by Emerging Market Equities Team, AllianceBernstein

A Wall Street Journal (WSJ) blog on Wednesday warned that the emerging-market (EM) trade is under threat. But we think investors shouldn’t be swayed by short-term market moves. History shows that EM equity performance cycles typically unfold over several years.

After a two-year rally, EM stock returns slowed in early 2018. According to the WSJ, EM currencies, stocks and bonds have been under pressure recently due to “a sudden resurgence in the US dollar, rising expectations for US interest-rate increases and uncertainty over the path for global growth.”

We think the short-term reaction is overdone. In our view, developing economies are much more shock-resistant than they used to be, owing to improved trade balances and debt positions. What’s more, EM stocks are exposed to improving domestic macroeconomic conditions, strong secular growth drivers and broadening sources of earnings.

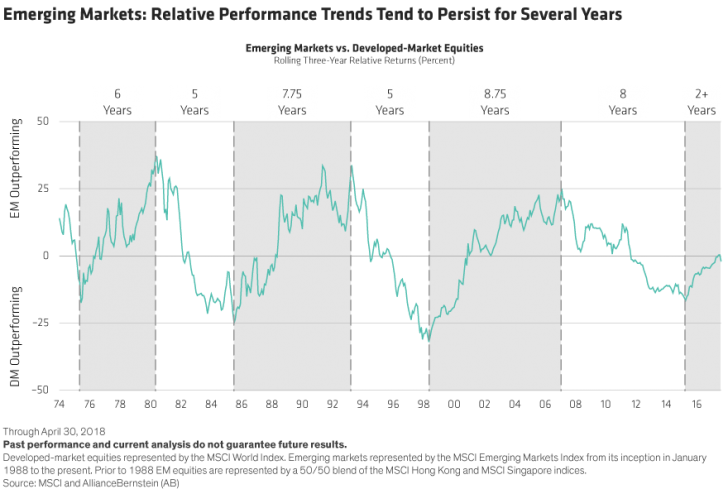

In the past, EM stocks have outperformed or underperformed developed-market stocks for relatively long multiyear cycles (Display). The last eight years of EM underperformance (which ended in 2016) were preceded by nearly nine years of outperformance.

Of course, historical performance trends don’t guarantee a repeat this time around. Yet EM stocks trade at a 23% discount to their developed-market peers based on price/forward earnings. So even though the road ahead might not be smooth, we think there’s a solid foundation to expect a continued recovery for EM stocks over time.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein