by Hubert Marleau, Market Economist, Palos Management

February 23, 2020

In street parlance, the stock market is overbought, particularly the FAANG-plus-Microsoft. The Barrons reported this week that the bullish call-option volume in this segment is blowing away bearish put-option volume. And that is despite the fact that these stocks are up 10% year to date, more than 60% in the past year and their average P/E ratio has jumped to 35 times, based on 2020 forward earnings.

We should therefore not be surprised by this week's 1.2% drop in the S&P 500 index. Should the S&P 500 Index return to its 200-day moving average, the index would suffer a 10% correction. The gold, the foreign exchange and the bond markets are telling us that the above scenario is likely to happen.

The rush to safe havens was widespread. The price of gold rose 3.7%, the DXY increased 0.7% (that is a lot for a currency) and U.S.bond yields across the board declined more than ten basis points. Do I think it is going to happen? There is a distinct possibility but I believe it will be short lived because it appears that speculative money is flowing into the Greenback to take advantage of what international traders see as U.S. interest rate and growth bargains.

It would appear that investors still have faith in the ability of monetary and fiscal policies to remedy a potential slowdown. The belief is strong that the Fed is standing by and would react strongly if the coronavirus risk was to affect the domestic economy. The Goldilock scenario is assured because we are in a liquidity-driven world.

Meanwhile, oil prices ($53.36) rose and so did copper prices ($2.61). As matter of fact, High Frequency Economic Models have increased their growth estimates for Q/1, a turning point in the number of coronavirus infections is approaching and inflation, contrary to popular opinion, is up. Last week, there were reports showing that if one were to look carefully under the hood, one would see that inflation is clearly present.

Wage rates (3.5% y/y), wholesale price (2.1% y/y) and existing-home sale price (7.0% y/y) changes are all above the Fed’s target rate of 2.0%. Thus, the possibility of a pass-through from the above items to the Fed’s favoured PCE deflator (1.6% y/y) is rising.

Inflation may turn out to be not as dormant as commonly believed. it’s important to note that the Fed will likely give asymmetric inflation guidance in June like accepting for a while inflation above the 2.0% target rate. Fed Governor Lael Brainard threw her support behind the central bank adopting average inflation targeting.

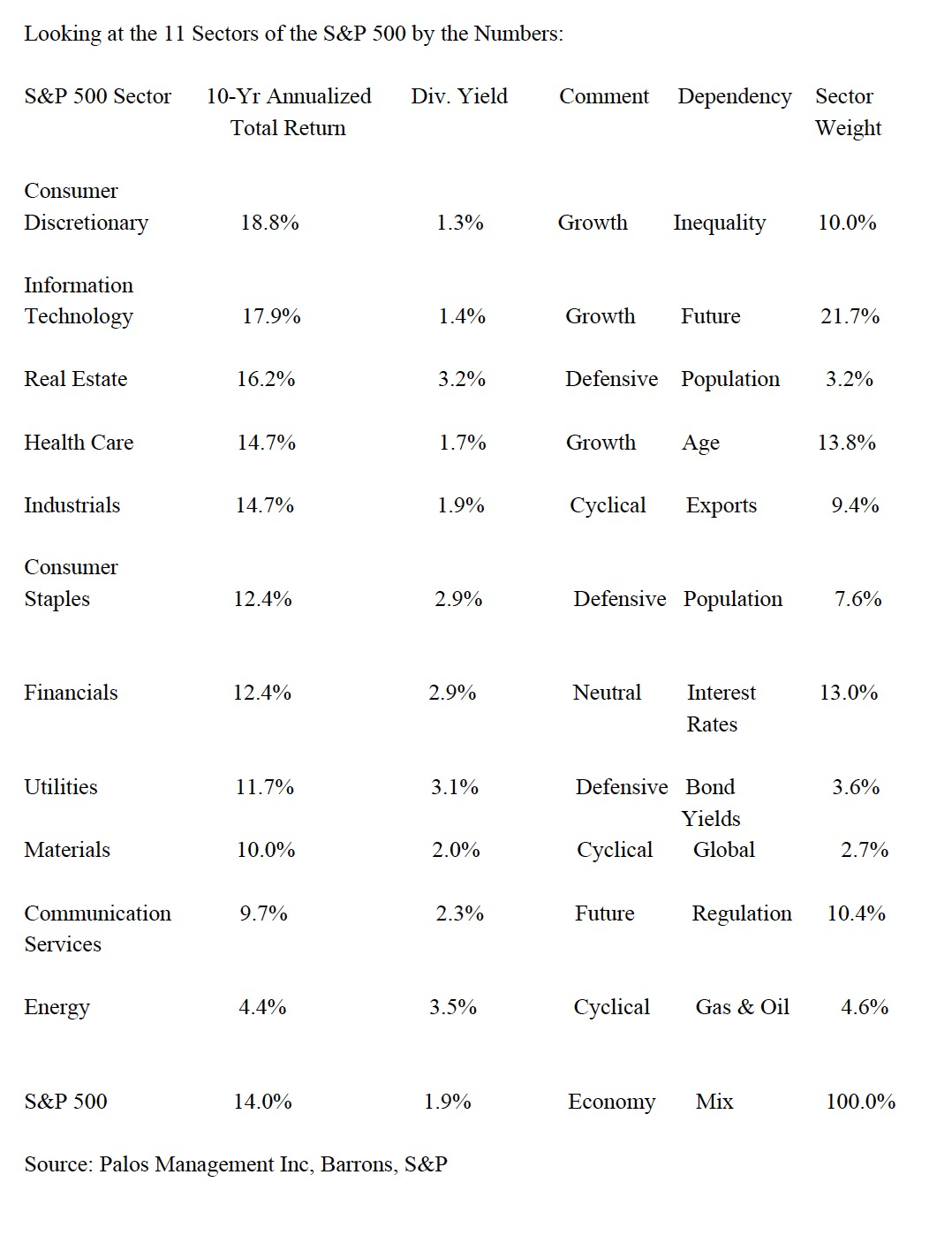

While I support the idea of trading the momentum of defensive oriented stocks, I’m still of the opinion that a slow rotation towards material, energy, real estate and industrial stocks might be a good strategy. They may in the end provide superior market returns.

Thematic Research: Anticipating Dominant Themes. Secular Trends and Major Shifts.

There is sufficient empirical evidence and theoretical validity to the proposition that asset allocation strategies based on global and macro themes have brought superior market returns. It's best to identify secular trends and major shifts when they are emerging. During the past few weeks, I have read several thematic working papers and articles.

In a few words Haim Israel, BofA’s resident futurist, said: “ the coming decade will be unlike any before it and we haven’t seen anything yet.” He knows more about what the future may bring than most because he draws on the work of 800 securities analysts as well as four other thematic research analysts at BofA. In a paper that was presented at Davos by the Deutsche Bank, it argued that the world was on the cusp of several revolutions—one of AI—that could lead to significant, sudden and rapid changes to many important spheres that have been taken for granted for decades.

In this respect, active management may once more shine as passive investment hits a reckoning. During bull markets when all asset prices are rising, there is hardly any need for price discovery. This is particularly true when the largest stocks in an index keep getting bigger year after year. Given that the Global Economic Policy Uncertainty Index has risen to record levels, a stunning dissonance is apparent.

