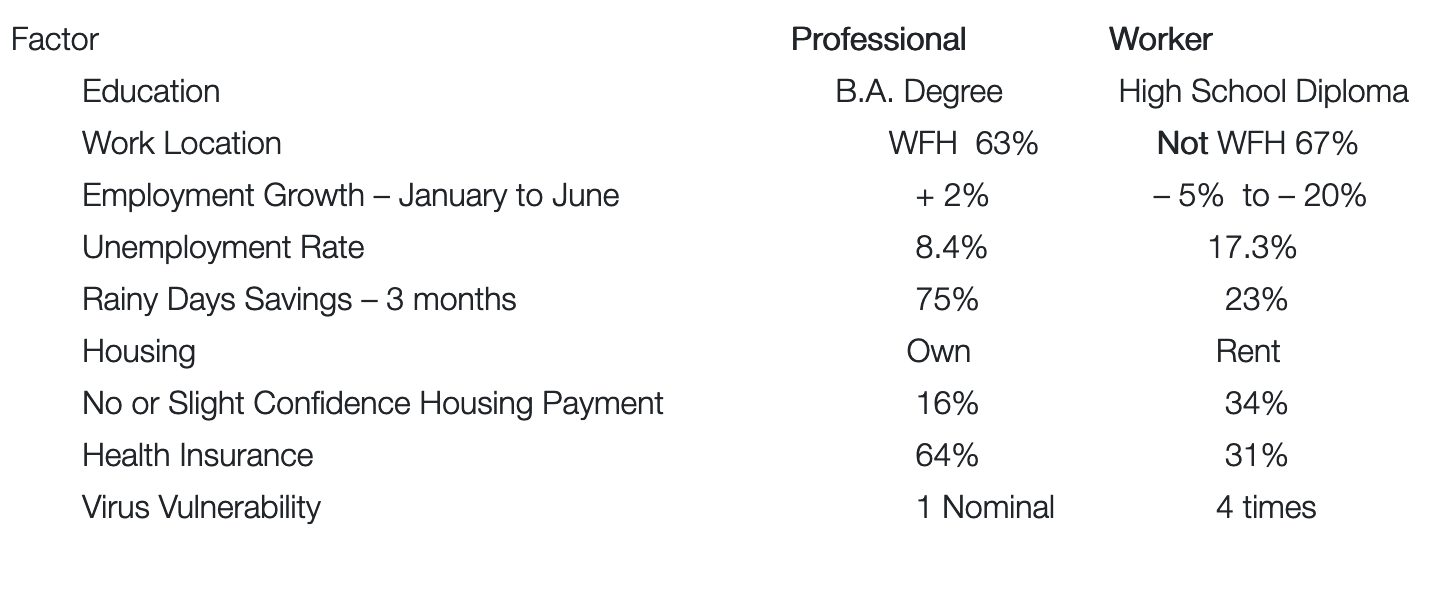

Next, we’ll look at professional and worker economies in more depth related to their contrasting job, income, housing, and health factors. Finally, we will compare the two economies side by side using these factors revealing stark differences.

The comparison shows how interdependent these two sectors are in the national economy. Noting this dependence, we outline our concern which is that while Congress delays relief and making long term investments the ‘window of relief’ is already closing to prevent a deeper recession. The worker economy must recover for the national economy to return to a growth track.

Breaking It Down

A remarkable attitude in the professional economy is the confidence they express about their home, job, and financial situation. Though, they are still concerned about future job security as they see the economy slip into a recession. Before the pandemic, they are likely to work a day or two each week from home.

Most have a job where they can work from home five days a week. A Federal Reserve survey found that for workers with college degrees, 63% could perform their job online. Working from home is a benefit to many workers. A relaxed Google worker replied when asked about working from home, “I get to spend more time with my family at home than before the virus”.

Professionals enjoy a level of financial security far greater than for high school graduates. In 2019, a Federal Reserve study found that only 13% of professionals would have to delay paying current bills if an unexpected expense of $400 were to arise. Pew Research reports that 75% of upper income adults had a ‘rainy day’ of fund equaling three months of expenses versus only 23% for lower income adults

This chart shows the employment disparity between adults making over $32/hr versus lower paid hourly workers ranging from under $32/hr to under $14/hr:

Sources: Opportunity Insights, The Washington Post – 8/13/20

Job Gainers

Note, that for workers in the over $32/hr group they actually saw an increase in employment during a time when 28M total workers were on unemployment assistance. Part of this hiring growth is due to companies hiring software programmers, technicians, and internet support staff to support more of their employees working from home on a long term basis.

This high tech hiring trend does not mean that some professionals are not getting laid off. As companies in financial services, the corporate staff at hotel and restaurant chains, ride-sharing, and many startups in Silicon Valley are permanently laying off workers.

Over 70% of professionals own their own homes providing security and room to self-quarantine. Many companies in information services or technology like Google, Facebook, and Apple are offering permanent work from home options that professionals are taking.

These workers with high incomes in core city centers like San Francisco and New York are purchasing homes in the suburbs or less expensive regions. Rent prices in major professional centers are falling as a result of the professional exodus by greater than 10% in the San Francisco Bay Area and 11% in Manhattan.

Sources: Zumper, The Wall Street Journal – 8/14/20

Sources: Miller Samuel, The Daily Shot – 8/14/20

A Blind Survey

A survey by Blind, an employee discussion platform provider, of 3,300 Bay Area professionals found that 15% had left the area completely. As more companies offer permanent work from home options, more employees are likely to leave core cities across the U.S. for lower cost suburbs or regions.

However, homeowners are still anxious about the economy and their own ability to make their next mortgage payment. Mortgages that were 60 -89 days past due jumped to 2.8%, the highest level since 1999. The major jump in over 30 days past due shows how some immediate layoffs have changed the financial situation for overleveraged homeowners.

Source: CoreLogic, The Daily Shot – 8/12/20

Homeowners are still concerned about meeting future mortgage payments. In July, the Census Bureau reports that 16% of homeowners have slight or no confidence in making next month’s payment.

Health care coverage is crucial for employees facing possible infection and hospitalization from the COVID-19 virus. About 64% of college-educated workers who worked full time had employer-based coverage in 2018. The combination of good health care coverage and being able to work from home provided a strong virus health shield for professionals.

Worker Economy

Most customer service and production workers describe their predicament in highly anxious terms, oftentimes, despair. A travel agency worker in Cincinnati observed,

“This isn’t a snow day where you are waiting for the sun to shine and the world to return, because the world we have lived in for so long in many ways is never coming back.”

Their jobs are in close proximity to other workers or customers. In restaurants, salons, gyms, concert halls, stadiums, factories, and farm fields made them more vulnerable to infections. They are in the opposite job environment from professionals. A Federal Reserve survey found that 67% of low-income workers responded that they cannot work from home.

Government business shutdown requirements have triggered soaring job layoffs for non-college-educated workers. Restaurants, bars, personal services businesses, retail shops, hotels, non-food factories were deemed non-essential and were required to close. The unemployment rate for high school graduates at 17.3% is two times higher than the rate for college graduates and at worse levels than in the 2008 Great Recession.

Sources: Bureau of Labor Statistics, The Washington Post – 7/15/20

Layoffs

Due to temporary and permanent layoffs, and reduced working hours, wages for low-income workers fell. The percentage of adults experiencing a loss of employment income ranged from 60% in the less than $25,000 level to 51% at $74,000 to $50,000.

Source: Wolfstreet.com – 8/4/20

The $600 a week federal unemployment assistance program expired on July 31st. The assistance check payments return to state levels at an average of $247 per week. Over 160M stimulus checks for $1200 were sent to adults last spring. Some individuals used these check funds for down payments for car purchases for those that qualify. Yet, surveys show most people used the money to pay down debts or add to savings.

On August 8th, President Trump signed an executive order to add weekly unemployment assistance at $400 per week. That order requires states to fund $100 of the assistance. Economists report that most states only have about 1-2 months of funds left in their unemployment programs to extend benefits.

The Treasury Department reports that state unemployment systems would have to be reprogrammed for the new checks causing at least a 3 – 4-week delay. Besides losing all these relief sources of income, 57 % of workers rehired at regional reopenings now report layoffs for a second time.

Renters

The majority of high school graduates rent rather than own homes. Workers feel an increasing level of doubt about making rent payments. 34% have only slight or no confidence in making their August payment. The financial squeeze is most acute for minorities with Blacks and Hispanics twice as concerned.

Sources: U.S. Census Household Pulse Survey, USA Today – 7/24/20

As renters miss housing payments the threat of eviction emerges as a major concern. About 40M renters face the threat of eviction by December 31st 2020.

Sources: Aspen Institute, ANZ Research, The Daily Shot – 8/12/20

The Cares Act

The CARES Act provided a 120-day rent moratorium for properties participating in federal housing assistance or have federally backed mortgages. This moratorium ended on July 24th, permitting landlords to give renters a 30-day notice to vacate the premise. Local cities in some states have extended moratoriums, but full enforcement has not been widespread.

A few renters report receiving eviction notices requiring that they move in 30 days even before the July 24th deadline. Property owners are stuck between delayed rental payments and monthly building mortgages. Only 35% of rental payments were received by landlords in July, compared to 75% in the January – March timeframe.

President Trump’s executive order of August 8th instructs the CDC to look into how to help renters stay safe and set a policy to prevent evictions. The order instructs the CDC to only make eviction waivers when the infection is an imminent threat. Thus, in fact, the executive order does not extend the rent moratorium.

Low Income Benefits

Employers usually do not offer health care benefits for low-income workers in hourly jobs. For example, in the restaurant sector, only 31% of workers receive health care insurance. Families of four with yearly incomes below $33,500 qualify for Medicaid benefits in most states.

Extended Medicaid benefits that offer coverage at higher income levels are available in ten states. Most employers for hourly workers in factories, farms, and meat plants do not offer sick days to be used for self-quarantine.

The CARES Act mandated that employers offer sick leave days if the employee felt sick. But, companies depending on essential workers were reluctant to let them quarantine at home. Even when their company offered sick leave workers were afraid of contracting COVID-19 because they could not socially distance from other workers. In some cases, workers complained that their company had poorly implemented virus safety measures.

An added concern for many production workers is their rental home or apartment affords limited or no quarantine areas. So, if a family member gets sick the likelihood of becoming infected is quite high. The following chart from the Federal Reserve of St. Louis confirms their reluctance to return to an unsafe work environment as the number of quits surges up.

Sources: Federal Reserve of St. Louis, The Daily Shot – 8/11/20

Medicare

A Health and Human Services analysis showed that Medicaid patients of low income were more than 4 times as likely to be infected with coronavirus versus Medicare patients. Medicare covers all adults over age 65 and includes private alternative Medicare plans. The rate of infection for Blacks was two and a half times the rate for whites. Hispanics were about one and a half times the rate for whites. The analysis includes records for the January through June period.

People in the worker economy are facing daunting income, housing, and health factors coming at them at once. From the loss of a job or fear of a job loss to the stress of being evicted and the uncertainty of becoming infected it is little wonder, they feel their life is ‘on the edge of a cliff’.

The Worker Economy Must Recover For the National Economy to Grow

The differences between these two economies is stunning. Workers with lower income, increased job insecurity, housing uncertainty and virus vulnerability sharply contrasts with the financially certain, high level of job security and health protection status of professional economy adults.

Starting with the contrast in the ability to work from home versus factory, the two groups have been at opposite financial positions during the crisis. Professionals believe they can handle the crisis. High tech employees at information services companies like Apple, Google, Facebook, and Netflix feel secure as sales increase, though these high growth sales may not continue.

For professional knowledge workers across multiple sectors, they actually saw an increase in employment. Higher-income workers had three times the number of households with ‘rainy day’ funds, two times the health insurance coverage, and are much less vulnerable to catch the coronavirus. While worker economy adults face eviction, are more anxious about making house payments and have limited health insurance options.

Plus, 56% of small businesses are owned by high school graduates. As core cities are vacated by professionals these commuter supporting businesses have experienced 50 – 80% sales declines.

Major city restaurants, gyms, salons, corner grocery stores, and personal services are all financially stretched with most having only 30 days of free cash flow. The Payroll Protection Program for these businesses ended on July 31st and has not been renewed.

Professional Concerns

Professionals are concerned about their future financial position. This August 2nd chart shows a fall in consumer spending using recent high frequency data with twice the decrease in spending in the higher income segment versus middle and lower income segments. If the high income segment continues to reduce spending it will cap any spending recovery.

Sources: Opportunity Insight, Harvard, The Daily Shot – 8/17/20

When consumer spending falls, advertisers will pull back on advertising, even digital advertising. Information services firms like Google that derive 71% of their revenue from advertising are likely to see significant declines in revenue and profits.

Even leading information technology firms will need to reorganize, cut costs, and lay off staff due to a sharp fall in sales. Millions of small businesses have kept operating with PPP loaned funds, now most of those firms are facing continuing losses. If millions of small businesses close, they will not be purchasing goods over the internet, so e-commerce companies like Amazon will see a decline in sales. With declining sales, Amazon will lay off professional staff and managers as well as worker economy warehouse employees.

First Policy Phases

There must be two policy phases implemented to recover from the present recession. The first phase is to get relief funding programs in place for workers and businesses, as we noted above. The second phase is to implement long term investment programs including infrastructure, technical education with a particular focus on information technology skills, a health safety net for low-income workers, and child care for many families that cannot afford it. We can put more parents to work if we had an adequate child care program, as most advanced economies have in place.

First phase relief spending needs to be passed by Congress immediately. The time window to mitigate the effects of ending the $600 unemployment assistance, the expiration of PPP for small businesses, and rent relief is closing fast.

We hope that a relief bill will be passed in time to save most consumers from falling into insolvency. But, there is a reasonable possibility that the ‘window of relief’ is closing, as Congress should have passed relief funding in mid- July.

Yet, from surveys, it is clear that both homeowners and renters are worried about making their August payments and are delaying payments on other bills. When the tide of insolvency events floods mortgage holders, foreclosures and evictions will quickly increase. As foreclosures and evictions rise, consumer spending will fall even further.

Second Policy Phase

The second phase for longer-term investment programs cannot be implemented until the virus is under control. The patchwork approach of states taking the lead in virus containment has not brought down the infection rate far enough to proceed with permanently reopening the economy. As we noted in our post: Will Consumers Bailout the Economy, the federal government must take the lead in testing, tracing, and treatment of the virus to achieve containment.

When we recognize that we are all in the same economic boat, then we can build a New Economy. A New Economy that lifts the income and wealth of all citizens while investing for the long term providing equal economic opportunities and creating new businesses. A recent AP poll shows that 80% of Americans feel the country has headed in the wrong direction. We need for our policymakers to use intelligence, consensus, and policies based on science to put the national economy back on a recovery track.

Copyright © RIA