by Scott Thiel, Blackrock

We see income, or carry, reasserting itself as the key driver of bond market returns. Scott explains.

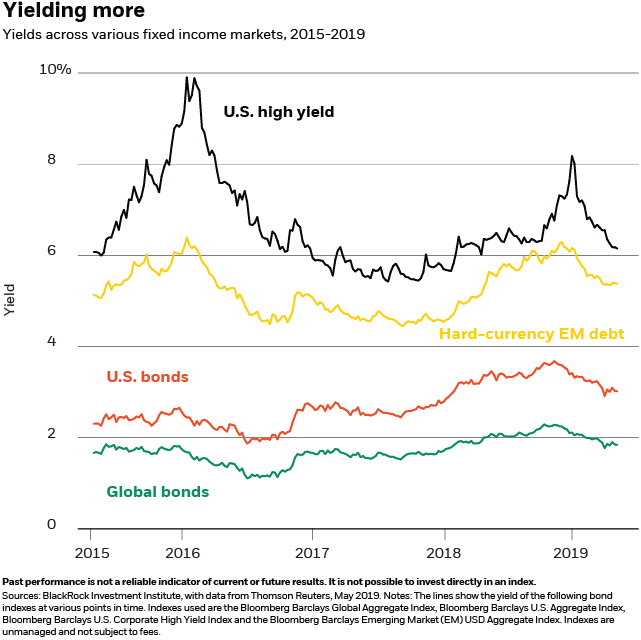

Coupon income historically has contributed the lion’s share of total returns across global fixed income markets. Yet declining yields this year elevated the role of capital appreciation in generating returns. Price appreciation made up roughly three-quarters of U.S. Treasury returns in the first quarter, we estimate.

We see carry, or income, reasserting itself as the key driver of returns in bond markets in the quarters ahead, taking back the reins from price appreciation, as we write in our latest Fixed income strategy piece Carry is king. A patient Federal Reserve and a dovish tilt to monetary policy globally reinforce our view, as does a slowing, but still growing global economy.

Central banks, growth and inflation

We see rates in the U.S. on hold for the time being, as the Fed remains on pause. The Fed may also allow inflation to run hotter, as it considers a change (unlikely for now, in our view) to its inflation targeting framework. We expect the European Central Bank to pause further steps toward policy normalization for 2019 and beyond, as it seeks to ensure a return of inflation. We believe the Bank of Japan may tweak policy earlier than markets expect, in an effort to improve the sustainability of its “yield curve control” policy.

Our BlackRock GPS indicates that the global expansion should continue through the year, albeit with global growth moderating further. We see U.S. growth slowing as the economic cycle moves into the late stage. Yet we believe the U.S. economy can remain in the late-cycle phase, avoiding recession throughout 2019. We see little sign of economic overheating or inflationary pressures.

We expect European growth to find firmer footing later this year (read our recent Macro and market perspectives), but worry about the ECB’s lack of policy levers to counter any future downturn. We are increasingly confident the Chinese economy will turnaround in the second quarter, fueled by fiscal and monetary policy easing. Global inflationary pressures remain subdued, particularly in the eurozone and Japan.

This backdrop should give comfort to investors in search of income. Yields are higher across global bond markets versus two years ago, offering greater income potential. See the chart below.

Risks to our outlook

Overall, we see a narrow path ahead for risk assets to move higher – but there are risks that could knock markets off track. A resurgence of recession fears or inflation pressures that force the Fed to resume tightening pose risks to our outlook, as detailed in our Q2 2019 Global investment outlook. Other risks include a further intensification of U.S.-China trade disputes or a U.S.-Europe trade showdown (read more about key risks on our BlackRock geopolitical risk dashboard).

Our fixed income views

U.S. Treasuries have historically played a key role in cushioning portfolios against such bouts of volatility. We also like U.S. credit, including high yield bonds, and emerging market debt from a fixed income perspective because of their income potential. Yet we are neutral on these asset classes in a multi-asset context, where we prefer to take economic risk in equities.

Scott Thiel is BlackRock’s chief fixed income strategist, and a member of the BlackRock Investment Institute. He is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of May 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0519U-856700-1/1