by Elga Bartsch, PhD, Blackrock

Elga explains what our new tracker of developed market earnings is telling us, and why our view on earnings is gloomier than the markets.

We have created a new tool for tracking developed market (DM) earnings. Our new earnings tracker leverages our existing suite of macro indicators, including our Growth and Inflation GPS, trade nowcast and additional inputs, as we write in our Macro and market perspectives Profit margins under pressure.

The chart below shows trailing 12-month earnings growth (based on EBITDA–earnings before interest tax depreciation and amortization) for the MSCI World and our new earnings tracker. Our earnings tracker suggests earnings growth should drop to zero year-on-year by the middle of the year–and points to some stagnation in DM earnings this year.

Most of the inputs into our tracker are pointing down. Our Growth GPS is ticking lower, while the proxy for unit labor costs has been rising as nominal wage growth has outstripped productivity. Yet the biggest driver of the G3 earnings retrenchment is our global trade tracker–DM earnings are sensitive to the global manufacturing and trade cycle.

What would it take for our earnings tracker to rise?

We would need to see a rebound in annualized global trade growth to about 3.5% from current levels near -5%. We believe this is possible. A very real upside risk to our outlook is that stimulus in China and Europe could spark an upturn in the global economy in the second half of the year. Any such rebound in global growth could more than offset the late-cycle drop in margins.

Our view is gloomier than the market’s. Our estimates for U.S. profit margins and nominal growth–implied by our Growth GPS–point to a 1% drop in national accounts data profits in 2019 and just below zero for S&P 500 pre-tax earnings. The calendar effects of 2018’s earnings acceleration mean that earnings growth near zero this year would require a few quarters of quarterly declines.

What earnings growth is priced in? The consensus S&P earnings growth forecast for 2019 is 4.4%: based on current price-to-earnings ratios and our estimate of the equity risk premium, we see the market is pricing in real earnings growth just below 3% (all according to March 2018 Thomson Reuters data).

We focus on the U.S. because it has led the current business cycle. There is evidence that through past cycles, the U.S. data have led DM profits and margin data too. And other countries don’t have the same detailed national accounts data.

Adding it up

Equity markets do not appear to be pricing in an earnings recession, and debt issued by highly leveraged companies could be particularly exposed. At face value, entering the late-cycle phase and an outright earnings recession appears a difficult backdrop for risk assets. Yet late-cycle stages and earnings recessions have historically been bullish for equities–as long as they don’t coincide with a full-blown recession.

What are some of the other implications?

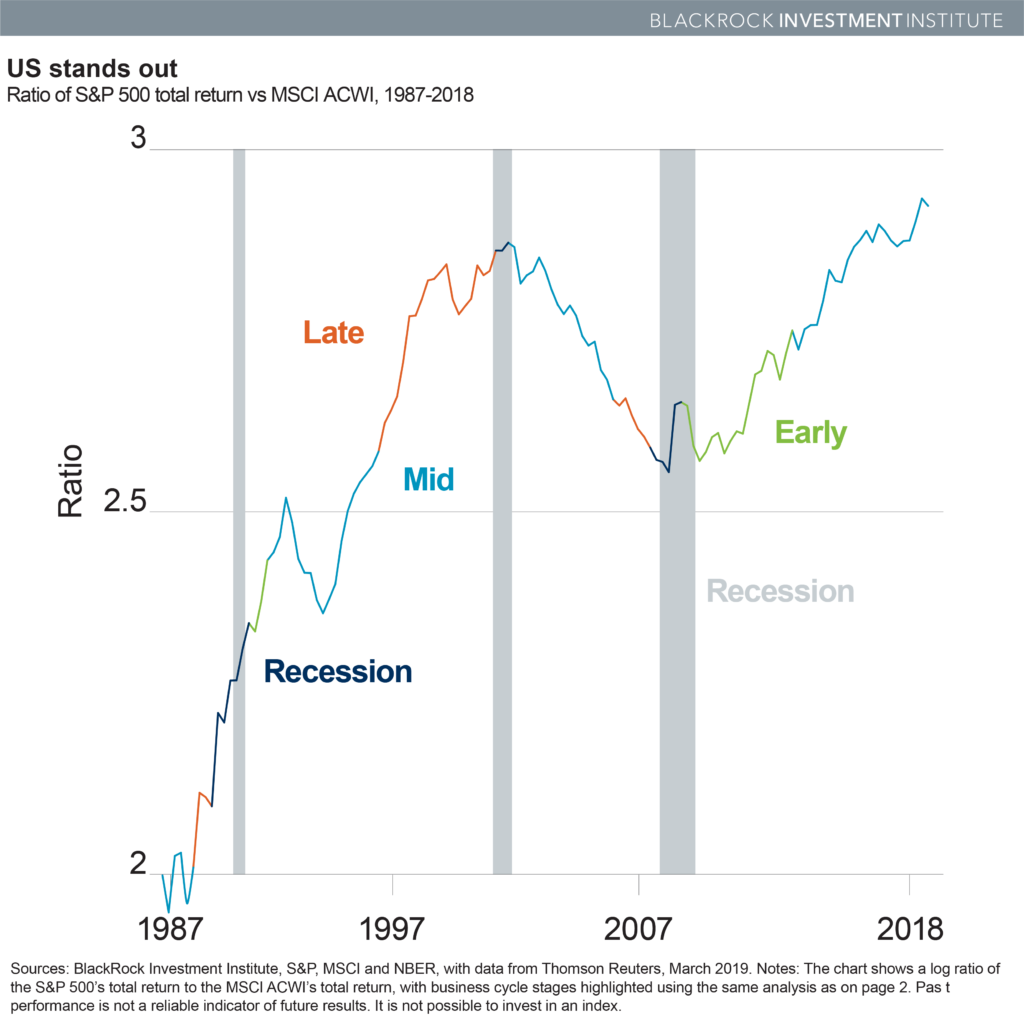

U.S. equities seem to have decoupled from global equities thanks to their lower beta (i.e. their sensitivity to short-term cyclical swings in the economy) and higher profit margins. Since the late 1980s, U.S. equities have outperformed global stocks. See the chart below.

The only prolonged period when U.S. equities under-performed was in the early 2000s when the rise of China and other big emerging markets (EM) caused MSCI ACWI to outperform for about six years. Higher potential growth in the U.S. vs. other DMs and lower risk premia in the U.S. vs. EMs should keep supporting the secular out-performance of the U.S. against the rest of the world.

Elga Bartsch, PhD, Head of Economic and Markets Research for the BlackRock Investment Institute, is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

International investing involves special risks including, but not limited to currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of March 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0319U-762516-1/1