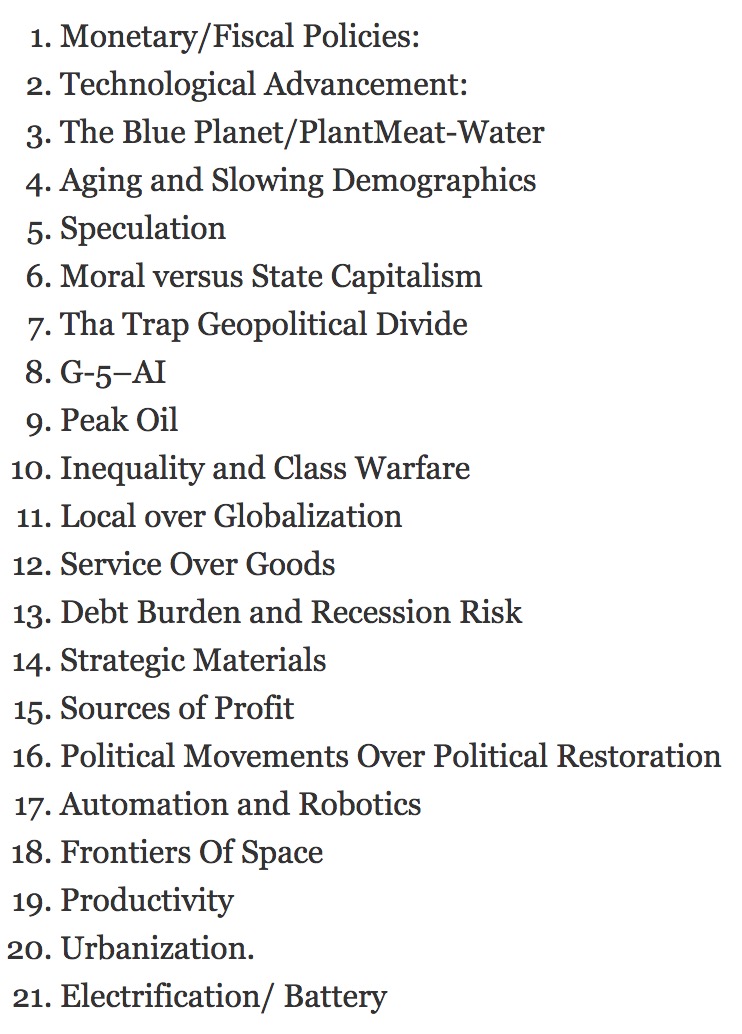

It's not uncommon when economic, scientific, social and political views about the future are changing and old trends are morphing into new ones. Thus, long-term investors aware that major transformations lie ahead, should armed themselves with fundamental research that shows which underlying forces need to be considered to get strategic investment advantages. For the purpose of this missive, I’ve identified 21mega trends that have important investment implications. Some of these trends have already emerged and are early signs of things to come. What is crucial is that the intensity is rapidly rising and broadening fast.

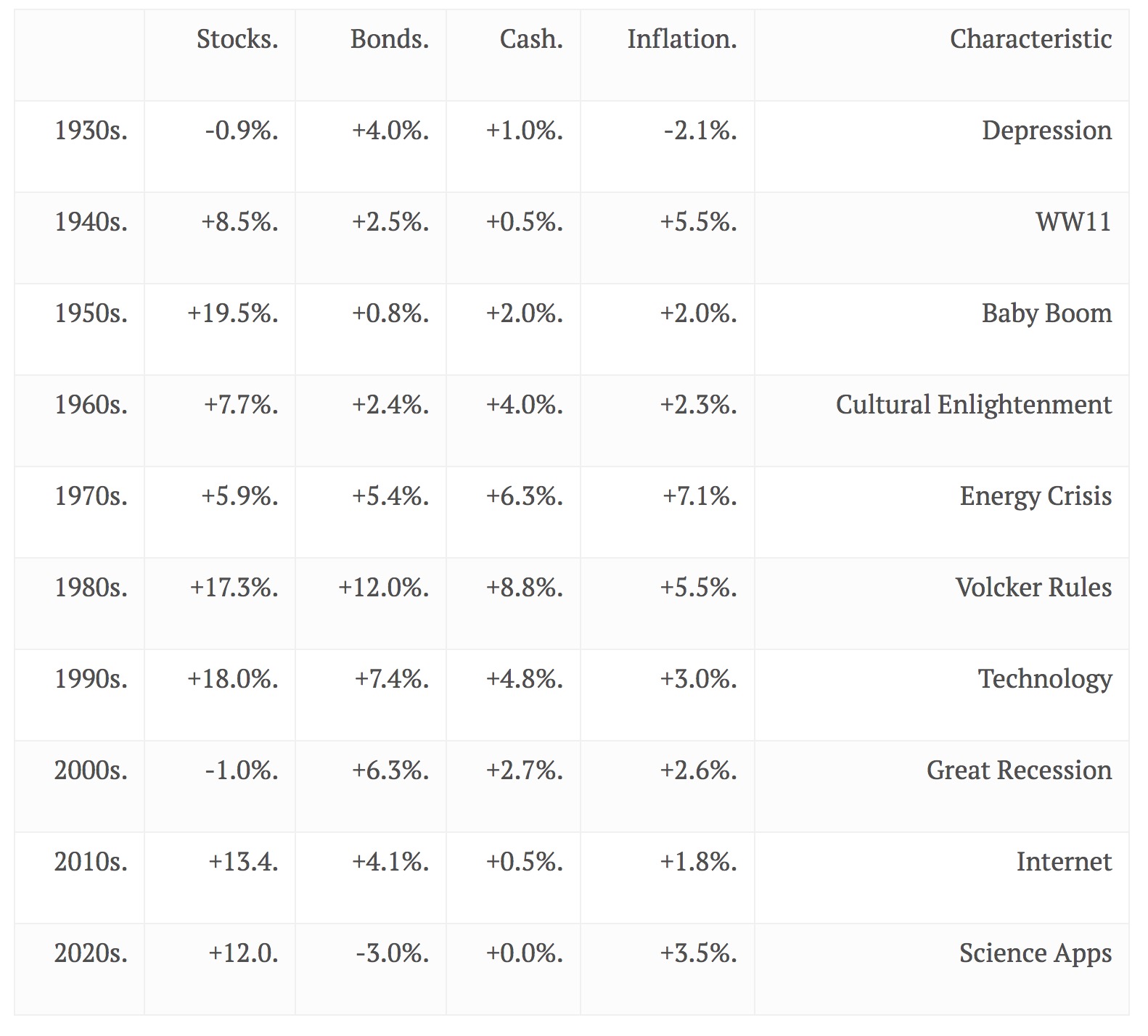

Over the next few weeks I shall discuss each of these major themes, one by one, and explore what could be their investment implications. But first, using NYU professor Aswath Damodaran’s analysis of annual returns since 1928 which I found in one of Ben Carlson’s letters, might prove to be helpful.

In order to avoid any cherry-picking and avoid the false idea that tops and bottoms can easily be actual entry points, Carlson looked at each decade in terms of asset class annual returns and inflation. The 2020s is my prediction for now.

Modern Monetary Theory: What Should Investors expect? Inflation

The eras of persistently falling inflation will likely be reversed by Modern Monetary Theory (MMT) which could also turn losers into winners and vice versa. Although the theory is generally not embraced by conventional schools of thought, it has not stopped lawmakers of the right and left from embracing it. MMT is based on the notion that a government with its own currency faces no financial constraints and can therefore print money to pay principle and/or

interest. Under this theory, vast spending ambitions of governments can be financed at the central banks. MMT is not about employing fiscal policy as a cyclical tool; it's about issuing spending money to the general population by treasuries and/or buying all the government bonds at will to finance budget deficits. Politically, this is appealing to the lawmakers because they can easily fulfill electoral promises.

Additionally, it agrees with both the sentiment and political priorities of the populist movements (Left and Right). The center no longer exists. Political pressure on the Fed is a reality to contend with. Does anyone believe that democratically elected governments completely dependent on the mercy of the populace would be willing to raise taxes, cut future pension/health benefits, reduce national security or any other expenditures, in a bid to delay the fiscal time bomb? I doubt it. They are more likely to force the Fed to come to the rescue.

The Federal Reserve’s framework review of its monetary strategy and tools is approaching decision time. We know one thing for sure. The Fed wants higher inflation. In the past ten years, inflation has been below the 2.0% target rate more often than above. This partially explains why inflation expectations have remained most of the time way below 2.0%.

The cumulative result has been that the price level has now fallen 5% below that which would have been achieved if inflation had average 2% from 2012 onwards. The Fed is clearly not willing to tolerate these shortfalls any longer. The FOMC does not want the US to get trapped in a cycle of deflation and persistently low inflation like in Japan and Europe.

It is something that the U.S. can ill afford because it is burdened with a huge twin deficit (Budget and Trade) that needs to be conventionally financed with domestic funds and/or foreign money. Last week, the Congressional Budget Office (CBO) put out a forecast that the federal budget deficit will hit more than $1 trillion this fiscal year---4.6% of N-GDP.

Tack on a 4.0% Current Account Deficit to N-GDP, the U.S. economy starts off every year with a negative savings of nearly 9%. According to the U.S. treasury, federal debt levels are already more than $22 trillion going to $31 trillion by 2030 and reaching 5.4% of N-GDP. Debt-to-GDP was 30% in the 80s but now it’s over 100% and it will be over 125% in 2010. Imagine if the greenback were not the premier world’s currency

Negative rates do not work well when external dependency for public and official money is a factor. Japan and the Eurozone enjoy surpluses and can survive the monetary black hole of zero rates even with the prospect of escape. In this respect, a watered-down MMT could be adopted. While it is certainly not the intention of the Fed to go all-in on MMT, MMT-Lite is an option---given that indeed the Fed wants more inflation.

Investors should take note that over the long term central banks cannot change the aggregate level of resources in any given economy. Growth is about the percentage of people that are of age to work and their level of productivity. All countries, even the mighty USA, have resource

constraints. If a budget deficit adds more demand than the real economy can handle, inflation will result. Even more so, if the budget deficit is paid with created money.