by Mohieddine (Dino) Kronfol, Franklin Templeton Investments

Gulf Cooperation Council (GCC) bond markets experienced a whirlwind year in 2019. Yet despite a backdrop of geopolitical uncertainty, a series of “firsts” occurred in regional credit markets. Dino Kronfol, chief investment officer, Franklin Templeton Global Sukuk and MENA Fixed Income, sets out some of the developments that he thinks could be drivers for a thriving year ahead for GCC debt.

It has been a year of unexpected developments for the Gulf Cooperation Council (GCC) debt market in 2019. The GCC bloc was included in the JP Morgan Emerging Market Bond Index (EMBI), Saudi Aramco issued its first bond, and a host of higher-yielding independent companies also issued debt, a trend we haven’t seen to this degree before. These are significant developments for what we think continues to be an underappreciated asset class. As we look towards 2020, we are particularly upbeat on GCC debt for several reasons.

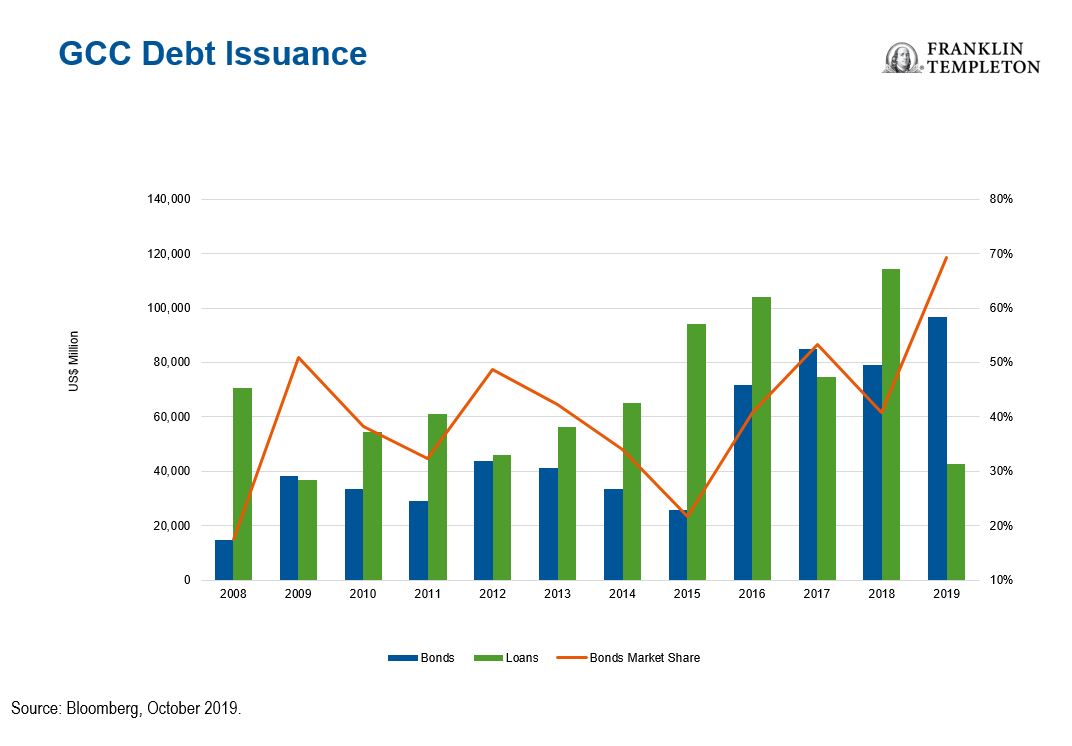

Firstly, we’ve seen a significant pick-up in issuances. With close to US$96 billion issued as of November 2019, the GCC is already on pace to exceed last year’s figure by 25%.1 GCC governments continue to tap capital markets to fund their budget deficits, and the region’s corporates increasingly borrow more in response to improving economic growth in the MENA region. Our observations suggest that over the past 10 years, bonds have steadily replaced banks as a funding source for the region, so now the ratio of bonds to syndicated bank loans is 70/30 in favour of bonds.

We believe there are good reasons to think companies will continue to use bond markets to tap into a growing liquidity pool. This should widen the choice for emerging-market debt investors and could help dampen volatility and improve the risk adjusted returns of the emerging-market bond asset class.

Secondly, the GCC’s phased inclusion into JP Morgan’s EMBI Index over the course of this past year signals a significant increase in investor interest and demand for GCC bonds.

The GCC has historically had a strong, liquid domestic investor base, and now the inclusion of the region in JP Morgan’s emerging-market benchmarks has prompted crossover investors, those who traditionally were not invested in GCC bonds and entered the market for the first time. This development has also added very important technical support to GCC bonds as an asset class. The region now accounts for approximately 18% of JP Morgan’s EMBI Investment Grade government bond index and could bring fresh flows of roughly US$50 billion.2

Thirdly, economic fundamentals in GCC countries have improved. We have seen GCC economies take bold steps to implement fiscal reforms and diversify economies away from their dependency on oil.

Governments in the GCC region continue to move their focus to growth, from a previous fixation on fiscal consolidation. Some economies, such as Saudi Arabia, continue to push for financial integration on a global scale, with the initial public offering (IPO) of Saudi Aramco a central pillar of its Vision 2030 strategy. Improving fundamentals, coupled with market development and liquidity drivers mean the backdrop for GCC bond investors is encouraging.

While we are excited about the year ahead, there are still a few areas that cause us to stop and think.

