I think the storyline is about to get better for the markets

by Jurrien Timmer, Director of Global Macro, Fidelity Investments

Key takeaways

Against the backdrop of a sentiment extreme in December, I see three reasons why the stock market’s narrative could be about to improve:

• First: The steep decline in earnings estimates for 2019 seems to be stabilizing.

• Second: The U.S. Federal Reserve is on hold and may be adopting a more dovish approach to inflation targeting.

• Third: China finally seems to be moving to reflate its economy in earnest.

In last month’s report I made the case that “context is everything” when deciding whether to buy or sell stocks during the kind of correction that we experienced in the fourth quarter of 2018. Now, with the market rebounding strongly despite ongoing erosion in earnings estimates for 2019, the only way for me to be able to justify current valuations is to believe this earnings dip to be temporary and not the start of an actual earnings recession. [backc url='http://www.dynamic.ca/leadership/eng/active.html?fund=dreii2f&utm_source=aa&utm_medium=banner&utm_campaign=alts_2019&utm_content=dreii2f']

Context remains everything. Viewing the market through the four lenses of earnings, liquidity conditions, valuation, and sentiment, I saw the stock market’s -20% minibear (from the S&P 500® index’s high of 2940 in early October to its low of 2347 in late December) as a buyable correction—and I am still reasonably constructive on equities, despite the 20% rally since Christmas Eve’s close.

In my book, a sentiment extreme + a Fed pivot + no recession = a buying opportunity (at least of this writing). That investors continue to sell equities at a rate of $113 billion per year—according to EPFR Global—certainly has helped me stay constructive. Everyone just hates this bull market, or so it seems. To me, the December bottom was a sentiment extreme if ever there was one.

Earnings

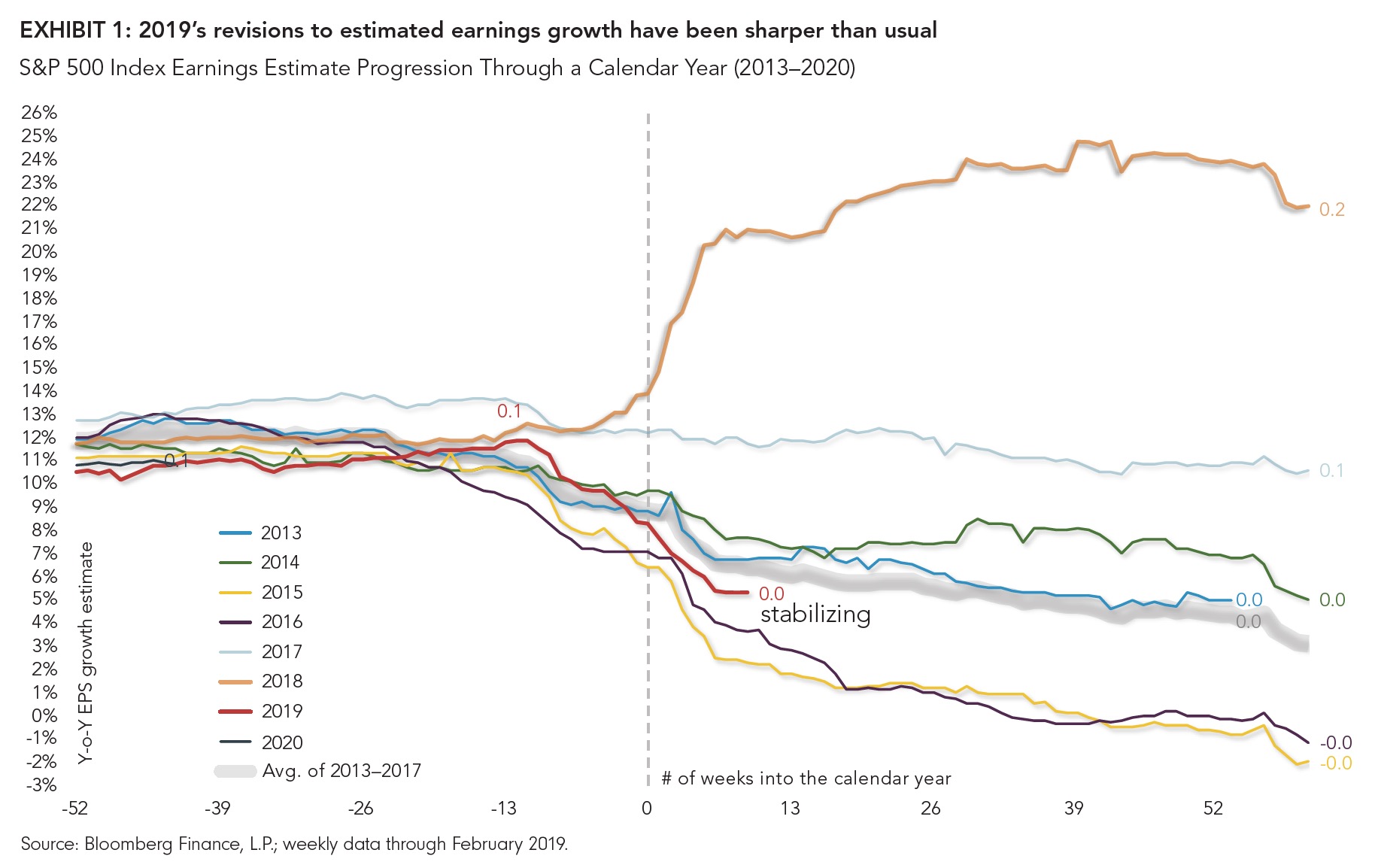

S&P 500® earnings estimates for 2019 have fallen like a stone in recent months, to the tune of about 40 basis points (bps) per week (Exhibit 1). Three months ago, the expected growth rate for 2019 stood at 11.9%; last week it was down to 5.3%.

In my experience, downward drift is a normal feature for earnings estimates: They start too high and then erode as we get closer to the reporting quarter (or year).

The low comes right at the beginning of earnings season, and then the bounce happens as companies miraculously beat their lowered estimates. It’s the oldest game in town.

But for 2019 so far, the slide has been steeper than usual.

This led me to the view that while the December low was buyable, the market wasn’t going to be able to make much more upside progress from here—certainly not to new all-time highs. For that to happen we would need better clarity on the earnings front. If estimates can stabilize in the mid-single-digit range and rebound to trend (about 7%) in 2020, then I think all should be well.

This is what Wall Street seems to be betting on, too.

According to Bloomberg, as of February 28 the yearover- year earnings estimates for the next five quarters are -2.9% (Q1), +1.5% (Q2), +2.7% (Q3), +9.4% (Q4), and +15.2% for Q1 2020. In other words, we will see a singlequarter contraction followed by a V-shaped earnings recovery, basically to match the V-shaped price recovery for the S&P 500®. But it’s only February, so who knows how much further estimates will drop? Maybe the consensus is wrong and we get the earnings recession that so many seem to expect. If so, this market is overvalued at a price-earnings ratio of 16.4x next year’s earnings.

So, I noted with interest recently—on the last Friday in February—that for the second week in a row, the 2019 overall growth estimate fell by only 3 bps. This is less than one-tenth the weekly drift that we have seen over the past 17 weeks. It’s way too soon to start drawing conclusions on whether the bleed is finally ending (or at least moderating), but if so, I believe it could lead to a more bullish shift in the market’s narrative, from “imminent earnings recession” to “the worst is behind us.”

If that’s the case, the sellers of that $113 billion in equities may need to reconsider, and that could provide fresh fuel for a market that all of a sudden has a better storyline.

The Fed

Two other developments also could help shift the narrative. One is the possibility that the Federal Reserve could switch its inflation mandate from inflation-rate targeting to so-called price-level targeting or some variation thereof. Whereas inflation targeting ignores the past, price-level targeting aims for an average rate of change over a full period. In other words, the Fed would allow inflation to overshoot in order to make up for all the time it has spent below 2%. Given how long inflation has been undershooting 2% (years and years), this could in theory lead to a prolonged period of relative dovishness.

I’m skeptical that this change in approach would actually create more inflation, but it could tilt the narrative toward one where the market worries less about inverted curves and the Fed taking the punchbowl away, and starts viewing this change as a cycle extender—a reboot of sorts, like early 2016.

