Of course we are not. This market stinks. Rising U.S. inflation and a slowing global economy. Rising interest rates and ugly Treasury bond auctions. Trade wars and Navarro’s threats to corporate leaders. Plunging Oil prices. And now a warning from a key Apple iPhone supplier? Just stop.

Still little reason to take a lot of risk in the current market. I want to be evenly matched on my long and short equity exposures, while avoiding fixed income and enjoying my 2.5% yields on my cash. I will watch and wait until the news flow gets better or investors stop selling.

The good news is that the election is over and the campaign ads and robo calls will stop for at least twelve months until they ramp up again into the primaries.

To receive this weekly briefing directly to your inbox, subscribe now.

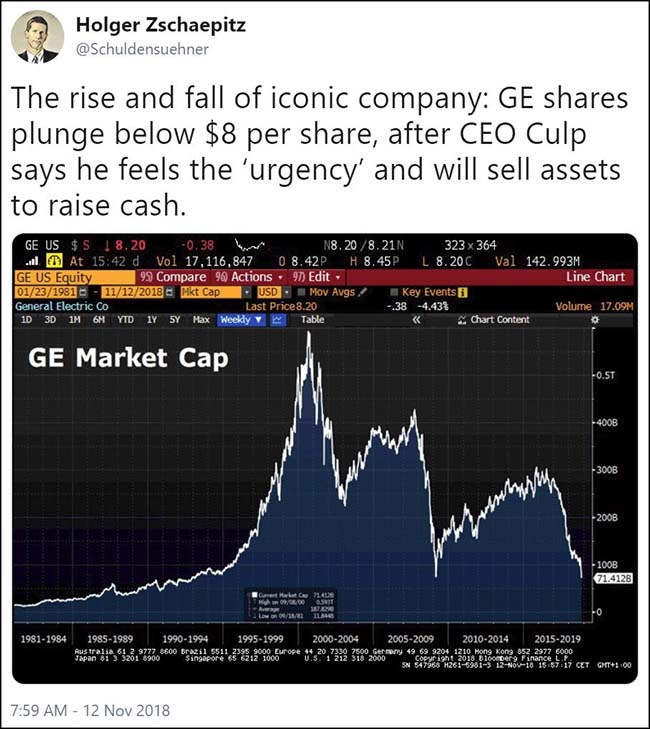

One big sign of a terrible market: GE…

Listen, brand name 12-digit market cap stocks just don’t lose 2/3 their value unless there is something wrong with the balance sheet. The garage door is now open and everything is for sale. The recent continued decline tells you that the market is now scared to buy its assets. Had the garage sale happened 2-3 years ago when interest rates were zero, GE could have sold everything. But not now. Think of how many other companies missed the window to be able to sell at a top price (or any price).

Another sign of a bad market is that major global commodities just don’t fall 20% in a month…

After hitting 3+ year highs in October, Crude Oil took a swan dive into a bear market as too much supply hit the market in the face of all of the Iranian sanction waivers. Over the weekend, the Saudi’s realized that too much global production, combined with a slowing global GDP, would not be in their best interest so they are moving to significantly cut production. It might help prices in the short term, but in the longer term, increased consumption would be a more permanent solution.

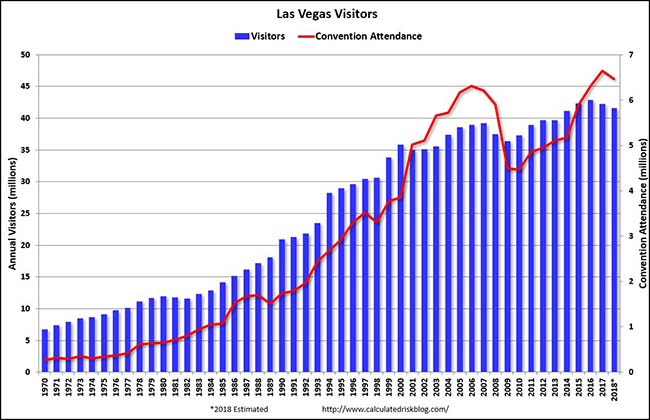

A further sign of a rough market: The big Vegas stocks are down 30-50%…

Vegas traffic has peaked which is never a good sign for a highly leveraged industry. Throw in a bigger problem in their slowdown of traffic in Macau and the stocks have found themselves next to the pickles at the buffet bar.

“Las Vegas: Visitor Traffic down 1.3%, Convention Attendance down 2.7% compared to same Period in 2017”

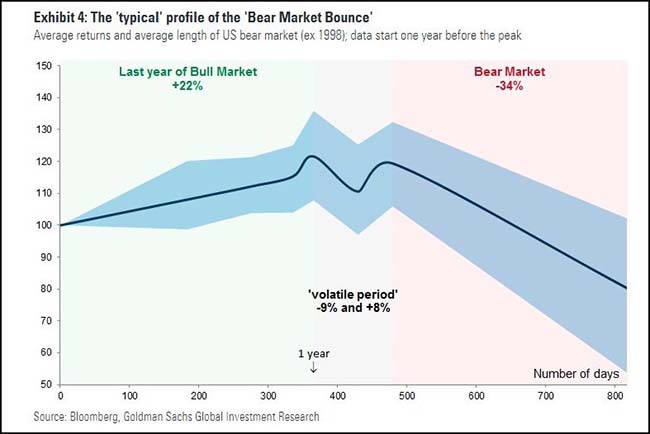

It sure feels like we are inside the “volatile period” right now…

If true then by the averages we should expect another two months of crazy volatility before our bear market begins for the next year. Should make the timing of the 2020 election interesting.

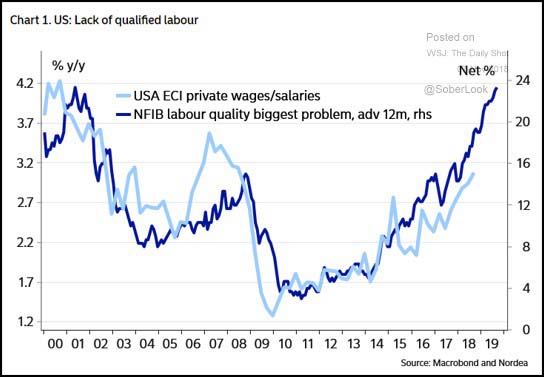

Wage inflation is accelerating…

Amazon splitting their HQ2 in half and Foxconn not being able to hire in Racine, WI is further proof that good talent is difficult to find.

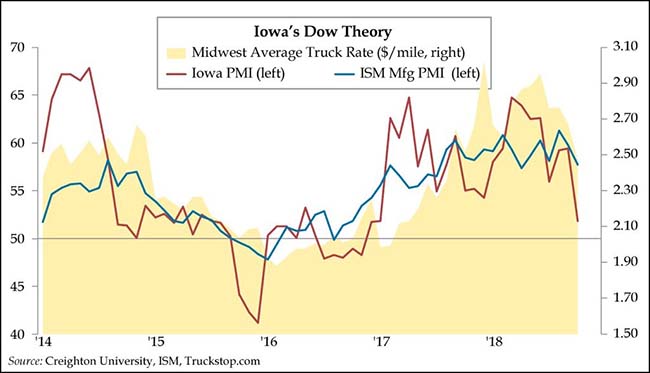

If Iowa is the heartland of the U.S., then take note because its economy is slowing rapidly…

@LizAnnSonders: Iowa #PMI = leading indicator of #ISM mfg index; Iowa PMI’s most recent top in March was 5m ahead of Aug high for ISM; Iowa PMI’s sharp decline in Oct = weaker ISM to come; avg truck rates for Midwest also down sharply

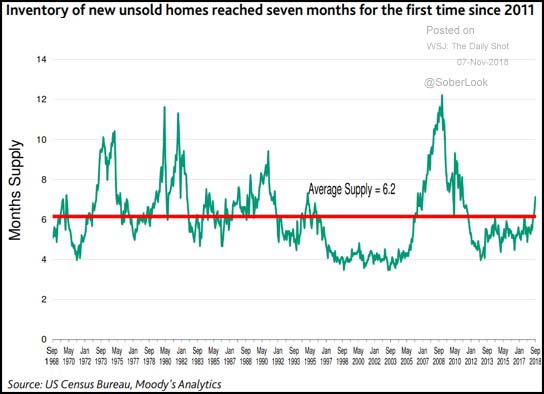

The inventory of unsold homes is beginning to surge…

(WSJ)

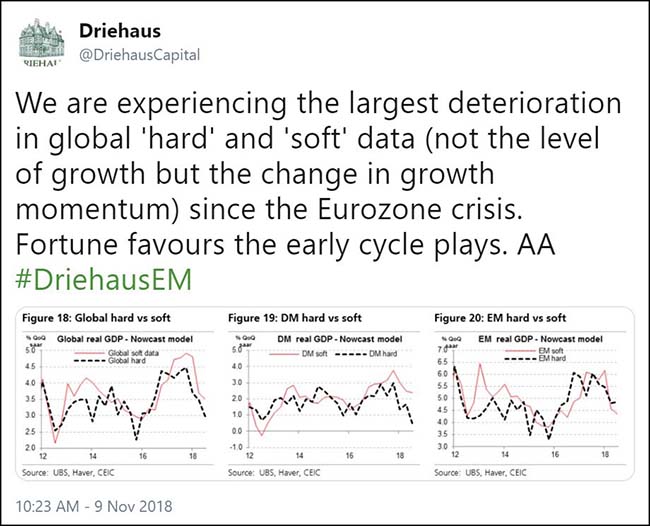

No matter how you slice and analyze it, global growth is slowing down, quickly…

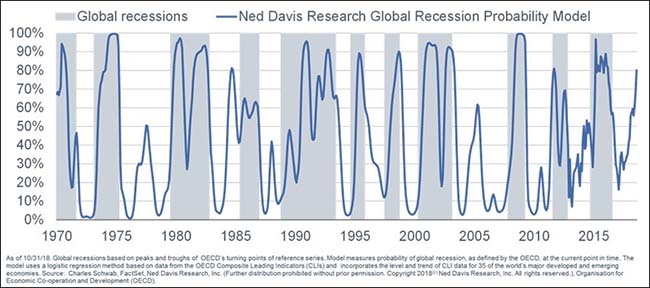

Ned Davis’ model shows that a global recession now looks highly likely…

(@LizAnnSonders)

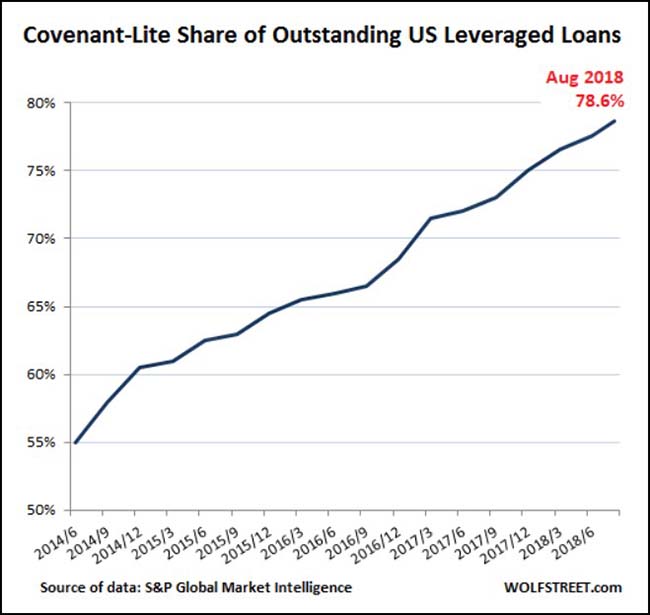

If we head into a global recession, U.S. debt lenders are not ready…

Probably a very good time to lighten up on those high yield credits in your portfolio.

