by Fixed Income AllianceBernstein

Aluminum. Cars. Solar panels. It’s hard to track the tariffs without a scorecard. As headlines continue to swirl, many investors worry about the impact on the US economy. Clearly, tariffs and trade wars hurt growth, but we don’t think the impact will be big enough to derail the economy just yet.

Clearly, tariffs and trade tensions are a headwind for growth—both in the US and in other countries. However, the US economy is robust, and in our assessment, it can absorb the potential hit without too much disruption. Of course, with both announced and threatened tariffs coming and going by the day, the true impact is a fast-moving target.

From our perspective, there are three channels through which trade measures can exert their influence on the economy:

1) Direct Impact: Less than in Most Other Countries

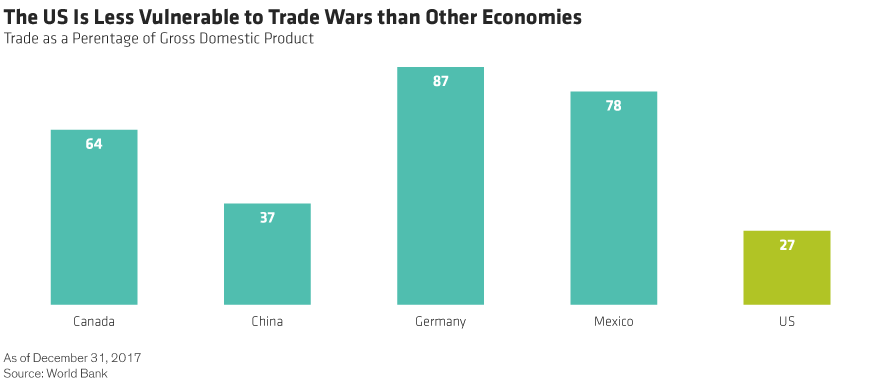

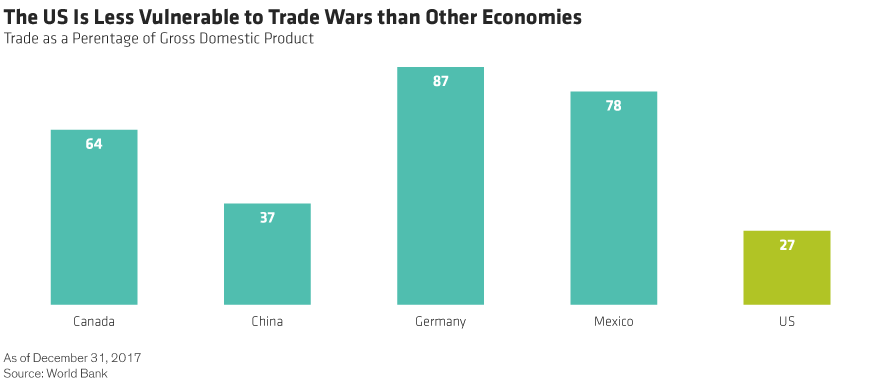

The good news for the US is that its economy isn’t particularly trade sensitive. In technical terms, the US is a relatively “closed” economy: Trade is a relatively small percentage of gross domestic product (GDP) (Display). So, a 10% tariff on $200 billion of imported goods, for example, would reduce gross domestic product (GDP) growth by $20 billion—or about 0.1% of GDP.

The direct growth impact of the ongoing trade war will likely be larger in other countries. For one thing, their overall economies are significantly smaller than that of the US. And they’re more “open” than the US economy: Trade is a bigger share of their GDP. That makes them more exposed to the direct impact of tariffs and restrictions.

2) Markets: Costlier Financing All Around

The direct impact of trade tensions is likely to be quite small, but that’s not the only channel through which the trade-war impact will be felt. Each new round of announced tariffs and every round of rhetoric threatening tariffs has unnerved financial markets, pushing equities lower and the dollar higher.

Both of those market responses will slow growth over time by raising the cost of financing for both businesses and consumers. The dollar has already appreciated by almost 6% over the last six months or so. That isn’t enough to derail economic growth, but it does dampen the prospects over time.

3) Business Investment: The Confidence Factor

Over time, the biggest impact will likely come from lower business confidence. Many US businesses, particularly manufacturers, rely on imported goods. Tariffs will make many of those goods pricier, hurting bottom lines and making investment and production in the US less attractive.

Exporters will likely see less overseas demand because of reciprocal tariffs imposed by US trading partners. It’s too early to know for sure how big the impact will be—most of the announced tariffs only went into effect in early July or should start in the next couple of months.

But there are early indications. The Federal Reserve Bank of Philadelphia’s survey of companies’ capital-investment plans shows that investment plans have declined since trade tensions started to percolate a few months ago (Display). Essentially, the impact so far has offset much of the investment incentive from last year’s tax cuts. It doesn’t necessarily slow growth as much as prevent it from accelerating further.

Trade Friction Is a Negative—but Unlikely to Derail the US Economy

Because the US economy is relatively closed and financial markets have been resilient so far, we don’t think that trade tensions are likely to be significant enough to derail a very strong economy.

But trade frictions are clearly a negative for economic growth. With no sign that things will settle down anytime soon, trade policy remains a clear risk to our forward outlook. We don’t think it’s necessary to adjust our growth forecasts just yet, but like the rest of the world, we’re watching closely to see how the trade war plays out in the coming months.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein