by Urban Carmel, The Fat Pitch

Summary: NDX, RUT and DJIA have all risen 9 weeks in a row. Long win streaks like these have a very strong propensity to continue higher over the next several months, although an interim period of consolidation and retracement is frequent. That SPX is now back at the top of its trading range from October to early December perhaps makes that outcome likely now as well. But years that start as strongly as 2019 have almost always (more than 90% of the time) added sizable gains the rest of the year.

* * *

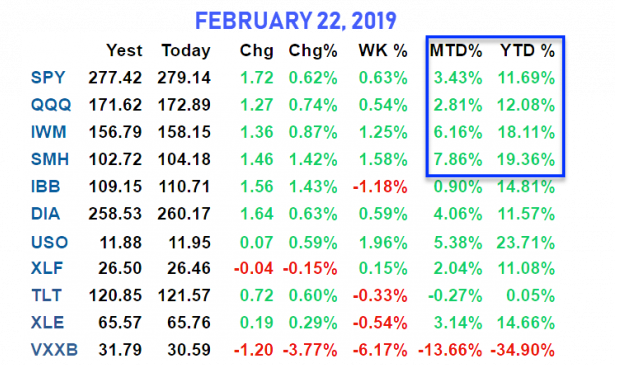

Since Christmas Eve, SPX is up 19%, NDX 20% and RUT 25%. NDX, RUT and DJIA have each risen the past 9 weeks in a row (table from alphatrends.net). Enlarge any chart by clicking on it.

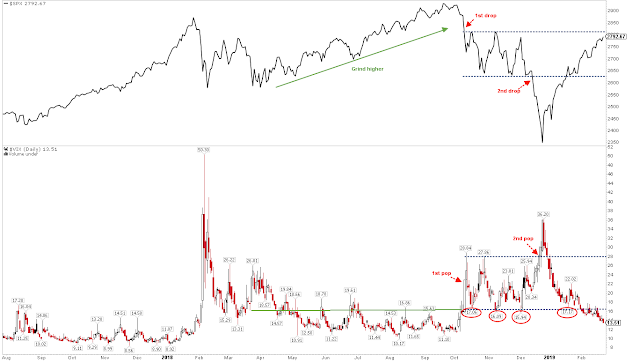

SPX is now back to within 0.5% of the top of its trading range from October to early December (upper panel). The index is grinding higher as Vix sinks further under 16 (lower panel). It would take a close under 2600 to trigger a bearish failure. There are a lot of eyes on this chart and it would be very surprising if SPX did not encounter some resistance before 2810.

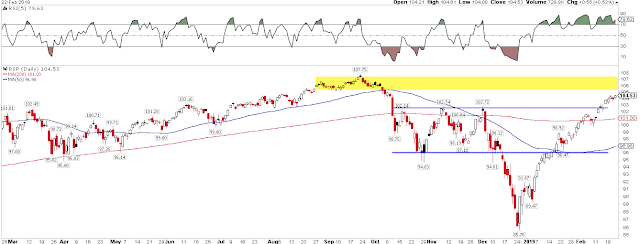

The very broad NYSE index closed above the top of this range on Friday, but not by much. A decisive move higher in the coming week would be consequential, setting up a retest of the September all-time high (ATH).

Likewise, the SPX on an equal-weight basis closed above the top of its prior range this week. It's now less than 3% from its September ATH.

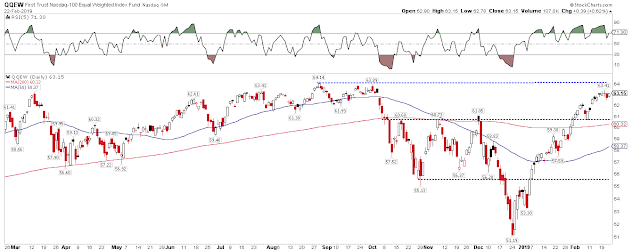

The same is true for the equal-weight NDX, which is less than 1.5% from its ATH. Put another way, FAANG stocks are holding the indices back; given their heavy weighting, if they kick into gear, the traditional market capitalization-based indices will likewise move back to their ATHs.

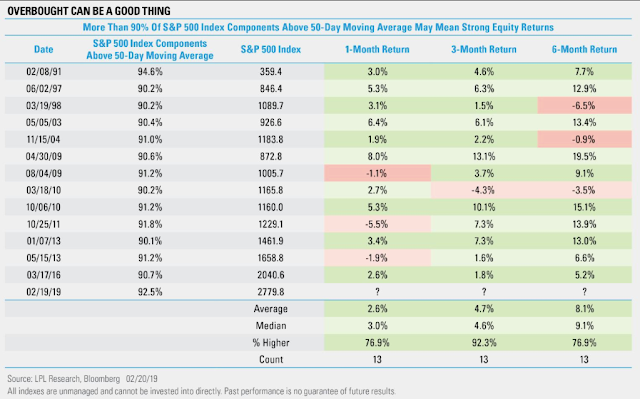

That NYSE and the equal-weight indices are leading says that breadth has been strong. This is a net positive. More than 90% of the SPX is now back above their respective 50-dma. In the past 30 years, SPX has closed the month higher within the next 3 months every time. If returns 3 months from now meet the historical average (4.7%), SPX will be essentially back at its September ATH (the next two charts are from Ryan Detrick).

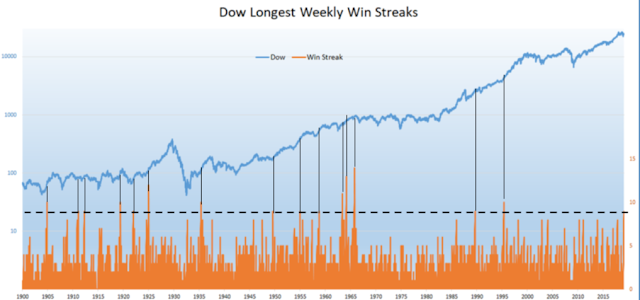

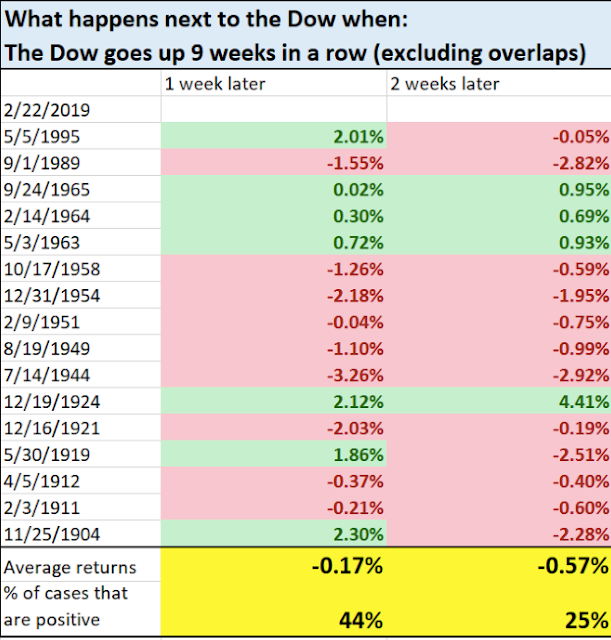

That the DJIA, NDX and RUT have all closed higher the past 9 weeks in a row is also an intermediate-term positive. For the DJIA, this has happened at least 15 times in the past 120 years, and none marked a major top. The instance from 1965 looks close but the reality is the DJIA closed higher 14 weeks in a row and then rose another 4% after that.

Likewise, when COMPQ has gained 9 weeks in a row, it has continued higher: all instances closed higher after either 6 or 12 weeks. Risk/reward was extremely biased positive during the next 3 months. If returns 3 months from now meet the historical average (10.5%), COMPQ will be well above its September ATH (7.5% above Friday's close; table from Steve Deppe).

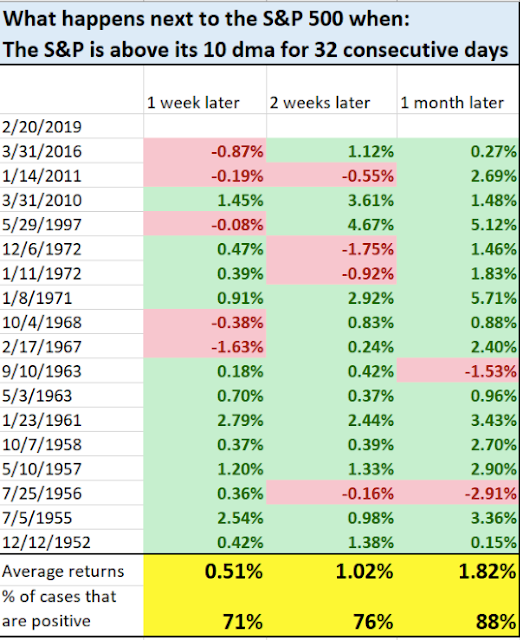

The rise in the indices has been unrelenting in another way: SPX has not closed below even its 10-dma in more than 32 days. There has been only 4 other instances like this in the past 46 years. In the past 70 years, SPX has continued higher over the next month 88% of the time. This streak might end soon, but the uptrend in SPX is likely to continue (table from Troy Bombardia).

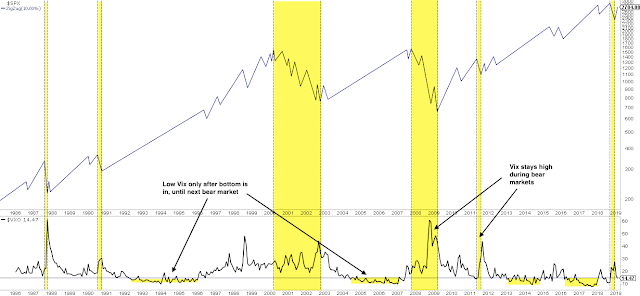

The rally since Christmas continues to look more like an uptrend to new highs than a bear market bounce. This week, the volatility index dropped under 15. Volatility tends to remain elevated during a bear market bounce, but this market has relentlessly ground higher. It's a limited sample size, but no ongoing bear market in the past 30 + years (yellow vertical shading) has had equally low volatility as now.

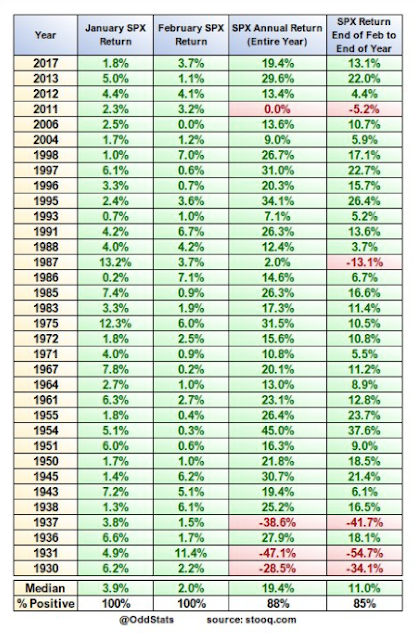

The month of February ends Thursday. So far this month, SPX is up 3.3% after rising 3.6% in January. Years when SPX has gained in both January and February have had a very strong tendency to continue higher into year end: since the end of WWII, equities have risen 25 of 27 times (93%) by a median of another 11% (table from Odd Stats).

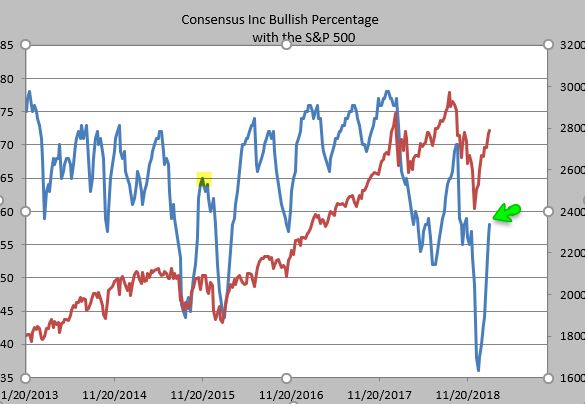

Despite a strong 9-week rally, sentiment amongst analysts has not rebounded very strongly, yet (blue line). Bulls climbed back to just 58% this week; rallies in the past 8 years have not fizzled out until bulls were at least 65% (like late-2015 before the second swoon in early 2016). It would be unusual for there to be much downside until sentiment improves further (from Helene Meisler).

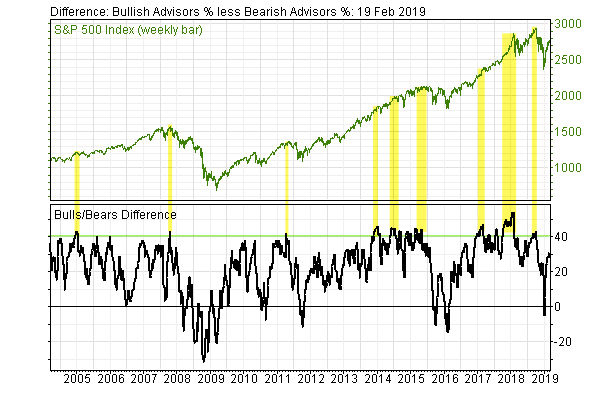

It's true that sentiment among newsletter writers (Investors Intelligence) has rebounded more strongly (to 31% net bulls) but this has not been a very useful indicator on its own: SPX has topped, or chopped sideways or just continued higher in the past (yellow shading in the first chart). A rise to a 40% bulls, on the other hand, would be a notable extreme (second chart; from VixSquared).

As stated at the top of this post, it would be very surprising if SPX did not encounter some resistance soon. Even strong rallies like this one usually consolidate and retrace gains before moving higher. Two bits of evidence support that conclusion.

First, 6 of the last 8 times that Investors Intelligence net bulls exceeded 31%, SPX was lower 2 weeks later (75% loss rate; data since 1981, from Sentimentrader; to become a subscriber and support the Fat Pitch, click here).

Second, while the 9-week win streak in DJIA is a longer term positive, it has historically been most often followed by near-term weakness: the index was lower 2 weeks later 75% of the time, although the losses were minor (table from Troy Bombardia).

The case from 1989 is worth highlighting. DJIA rose 9 weeks in a row and then went into a 10% trading range lasting the next 8 months. It eventually broke out of this range and made a new ATH another 8% higher. The lesson: a set up for a longer term continuation higher can sometimes take a frustrating long time to unfold.

Looking head for the year, the fundamental picture for US equities is less positive.

In the corporate results released for the fourth quarter, profit margins fell by the most since the "profit recession" in 2015.

Expectations for 10% earnings growth in 2019 have already been revised down to 5% but this still looks too optimistic: if margins in 2019 remain at the same level as in 4Q18, then earnings growth will be 0%.

Valuations are not cheap, but the excesses from early 2018 have been worked off: if investors once again become ebullient, there is room for valuations to expand. However, with earnings growth likely to negligible, the key for share price appreciation in 2019 is likely to hinge entirely on valuations expanding.

A new post on this is here.

On the calendar this week: housing starts on Tuesday, GDP on Thursday and PCE on Friday. Due to the government shutdown, delayed data will be released over the coming weeks (from IBD Investors; for a trial subscription, please use this link).

Copyright © The Fat Pitch