China

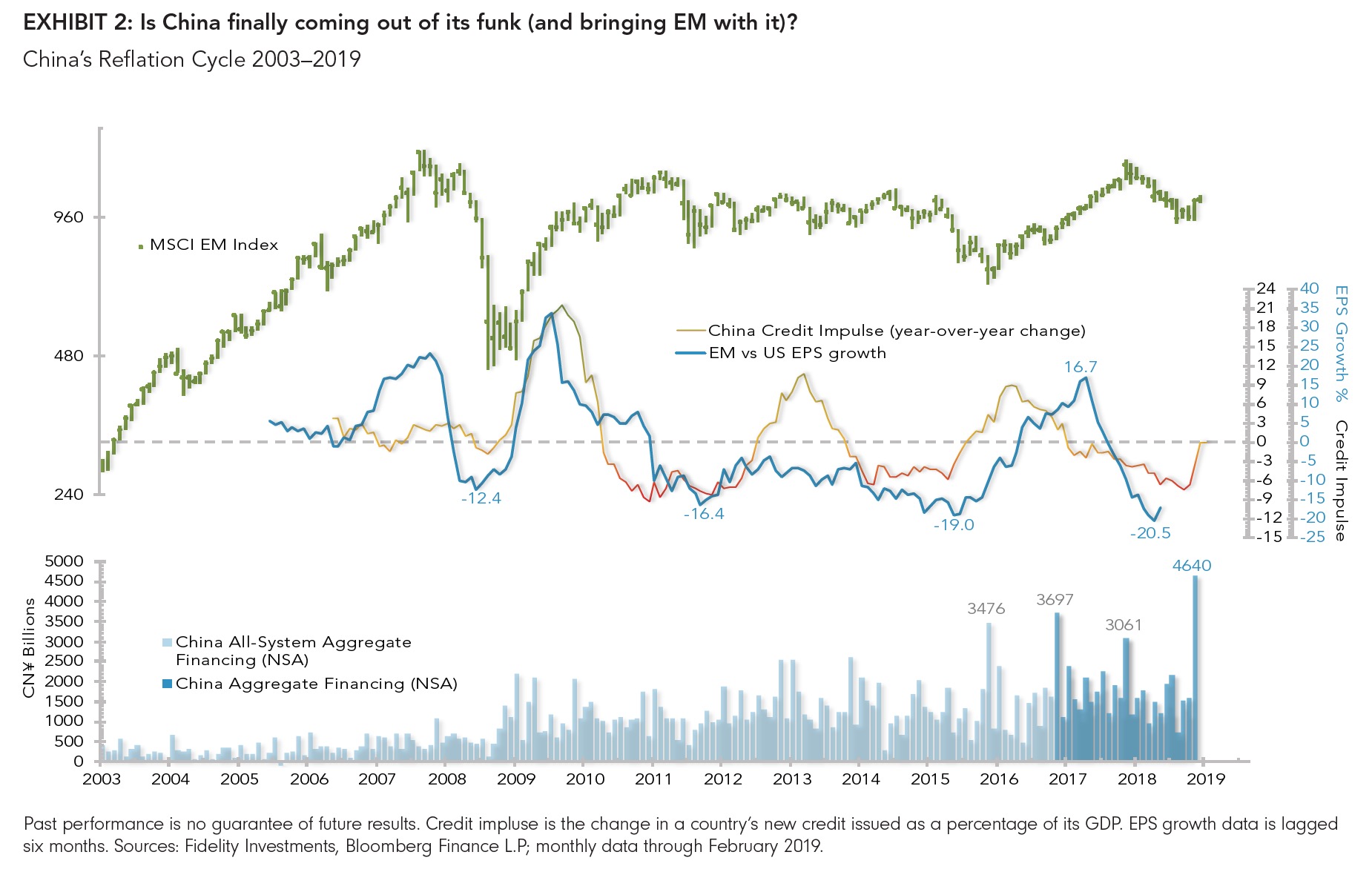

The third development relates to China. For months I have been waiting for the country’s typical two-year reflation cycle to kick in, to no avail—at least until now (potentially). According to Bloomberg (Exhibit 2), January showed a big jump in aggregate financing (formally known as “total social financing”), to the tune of CNY 4.6 trillion (USD 690 billion). Even though the numbers are not seasonally adjusted (NSA), and thus may overstate the state of things, I now am wondering whether China’s anticipated reflation has finally arrived. If so, that could change the narrative for global earnings growth and the performance of emerging-market (EM) equities.

The middle panel of Exhibit 2 shows China’s credit impulse, or the change in new credit issued as a percentage of GDP, more or less leading emerging markets’ relative earnings growth (relative to the U.S., that is). It’s far from a perfect fit but, conceptually, it sort of makes sense. If the credit impulse is turning here, EM earnings could outperform U.S. earnings, which again suggests that EM stocks could outperform U.S. stocks, in my opinion.

Speaking of EM earnings, let’s take a look at the progression of earnings estimates for the MSCI Emerging Markets Index by calendar year (Exhibit 3). As is the case with U.S. estimates, analysts generally are too bullish at the beginning and bring their numbers down as the year goes on. The top panel shows next-twelve-months (NTM) and last-twelve-months (LTM) earnings estimates over time, overlaid with drift from -52 to +52 weeks for each calendar year. The bottom panel displays EM’s calendaryear drifts in earnings estimates relative to those of the United States. The exhibit is meant simply to present an overall picture of the downward drift of EM estimates as generally analogous to what we see for the United States. It looks to me like the 2019 progression may be bottoming. If that’s the case, I think it adds further support to the idea that EM can outperform U.S. equities for a while.

*****

Author

Jurrien Timmer | Director of Global Macro, Fidelity Global Asset Allocation Division

LinkedIn: jurrien-timmer-fidelity | Twitter: @TimmerFidelity

Jurrien Timmer is the director of Global Macro for the Global Asset Allocation Division of Fidelity Investments, specializing in global macro strategy and tactical asset allocation. He joined Fidelity in 1995 as a technical research analyst.