by Grant Bowers, Franklin Templeton Investments

There’s an old adage called “climbing a wall of worry” that’s used to describe a situation where markets continue to climb in the face of uncertainties. Certainly there is no shortage of uncertainties today, yet US stocks have clawed their way to new all-time highs. Franklin Equity Group’s Grant Bowers recognises there may be a few cracks emerging, but says there are still two main reasons to be optimistic about the outlook, and believes there is still room for US equities to run in 2020.

Listen to our latest “Talking Markets” podcast to hear more from Grant on US equities, along with our Andrew Burkly, who shares a European outlook.

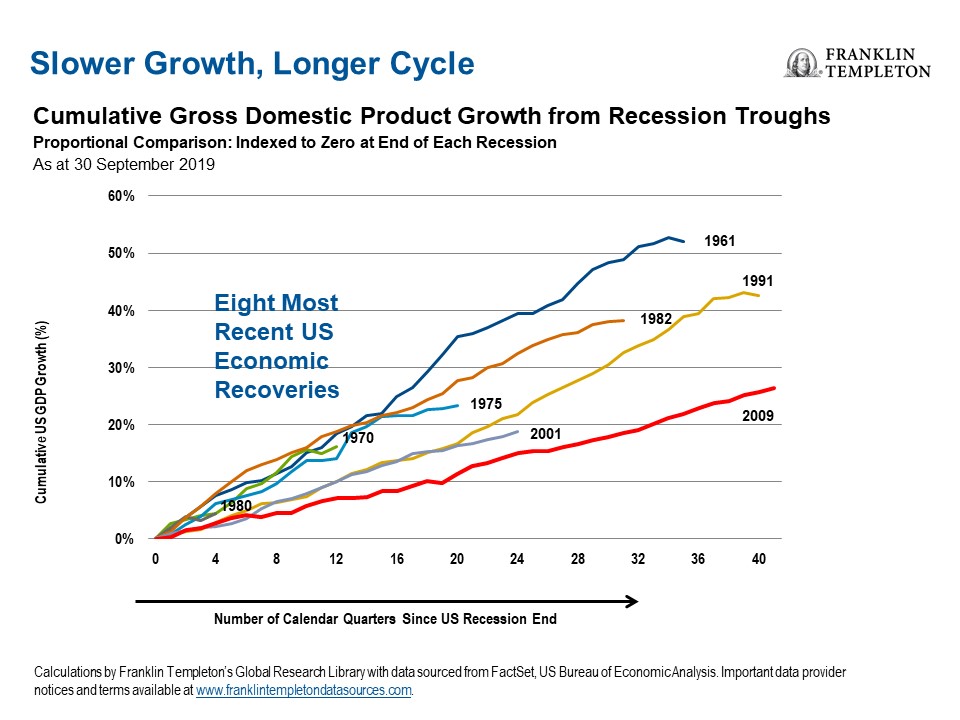

As we near 2020, we’ve received questions from growth-minded investors in particular about whether the US equity bull market still has room to run over the next decade. That’s an understandable concern, considering the United States has been in one of the longest periods of economic expansions in history—dating back to June 2009.1 However, it has also been very shallow and slow compared with similar expansionary periods in the past. This slower rate of growth is a result of the severity of the global financial crisis a decade ago, and the low-inflation, low-interest-rate environment that followed.

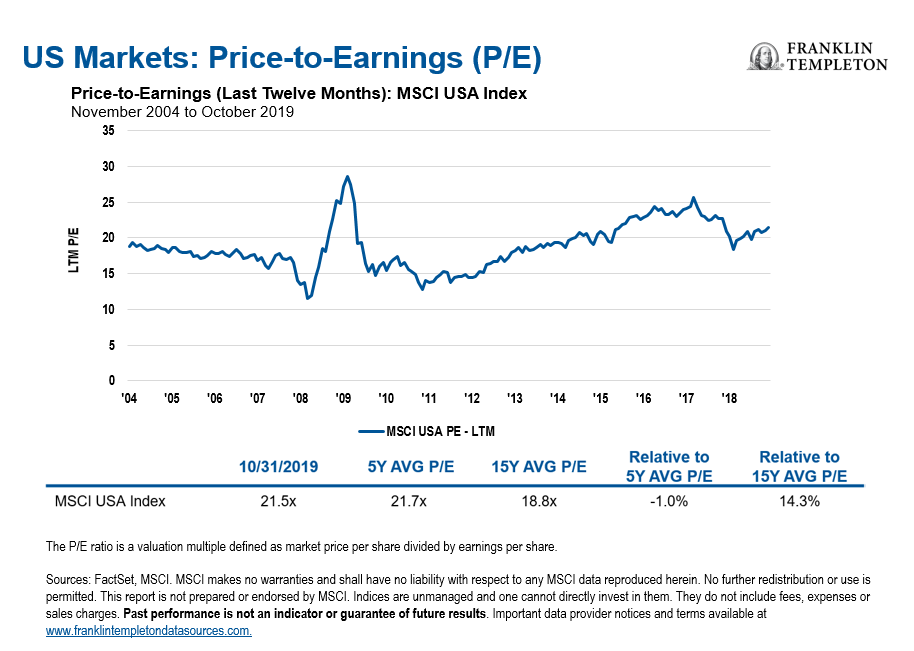

Though market pundits raise concerns about the duration of the current cycle, US equities remain near all-time highs. When we look at the data and what’s going on in the market, we believe this late-cycle period can last much longer than people expect. According to our analysis, valuations for US stocks, as measured by the forward price-to-earnings (P/E) ratio of the S&P 500 Index, suggest US equity valuations are in line with historical averages.2

Although US stocks aren’t cheap, we don’t think they are expensive either. We believe the US Federal Reserve’s decision to lower interest rates this year has created a more supportive backdrop for US equity growth.

Even with a reasonably constructive view of the economic backdrop, we recognise that at this point in the cycle, the likelihood of significant market advances may decline going forward; we also anticipate those advances may be paired with higher levels of volatility. For these reasons, we believe selectivity and active management are important elements for investors to consider. We find many investment themes today very compelling; you can find insights on these themes in another recently published blog post.

US Economy’s Two Main Sources of Strength: Consumers and Corporates

In our view, the US economy can continue to grow in a range of 2%-3% a year for much longer than many people believe.3 We base this view on two main factors: consumer strength and corporate earnings.

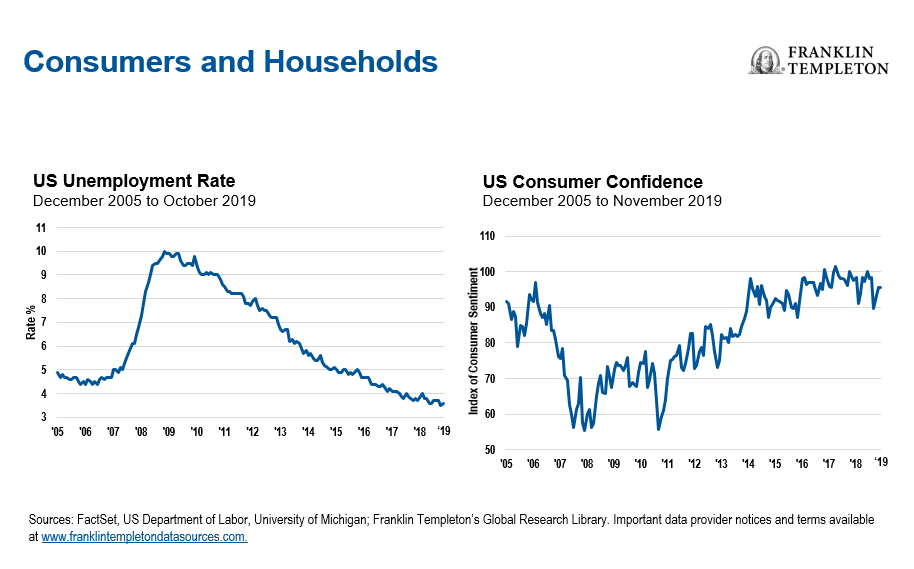

US consumers have benefitted from strong US job growth for many years now and are feeling strong enough to go out and make large purchases. We’ve also seen some wage growth in the past two years, which has further benefitted consumer spending.

We continue to keep a close eye on the strength of the consumer, because it is one of the biggest drivers of the broader US economy—responsible for roughly two-thirds of US gross domestic product.

We are also monitoring consumer debt levels and debt ratios, which remain low compared to historical averages. Although consumers have taken on more leverage, they are not spending more in ways they did in past periods of economic cycles or economic peaks.

Although US earnings moderated a bit in the third quarter of this year, the market has looked beyond that to prospects for the fourth quarter and for 2020. We are seeing signs that the outlook for corporate earnings is generally more positive today than it was a few months ago. We think earnings could continue to improve going forward. US companies would likely benefit from a rebound in global growth, considering about 40% of profits for multi-national companies come from overseas.

As earnings grow, we expect to continue to see stock buybacks and dividend increases, as well as core capital expenditure investment. As active investors, we have the opportunity to speak with executives and management from a number of companies. They’ve told us they are spending on technology such as artificial intelligence and data analytics to boost productivity and enhance investments, versus building new factories or buying more machinery.

As those investments and themes emerge, we believe it remains an exciting time for growth investors. We look forward to uncovering new investment opportunities in the new year.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investment updates, follow us on Twitter @FTI_Global and on LinkedIn.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investing in fast-growing industries, including the technology sector (which has historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement. Value securities may not increase in price as anticipated or may decline further in value. Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections.

1. Source: National Bureau of Economic Research.

2. Sources: FactSet, MSCI. Indices are unmanaged and one cannot invest in an index. They do not include fees, expenses or sales charges. Past performance is not an indicator or guarantee of future results. MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. No further redistribution or use is permitted. This report is not prepared or endorsed by MCSI.

3. There is no assurance that any estimate, forecast or projection will be realised.

This post was first published at the official blog of Franklin Templeton Investments.