by Fixed Income Team, AllianceBernstein

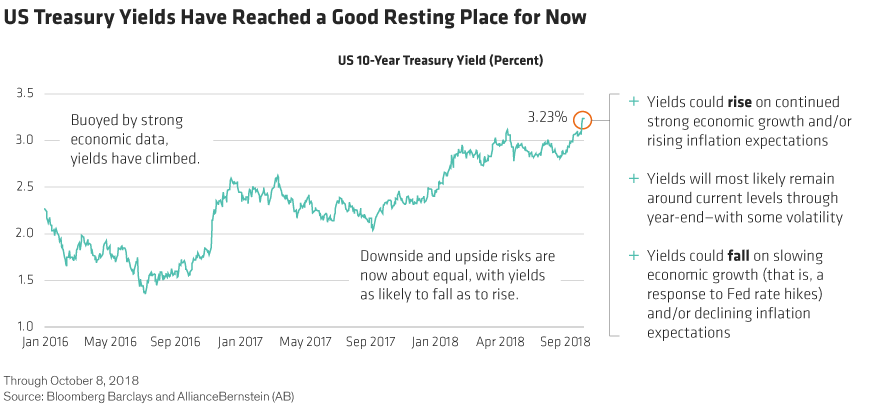

US Treasury yields have risen in response to strong economic growth. In the first week of October, the yield on the 10-year bond surged to its highest level in more than seven years. The question is: Do yields have more room to run?

Yields may remain somewhat volatile into the near future, but we expect them to finish the year around current levels—with the 10-year at 3.25%. Upside and downside risks are now about equal, with yields as likely to fall as to rise. Yields could rise if economic activity remains strong and/or inflation expectations increase. Yields could fall if the US economy begins to slow in response to Fed rate hikes or if inflation expectations decline.

It’s important to note that, so far, inflation expectations have remained relatively unchanged. Up to this point, only strong economic activity, such as continuous improvements in the labor market, has driven the rise in yields. We characterize that as a “good” rate rise. If inflation expectations do increase, pushing yields up further and out of step with the economic cycle, that could be disruptive to the broader financial markets. We are monitoring the inflation picture closely.

In this environment, investors should remain properly invested, for several reasons. First, it’s important to hold some duration—or interest-rate sensitivity—as an offset to risk assets. Second, shifting to cash will soon leave you lagging both income-generating bonds and inflation. Third, don’t expect to time the end of the rising yields; not even seasoned bond managers can do that.

So what steps can investors take at this stage of the rising-rate environment? One strategy investors might consider is a credit barbell. This approach balances interest-rate risk and credit risk in a single strategy. The manager alters the exposure to each as valuations and conditions change. This kind of strategy helps minimize risk by preventing investors from reducing duration too much, as well as from tilting too far into credit. It also takes advantage of the interplay between the two risks—which in itself is the most important risk investors face today.

Copyright © AllianceBernstein