by Craig Basinger, Derek Benedet, Chris Kerlow, Alexander Tjiang, Richardson GMP

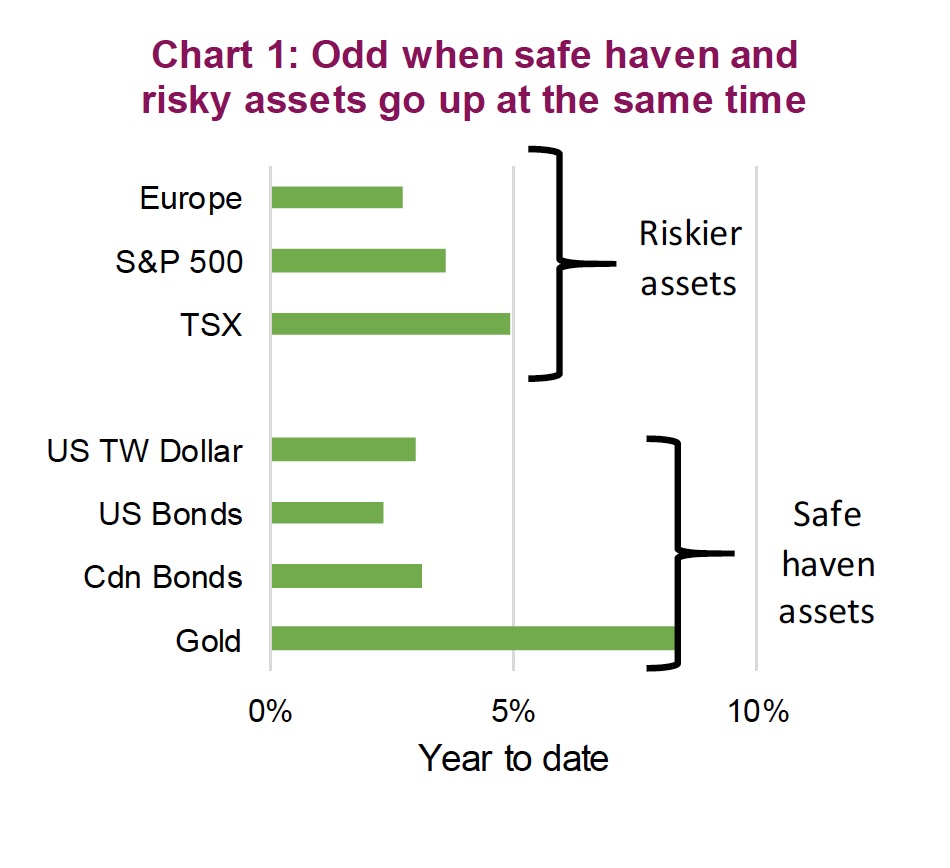

In the markets, the balance between fear and greed is ever changing, determined by the aggregate risk appetite of investors. Sometimes fear rules the day as investors become more sanguine (like the last few days). Sometimes investors become more optimistic about the future, encouraging more greed- oriented behaviour. This culminates in a market that is sometimes risk-off, which sees risky assets such as equities trading lower and risk-haven assets such as bonds or gold trading higher. Other times the market is in a risk-on mood, which sees equities and other riskier assets trading higher and safe-haven defensive investments trading lower. This is normal and is in stark contrast to the trading behaviour of the past few weeks.

So far in 2020, up until the last few trading sessions, we seemed to be experiencing an almost ‘magical market’ that had both risk-on and risk-off assets trading higher simultaneously. The S&P 500 U.S. equity market made a fresh new all-time high as recently as last Wednesday (February 19), as did the more technology-heavy NASDAQ. The S&P/TSX Composite made a new high on February 20. European equities made a new cycle high last week. The list goes on. In addition, there have been mind-blowing gains in many concept stocks. Remember Ballard? A darling of the late 1990s, shares are up 87% so far in 2020. Tesla is higher by 115%. Virgin Galactic Holdings, the company that says it will take you to space and back, is up 200% this year. Tesla is just starting to turn a profit, Ballard is not and Virgin doesn’t even really have revenue. This is clearly a risk-on environment from the equity market perspective.

But wait, safe-haven assets are up too. Bonds are off to a great start this year. The 10-year yield on U.S. Treasuries has fallen from 1.92% to 1.39% (lower yield = higher price). The Canada 10-year yield has fallen from 1.70% to 1.28%.

It’s not just bonds – other safe-haven assets are being bid higher. The U.S. dollar is up over 3% this year on a trade-weighted basis. Gold is up over $125 to $1,645/oz. These two do not normally move in the same direction at the same time. Then again, safe havens and risky assets usually don’t move in the same direction.

More evidence of this dynamic – ‘safe and risky’ assets rising together – can be found in the year-to-date performance of a number of equity sectors (as of Friday February 21). For each the S&P 500 and TSX Composite, the top four best-performing sectors since 2020 began, include two of the more defensive sectors and two riskier or more cyclical sectors in each index. In the U.S., the more defensive utilities and real estate rank first and third, respectively, so far in 2020. Simultaneously, the more growth or risky sectors of technology and consumer discretionary are ranked second and fourth, respectively. In Canada, utilities and real estate are ranked second and third. While technology and industrials are first and fourth. If gold had its own sector, as it is included in the broader materials sector, it would have sat in fourth place.

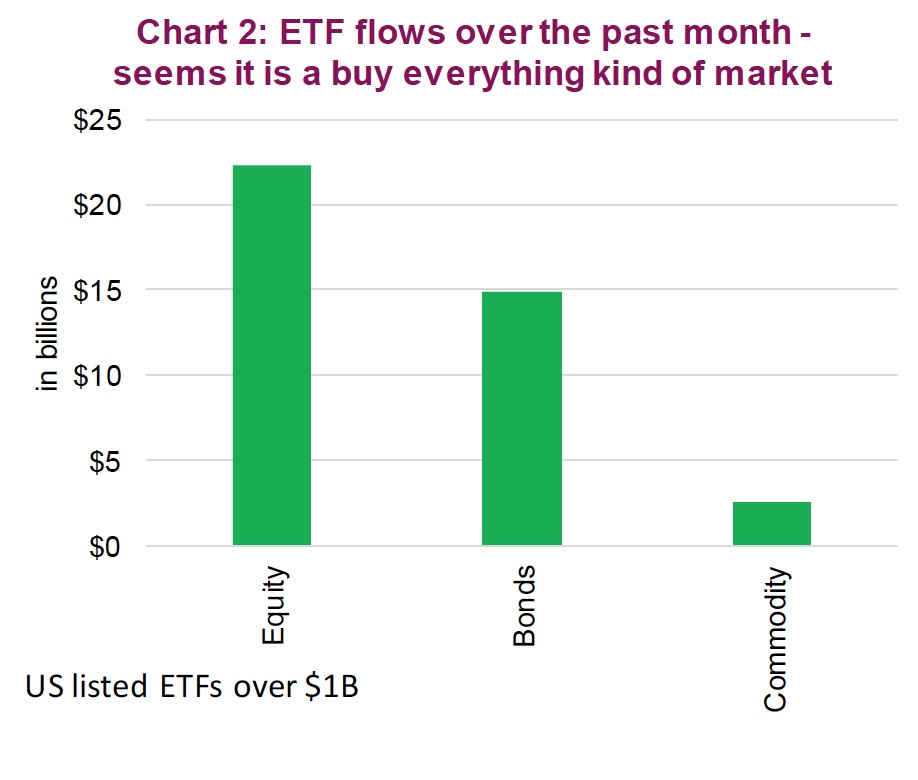

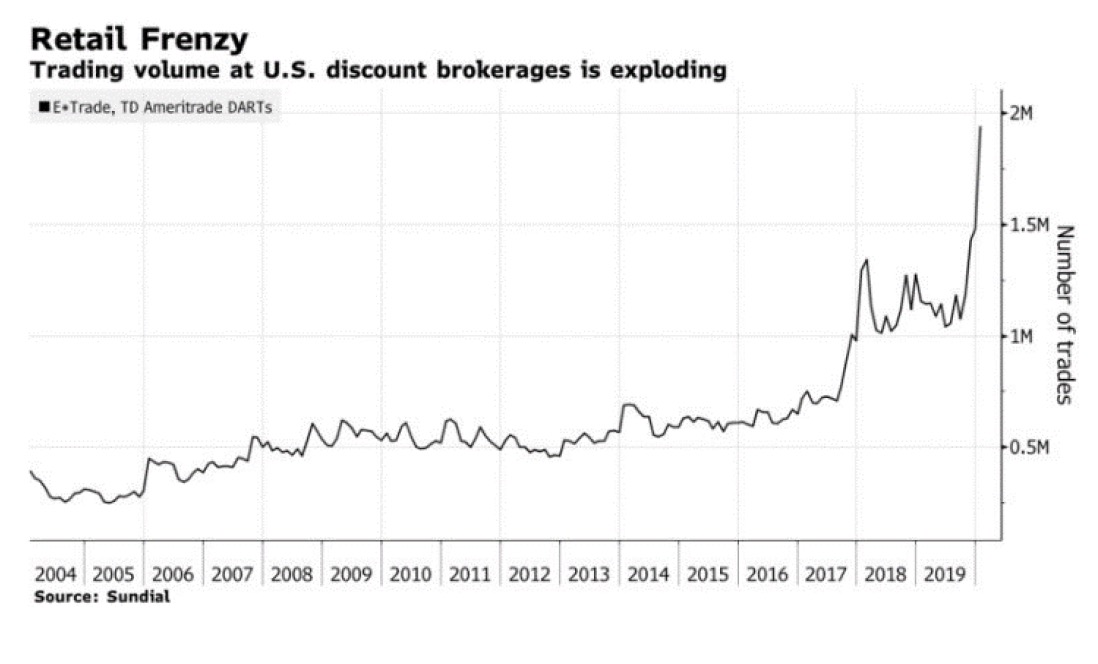

ETF trading flows have been very strong so far in 2020 and notably over the past month (Chart 2). This could be a sign that retail investors are becoming more engaged, but many institutional money managers are now using ETFs to implement strategies (like us) so it has become less clear. However, the recent explosion in activity in the form of discount brokerage trading is clear evidence of retail jumping in. The ‘Retail Frenzy’ chart is from Sundial and Bloomberg, showing the big move in online trading volumes over the past few months. Perhaps this is due to their move towards zero trading commission on many U.S. platforms. Or it’s the greed impulse overcoming fear. Remember, equity markets did rise over 20% in 2019 and that can draw many investors from the supposed ‘side lines’. It does have some echo of the late 1990s.

Our favourite quote from the media during last week was “there simply are no more sellers”. Now, the fact is for every buyer there is a seller – that is how the market works. Nonetheless, it did appear there have been some motivated buyers out there for both safe-haven assets and riskier ones. We say ‘did’ as given the market moves on Friday and the way the futures are lining up on Monday, February 24th, it would appear ‘risk-off’ has won the day.

Portfolio implications

This is classic late-cycle behaviour. While it is great to see evidence of more retail investors jumping into the market, it is unfortunate this is year 11 of the current cycle. Fundamentally, we have a hard time reconciling bond yields moving lower on dimming economic growth prospects while credit spreads remain near cycle lows. If economic growth continues to slow, defaults will rise. Either yields or spreads will be proven wrong, at some point. The same with equities: lower growth means lower earnings – that is not supportive of an equity market trading at 19x.

This period of both risk-on and risk-off assets rising together appears to be ending with a bang. We may even be in the early stages of a correction based on how the market is poised to open on Monday February 24. But this is the silly season of the cycle and the market has appeared very resilient of late. Our stance? From our 2020 outlook we continue to believe a correction is likely in the near term, this could be it.