by Hubert Marleau, Market Economist, Palos Management

When the FOMC convenes as it did last week and delivers its verdict, the global financial markets attentively listen. The Fed cut its target rate for the third meeting running to 1.63% and communicated that “if developments emerge that are a cause for material reassessment of our outlook, we would respond accordingly.”

The guidance was arranged in a way to satisfy both the hawks and the doves. Powell gave the Fed some space before taking any new actions. On the one hand, the Fed would need to see serious recessionary signals to bring about another rate cut. On the other hand, the monetary authorities would need to see a really significant and persistent move in inflation before they would consider raising rates.

The stock market squealed with excitement because it took the message well. The recession risk is manageable at only 12%, the ongoing data prints in the job market and in the consumer sector are supportive for an economic expansion of at least 1.5%. The preferred measure of inflation is running well below 2.0%.

Currently, the pace of the economy on the supply side is running with an attainable 0.7% annual increase in productivity and 1.2% in employment. On the demand side, real disposable income was up 3.5% year-over-year in September, representing 70% of the GDP--that tantamounts to a growth factor of 2.5%.

As a matter of fact, just about everything is normal and in a good place with the possible exception of the dollar. Earlier in the year, “good news” was considered bad while bad news was “good” because the equity market was signaling that it needed the Fed’s help. It appears that this is no longer the case. The policy rate is now basically equal to the neutral rate and the yield curve is mildly positive.

Moreover, the inflationary content of the Misery Index ( the combination of the unemployment rate and the inflation rate) is in a sweet spot at 30% and the Palos Monetary Policy Index which takes into account inflation, employment and growth, stands at 100.00 suggesting that everything is hunky-dory. In other words, the economy is better to be left alone.

The consensus among the strategists, the collective view of the markets and the scholarly knowledge of the Fed are looking at the same data in an indisputable environment of unopposed views.

Perhaps, the most telling question about where the economy is heading may be the dollar. The DXY which measures the US currency against a basket of major peers tracked its worst month since January 2018.

That is actually a welcome event and very positive. It’s notable that foreign exchange traders are trimming their long positions as their strategists are no longer raising their dollar forecasts. Thus, international investors are less lured to the safety aspects of the greenback.

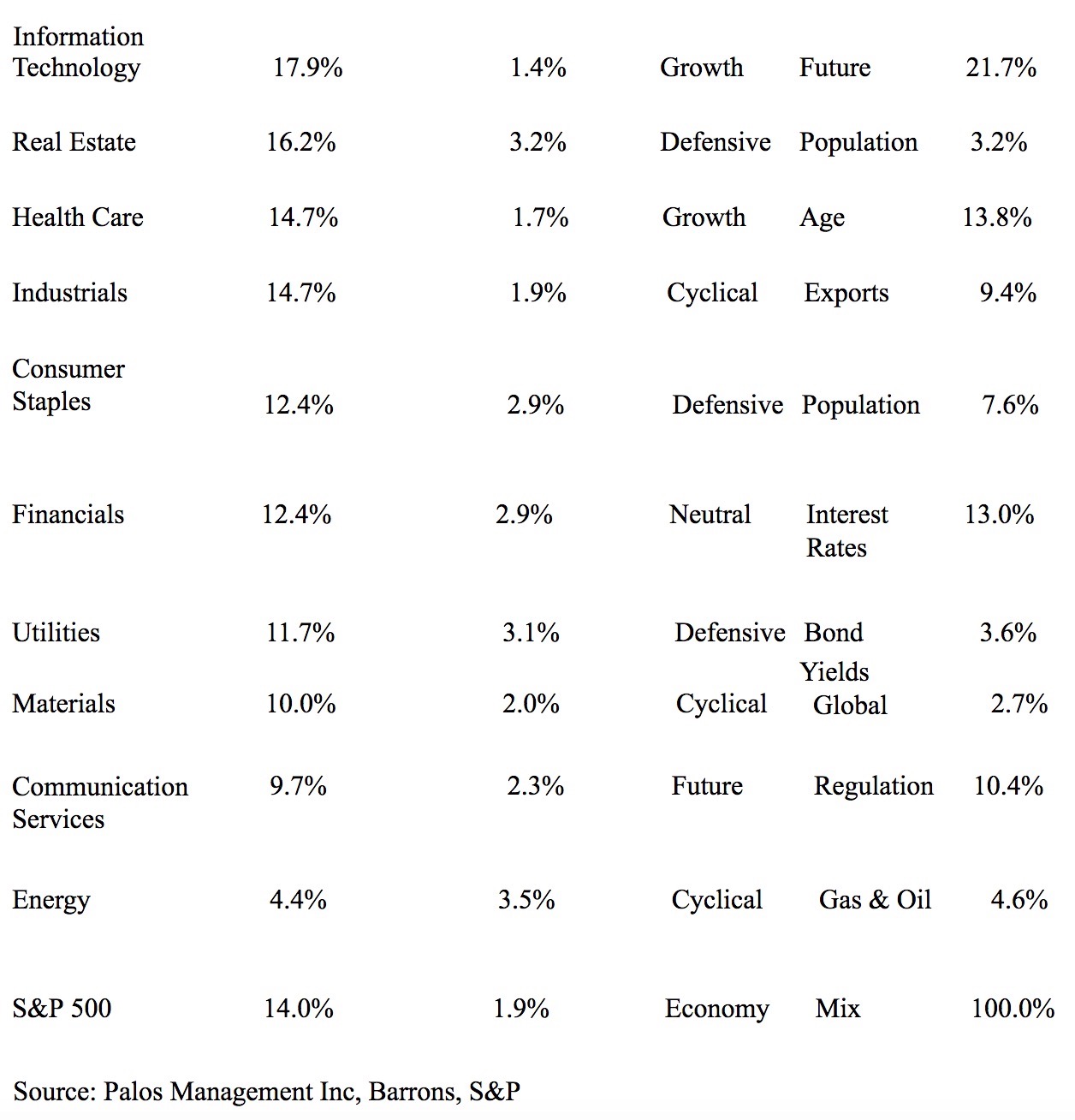

Many are rooting for a lower dollar value. Greenback weakness is on the contrary very supportive of growth including trade, commodities, emerging markets and global markets. It is the main reason why cyclicals are leading the way.

Bloomberg’s Weekly Fix wondered how long Powell’s desire to move the Fed to the sideline can last. Using history as a guide, one of the longest Fed pause in the last 30 years was from March 1997 to September 1998--18 months.

However, within the ZIRP period the stretch was longer, from October 2013 until lift-off in December 2015--27months. Of course, nobody knows how long this halt will last. Suffice it to say, the spread between January 2020 and January 2021 Federal Funds Futures is likely to remain significantly compressed.

Under these circumstances, the Fed is unlikely to make further changes, up or down for an extended period of time, decade-long bull market still has a lot of room to run. Studies on equity peaks since 1937 show that being uninvested under the kind of financial and economic conditions that we are now in, investors would leave a considerable amount of money on the table.

Interestingly, stock market metrics are also in a good place. The equity risk premium for the S&P 500 is 425bps, the Rule of 20 is favourably positioned at 18.25x, earning yields are 440 bps above inflationary expectations and the Advance/Decline ratio is generally positive on a daily basis.

Copyright © Palos Management