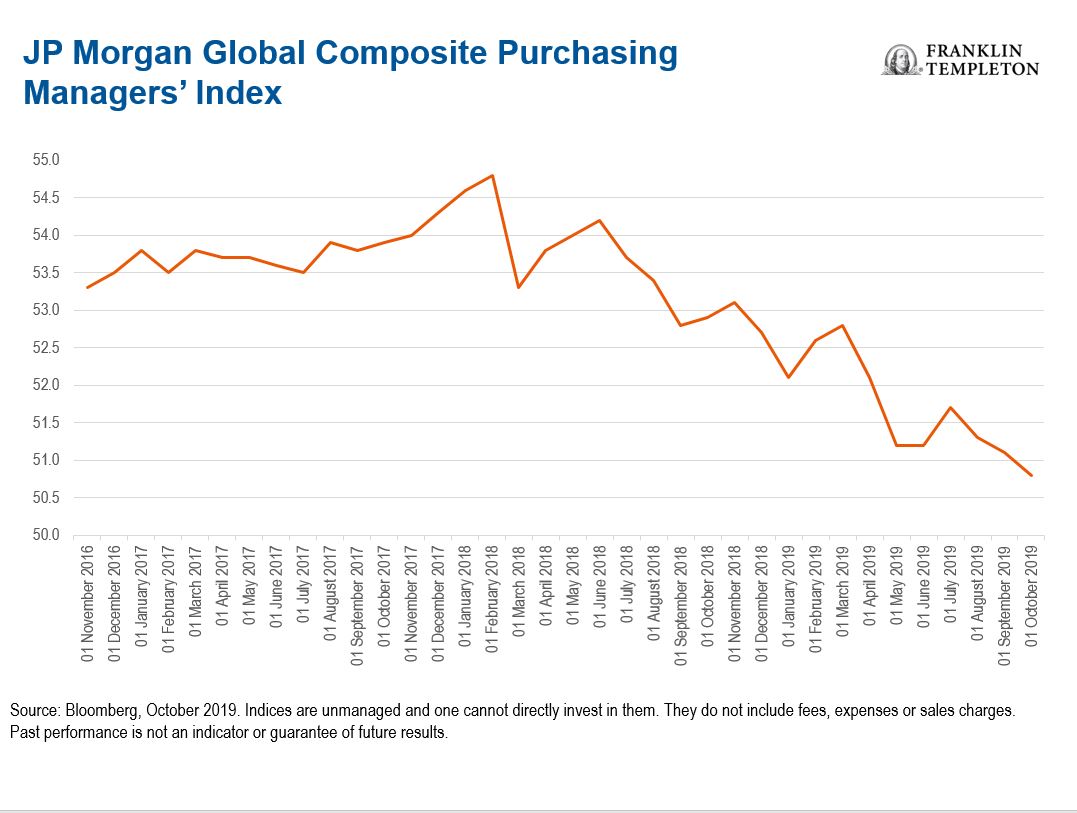

We remain relatively concerned about the short-term outlook for the global economy in light of increasing geopolitical uncertainty. While GCC bonds typically have a low correlation to oil prices and other fixed income assets, investor sentiment towards overall business and consumer confidence indices could still dampen the investor environment. Barometers of investor sentiment include weak global manufacturing purchasing managers’ indices, slowing global trade volumes, and weaker leading indicators in the United States. All these pressures could prompt central banks across the globe to adopt more accommodative monetary policies, but could complicate the valuation of risk assets.

As a result of the uncertainties we see, we want to increase the quality of our portfolios and reduce non-US dollar exposure as a precaution against what we see as asymmetric risks. We think that a deterioration in global growth could weaken risk assets that have been supported by looser monetary policy, and the prevailing view that a recession is still more than a year away. We also believe potential gains from an improvement in outlook are likely to be less than potential losses from a deterioration. And lastly, we are cognisant that valuations of bonds are less attractive now, after double-digit returns in the year-to-date period in the FTSE MENA Broad Bond Index.3

The challenge, which extends beyond the end of the year, is to better understand if economic indicators in the United States and other large economies turn back up again to support risk assets, or remain soft and require additional monetary stimulus beyond what the market is already pricing in.

We also need to consider region-specific factors affecting sovereigns, banks and companies, particularly those related to, or dependent, on oil prices. It seems to us that a more prudent approach at this juncture might offer some opportunity amid global uncertainty.

Broadly speaking, we believe the defensive characteristics GCC markets generally possess—lower correlations, lower volatility and smaller drawdowns—should persist and provide opportunities in this uncertain environment.

As we bring in the new year, we think GCC bond markets merit much more attention than they’re currently receiving. The growth of corporate issuance for example has introduced opportunities for investors to find new idiosyncratic exposures. And while we are more cautious than we were at the beginning of the year, we are ready to seek opportunities that a potentially volatile market and a growing region present.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

The comments, opinions and analyses presented herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FT affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in developing markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with their relatively small size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Such investments could experience significant price volatility in any given year. Investments in the energy sector involve special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector.

1. Franklin Templeton’s own calculations based on Bloomberg bond issuance data.

2. Franklin Templeton’s own calculations based on JP Morgan data. These figures are estimates only. There is no assurance that any estimate, forecast or projection will be realised.

3. Source: Bloomberg, September 2019. The FTSE Middle East and North Africa (MENA) measures the performance of investment-grade and high-yield US dollar-denominated debt issued in the MENA region. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or guarantee of future results.

This post was first published at the official blog of Franklin Templeton Investments.