by Frank Holmes, CIO, CEO, U.S. Global Investors

Share this page with your friends:

Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page.

May 21, 2018

Last week I had the pleasure to attend Consensus 2018 in New York, the premiere gathering for the who’s who in blockchain, bitcoin and cryptocurrencies. Attendance doubled from last year to an estimated 8,500 people, all of them packed in a Hilton built for only 3,000. Ticket sales alone pulled in a whopping $17 million, while event booths—the largest of which belonged to Microsoft and IBM—generated untold millions more.

The entire three-day conference, hosted by crypto news outlet CoinDesk, had the energy and flair of the world’s greatest carnival. Sleek lambos sat outside the hotel, attracting all sorts of gawkers. Passersby also stopped and stared at the “bankers against bitcoin” protest, conceived and funded by Genesis Mining, one of the largest bitcoin mining companies. (You can read my interview with Genesis cofounder and CEO Marco Streng here.)

The same money went to finance bitcoin awareness billboards outside the Omaha office of Warren Buffett, who recently bashed the cryptocurrency, calling it “rat poison squared.”

“Warren,” the billboards read, “you said you were wrong about Google and Amazon. Maybe you’re wrong about Bitcoin?”

Bringing #BitcoinAwareness to the Masses

That Buffett has a negative opinion of bitcoin shouldn’t surprise anyone. The “Oracle of Omaha” has famously been averse to emerging technology and tech stocks he doesn’t fully understand, including Google, Amazon, Microsoft and others. But he’s changed his mind in the past after he’s seen the value these companies provide.

I’m old enough to remember when Buffett was vehemently against airline stocks. The industry was a “death trap” for investors, he once said. Today, his company Berkshire Hathaway is one of the top holders of stock in the big four carriers—United Continental, Delta Air Lines, Southwest Airlines and American Airlines. He even told CNBC he “wouldn’t rule out owning an entire airline.”

Obviously there’s a world of difference between airline stocks and bitcoin—although blockchain, the technology that bitcoin is built on top of, is already being used in aviation to increase transparency in aircraft manufacturing and maintenance. All I’m saying is I wouldn’t rule out bitcoin, or cryptocurrencies in general, just because Buffett isn’t a fan. He doesn’t like gold as an investment either, and that hasn’t stopped it from being one of the most liquid assets on the planet.

The Future of Gold Mining (And Investing)

But back to Consensus. It wasn’t all fun and games, and there were some serious discussions on how governments might one day use cryptocurrencies; the future of bitcoin mining; and blockchain applications in finance, health care, insurance, energy and more. As I explain in last week’s Frank Talk Live, charitable giving is down because donors are increasingly concerned about fraud. Blockchain can help validate where your money is going.

I would include the mining industry to that list. Blockchain has the potential to revolutionize how gold and precious metals are manufactured and delivered. Consider the journey a gold nugget must take along its supply chain, from mine to end consumer—it cuts through several other industries and practices, including legal, regulatory, financial, manufacturing and retail, each of which might have its own ledger system.

These ledgers are vulnerable to hacking, fraud, errors and misinterpretations. They can be forged, for example, to conceal how the metal or mineral was sourced.

With blockchain technology, there’s no hiding anything. Decentralization guarantees complete transparency, meaning anyone along the supply chain can see how, when and where the metal was produced, and who was involved every step of the way.

This will give the industry a huge shot of trust, not to mention dramatically increase efficiency.

Many producers, tech firms and entire jurisdictions have already adopted, or plan to adopt, blockchain technology for these very reasons. IAMGOLD, a Toronto-based producer, announced last month that it partnered with Tradewind Markets, a fintech firm that uses blockchain technology to facilitate digital gold trading. IBM just helped launch a diamond and jewelry blockchain consortium, TrustChain, that will track and authenticate diamonds, metals and jewelry from all over the world. And sometime this year, the Democratic Republic of Congo will begin tracking cobalt supply from mines to ensure children were not involved.

With precious metals being used more widely in industrial applications, from smartphones to electric cars to Internet of Things (IoT) appliances, tracking metals across the supply chain has become increasingly more important to businesses and consumers. According to the Semiconductor Industry Association (SIA), global sales of semiconductors—which contain various metals, including gold—crossed above $400 billion for the first time in 2017. Total sales were $412.2 billion, an increase of nearly 22 percent from the previous year.

That’s a lot of metal and other materials that blockchain tech can help authenticate.

Before I get off this topic, I want to mention that blockchain is also bringing change to gold investment. Consider Royal Mint Gold (RMG), which aims to provide the “performance of the London Gold Market with the transparency of an exchange-traded security.” There’s also the Perth Mint’s InfiniGold, which issues digital certificates guaranteeing ownership of gold and silver in the mint’s vault. A number of other platforms exist to help facilitate gold trading.

Should even one of these become hugely popular, it “could be as big a change to the gold markets as the development of ETFs, but with the added advantage of appealing to younger generations,” according to the World Gold Council’s (WGC) chief strategist, John Reade.

Who Says Size Matters?

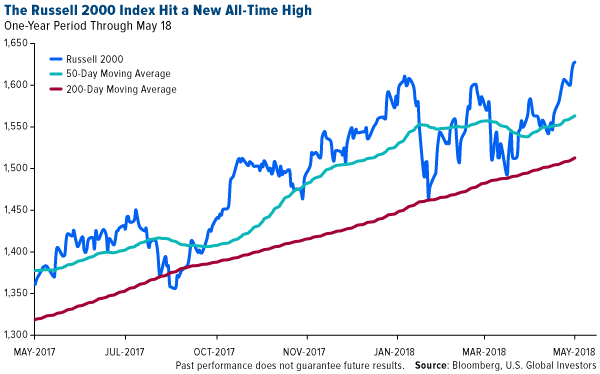

The small-cap Russell 2000 Index closed at its third straight record high on Friday after putting up bigger gains than the larger-cap S&P 500 Index and Dow Jones Industrial Average.

As I’ve explained before, President Donald Trump’s protectionist policies and low corporate tax and regulatory environment strongly favor small-cap stocks. Investors hate uncertainty, which is precisely what the market is feeling with regard to tariffs and global trade. Because small-cap companies don’t rely as heavily on overseas markets as huge multinationals do, it’s little wonder why we’re seeing money flow into the Angie’s Lists and Yelps of the world right now.

The Russell 2000 Index is a small-cap stock market index of the bottom 2,000 stocks in the Russell 3000 Index. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2018): IAMGOLD Corp., United Continental Holdings Inc., Delta Air Lines Inc., Southwest Airlines Co., American Airlines Group Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors