by Tony Scherrer, Smead Capital Management

Know what you own, and know why you own it.”

– Peter Lynch

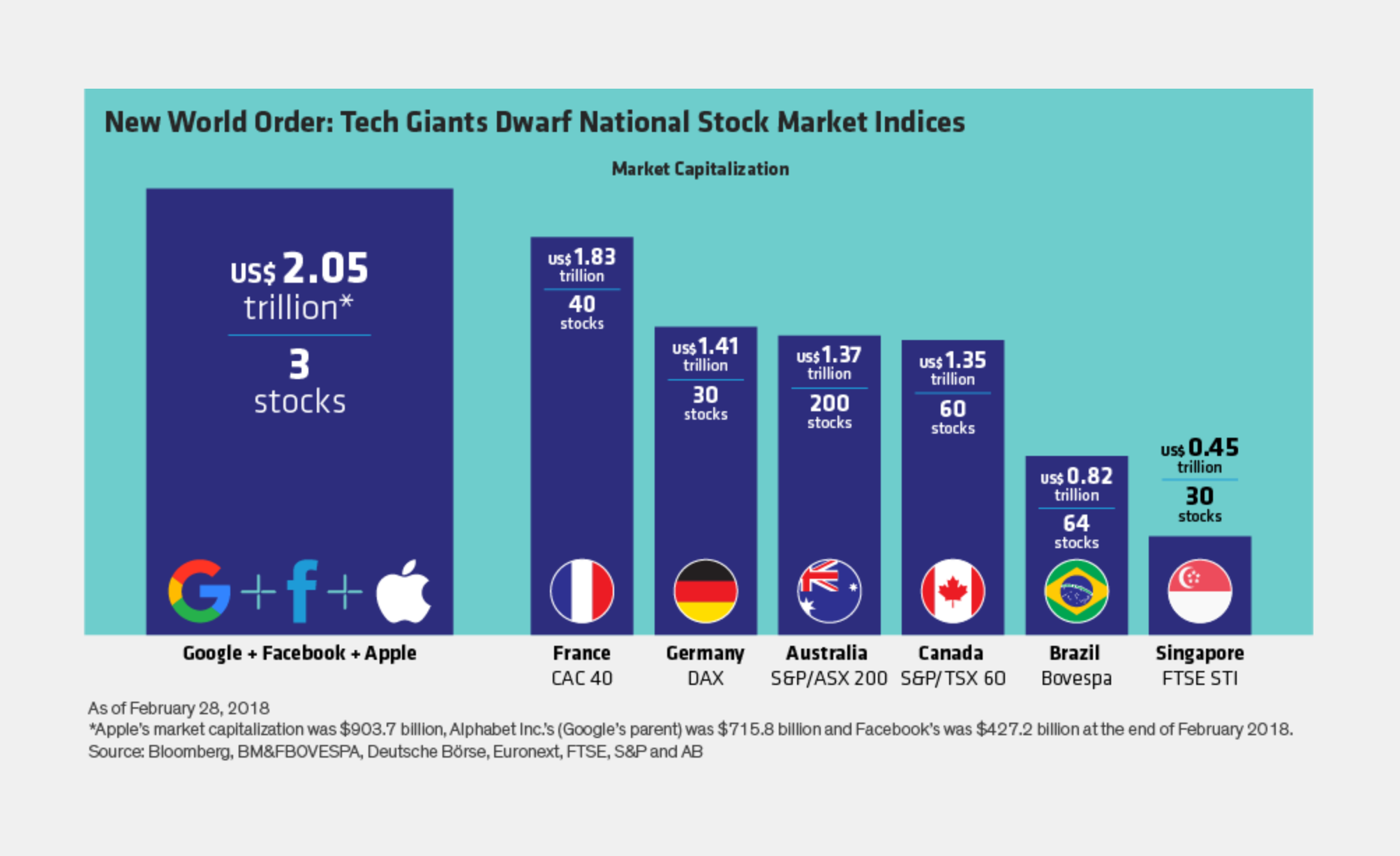

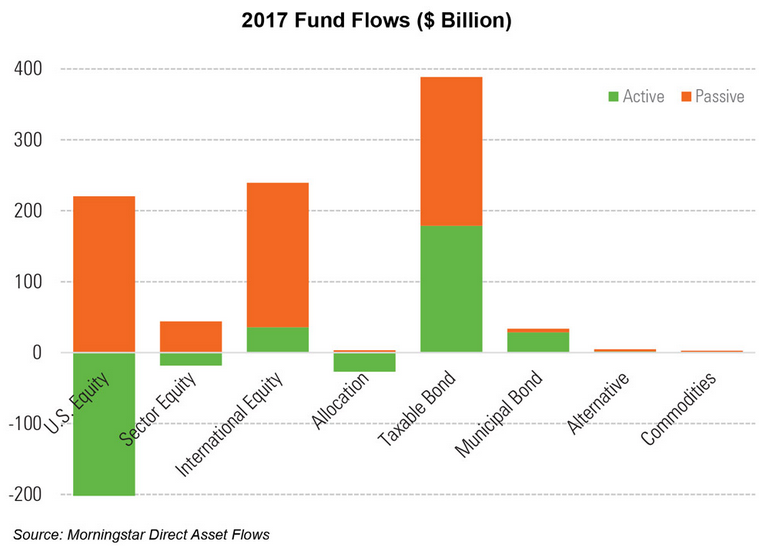

Money flowed into passive investment vehicles at an ever-increasing rate in 2017. It was a record year for these products designed to replicate a stock market index and agnostically own a basket of securities without discretion. As investors who build our portfolios from the ground up through careful security selection, we think the ramifications of this passive ideology should be revisited, as we believe its impact will be felt in our markets for the foreseeable future.

First, here’s the picture from Morningstar showing the $685 billion that moved into passive indexes last year (orange bars), some of which was at the expense of actively managed funds (green bars), followed by a graph of flows into passive since 2006:

Source: Morningstar

Source: Morningstar

Author and investment analyst Humphrey B. Neill once warned, “Don’t confuse brains with a bull market.” He said this well before indexing came into vogue. We wonder how he would characterize that same concept today, in a market where brains are an unnecessary burden for passive investors, who are required to check them at the door when entering the room of investing.

As we enter this ninth year of a bull market, it certainly has become easy to become agnostic or atheistic with regards to investing. The rear-view mirror shows that doing so has paid handsomely. Despite this, any experienced investor also understands there are no atheists in foxholes. At some point, those who want to remain in the game will need to spend time in the trenches. As Peter Lynch’s quote above indicates, if you don’t know what you own and why you own it today, you will simply not possess the strong hands necessary to sit through a war, or perhaps even a small challenge.

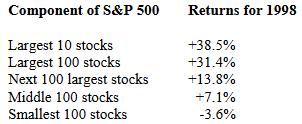

In today’s market, the battlefield is being set, in part, by the dumb-money that has flowed into the indices. Index investing works well in markets favoring growth vs. value, mainly because of the nature of how these indices are created and capitalization-weighted structure they employ. There have been four major periods since 1929 where “growth” has beaten “value.” We currently sit at the tail end of the longest stretch where that has been the case, creating the biggest differential between the two we have ever seen.

Given all of this, there are a few things that need to be understood:

-

- 1.

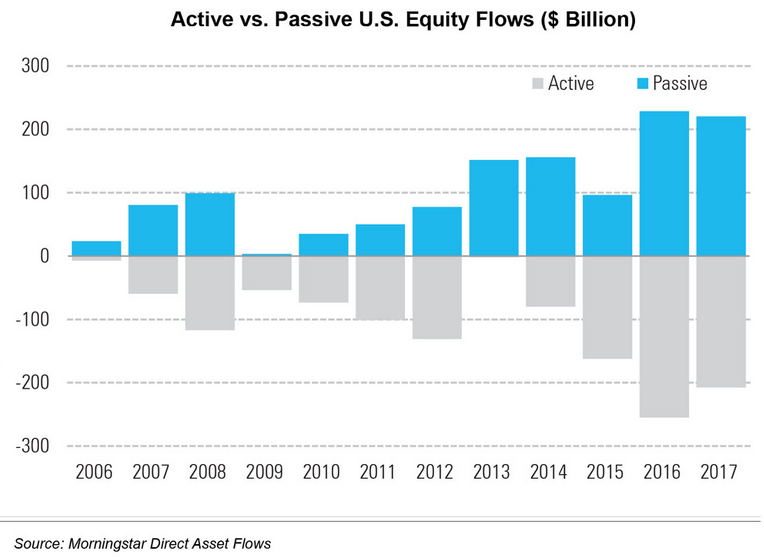

The leadership in this market is very narrow, and that is not normal.