“Covenant-lite” refers to loans that do not contain financial performance safeguards for the lender, such as specific commitments to maintain financial ratios related to debt service. These types of loans used to be reserved for the highest quality borrowers. Today, “cov-lite” structures are widespread.

How cov-lite loans would perform in a downturn is not well understood because data are not available.

The chart below shows how cov-lite loans have taken over leveraged lending in recent years. Their share surged from an already high 55% of outstanding leveraged loans in 2014 to 78.6% at the end of August.

How too much leverage + 23 inches of rain = bankruptcy…

Talk about running your business on balance sheet liquidity fumes!

In late August, Tex-Mex chain Taco Bueno hired Houlihan Lokey Capital to restructure the business and ultimately find a buyer.

And then the skies opened up.

Between Sept. 1 and Oct. 17, more than 23 inches of rain fell at the Dallas-Fort Worth International Airport, making it the wettest fall on record, according to court documents in Taco Bueno’s bankruptcy filing this week.

The rain led to a 20% decline in sales at the 169-unit chain.

For a chain with $130 million in debt and leased locations, the decline proved too much. It led to a shortage in liquidity that was so severe the company had to explore a debt sale and equity swap and bankruptcy to ensure the company could get cash needed to maintain its operations.

The company also feared that its landlords would start evicting locations. One filing indicated that the landlord of one of its most profitable Dallas-area restaurants was beginning proceedings to evict the chain from the space…

But the problem at Taco Bueno illustrates the position companies put themselves in when they leverage themselves to the hilt: One bad month can end it all.

Of course given the ugly Treasury auction last week, maybe you want to lighten up on all U.S. bond holdings…

The Treasury’s auction Wednesday of $19 billion of 30-year bonds met the weakest demand since 2009, a sign the flood of new U.S. government debt requires higher yields to attract investors.

Bidding was weak even as the 30-year bond yield hovered around 3.4%, near the four-year high reached earlier this month. Investors and dealers submitted bids totaling 2.06 times the amount of debt sold at Wednesday’s auction. This multiple, known as the bid-to-cover ratio, was the lowest for a 30-year bond auction since February 2009 and well below this year’s average of 2.36.

Some analysts credit a surge in borrowing with helping push yields higher this year. The Treasury has sold more than $2 trillion of notes and bonds so far in 2018 to fund last year’s tax cuts and an increase in government spending, increasing the supply of outstanding bonds at a time of uncertain demand. The department said last month it would sell $1.34 trillion of new debt in the 2018 calendar year, on top of the maturing bonds and notes it will roll over into new securities.

The market this year also has had to absorb the $161.7 billion of Treasury debt that the Federal Reserve has allowed to roll off its balance sheet. In October, the Fed stepped up the pace at which it is reducing its holdings of U.S. government debt to $30 billion a month.

“We’re getting a lot of supply, both from the Treasury and from the Fed,” said Andrew Brenner, head of global fixed income at NatAlliance Securities. “It’s really having a bearing on demand.”

(WSJ)

