by Caglasu Altunkopru, Head, Macro Strategies, Mutli-Asset Solution, AllianceBernstein

In addition to its tragic human toll, COVID-19 triggered the sharpest recession in recent history, and efforts to control its spread have transformed the way we work, the way we shop and how we connect with others. We think these changes will last awhile—with implications for asset allocation.

A Big Leap Forward in Technology Adoption

Transactions and interactions quickly migrated to electronic platforms, accelerating existing trends. Digital capabilities like teleconferencing and contactless payments aren’t new, but social distancing jumpstarted the shift. As Microsoft CEO Satya Nadella put it in late April, “We’ve seen two years’ worth of digital transformation in two months.”

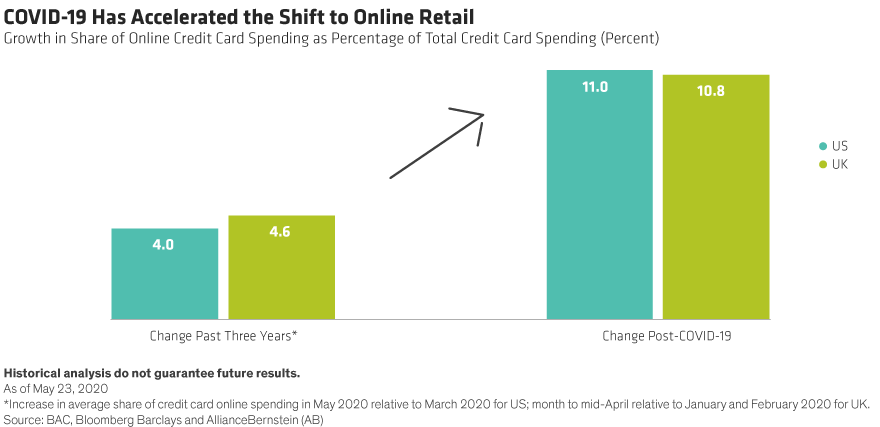

Early data suggest this may be an understatement. The share of online retail spending on credit cards has jumped by 11% in the US since COVID-19, more than doubling the 4% cumulative change over the past 3 years. (Display); UK data show a remarkably consistent trend—from a 4.6% gain in share over the last three years to 10.8% this year alone.

As business and family gatherings moved online, traffic on top videoconferencing platforms increased by 10 times (20 times for Zoom alone). Education and healthcare also saw accelerating online adoption. While telehealth has been a clear winner, healthcare companies are now talking about broader recognition of the value of robotic surgery.

Even as the level of activity normalizes, these behaviors are likely to be at least partly sticky—especially in areas where consumers and businesses find new ways of operating to be more convenient and efficient than the old ways. And the reopening of economies seems to have brought a resurgence in new cases, particularly in the US. If social distancing measures last for a while, changes in consumer, business and government behavior could become further entrenched.

More Routine Jobs May Vanish Permanently

As economies reopen with social distancing requirements to protect workers, overhead labor costs for many firms are rising. The answer for some of these employers, such as those running call centers, may be more automation. The shift could be supported by the rising share of economic activity taking place on digital platforms—and by the drive to secure global supply chains.

The notion of jobs vanishing, never to return, isn’t new. A paper from the National Bureau of Economic Research, Job Polarization and Jobless Recoveries, found that jobless recoveries following recent recessions were caused by permanent losses of routine jobs (Display) such as those in manufacturing and office administration. A declining cost of capital investment relative to labor over the past 30 years has likely been a major driver, and COVID-19 seems to have tilted the scales further toward investment.

Uninterrupted, these shifts are likely to accelerate and extend some of the hallmark secular trends of the modern era: increasing returns to scale, skill and capital. This bodes well for the long-term earnings power of large firms and secular growers—as well as equity ownership. But this evolution would also be likely to exacerbate already extreme economic inequality.

The unequal distribution of the COVID-19 burden across the workforce already weighs on society. A slow jobs recovery will likely pressure governments to deliver more support to the unemployed by expanding debt burdens and bolstering policies aimed at redistributing income and wealth. Public policy will remain center stage as governments seek to balance stakeholders’ increasingly conflicted interests.

The Portfolio Perspective: Tactical and Strategic Implications

So, how can multi-asset investors translate these trends into portfolio asset-allocation decisions? We expect rising technology adoption will likely benefit large firms and secular growers, so we favor overweight equity exposure as a way to access improving corporate earnings power.

Within equities, we also think it makes sense to consider an overweight to US equities. Valuations are higher than those of other regions, but the US stock market offers more exposure to technology, which is benefiting from the rapid move to digital behavior in the social distancing era.

Meanwhile, a slow jobs recovery might help keep inflationary forces at bay for some time, allowing central bank policy to remain accommodative. As a result, government bonds can still be effective diversifiers to equity risk…although with much lower expected returns versus history.

The key risk to this view is whether public policy can successfully pursue prolabor, redistributive and/or inflationary policies. COVID-19 has forced the hands of governments and central banks, necessitating a much more stimulus-driven approach. More policy action may be on the way if the recovery proves slow. But will that lead to inflation? It remains to be seen. Japan’s example suggests that there may be more to generating inflation than low interest rates.

Caglasu Altunkopru is Head of Macro Strategies for Multi-Asset Solutions at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

This post was first published at the official blog of AllianceBernstein..