by Frank Holmes, CIO, CEO, U.S. Global Investors

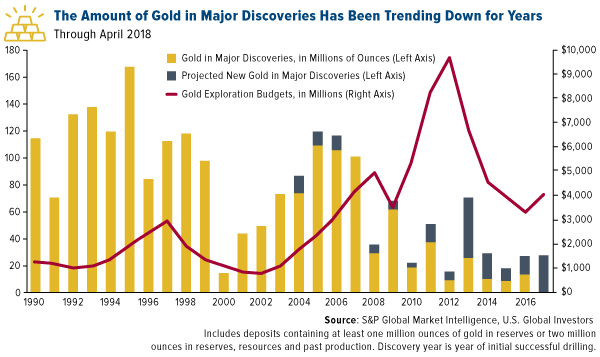

Consolidation season has finally arrived in the goldfields, just as many experts and analysts have been predicting for some time now. With exploration budgets having been slashed since their 2012 peak, and because there are today fewer and fewer ounces of gold available to be mined, one way forward for producers of all sizes will be to ramp up mergers and acquisitions (M&A) activity.

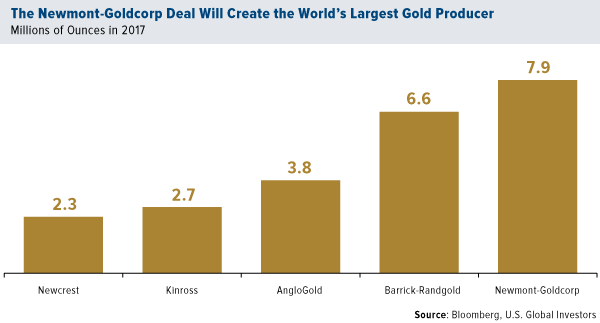

You might have heard that Newmont Mining will be buying Goldcorp in a massive $10 billion deal. The resultant company, to be headquartered in Denver, will be the world’s largest gold producer by number of ounces mined—larger even than what’s being called “New Barrick,” after the $6.5 billion merger of industry giants Barrick Gold and Randgold Resources, announced back in September. Whereas Barrick-Randgold produced a combined 6.6 million ounces of gold in 2017, Newmont-Goldcorp was responsible for as much as nearly 8 million ounces.

click to enlarge

I see this news as positive overall for the metals and mining industry, which has long signaled the need for consolidation. As I explained in a Frank Talk Live segment back in October, it’s when an industry has found a bottom that you start to see big M&A deals. A couple of years ago, the very talented people at Visual Capitalist showed in an infographic that mining M&As peaked in the aftermath of the financial crisis.

A Positive Case Study in M&As: Domestic Airlines

This tacit rule applies not just to metals and mining but also to most other industries. Look at domestic airlines. It’s easy to forget now that between 2005 and 2008, more than two-thirds of U.S. airlines were operating under Chapter 11 bankruptcy protection. A huge wave of consolidation followed, giving us the “big four” carriers—Delta, American, United and Southwest. Profits surged to new highs. This year, according to the International Air Transport Association (IATA), global airlines should see their 10th straight year of profitability, and fifth straight year where “airlines deliver a return on capital that exceeds the industry’s cost of capital, creating value for its investors.”

Consolidation Could Speed Up the Closer We Get to “Peak Gold”

So will gold miners follow suit and consolidate (more so than they already are)? And will this lead to a similarly sustained period of outstanding profitability?

No one can say for sure, of course, but my guess is that we’ll continue to see more and more deals the closer we get to the idea of “peak gold.” As I’ve shared with you before, the yellow metal is getting exponentially more difficult and costly to mine. The “low-hanging fruit” has likely already been plucked, so to speak. Exploration budgets have been slashed, and the days of 20- and 30-million-ounce gold deposits could be behind us, to say nothing of 50-million-ounce discoveries.

click to enlarge

To replenish their own reserves, big-name miners such as New Barrick and Newmont might decide to absorb smaller-cap junior producers with provable mines instead of spend higher and higher costs to scour the world for progressively harder-to-find deposits.

Says Michael Siperco of Macquarie Research, the Barrick-Randgold and Newmont-Goldcorp deals could “spark a wider consolidation in the industry, where too many gold companies are chasing too few assets.”

Only time will tell if this happens. I’ll be curious to see what companies could be next to strike a deal!

*****

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2018: Newmont Mining Corp., Barrick Gold Corp., Newcrest Mining Ltd., American Airlines Group Inc., Delta Air Lines Inc., United Continental Holdings Inc., Southwest Airlines Co.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors