Official measurements are catching up to today’s difficult circumstances.

by Carl R. Tannenbaum, Ryan James Boyle, Vaibhav Tandon, Northern Trust

This month, we are watching economic data catch up to the difficult circumstances. We could see in our daily lives that the economy was approaching a standstill; now, we can begin to understand the extent of the economic impairment.

With smart behavior and some good fortune, we can put the worst of COVID-19 behind us. Many states are setting cautious paths to resuming economic activity. But the virus has not been defeated, and so a full return to normal activity will not happen until a vaccine or reliable course of treatment is proven. Until then, restrictions on movement will linger, precluding a “V-shaped” recovery.

We expect the second quarter will see the worst outcomes. We are expecting successful return-to-work waves to restore a modicum of activity as we move through the summer, regaining a good measure of the lost ground. But progress will be slower from there. A second wave of infections is not our base case, but is the leading downside risk.

Influences on the Forecast

- Employment losses are beyond precedent. After seven weeks of initial jobless claims exceeding three million, the April unemployment rate of 14.7% was expected but still difficult to digest. The loss of six million workers from the labor force suggests this high reading is still an understatement of unemployment. Stimulus measures that supplement unemployment insurance and extend grants to businesses are important to help both workers and employers weather the storm. Hiring will resume as the worst of the virus passes, but at a more gradual pace than reductions occurred.

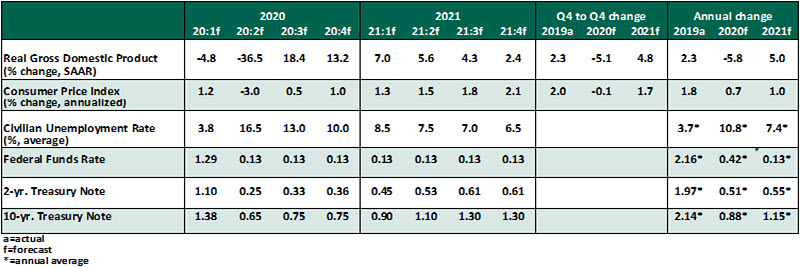

- The economy entered a contraction in the first quarter, with real gross domestic product (GDP) declining by 4.8% on an annualized basis. January and February were business as usual, but the beginning of the slowdown in March was sufficient to turn the whole quarter negative. On this basis, with April in lockdown and a cautious return to activity in May and June, we expect a massive output decline in the second quarter. Growth will resume at a decent clip in the third quarter, but from a low base. We don’t expect the U.S. economy to recover all of the output lost until well into 2022.

- In the press conference following the April 29 Federal Open Market Committee meeting, Chair Jerome Powell indicated the Fed was in “no hurry” to raise interest rates. Attention has turned to the Fed’s range of facilities to support financial markets. The Fed is doing everything in its institutional power to keep markets functioning. The Fed’s balance sheet has grown by $2.5 trillion in the year to date and will continue growing as more measures are announced.

- In the month ahead, the Fed’s Main Street Business Lending facilities will begin offering support to a broad set of businesses. The Treasury has committed more than $75 billion to the program, which the Fed will scale to $600 billion of loan support. However, the loans exclude higher-risk borrowers and cannot be forgiven, which could limit the loans’ adoption. The program may serve more as a supportive signal to lending markets.

- The U.S. government has passed three rounds of spending to address the economic effects of the coronavirus, totaling more than $2.5 trillion, about 12% of U.S. annual gross domestic product (GDP). These measures are of substantial size, but more may be needed. State and local governments are feeling a severe revenue pinch, and have begun shedding workers. Aid would help limit the loss of jobs and sustain local governments in their roles as front-line providers of medical services and unemployment benefits.

- Speculation about inflation is growing, in both directions: A massive demand drop may cause deflation, but large-scale liquidity interventions could be fuel for inflation. Data releases to date, including the core personal consumption expenditures deflator growing by 1.7% year-over-year in April, do not show inflation breaking either way. In the near term, we expect disinflationary forces, especially low oil prices, will prevail. The Fed has many tools at its disposal to deal with any unwelcome upward movements in the price level.

- Housing has been a bright spot in the data thus far. Residential investment was a rare point of growth in first quarter GDP, while house price indices have continued to appreciate, supported by low interest rates and limited inventory. We expect this will be the next sector to show stress, as job losses and uncertainty will preclude investment. The fiscal stimulus included a mortgage forbearance policy that will help to prevent a wave of foreclosures.

*****

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2019 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.

Copyright © Northern Trust