-

- Today’s market has many similarities to the tech boom of the late 1990’s. Consider what drove the S&P 500 in 1998:

1

Source: Semper Augustus Investments Group LLC

Or 1999, when the largest 25 contributors to the S&P 500’s performance provided more than 100% of the S&P’s return. In that year, the average of the other 475 companies contributed negatively to index returns, and over half the index (257 of them to be exact) actually saw their stocks decline. All of this turned on its head on March 10, 2000, when that bubble popped.

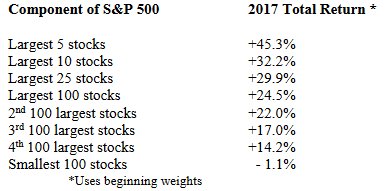

With a quick look at last year, you can see the parallels:

Source: Semper Augustus Investments Group LLC

-

- 2.

The leadership of a market during one era is not the same leadership in the next.

- Do you recall the idea that the internet was going to change our lives in 1999 and how the world capitalized the stock market accordingly? The thesis proved true, but when the truth gets massively overpriced in the stock market, it leads to severe heartache. In the aftermath, it was the areas of the market that were drastically undercapitalized that did the best over the subsequent eight years.

-

- 3.

Higher interest rates historically favor value investing at the expense of growth strategies.

- It is rational to want to pay-up for something that offers growth, in a world where growth is quite scarce. This is part of why “growth stocks” have done so well over the past decade. We have lived through a prolonged period of stagnant and anemic economic growth from 2009-2016. Higher interest rates could bring with it a broader set of attractive alternatives and will cause growth to look less unique. We have argued for some time that this market will eventually broaden out, and perhaps the market volatility we witnessed in February was a harbinger of that idea.

-

- 4.

Dividends matter.

- Well, they used to anyway. Today, the top five weighted stocks in the S&P 500 are Apple, Microsoft, Amazon, Facebook and JPMorgan. We doubt anyone owns Apple for its 1.4% dividend yield, Microsoft for its 1.8%, and Amazon or Facebook which pay no dividends. Dividend income contributed an important 42% of the total return experienced by owning the S&P 500 from the 1930’s until 2012. For two of those decades, the 1940’s and 1970’s, dividend income contributed no less than 75% of the total returns

-

- 5.

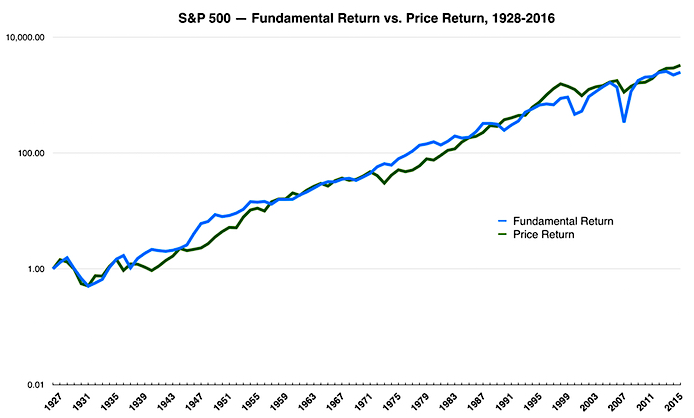

Earnings matter.

-

- John Bogle does a good job of tracking what he calls “Fundamental Return” vs. “Price Return” of the S&P 500, and here is what it looks like:

2

Source: Robert Shiller.

We do not pretend to know when the popularity of the ideology surrounding passive investing will exhaust itself or whether it will ever end. What we do know is some of the ways it has impacted or exacerbated today’s market. We also know that market fundamentals ultimately revert to long term averages, and to us the current circumstances seem out of whack. At market extremes, there is money to be made that we must chose to forego. As always, we will gravitate toward owning high quality businesses offered at attractive valuations. It is our belief that our value opportunity set is extremely attractive right now relative to what the S&P 500 Index and other disciplines might offer.

Warm regards,

Tony Scherrer, CFA

1Source: Semper Augustus Investments Group LLC, Double, Double Toil and Trouble

2Source: Robert Shiller

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Tony Scherrer, CFA, Director of Research, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

© 2018 Smead Capital Management, Inc. All rights reserved.