by Blaine Rollins, CFA, 361 Capital

Trade angst. Inflation angst. Emerging Market angst. Political angst. And now Hurricane angst. So much to think and worry about while we try and extract every last bit of return out of these financial markets. So where do we stand?

- The White House has now threatened tariffs on another $260 billion in Chinese goods, as well as now drawing swords on Japan.

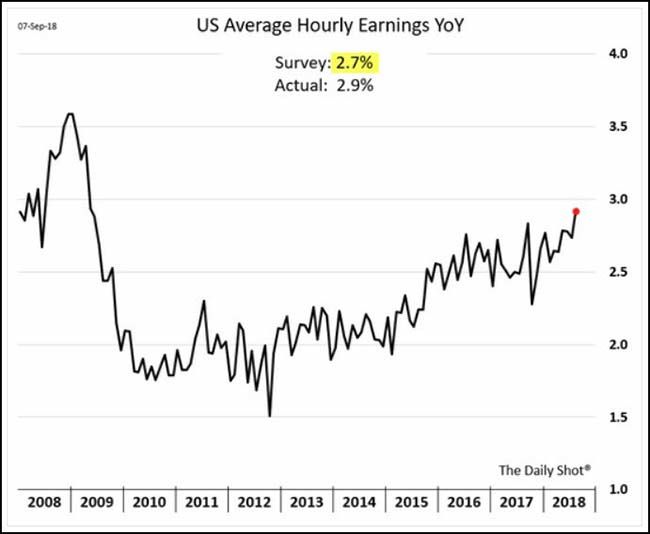

- Friday’s average hourly wages spike to +2.9% y/y and combined with the week’s early strength in the ISM manufacturing, services and prices paid data, left few thinking the Fed would back off on raising interest rates.

- The strength of the U.S. dollar and interest rates continues to weigh on the emerging market currencies, debt and equities.

- An anonymous White House Op-Ed was written and a book by Bob Woodward was published. For some reason, the National Enquirer was not able to buy and bury both. Midterm elections are in less than two months and changes in Congress look likely.

- Hurricanes on track for the Carolinas, Hawaii, and many spots in the Caribbean.

Among all the angst in the world, I still prefer my exposures to be heavily in the U.S. with solid weights in both small, mid and large cap stocks, while concentrating in Technology, Consumer Discretionary and Healthcare companies. I also have a very big slug of cash and shorts. Have a good week and for those of you on the eastern seaboard, be safe.

To receive this weekly briefing directly to your inbox, subscribe now.

More than expected, wage inflation surges in Friday’s jobs numbers…

Walmart is pushing wages higher as they try to keep their flow of goods on track…

Walmart Inc., pinched by the worsening shortage of truckers, plans to double its spending on attracting and retaining drivers by year-end.

The retailer, whose private fleet of 6,500 trucks is one of the largest in the nation, will offer referral bonuses of up to $1,500, shorten the on-boarding process for new hires by more than a month and broadcast its first national TV adfocused on its 7,500 truckers. The program, which coincides with National Truck Driver Appreciation Week beginning Monday, aims to fill vacancies and improve the image of long-haul driving as a career amid a tight labor market.

“To be candid, right now I could hire a few hundred drivers,” Tracy Rosser, Walmart’s senior vice president of transportation, said in an interview. “It is getting tougher and tougher to find qualified drivers. It’s a really serious situation right now.”

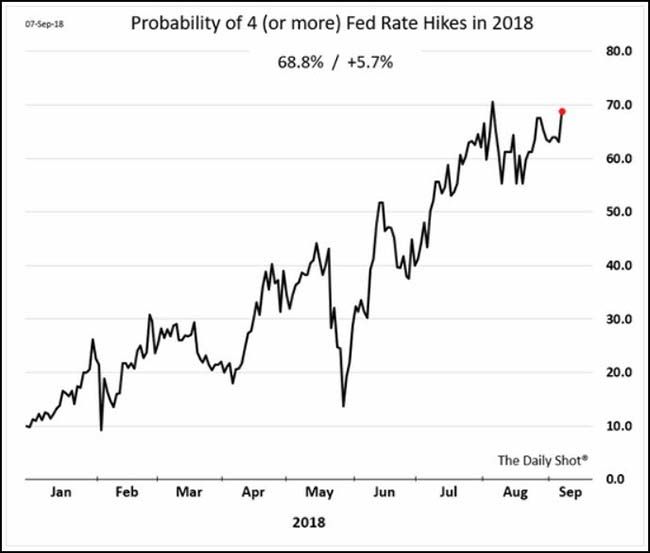

Almost a lock that the Fed will raise the Fed Funds rate in September and December…

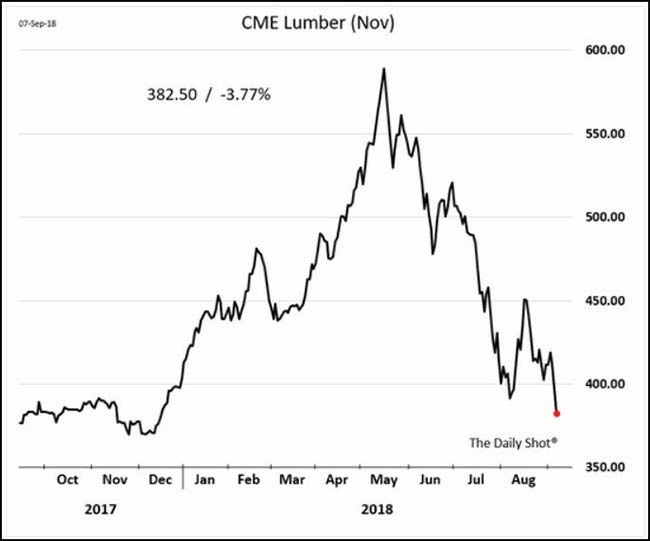

Of course the flip side to higher interest rates is lower housing activity…

Which is crushing lumber prices to one-year lows.

And now some new talk of alternative tightening at the Fed?

The good news is that at least someone in Government thinks it is a good time to save for a rainy day. Of course, the bad news is that higher capital requirements at the banks will mean less lending for all.

“This would be a good time to be raising that capital buffer,” said Cleveland Fed President Loretta Mester in a July interview. “In good times, you raise it.” Not using it now “puts you more into the camp of” using interest rates to guard against financial instability, she added.It was a subject of discussion at a Boston Fed conference Friday and Saturday. Ms. Mester is among five regional Fed bank presidents pushing for a move, but the authority isn’t in their hands. Instead, Fed governors in Washington, overseen by board Chairman Jerome Powell, make the decision, voting at least once a year on its level.

One Fed governor, Lael Brainard, has publicly backed increasing the buffer. Mr. Powell hasn’t weighed in publicly, except to say in June he didn’t think financial-stability risks were meaningfully above normal.

Goldman figures that a full trade war with China will knock 0.3% off of GDP…

(Goldman Sachs)

When free trade dies and the government starts picking winners and losers, well run companies and their employees get hurt…

Mid Continent is the largest nail manufacturer in the U.S. and has been in Missouri for more than 25 years. It had 500 employees at its Popular Bluff plant and was the second largest employer in the small town before the Trump tariffs hit.

The trouble for Mid Continent is that foreign producers making nails abroad use low-price steel and export their production to the U.S. They can offer better prices than their U.S. rival because, as Chris Pratt, operations general manager for the plant, explained in a Journal op-ed last month, the tariffs pushed costs up “overnight” and made the company uncompetitive. “Orders dropped 70% in two weeks, and our workforce shrank from 500 employees to 370,” he wrote.

(WSJ)

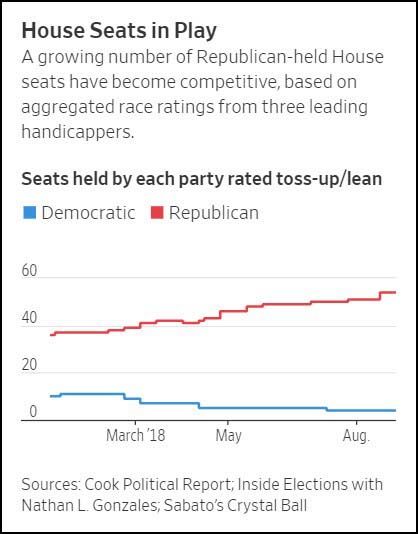

The rising political angst will likely lead to a shift in Congress…

While the markets typically enjoy a split government, new changes can always create some anxiousness in the markets.

The president’s party has lost House seats in 18 of the last 20 midterm elections, with an average loss of 29 seats. The last time a president’s approval rating was as low as Mr. Trump’s 40%, Republicans lost 30 seats as George W. Bush’s popularity sagged during the Iraq war in 2006.

Democrats must flip at least 23 seats to take a House majority. Privately, officials from both parties have estimated the range of Democratic gains from 15 to 50 seats.

(WSJ)

While our government works on a two-year cycle, the Chinese are playing the long game…

(WSJ)

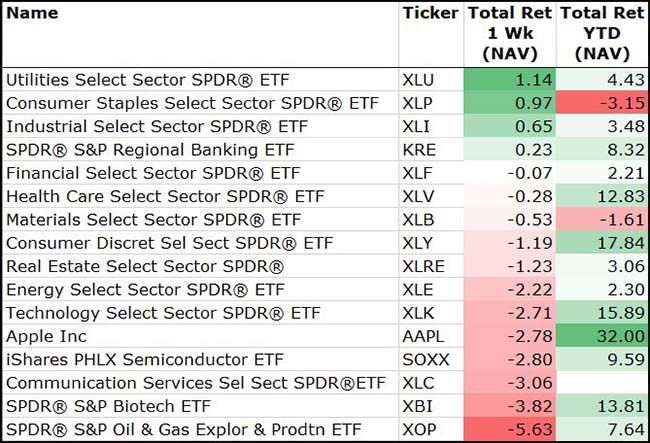

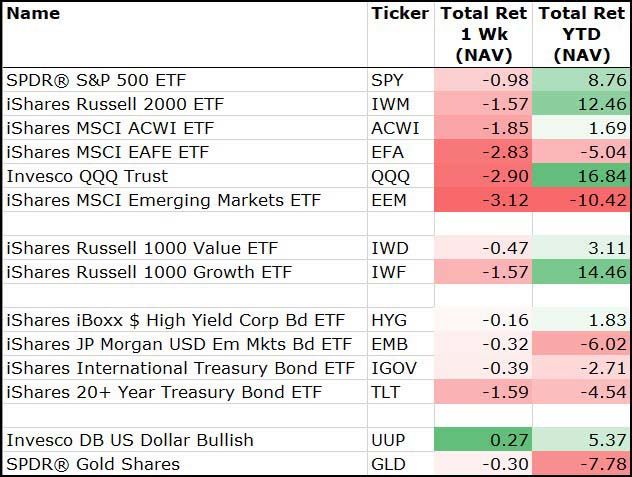

A risk-off week in the markets with International investments continuing to underperform…

(9/7/2018)

And while the Nasdaq continues to trend higher, the higher risk stocks are no longer leading its charge…

@HumbleStudent: Risk appetite misbehaving – $NDX breached an uptrend Thursday and didn’t recover, and High beta/Low vol suffered another relative breakdown $QQQ $SPLV $SPHB

Meanwhile among the sectors, it was also risk off as Utilities and Staples outperformed…

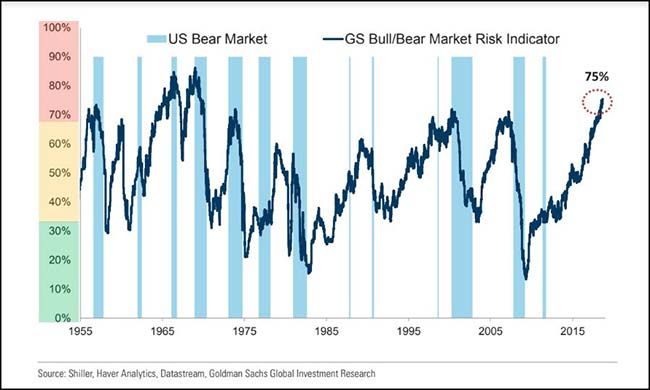

Goldman throws up another cautionary flag as many of its indicators are in or near peak levels…

A gauge of bullish and bearish momentum in the U.S. stock market is ringing alarms for strategists at Goldman Sachs.

The investment bank’s so-called bull-bear indicator, which examines five market factors, indicates that the likelihood of a bear market occurring is at its highest point since around the mid-1970s (see chart below).

Goldman analysts led by Peter Oppenheimer, chief global equities strategist, said an unusual period for Wall Street, characterized by loose monetary policy and a recent spate of fiscal stimulus has resulted in an uncannily bullish cycle for markets that is likely to come to a screeching halt.

However, the upshot of the 54-page Goldman report dated Sept. 4 isn’t that investors should panic and head for the hills, but rather that a period of lower returns should be anticipated.

If you want to get my attention, just say ‘Space Elevator’…

I totally love this concept and hope that I get to ride one in my lifetime.

A team of researchers from Japan’s Shizuoka University and other institutions will conduct the first test in space this month as part of a project to build a space elevator, Japan’s The Mainichi reported last week. The space elevator essentially ferries people and cargo shipments in an elevator car travelling on a cable connecting Earth to a space station.

This test is the first exploring the movement of a container on a cable in space. Two ultra-small cubic satellites measuring 10 centimeters on each side connected by a steel cable about 10 metres long will be carried from Kagoshima’s Tanegashima Space Center to the International Space Station on Sept. 11.

From there, the connected satellites will be launched and a motorised container acting as an elevator car will travel along the cable and have its journey recorded via a camera attached to the satellites….

Space elevators are expected to cut the costs — and risks — of space travel massively if they can be realized. While cargo would typically cost about $22,000 per kilogram via shuttle, Obayashi’s elevator will cut that to about $200. Researchers also expect these elevators to travel up to 200 kilometers per hour and arrive at the ISS eight days after launch, said the publication.

(CNET)

Finally, our top quant and colleague Aditya is a big thinker…

When he isn’t thinking up new Star Wars conspiracies or suiting up in his goalie equipment for a hockey game, he likes to dive into some quality readings. Every week he will be putting out his favorite reading list so give it a look.

Copyright © 361 Capital