by Ronald Temple, CFA, Co-Head of Multi-Asset and Head of US Equity, and

David Alcaly, CFA, Research Analyst, Lazard Asset Management

Slowing growth never feels good. In 2019, global real GDP growth will likely decelerate from 3.6% in 2018 to just above 3%.1

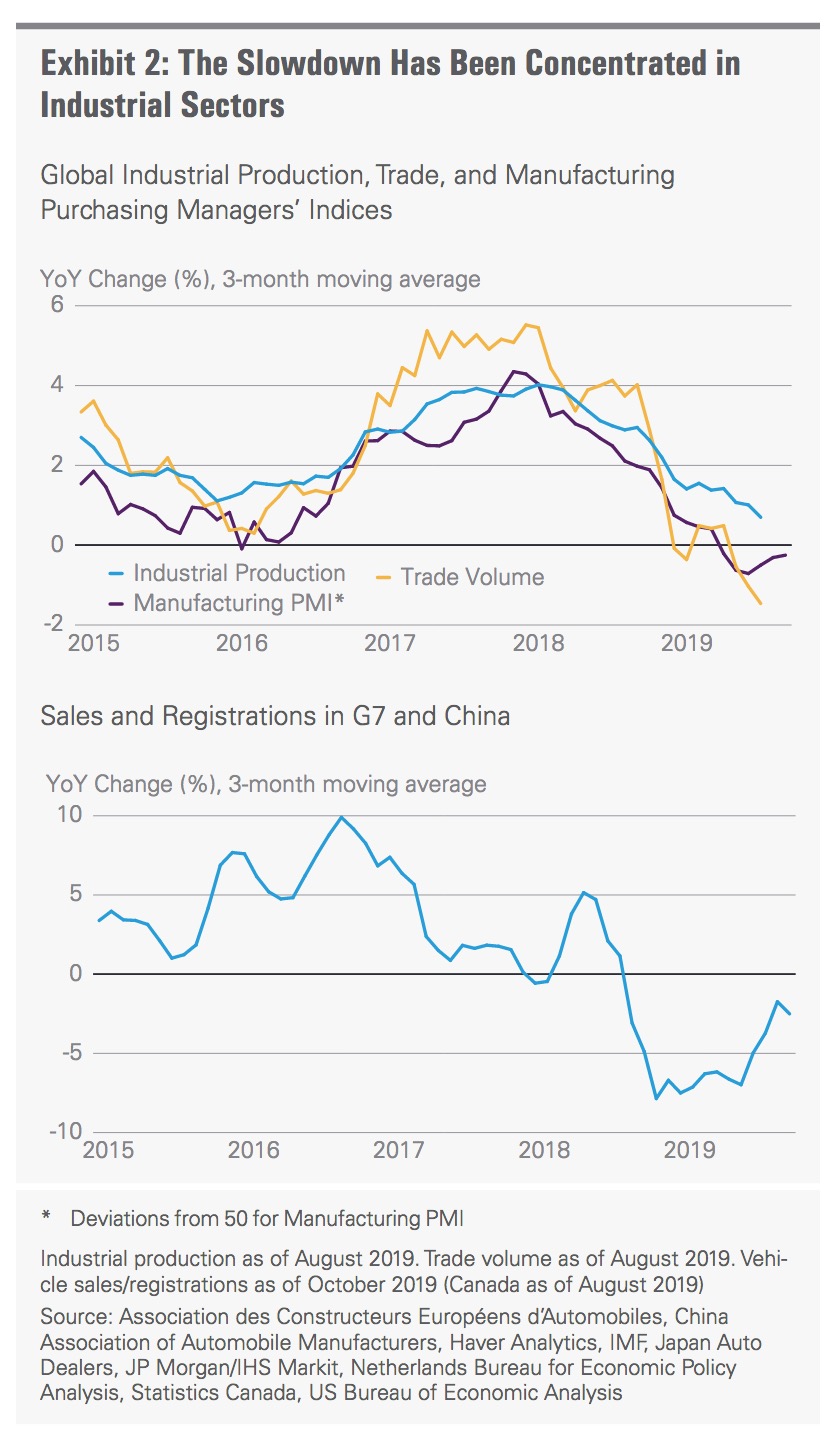

The slowdown was most concentrated in industrial and trade-exposed sectors and economies, with the US-China trade war and a meaningful decline in auto demand weighing particularly heavily on activity. In spite of the third industrial down-cycle in the last decade, service-and consumer-exposed sectors largely remained resilient. In the US in particular, household finances continued to improve on the back of labor market strength.

Political concerns continued to cloud the economic outlook as US protectionism escalated substantially, Brexit uncertainty persisted, European political fragmentation continued, and impeachment proceedings against US President Donald Trump began.

Central bankers did their best to stimulate growth. The Federal Reserve completed its U-turn on monetary policy and unwound three of the four rate hikes from 2018. The European Central Bank (ECB) took rates further into negative territory with the first rate cut since 2016, bringing the deposit facility rate to -50 basis points (bps). Both the Fed and the ECB also resumed asset purchases—the Fed for technical reasons and the ECB for stimulus. The People’s Bank of China (PBoC) continued to add liquidity to the banking system on the margin, cutting reserve requirements but keeping benchmark rates largely unchanged.

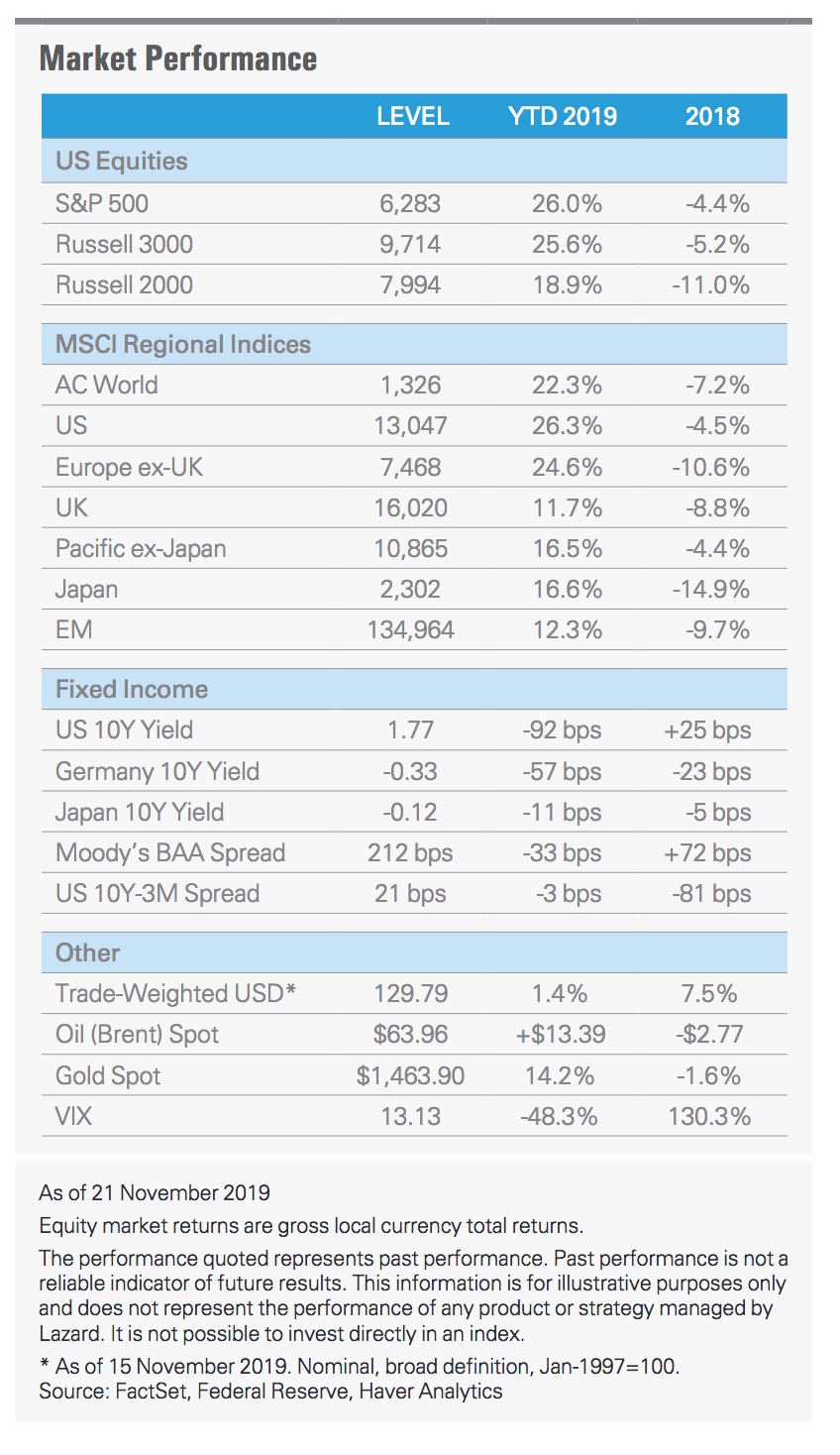

Central bank stimulus drove financial asset values higher. Global bond yields declined sharply, and after a climactic run in late August, more than $17 trillion in debt was in negative-yield territory. At the same time, equity markets powered higher, with the S&P 500 Index reaching a new record high over 3,100 and the MSCI AC World ex USA Index rising by more than 15%.

1. Trade Tensions

1. Trade Tensions

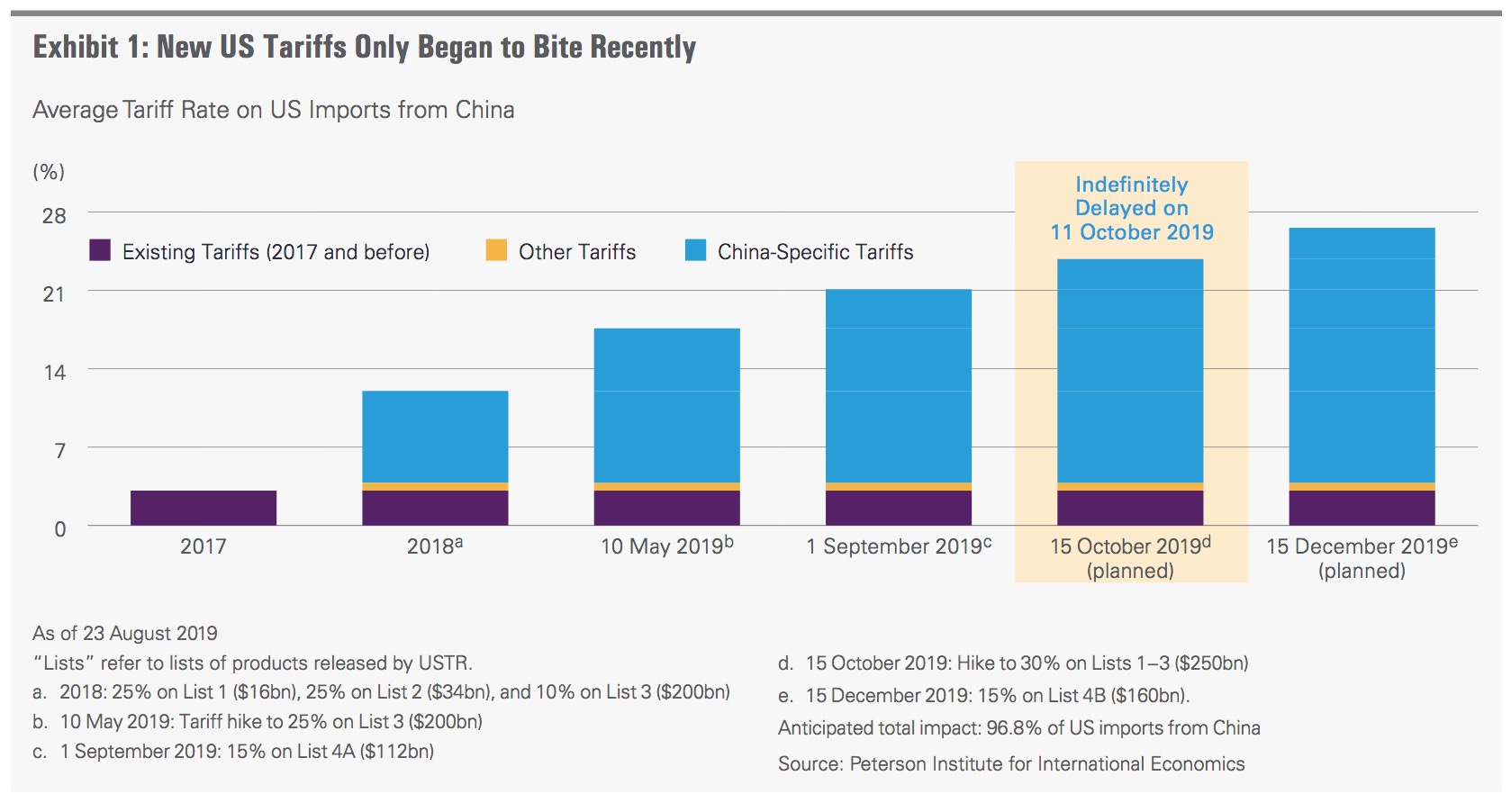

In 2019, US protectionism—and Chinese retaliation—escalated substantially (Exhibit 1). Both the direct impact of tariffs and the larger impact of uncertainty on business investment became increasingly evident. As pressure mounted, US and Chinese negotiators signaled in the fourth quarter that they were nearing a “phase one” trade deal that still needed to be formalized.

We continue to believe the overall trajectory for US-China trade tensions is negative—two steps backward, one step forward—and that the political space for any deal is very narrow. That said, we see three broad scenarios facing investors on US-China trade in 2020:

• Bull case: Tariffs are partially rolled back and China agrees to purchase more US commodities.

• Base case: The escalation in tariffs pauses, but tariffs already imposed remain in place at current levels.

• Bear case: Negotiations break down and the escalation in tariffs continues, with the US imposing the tariffs originally scheduled for 15 October and 15 December, and China retaliating.

We view resolution of the broader dispute as highly unlikely given that certain aspects of the US’ complaints are likely non-negotiable, including demands that China fundamentally change its economic system by dismantling its industrial policies. Moreover, with the increasingly prominent view in Washington that China has become a strategic adversary, it is highly likely that the US will continue to roll out targeted measures that restrict US companies from selling sophisticated technology products and services to Chinese clients.

Moving beyond China, the US also has fractured its trading relationships with a range of other parties. We see the most elevated risk being the US trade relationship with the European Union, where the US has most recently threatened tariffs on the automobile and auto parts industries.

2. Global Industrial Inflection

Global industrial production and trade began slowing in 2018 and decelerated even more acutely in 2019, with weakness in motor vehicle manufacturing (Exhibit 2) potentially accounting for as much as a third of the 2018 slowdown in trade, by IMF estimates.2

