by CIO Office, National Bank Investments

HIGHLIGHTS

HIGHLIGHTS

• Many investors were in low spirits at this time last year, a period where nearly all assets offered losses and the U.S. equity market had just undergone its worst December since 1931. Fast forward to today and we are looking at just the opposite picture, with 100% of the main risk assets that we track in positive territory on a year-over-year basis. Now what should we expect for 2020? To answer this question, we’ll go through our assessment of the four key pillars of asset allocation, namely, (1) monetary conditions, (2) global growth, (3) valuations, and (4) investors sentiment.

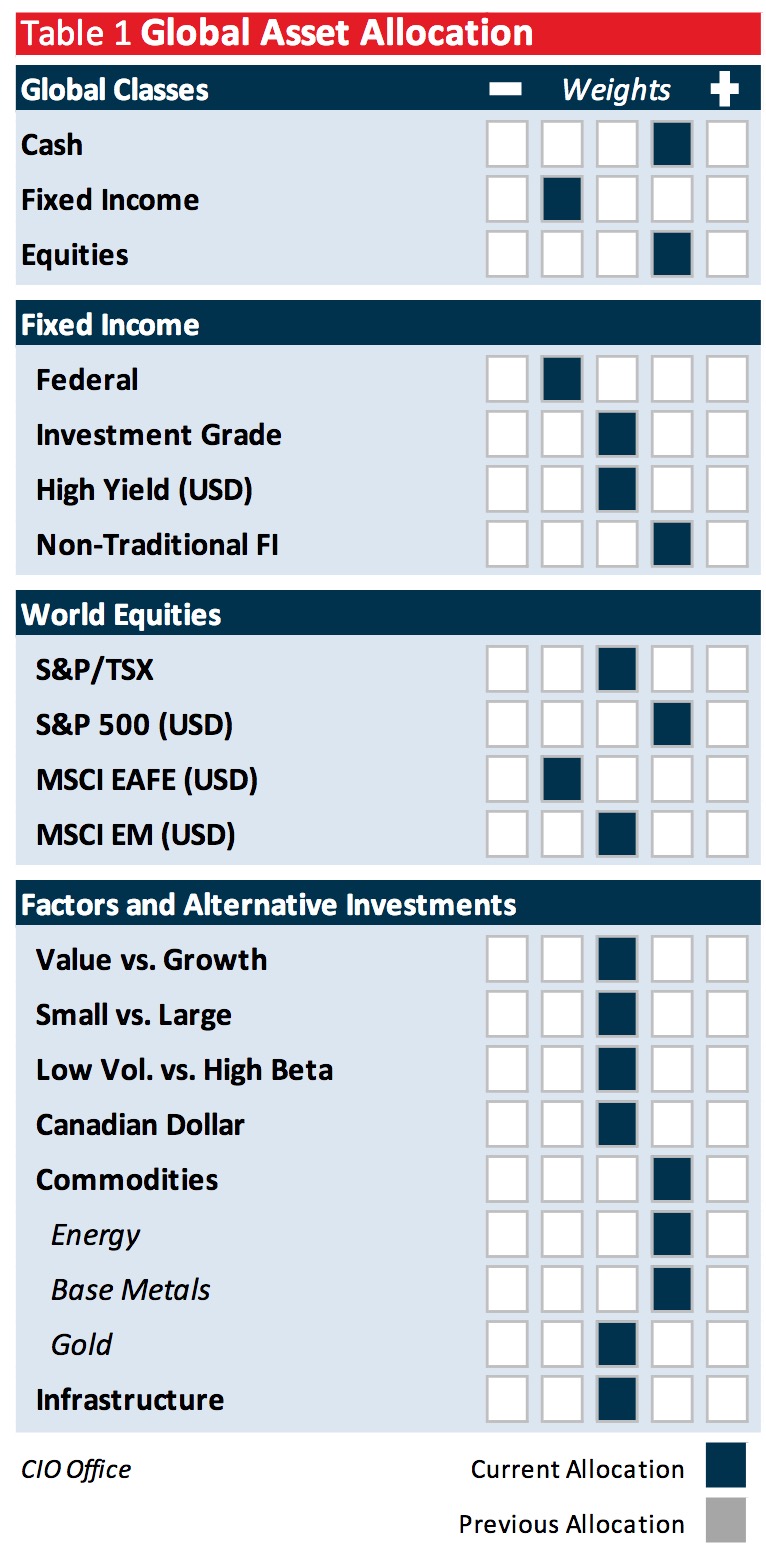

• The bottom line? With monetary conditions set to remain accommodative and global growth bottoming out, 2020 is shaping up to be a positive year for risk assets. However, investors must temper their return expectations given the already high level of valuation for most financial assets. What’s more, high optimism currently reflected in the markets calls for some prudence in the near term. Under these circumstances, we still consider our modest overweight in equities as the right positioning .

• Within the equity market, we are well aware of a growing consensus in favour of shifting assets away from the U.S. market and into more cyclical indices such as Canada’s S&P/TSX and the MSCI Emerging Markets – a legitimate choice assuming that global growth does indeed accelerate. Yet, it is specifically for th is reason that we are already holding more of these last two regions than what our GRT model currently recommends. Therefore, we’re keeping our geographical asset mix unchanged for now , but could soon bring up changes depending on how trends evolve.

• In the bond market, the backdrop of rising inflation, better growth and stable overnight policy rates should lead to steeper yield curves through modestly higher long-term interest rates. Against this back ground, shorter duration spread products should fare relatively well within the fixed-income space, but we don’t expect returns much better than their current yield-to-maturity.

• Turning to the FX market, we expect the U.S. dollar to face some headwind s in the coming months as global growth rebounds and the risk-on mood is reflected as such in the FX space. This should in turn support the Canadian dollar which has so far benefit t ed only slightly from the USMCA’s ratification and a sharp rise in interest rate spreads late last year. That said, the Loonie’s upside potential seems limited so long as the Bank of Canada doesn’t adopt a more hawkish tone, something we don’t foresee for now.

• In the commodity space, crude oil prices are likely to remain strong this year, benefit ting from sustained OPEC+ supply cuts, growing demand, reduced trade uncertainties , and a weaker U.S. dollar. As for gold, while it also tends to benefit from dollar weakness and provides a good hedge against most of the key risks preva i ling this year , we don’t see the precious metal maintaining its 2019 momentum under our base case scenario.

• Speaking of risks, we’ll have to closely follow various inflation measures through the year. They should tell us whether monetary tightening is coming sooner than expected, or if recent monetary easing fails in its attempt to re-anchor inflation expectations on target. Geopolitics should also keep investors on their toes as tensions between the U.S. and China – albeit not as severe as last year – could take markets by surprise. And, finally, the U.S. P residential campaign is likely to bring its share of uncertainties , as investors and businesses will have to weigh in the potential for higher taxes and greater regulat ory burden against four more years of Trumpism . These are the three key risks for 2020.

View the comprehensive outlook in detail – PDF

Copyright © National Bank