Teflon Market

by David Andrews, CFA, Director, Investment Management and Research, Richardson GMP

Many theories are making the rounds about why the stock market continues to march higher in the face of natural disasters, a nuclear crisis and government collapses. The relentless advance by stocks continues as global stocks gained for a seventh day, the longest rally for the MSCI World Index since September.

In Canada, the big news was that the opposition toppled Prime Minister Stephen Harper’s government, triggering an election that may result in an alliance to reverse his corporate tax cuts and overturn plans for more military spending. Opposition members from the Liberals, New Democrats and Bloc Quebecois passed a motion of no confidence in the house, which under Canadian parliamentary tradition leads to the legislature’s dissolution. The motion was passed by a vote of 156-145. Our dollar fell 0.6 percent to 98.12 cents per U.S. dollar, the biggest intraday drop since March 16.

Sovereign debt concerns returned to the fold this week with Portugal’s parliament rejecting proposed budget cuts that ultimately led to Prime Minister Jose Socrates’ resignation. Fitch ratings announced a cut in Portugal’s long-term foreign and local credit ratings to ‘A-’ from ‘A+ The extra yield investors demand to hold 10-year Portuguese bonds over benchmark German bunds rose the most in four months. Bonds pared declines after two European officials with direct knowledge of the matter said a bailout for Portugal may total as much as 70 billion euros ($99 billion). Gold initially surged to a high of $1447 before settling back to the $1430 level as both the Euro and the U.S. dollar slipped this week.

Protests in the Middle East & North Africa both intensified and widened as Libya’s Muammar Qaddafi remains defiant despite NATO-led air strikes enforcing the no-fly zone. In addition, protests spread into Syria and were met with stiff police and military intervention. Oil prices swung between gains and losses this week, ending lower as crude failed to breach technical resistance at its 30-month high and on concern that the European debt situation and the crisis in Japan will curb future fuel demand.

The Road Back to Surplus?

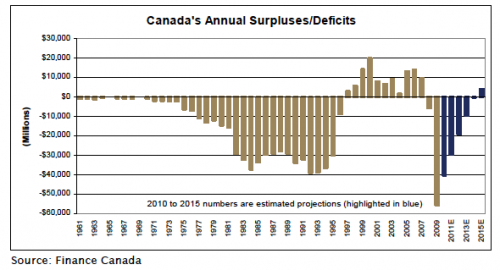

Canadians will be returning to the polls with Tuesday’s Budget defeated in a non-confidence vote. In that Budget, projections were made for our national budget to return to a surplus position

by fiscal 2015. Prior to our surpluses of the past decade and in the 1990s, do you remember when Canada posted its last surplus? If you guessed 1969 you’d be correct when our total federal debt stood at $19.2 billion. The debt reached its peak in 1996 when it totaled $562.8 billion and then fell to $457.6 billion in 2007. At the end of fiscal 2009-10, the federal debt was estimated to be $519.1 billion. The growing debt is a result of the stimulus spending and borrowing that was required after the financial crisis of 2008.

The Trading Week Ahead

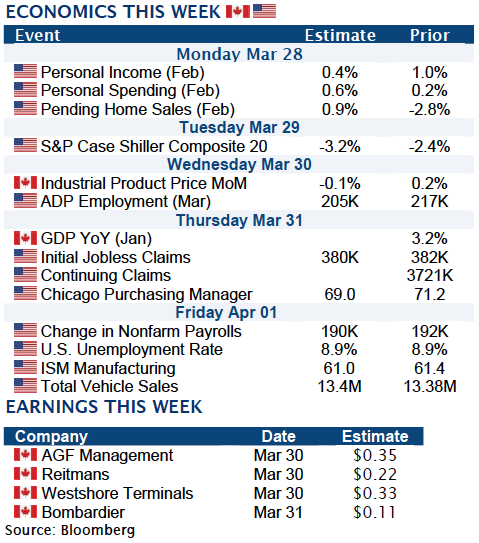

U.S. economic data will likely steal investors’ attention away from the ongoing geopolitical and natural disaster stories of the past several weeks. The first day of April falls this Friday,

which means the U.S. nonfarm payrolls and employment data for March will be released. The anticipation will begin to build on Wednesday with the ADP Employment report. ADP is expected to show a healthy number north of 200,000 in March. Despite a modest decline from the February, the U.S. labour market is indeed recovering. ISM manufacturing data should confirm that U.S. factory

production is booming and give support to equity markets. Stock market investors should not fear the economic fallout from the Japanese disaster or the Middle East conflict. In February, the ISM reached its highest reading (61.4) since 1984. Readings north of 50 point to expansion.

First quarter Earnings Season begins April 11th and with no disrespect to the handful reporting this week, none of them will be market moving.

QUESTION OF THE WEEK

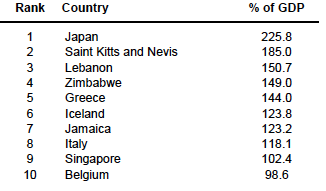

Q: Tuesday was budget day in Canada where the Conservatives projected a return to federal fiscal surplus by 2015. By that time, Canada will have its largest national debt ever in absolute terms. How do our public debt levels look relative to our economy (GDP) and how do we stack up against other countries in the world?

A: According to the World Fact book, based on 2010 figures, Canada’s debt to GDP is 34%, which is much smaller than it was during the deficits of the early 1990s. While we posted our highest deficit in history last year, our debt levels are smaller today (when compared to the size of the entire economy) than they were 20 years ago. Below are the debt to GDP ratios of Canada and other countries you may find interesting. Believe it or not the lowest debt to GDP figure amongst the 128 countries is Libya at 3.3%. Canada ranks better than average giving it much more financial flexibility than other more heavily indebted nations. The debt figures used in the calculation reflect the cumulative total of all government borrowings less repayments that are denominated in a country's home currency. Public debt should not be confused with external debt, which reflects the foreign currency liabilities of both the private and public sector.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results.

Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

Copyright © Richardson GMP