by Cole Smead, Smead Capital Management

Investors have been awoken to the carnage of the last three weeks. These circumstances, while unenjoyable, may be hiding the actual problems with today’s market. The unforeseen circumstances of today are no different than the past. Brad S. Gregory’s book, Rebel in the Ranks, reminds us that history ultimately exposes problems through the seeking of truth. His book captures the reformation starting with the pre-cursory situation for an unknown Augustinian friar by the name of Martin Luther. The opening jab for Luther’s argument was the practice of people paying indulgences. Luther didn’t believe it was grounded in the Bible, despite Papal support. There had only been a bull market in loyalty toward the Holy Roman Empire for centuries as local governments and, particularly, the Habsburg dynasty supported the Pope.

The old saying is ‘do not confuse brains with a bull market.’ This adage holds true today as people believe that the market holds the brains and the humans picking stocks hold none. It feels as awkward as it was for Luther in Wittenberg, Germany in 1517. The bull market in political loyalty toward the Catholic church began with Constantine and had been uninterrupted to Pope Leo X. Luther begins to communicate the differences of what the Bible said versus what the church was practicing. Indulgences were a practice of the day that Luther didn’t agree with.

Luther gets to the heart of things when he brings his humanness into the separation between the Bible and Papal authority. Luther wrote, “My will, desire, plea and counsel are that no one buy an indulgence. Let the lazy and sleepy Christians buy indulgences. You run from them.” He knew it was acceptable by the church, but he knew it wasn’t what mattered in his profession of preaching God’s word.

The difference between what is being practiced today versus what matters is just as important for us as investors. In Luther’s day, it was indulgences. Today, it is indexes. What began as a practice of creating a benchmark to have a standard of judging stock pickers has become a small-g god in and of itself and could create problems for the rational investor.

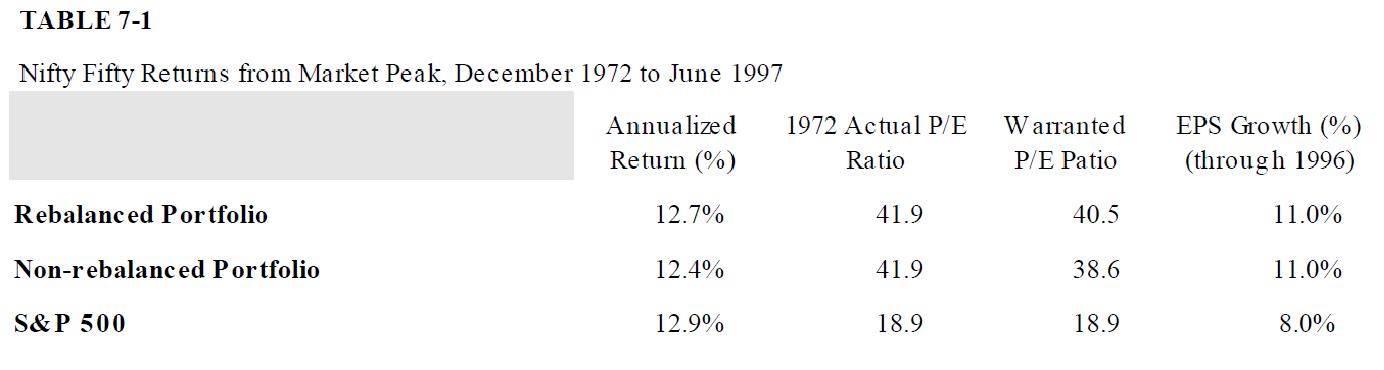

To understand the difference between what is being practiced versus truth for investors, we need go no further than Jeremy Siegel’s book, Stocks for the Long Run. The table below comes from the book looking at the Nifty Fifty from December 1972 to June 1997, almost 25 years:

The S&P 500 produced 12.9% returns coming from a price to earnings (P/E) multiple of 18.9x and grew earnings at 8% during the period. The non-rebalanced portfolio, the untouched Nifty Fifty, produced 12.4% returns from a multiple of 41.9x earnings. However, the Nifty Fifty produced 11% earnings growth during the period, 37.5% higher than the S&P 500.

How did a group of superior growth companies produce so much more operating success and yet lose to the average stock?

Today, there are some wonderful businesses that have terrible pricing for long-term investors! The value versus growth dispersion globally is too wide. To use an excerpt from a recent Bloomberg article, “Compounding the trend…is the growing popularity of passive funds that tend to pile on winners, and socially responsible funds that favor quality, a characteristic that’s often shared by defensive stocks.”

Why does this matter for us as investors?

The index’s popularity and success are the opportunity cost, so let’s look at what today’s quality businesses P/E multiples are, prior to the tumult of the last few weeks.

The list below is a group of wonderful, quality companies in aggregate that are likely to produce high earnings growth going forward, in our opinion. They are flirting with the same problem as 1972. They were expensive!

According to JPMorgan’s quant Marko Kolanovic, “Market distortions are so severe that value is trading at a discount to low-vol that is twice as wide as that during the dot-com era…” If you read what he is saying, you’d recognize that this makes the index and the quality businesses it owns look terrible for investors, like it did in 1972.

At the peak in 1972, Coca Cola was trading at 46 times earnings and all the professionals on Wall Street wanted to buy it. It was only eight years after the Nifty Fifty died that Coca Cola was trading at six times earnings. No one wanted to buy it. Please understand this risk.

Investors are taking this risk wholeheartedly, believing that the index will produce the returns they need for their retirement, endowments, pension plans and other investment needs. Christians in the 16th century were not markedly different. They believed the Pope was teaching them what God wanted for their lives. Luther rudely presented the facts about what was going on using the Bible.

Our opportunity and hope are that we get to be a stock picking organization armed with our eight criteria for selecting investments and can have a large effect on how people look at common stock investing going forward. To put it simply, like Luther did then, with the circumstances that sit in front of today’s stock investors:

Our will, desire, plea and counsel are that no one buy an index. Let the lazy and sleepy investors buy indexes. You run from them.

Warm regards,

Cole Smead, CFA

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Cole Smead, CFA, President and Portfolio Manager, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2020 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.