by Darren Williams, AllianceBernstein

Italy’s credit rating is under pressure. In an unscheduled downgrade on April 28, Fitch lowered the country’s sovereign rating to BBB-minus, just a notch above junk. Fitch cited the government’s rapidly rising debt, which it expects to reach 156% of gross domestic product (GDP) this year and then stabilize there, “underlining debt sustainability risks.”

So just how perilous is Italy’s situation? The first point to make is obvious: if the European Central Bank (ECB) were to withdraw its support tomorrow, Italy would immediately be rendered insolvent. But that’s a big “if.”

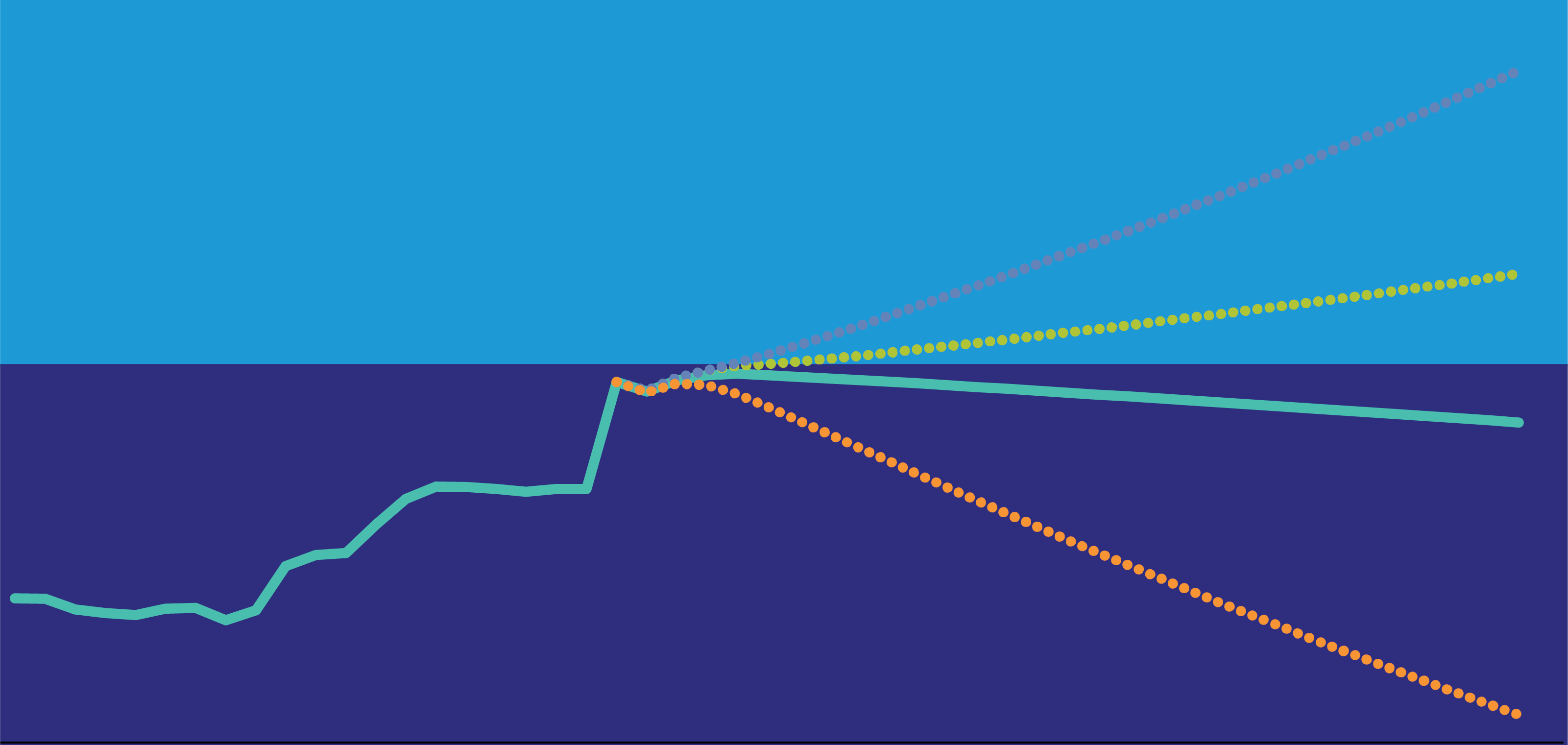

Interest rates are a hugely important determinant of debt sustainability. The Display above helps illustrate this point. It sets out four scenarios for the evolution of Italy’s debt-to-GDP ratio after the end of this year, by which time we think it will have risen to about 160%.

Scenario A (Baseline)

Our central scenario puts trend nominal GDP growth at 1.5% (0.5% real, with 1.0% inflation) and assumes that the primary budget position (excluding interest payments) moves into surplus (1.5% of GDP, its average since 2012) by the middle of the decade and stays there. We also assume that all future debt issuance is split evenly across the yield curve at the highest yield levels reached in recent weeks.

Italy’s debt/GDP ratio actually declines slightly in this scenario. That’s partly because of the assumption for the primary surplus. But it’s also because the weighted average interest rate on new debt is below the weighted average interest rate on maturing debt (2.0% vs. 2.8%). This reduces the snowball effect—when interest rates are higher than nominal GDP growth, the debt/GDP ratio will rise unless it’s offset by a primary surplus. So even the higher yields experienced in recent weeks would not push Italy onto an explosive debt path.

Scenarios B (Higher Rates) and C (Higher Rates and Primary Deficit)

The outcomes in scenario A are critically dependent on the assumption for interest rates and the primary balance. If, for example, interest rates were 1% higher across the curve, we would move into Scenario B. And if this were accompanied by a failure to move the primary balance back into surplus, we would move into Scenario C. Either path would be unsustainable.

Scenario D (Financial Repression and Higher Inflation)

In this scenario, we cut Italy some slack and assume that bond yields move back to last year’s lows and that trend inflation is 2% (1% higher than in the other scenarios). With the weighted average interest rate on new debt (0.6%) now below nominal GDP growth (2.5%), Italy begins to benefit from a reverse snowball effect and debt begins to fall quickly.

This scenario shows just how effectively a combination of financial repression and moderately higher inflation can reduce debt levels. We’ve been there before (think post World War II in the US and the UK). And sooner or later, we’re highly likely to be back there again.

The ECB Solvency Backstop

Because the ECB is willing and able to manipulate sovereign borrowing costs, it continues to exert a hugely powerful influence over Italian solvency. We’ve noted elsewhere that this is preempting decisions better left to democratically elected governments and stretching the central bank’s mandate to the breaking point. But that’s a story for another day. For the time being, the ECB is happy to step where governments fear to tread and looks set to continue underwriting the solvency of otherwise insolvent euro-area countries like Italy.

Darren Williams is Director—Global Economic Research at AllianceBernstein.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

This post was first published at the official blog of AllianceBernstein..