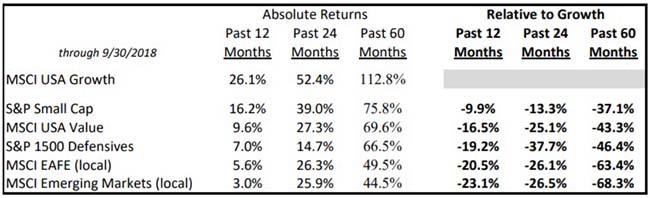

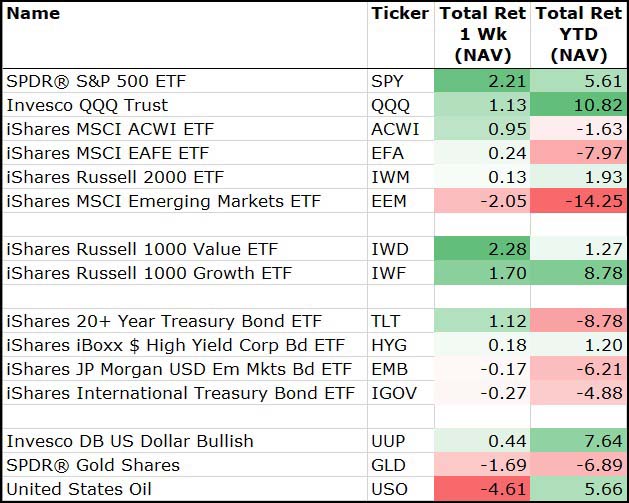

Incredible to see how well U.S. Large Cap Growth stocks have done versus everything else the last one, two and five years…

Of course October was a wake up call to the outperforming strategy. Now what happens next as interest rates rise, global growth declines and a more Democratic Congress joins with the President to lift the hoods further on mega tech companies.

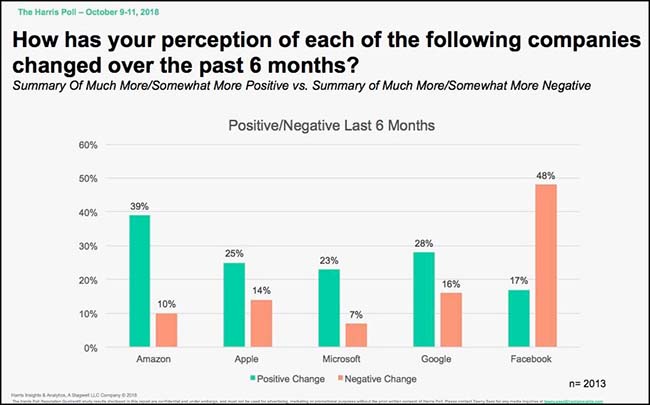

Speaking of large cap growth stocks, one of these companies has a large problem…

This won’t help holiday sales for the Facebook Portal.

A notable slowdown from a key optics provider…

Lumentum Holdings pre-release is below. Apple is a 30%+ customer and highly likely the one responsible for this disclosed order cut. This of course signals that iPhones are seeing less than expected sales. Important to note that everything was fine two weeks ago.

“We recently received a request from one of our largest Industrial and Consumer customers for laser diodes for 3D sensing to materially reduce shipments to them during our fiscal second quarter for previously placed orders that were originally scheduled for delivery during the quarter”

The market wants better-than-expected revenue growth. So end the trade wars and resume global trade.

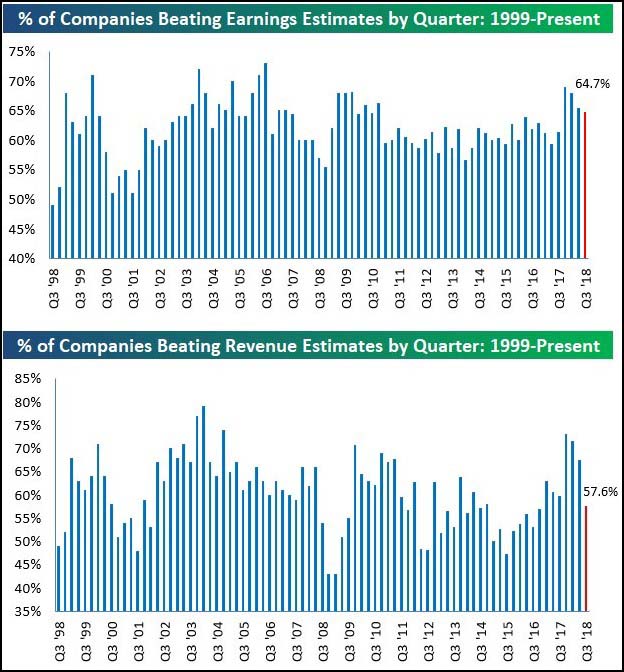

@bespokeinvest: Both top and bottom line beat rates are down this season compared to each of the last 3 quarters. Revenue beat rates down quite a bit.

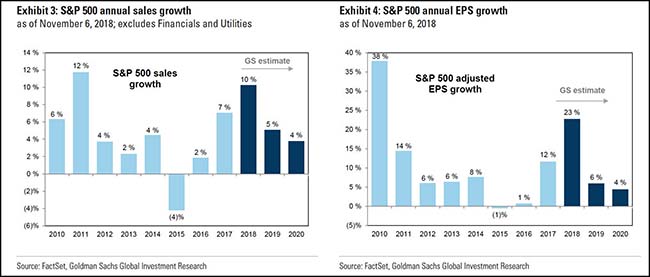

Goldman Sachs modeling a significant slowdown in future sales and earnings growth…

Goldman sees S&P 500 profit growth slowing dramatically to 4% in 2020 from 23% this year and revenue growth to drop from 10% this year to 4% in 2020 as benefit of tax cuts dissipates, econ growth slows and margin pressure builds.

(@Schuldensuehner)

Buy stocks the minute that Peter Navarro leaves the White House…

The vast majority of American executives, economists, and financiers are against the current White House trade stance.

“If there is a deal — if and when there is a deal — it will be on President Donald J. Trump’s terms. Not Wall Street terms,” Mr. Navarro said in his speech on Friday. “If Wall Street is involved and continues to insinuate itself into these negotiations, there will be a stench around any deal that’s consummated because it will have the imprimatur of Goldman Sachs and Wall Street.”

A senior White House official described the comment as a thinly veiled tweak at Gary D. Cohn, a Goldman Sachs executive who served as chairman of Mr. Trump’s National Economic Council until this year and who described the China tariffs as a “tax on Americans” in an interviewthis week. Mr. Navarro frequently sparred with Mr. Cohn over trade while the two worked together at the White House, and Mr. Cohn ultimately resigned after his views were essentially ignored by the president.

(NY Times)

A positive week for stocks…

But the up days (Monday through Wednesday) were uninspiring in terms of volume and breadth while Thursday and Friday were demoralizing to the bulls.

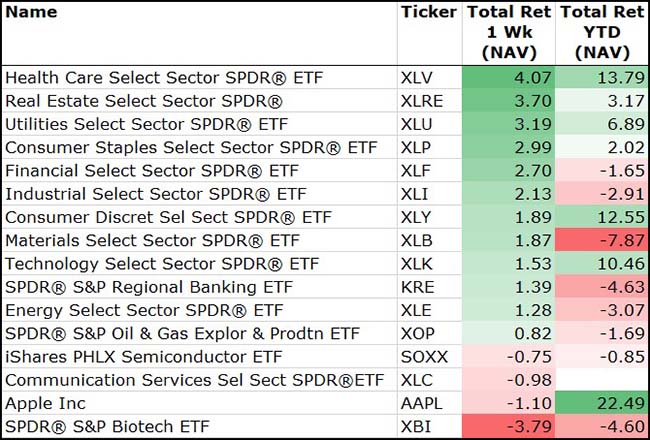

As for sectors, it was a week to play defense…

Healthcare, REITs, Utilities and Staples outperformed, while higher risk Biotech, Semis and Internet stocks underperformed.

If your cash isn’t making at least 2%, you need to find a new instrument…

Even 6-month T-bills are now yielding 2.5%, so there is no reason for a risk-free savings account to be paying you less than 2%. Go shop around. Get a new toaster.

In his quarterly letter Ron Baron interviews a top bank CEO to find out his potential concerns in the market. Thought it was interesting that this was specifically highlighted…

But, in his opinion, “the most discomforting issue is market structure.” The proliferation of ETFs has given traders an ability to invest in bond ETFs that own illiquid underlying securities. There are now $1 trillion invested in bond ETFs and few investors are even sure what is in those ETFs. Further, people have been leveraging those ETFs like equities. My friend called these “structured products the grandson of portfolio insurance and the son of credit default swaps (‘CDS’).”

“Portfolio insurance” is what exacerbated the Crash in 1987 and significant CDS counterparty risk had an important role in the financial crisis 10 years ago. Further, “HFTs, high frequency algorithmic traders, presently account for more than half of the daily trading volumes. Since HTFs are generally undercapitalized, a mistake or just a fat finger, could hit markets like a hurricane!”

In my opinion, the dramatic 10% market “correction” in the month of October was caused by exactly the market structure issues my friend described to me four weeks ago. It was not the result of any important change in business fundamentals or prospects. Which shows exactly how smart he is…and why he was able to become the Chairman of this bank from his start in an urban “hood.”

Link to the full Ron Baron letter…

There is no better picture than this one to capture the 2018 midterm elections…

(@gmoomaw: Classic Bob Brown shot from the @SpanbergerVA07 victory speech)

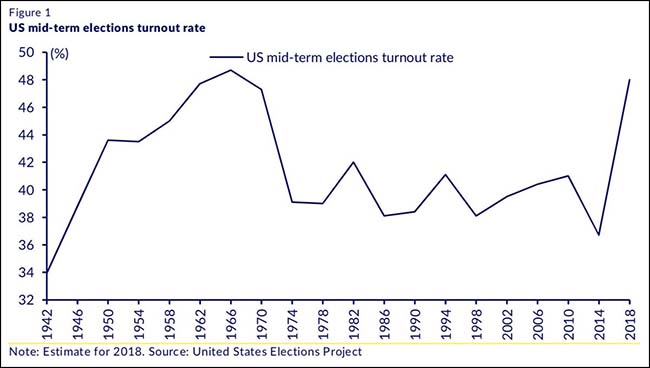

Voter turnout was massive…

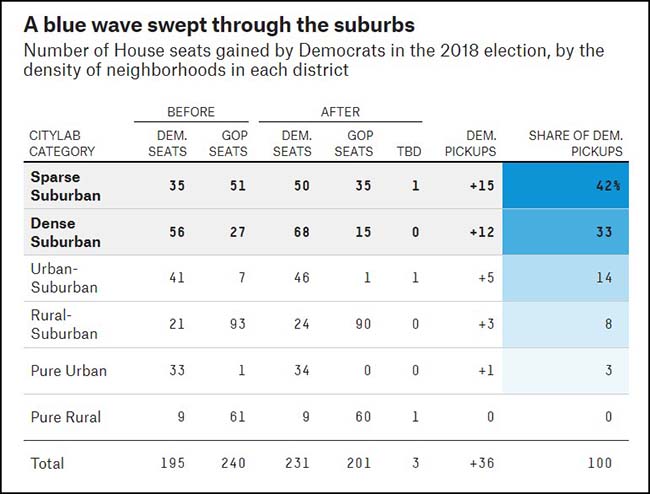

Women and suburban voters showed up and voted…

Many good G.O.P. politicians ran into a very hot hand of Democrats, Independents and even Republicans who wanted to send a strong message. The G.O.P. has two years to figure out what they want to pitch. And if they don’t solve the Trade Wars soon, they will also have a recession to factor into their campaigns.

Mum, can we get Robb Stark to be the next James Bond?

Bodyguard was brilliant. Thank you Mum.

(Netflix)

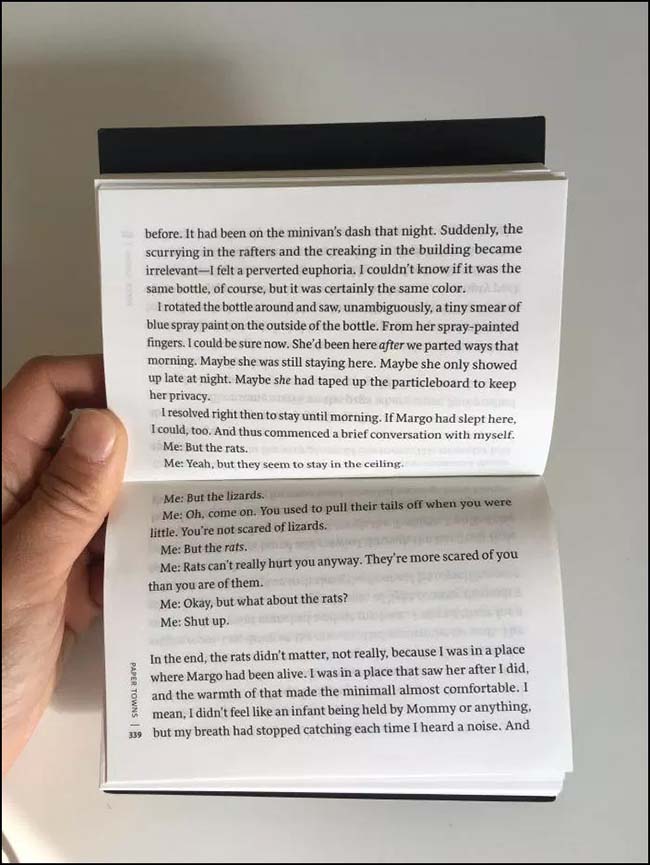

Just go order this holiday gift for your teenage daughter now before they sell out…

A new kind of beach reading has come to the US. “Penguin Minis” are books, super light and tiny, whose pages flip horizontally. On Oct. 23, Dutton Books for Young Readers, an imprint of Penguin Random House, released four mini versions of past novels by bestselling YA author John Green, unabridged.

And they work.

At 4.75 by 3.25 inches closed, Penguin Minis are smaller than an adult hand and slightly wider than the original iPhone. When the books are open, they’re almost exactly the same size as a Kindle Paperwhite and slightly bigger than the iPhone XS Max.

(Quartz)

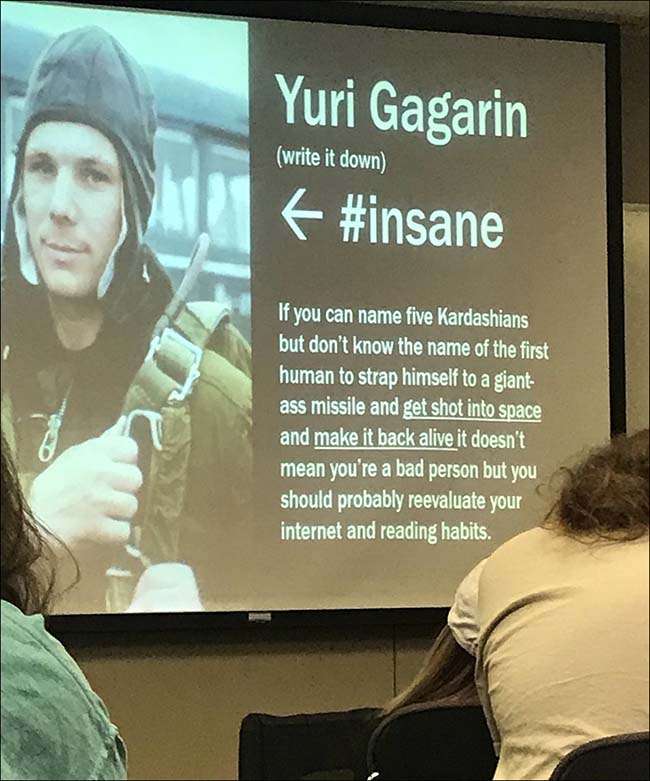

Finally, here is one University of Alabama professor who has been pushed to the limit by his students…

Copyright © 361 Capital