by Henning Stein, Head of Global Thought Leadership, Invesco Canada

Diversity and Financial Performance

Years of hard data draws an undeniable link

Despite years of research touting the benefits of diversity in the workplace, it remains a difficult and controversial topic for some. While some commonly complain that diversity is incompatible with the pursuit of meritocracy and fosters box-ticking and tokenism, the reality is that fostering an inclusive culture has intrinsic value and an unmistakable impact on the bottom line.

In our latest white paper, Broad Diversity as a Driver of Meritocracy, authors Caroline Atkinson, David Millar, Andrew Schlossberg and Dr. Henning Stein gather together decades of research on the topic of diversity and inclusion, from its early roots to a growing body of research that shows a positive impact on the bottom line. A lack of diversity could even be a risk according to Christine Lagarde, managing director of the International Monetary Fund, who famously postulated that Lehman Brothers might not have collapsed if it had been “Lehman Sisters.”

As investors gain access to more and more data linking diversity to organizational performance, it’s becoming a key issue for asset managers and asset owners alike, who can increasingly use it as a criteria for long-term decision-making.

To highlight the importance of considering diversity for investors, we present four critical data points that clearly show potential for financial upside:

Workplace diversity drives performance: According to McKinsey’s report, Delivering Through Diversity1, companies in the top-quartile for gender diversity on executive teams were 21% more likely to outperform on profitability and 27% more likely to have superior value creation. But it’s not just about gender. Companies in the top-quartile for cultural diversity on executive teams were 33% more likely to have industry-leading profitability.

Gender diversity on the board improves the bottom line: A 2011 study by Catalyst – The Bottom Line: Corporate Performance And Women’s Representation On Boards (2004–2008)2 – furthers the case for diversity. It shows clear evidence that companies with more women board directors perform better financially than those with the least: a 16% on return on sales and 26% for return on invested capital. At the same time, companies with sustained high representation of women on the board significantly outperformed those with sustained low representation by 84% on return on sales, by 60 percent on return on invested capital, and by 46 percent on return on equity.

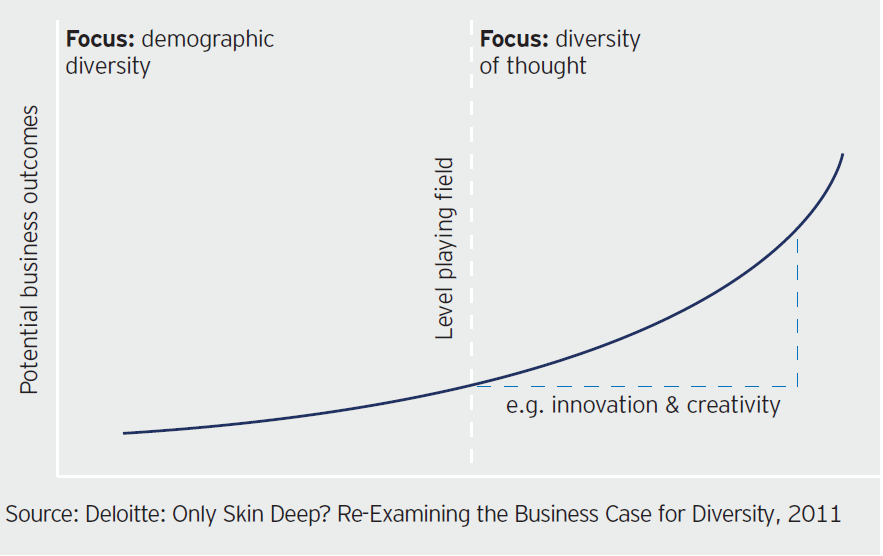

Demographic diversity breaks through “groupthink”: According to Deloitte’s influential 2011 study3, diversity in the workplace can also provide companies with a competitive edge through better and more diverse ideas. As the study points out: “demographics act as a lead indicator as to whether organisations are drawing from the full knowledge bank and making merit-based, rational decisions.” Figure 1 shows this correlation clearly.

Figure 1

The workforce will demand it: In 2016, the Institute for Public Relations4 published research showing that 47% of millennials would consider the question of diversity in the workplace when looking for a job, whereas only 33% of generation X members and 37% of baby-boomers would give the matter thought.

Download our full white paper, for institutional investors, with even more data and analysis here.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog