The Absolute Return Letter December 2010

"The Dirty Dozen"

“Risk concerns the deviation of one or more results of one or more future events from their expected value. Technically, the value of those results may be positive or negative.”

Wikipedia

The definition of risk

No, I am not going bonkers. Some egghead came up with this formula as a way to define risk, but we can do better than that. In the world of finance, risk is essentially the probability of an investment’s actual return being different from the expected return. As most of us are not overly concerned about actual returns being higher than expected, it is fair to say that in practical terms, risk is a measure of the probability of losing some or all of your investment.

Now, risk cannot always be quantified, and there is indeed a term for immeasurable risk. It is called uncertainty1. Good investment management is founded on robust risk management or, as we ought to label it, the ability to manage uncertainty well. Many moons ago, a good friend with more grey hair than myself gave me the advice to focus on the management of uncertainty. His philosophy was that if you manage that well, over time, performance will take care of itself.

Now, I must confess that over time I have made my fair share of mistakes. Managing risk/uncertainty is a heck of a lot more difficult in practice than the mathematicians want us to believe. I am only human. I get carried away from time to time like most other investors. Unless you were born with the DNA of Warren Buffett, keeping emotions at bay when making investment decisions is far from easy.

Herding like sheep

However, getting carried away seems to be the norm rather than the

exception these days. Maybe it is just me getting older and more cynical, but all around me I see investors chasing the same ideas with little (apparent) consideration given to the elements of risk involved. Find me an investor who is not in love with emerging markets or, for that matter, commodities. I see this sheep-like mentality wherever I turn.

That observation gave me the inspiration to this letter. Please note that I do not provide an enormous amount of detail in this letter (who wants to read a 50 page newsletter?). Rest assured, though, that most if not all of the risk factors mentioned below will be discussed in the months to come.

Before going any further, though, I need to get one more thing off my chest. I get a lot of positive feedback on these letters but also a fair amount of criticism for being too negative. I will admit that the Absolute Return Letter has a ‘negative’ edge to it, but I do not view myself as a perma bear. In fact, right now, we are looking for opportunities to increase the equity exposure in our private client portfolios. So why the somewhat downbeat tone to the letter? Because, as I have already stated, investment management is about managing risk well; hence most of my time is spent on identifying what can go wrong.

Now, let’s get started. In the following I list a number of risk factors which I believe investors should give serious consideration, but I do not for one second pretend for that list to be exhaustive. Neither should you read anything into the order of which those risk factors are listed. If you want my assessment of how to rank the various factors, you need to take a look at the risk scatter chart at the end of the letter.

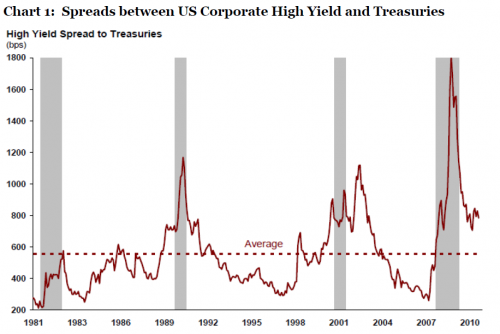

We begin our journey in the high yield space, which is another asset class currently prone to herding; however, I need not look any further than my own parents to understand the urge to invest in high yield bonds. Now in their mid 70s, they are desperate for a bit of income, and corporate high yield provides that better than most other asset classes. Multiply their situation with over 100 million retired – or nearly retired – people in Europe and North America, and you will understand why high yield spreads keep going down.

# 1:High yield spreads

We have done some research on high yield spreads in recent weeks, as we

were becoming increasingly uncomfortable with the tightening spreads. We began to wonder (risk factor # 1) if high yield spreads are priced for perfection? Are spreads getting so tight that one could even talk of a bubble, and could that bubble burst, should the US (and/or European) economy fall back into recession? There is no question that corporate high yield bonds are now priced for fair weather but, we believe, not yet for perfection (see chart 1). Keep a finger near the trigger but not yet on it.

Source: Kingdom Capital Management

# 2: Double dipping

Obviously, the fate of corporate bonds is closely linked to the well-being of the corporate sector. As we see things, the risk of double dipping (# 2) is currently more prevalent in the US than it is in Europe, so let’s focus on the US for now. The other day I came across some interesting stats on the US economy (all representing year-on-year changes), which may surprise one or two people:

GDP growth rate +56%

- Personal Income +4.35%

- Savings Rate +23.91%

- Fixed Investment +5.37%

- Steel Output +10.32%

- Business Sales +8.86%

- Durable Goods Sales +12.2%

- Factory Shipments +7.21%

- Retail Store Sales +7.31%

- Factory Orders +17.18%

- Exports +12.58%

Source: Contrarian Musings

I find these numbers revealing, considering how much bad press the US economy actually gets at the moment. Yes, I know that recent comparisons have been easy vis-à-vis a very weak 2009 and, yes, I am aware that this is to a large degree rear mirror analysis. But the reality is that the US economy continues to confound. The weak spot continues to be the housing sector and, unfortunately for the economy as a whole, that is a very important sector.