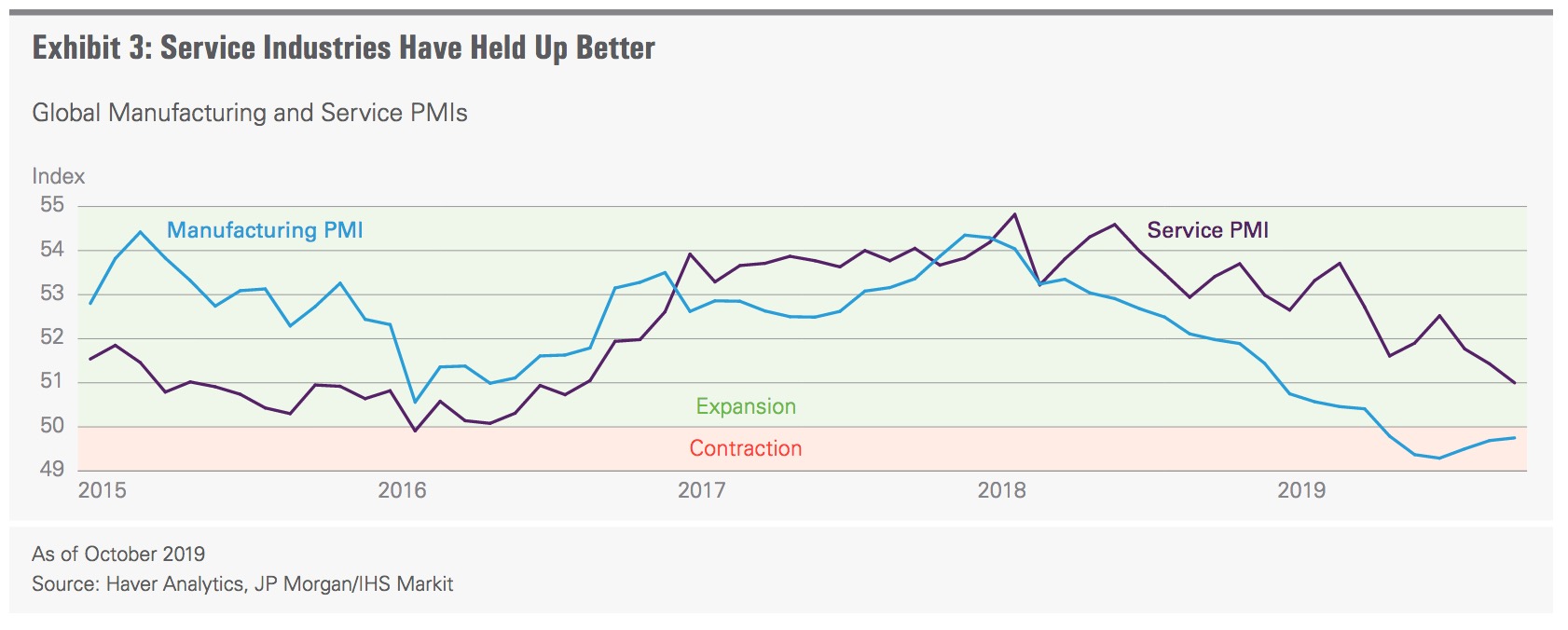

Late in 2019, we have begun to see survey data, such as the Purchasing Managers Indices for the manufacturing sector, stabilize and even start to rebound on the margin (Exhibit 3). Part of the stabilization may reflect improving sentiment due to the potential for a pause in the US-China trade war, but in our view, the bigger driver is that sentiment simply overshot on the downside relative to the reality of the manufacturing economy.

To the extent the US and China do reach an agreement, we would expect uncertainty in the business sector to subside somewhat and broader sentiment to improve further. The inflection in industrial activity is especially important to Europe, and particularly to Germany, which saw its economy contract in the second quarter after years of powering the euro zone economy. The rest of the euro zone has proven more resilient, as France and Spain depend less on industrial activity and exports to drive growth. Moving into 2020, it will be important for industrial growth to at least stabilize in order to avoid dragging down the service economy.

3. U.S. Labor Markets

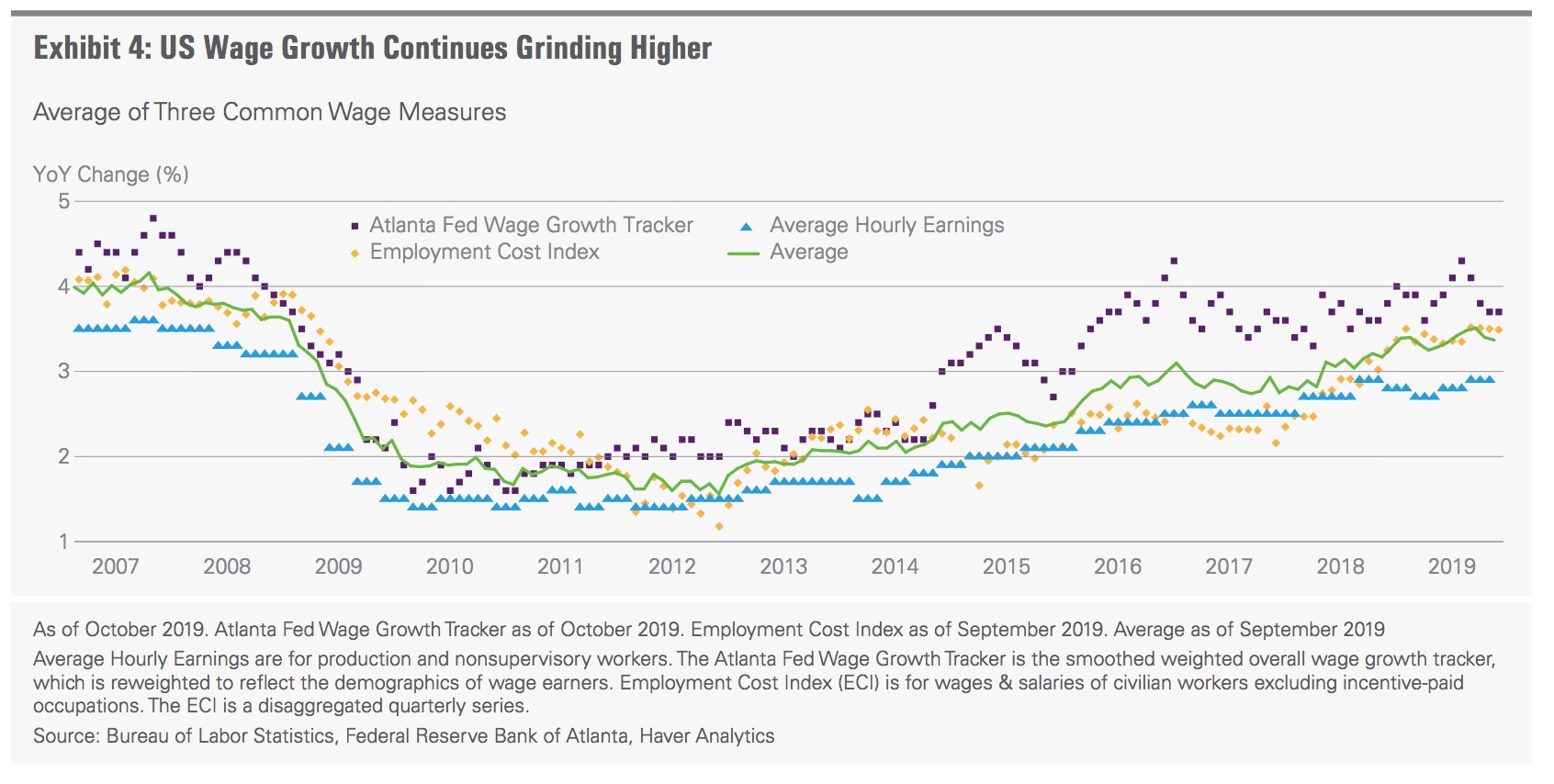

The strength of the US labor market, and its ability to drive wage growth, has been a key premise for our optimism regarding the US economy for the last several years (Exhibit 4). We believe there is a virtuous circle in which stronger labor markets lead to higher wage growth, which in turn leads to increased consumer spending, which then feeds back into job and wage growth.

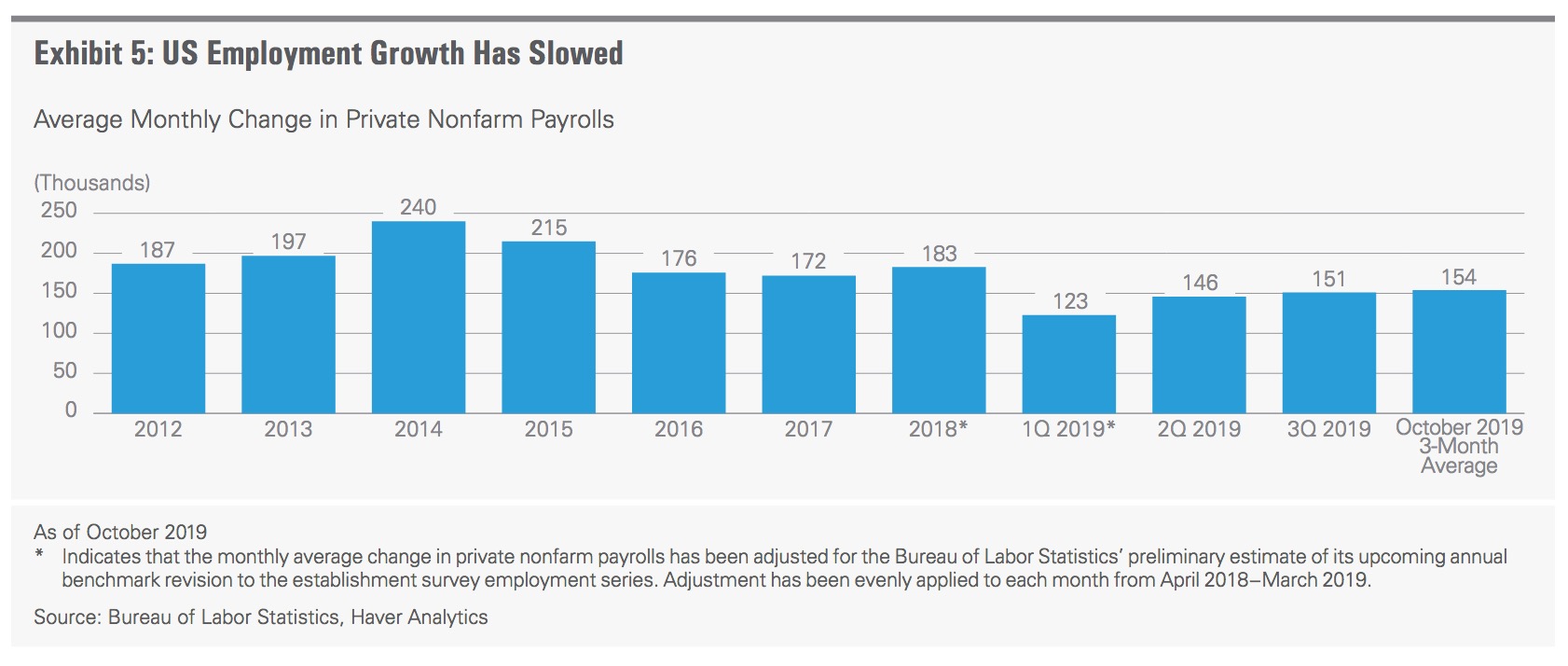

Through 2019, job growth decelerated (Exhibit 5) but remained at a level materially above that needed to keep pace with population growth. In 2020, we expect further slowing in the job growth numbers as employers find it more difficult to fill open positions and global growth remains sluggish.

Compounding the evidence of a slowing labor market is a decline in the job opening rate from a high of 4.8% at the beginning of 2019 to 4.4% as of September. Still, our base case is that job growth will continue to exceed the number of jobs needed to maintain stable unemployment— about 80.100,000 jobs per month—dragging the unemployment rate below 3.5% and continuing to put upward pressure on wages.

4. Monetary Policy

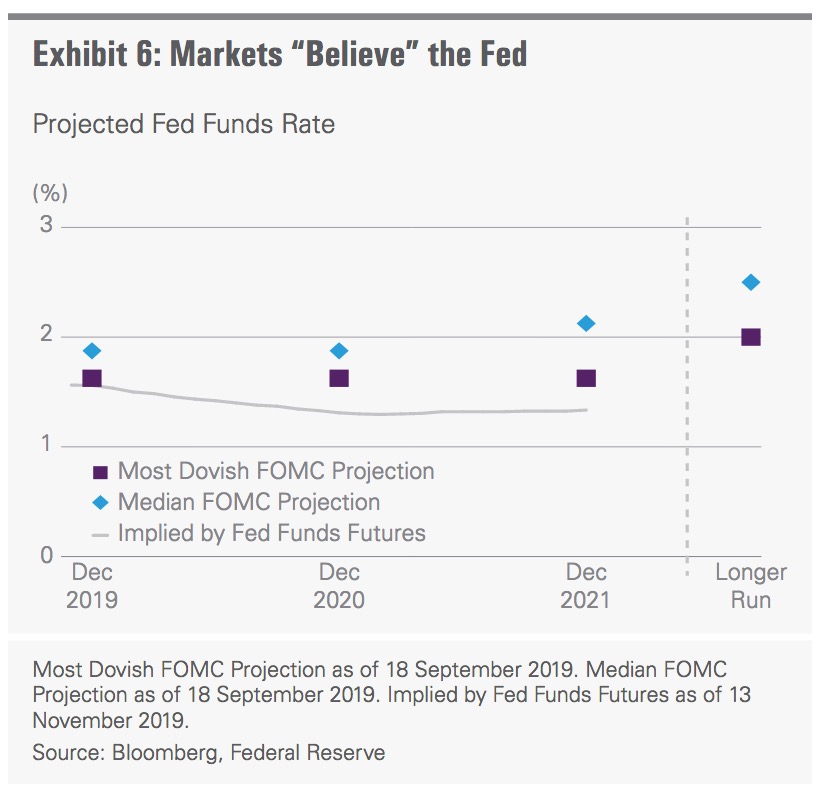

For perhaps the first time in a decade, 2020 might be a year in which monetary policy is not a key consideration. We expect central banks to remain on the sidelines for the foreseeable future. Federal Reserve Open Market Committee (FOMC) Chair Jerome Powell made it clear in the 30 October press conference that the Committee has no intention of either cutting rates beyond the current level of 1.5%.1.75%, barring a significant change in the economic outlook, or of raising them, barring a significant and sustained increase in inflation.

We believe this guidance, as does the market (Exhibit 6). Fed funds futures now imply one additional 25-bp rate cut by the fourth quarter of 2020, likely reflecting the view—which we share—that there is more downside risk to growth than upside risk to inflation. Market expectations for a number of other major central banks, such as the ECB, imply a similar outlook, which we feel is directionally appropriate: that rates are likely to remain on hold through 2020 with some downside risk.

However, several major central banks may reexamine their strategies in light of the challenges posed by low rates, low inflation and slow growth. The Fed is likely to finish a review of its strategy, tools, and communications in mid-2020, and the ECB could undertake a similar exercise. We expect any shift in strategy to be communicated carefully, to mitigate the risk of a market surprise. The results nonetheless will be important to understanding what central banks might do in the next recession.

5. Global Technology Ecosystem

While the technology juggernaut has dominated markets for the last decade, technology companies increasingly find themselves in policymakers’ crosshairs. Concerns over data privacy, global taxation, market power and competition, content moderation, and the role of social media in politics all increasingly arouse passion and raise questions about the public interest.

At the same time, US national security concerns are increasingly leading to restrictions on Chinese access to technology. To date, these limitations have been narrowly defined, but there is scope for them to broaden. And even if they don’t, it is clear that many companies in the sector are rethinking their supply chains.

Compounding these concerns is the fact that China increasingly is motivated to accelerate and broaden the scope of its efforts to develop a sophisticated indigenous technology industry that is not susceptible to US trade restrictions. How national competition in these areas plays out is likely to have far-reaching global consequences in several areas, including the development of global standards in the telecom arena.

Taking all of these factors together, the operating landscape for technology companies appears to be much less certain than in the past.

6. U.S. Politics

Finally, it would be negligent not to mention the uncertainty resulting from both the ongoing impeachment process and US elections in 2020. While undoubtedly important events, we believe investors tend to overestimate the importance of the president and policy to the overall trajectory of the US economy.

Furthermore, it is easy to overestimate the likelihood of large policy changes. Major changes usually require single-party control of the White House, Senate, and House of Representatives, and they are difficult to predict, as public policy does not operate in a vacuum. The policy areas that we believe should be most important to investors in the near term are:

• Trade policy, for which the president has significant flexibility to enact change individually;

• Corporate tax policy, as a single-seat majority in both houses of Congress is sufficient to make major changes;

• Regulation of industries such as energy, which the executive branch can direct in many instances.

Many other major policy changes would likely require a single party to win a majority in the House, a filibuster-proof majority in the Senate, and the presidency.

Investment Implications

Given our expectation for slow growth, but no recession, and extremely accommodative monetary policy, we have a moderately positive near-term view of financial assets, although we recognize that the risk of an unexpected shock is always present.

The challenge investors face at this point in the cycle is weighing short-term performance considerations against long-term investment objectives. The temptation to make decisions based on short-term market dynamics can lead to taking positions that can be very damaging. For example, buying a 100-year, low-coupon bond might be a very good trade for an investor who thinks rates will decline by 50 bps, as profit on the trade would be the duration multiplied by 0.5%. However, if rates back up by 100 bps, the same investor would incur large losses.

The reason we highlight this divergence between long-term investing and short-term trading is that the current market environment poses particularly difficult decisions to capital allocators. Rates are likely to stay lower than expected for longer than investors expected even one year ago. As a result, we believe managers will feel pressure to extend duration and take on more credit risk for higher yield. This trade may work for a few months or even a year or more. However, we believe the risk- reward of extending duration is asymmetrically negative at current rates. Moreover, we see increasing signs of underwriting sloppiness in the US corporate credit universe.

Looking through the year, our base case view is that the US 10-year yield stays in a range of 1.25%.2.25%. A break above 2.25% is most likely if the US and China resolve a meaningful portion of the trade dispute, but this is a questionable scenario. A breakdown of trade talks amid further escalation that leads to weakness in the service sector of the US economy could easily take the global stock of negative-yielding debt to $20 trillion and US 10-year yields below 1.25%.

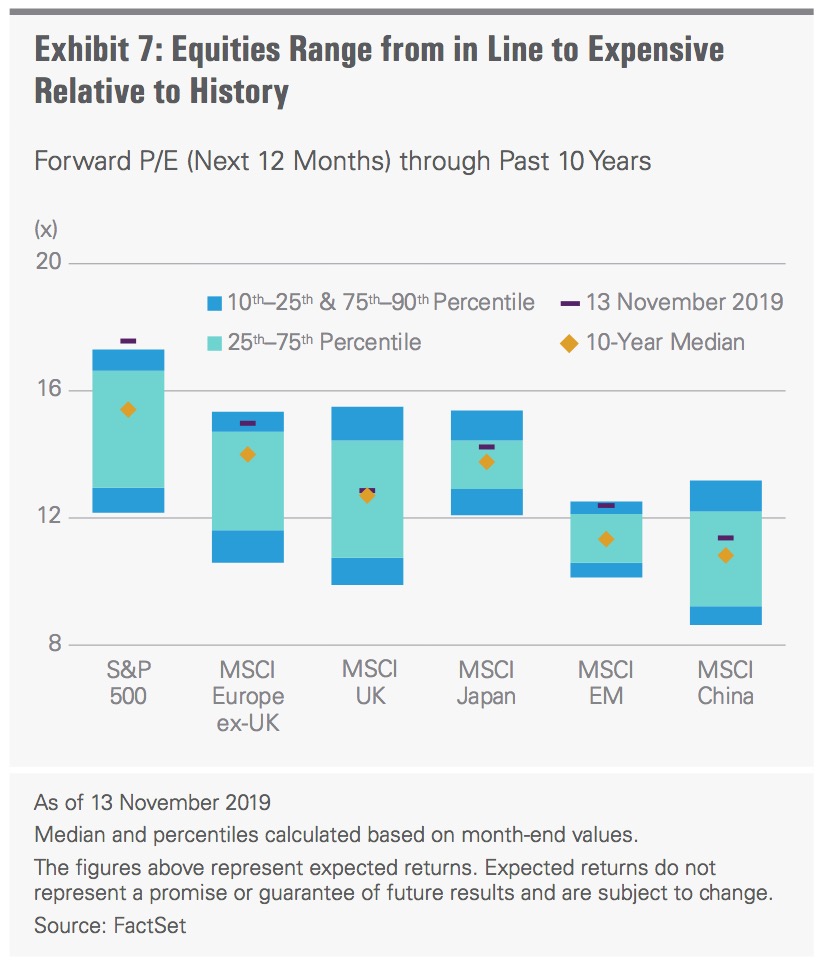

Given our view of rates and credit, it should be no surprise that we are more bullish on equities. However, we believe the easy money of 2019 is behind us and expect a slow grind higher driven by earnings growth rather than valuation expansion. As we survey global equity markets, no major market is inexpensive relative to the last 10 years, and the US and Europe ex-UK are particularly expensive. The UK is the only market close to the median of the last decade, as Brexit risk continues to weigh on prices (Exhibit 7).

Within markets, we remain positively disposed toward companies with high, sustainable returns on capital our analysis, these compounders tend to outperform throughout the market cycle and defend particularly well in down markets. The challenge more recently has been finding compounders at an attractive valuation. That said, in a market that is likely to be driven by earnings growth rather than valuation expansion, we also believe that security selection is likely to be a much more important driver of total return than in recent years.

Overall, we believe equity market returns in 2020 are likely to be confined to the mid-single digits with fixed income total return between 0%.5%. Going forward, it is critical that investors rightsize their expectations for returns, as it isn’t safe to assume that multiples will expand further. While fixed income offers a diversification benefit, it does not offer much of an income advantage over cash. It might be time to reallocate money away from debt toward cash, even if it means a bit of a drag against quarterly benchmarks. It also could be a good idea to allocate away from debt toward compounding equities, as the risk-reward profile is at least more balanced for companies that can sustain high returns.

Conclusion

In summary, investors should expect slower growth and very accommodative monetary policy in 2020. We believe the global economic backdrop will continue to be challenging as we enter 2020, but recession is not our base case. Rather, our base case is that the global industrial slowdown will find a bottom without spilling over to the service sector. Factors to watch in the year ahead include trade tensions and their impact on the economy, the resiliency (or lack thereof) of US labor markets, the evolving global technology ecosystem, and US politics.

Taking stock of the situation, we see modest upside for equities driven by earnings growth. We would caution that at this point in the cycle, investors should take opportunities to upgrade the quality of their holdings with a focus on valuation and fundamentals such as high returns on capital, strong balance sheets, and robust cash flow. In fixed income, while we see no reason to worry about a sharp backup in rates or a spike in defaults in the near term, we are wary of reaching for yield by taking on duration and credit risk. Finally, we believe this is a market environment in which security selection is likely to be a much more meaningful portion of total returns, as equity market appreciation is likely to be capped in the mid-single digits and bond returns may well be even lower.

For more insights from Lazard Asset Management visit our website. www.lazardassetmanagement.com

Notes

1 IMF World Economic Outlook. As of 15 October 2019.

2 Ibid.

Important Information

Published on 26 November 2019.

Information and opinions presented have been obtained or derived from sources believed by Lazard to be reliable. Lazard makes no representation as to their accuracy or completeness. This presentation is for informational purposes only. It is not intended to, and does not constitute, an offer to enter into any contract or investment agreement in respect of any product offered by Lazard Asset Management and shall not be considered as an offer or solicitation with respect to any product, security or service in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or unauthorized or otherwise restricted or prohibited. All opinions expressed herein are as of the date of this presentation and are subject to change.

An investment in bonds carries risk. If interest rates rise, bond prices usually decline. The longer a bond’s maturity, the greater the impact a change in interest rates can have on its price. If you do not hold a bond until maturity, you may experience a gain or loss when you sell. Bonds also carry the risk of default, which is the risk that the issuer is unable to make further income and principal payments.

Equity securities will fluctuate in price; the value of your investment will thus fluctuate, and this may result in a loss. Securities in certain non-domestic countries may be less liquid, more volatile, and less subject to governmental supervision than in one’s home market. The values of these securities may be affected by changes in currency rates, application of a country’s specific tax laws, changes in government administration, and economic and monetary policy. Emerging market securities carry special risks, such as less developed or less efficient trading markets, a lack of company information, and differing auditing and legal standards. The securities markets of emerging market countries can be extremely volatile; performance can also be influenced by political, social, and economic factors affecting companies in emerging market countries.

The securities and/or information referenced should not be considered a recommendation or solicitation to purchase or sell these securities. It should not be assumed that any of the referenced securities were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or equal to the investment performance of securities referenced herein.

Certain information included herein is derived by Lazard in part from an MSCI index or indices (the “Index Data”). However, MSCI has not reviewed this product or report, and does not endorse or express any opinion regarding this product or report or any analysis or other information contained herein or the author or source of any such information or analysis. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any Index Data or data derived therefrom. The MSCI Index Data may not be further redistributed or used as a basis for other indices or any securities or financial products.

This document reflects the views of Lazard Asset Management LLC or its affiliates (“Lazard”) based upon information believed to be reliable as of the publication date. There is no guarantee that any forecast or opinion will be realized. This document is provided by Lazard Asset Management LLC or its affiliates (“Lazard”) for informational purposes only. Nothing herein constitutes investment advice or a recommendation relating to any security, commodity, derivative, investment management service, or investment product. Investments in securities, derivatives, and commodities involve risk, will fluctuate in price, and may result in losses. Certain assets held in Lazard’s investment portfolios, in particular alternative investment portfolios, can involve high degrees of risk and volatility when compared to other assets. Similarly, certain assets held in Lazard’s investment portfolios may trade in less liquid or efficient markets, which can affect investment performance. Past performance does not guarantee future results. The views expressed herein are subject to change, and may differ from the views of other Lazard investment professionals.

This document is intended only for persons residing in jurisdictions where its distribution or availability is consistent with local laws and Lazard’s local regulatory authorizations. Please visit www.lazardassetmanagement.com/globaldisclosure for the specific Lazard entities that have issued this document and the scope of their authorized activities.

HB30897

Copyright © Lazard Asset Management