by John Lin, AllianceBernstein

African swine fever is ravaging China’s pork supply and having a global impact on protein prices. For equity investors, the crisis serves as a reminder that even amid trade-war uncertainty, research into domestic trends can help investors access the country’s vast stock market.

China is a pork-loving nation that produces and consumes about half the world’s pig meat. That’s why the outbreak of African swine fever is so dramatic. It’s a deadly virus with no known vaccine or treatment, so Chinese farmers have been forced to conduct massive culls of hog herds. By the end of the year, China’s pork output may be reduced by as much as 30%, according to some analysts. At a time when Beyond Meat’s IPO in the US is drawing attention to potential substitutes for animal proteins, China’s crisis is threatening to change the supply and demand dynamics of meat markets around the world.

Shrinking Pork Supply Shakes Global Meat Markets

Consider the numbers. In 2018, China produced 54.2 million tons of pork while consuming 55.7 million tons. The total world supply of pork was 113 million tons. If current forecasts materialize, China would lose about 16 million tons of supply by year-end—more than the total production of the US and Brazil combined. The world simply doesn’t have enough pork to fill the void.

What about other animal proteins? Last year, China produced 11.7 million tons of chicken and 7.3 million tons of beef, according to the USDA. Substituting other meats for pork would push up demand in China and globally. This will have several effects on global markets:

-

- Animal meat prices will increase—pork prices already rose 15%–20% in April, which is typically a seasonally weak period. Chinese pork prices may surge 50% by year-end, according to some forecasts. Chicken prices are rising and even the demand for premium Australian steaks has increased. There are already signs that meat prices are up, from the US to Europe to Brazil. Poorer countries will be affected most.

-

- Meat consumption will decline—as prices rise broadly, we expect a significant decline in meat consumption in China over the next year and a half. This could potentially lead to a change in consumer behavior and tastes for years to come.

-

- Grain prices are likely to fall—because there will be fewer hogs to feed. That’s bad news for farmers, especially those in the US who already feel squeezed by the US-China trade war.

-

- Chinese inflation may rise—hog prices are a significant component of China’s consumer price index. Rising hog prices are already driving up the CPI and could create inflationary pressures that might constrain the People’s Bank of China’s ability to ease liquidity and support the economy.

What Does This Mean for Investors?

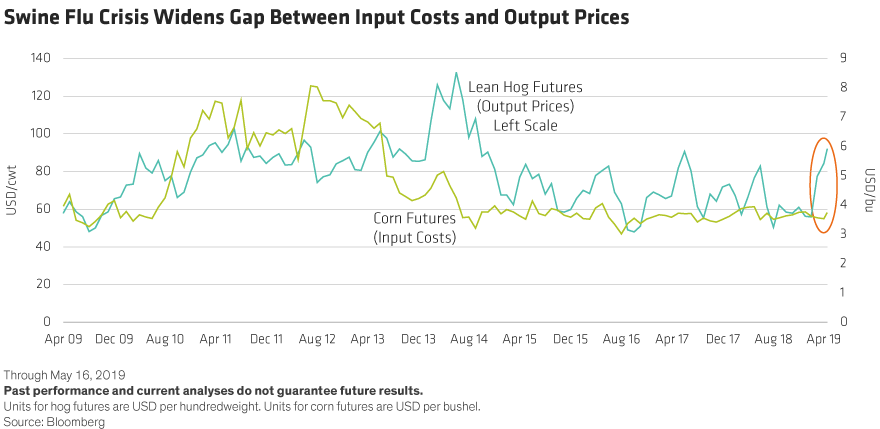

These trends offer some researchable points for investors. For example, the gap between input costs (corn) and rising output prices (hogs) is creating a more profitable dynamic for hog farmers not just in China, but in the US and beyond.

This analysis also highlights a key difference between trade-war uncertainty and the pork predicament in China. It’s very hard for investors to research the potential effects of a trade war because the outcome is tied to unpredictable political decisions. In contrast, it’s already possible to develop meaningful forecasts of how the swine flu will affect agricultural commodity markets, meat prices, industries and individual companies.

China’s Vast Stock Market Offers Plenty of Choice

For investors in China, the crisis also serves as a reminder about the power of the domestic economy and the depth of the local stock market. Even with the trade war raging, 1.3 billion Chinese people still need to put food on their tables. And China’s A-shares market is so vast, with more than 3,000 companies to choose from, that investors can find stocks of companies poised to benefit from shifting consumer habits and price trends, which are unrelated to trade tensions.

By understanding what’s happening on the ground in China, investors can position accordingly. Pork producers in China, Brazil and Europe could stand to benefit from rising prices and margins; shares of chicken farming companies might also see increased demand. At the same time, companies that sell animal feed and grain could face pressure, and their shares may be vulnerable today.

Fallout from the African swine flu reinforces the weight of China’s influence in global markets. In the past, the world would watch US trends to determine asset prices. Today, what happens in China matters just as much, as the world’s second-largest economy shakes up global markets for industrial commodities and soft agricultural commodities alike. Even if the fever is brought under control, it will take at least 12–18 months for China to get its hog herd back to its previous size. Such a major market event requires investors to take a closer look at companies around the world that may be affected—positively and negatively—by the unfolding crisis.

When looking to invest in China, trade wars shouldn’t be the only consideration. The pork crisis reinforces the importance of using focused bottom-up research across a range of industries and sectors to find attractive investments in China’s volatile and developing stock market.

John Lin is Portfolio Manager—China Equities at AllianceBernstein (AB)

Stuart Rae is Chief Investment Officer—Asia-Pacific Value Equities at AllianceBernstein (AB)

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

This post originally appeared at the AllianceBernstein blog

Copyright © AllianceBernstein