by Ong (Apichet) Kiatworakun, Equity Analyst, Mawer Investment Management, via The Art of Boring Blog

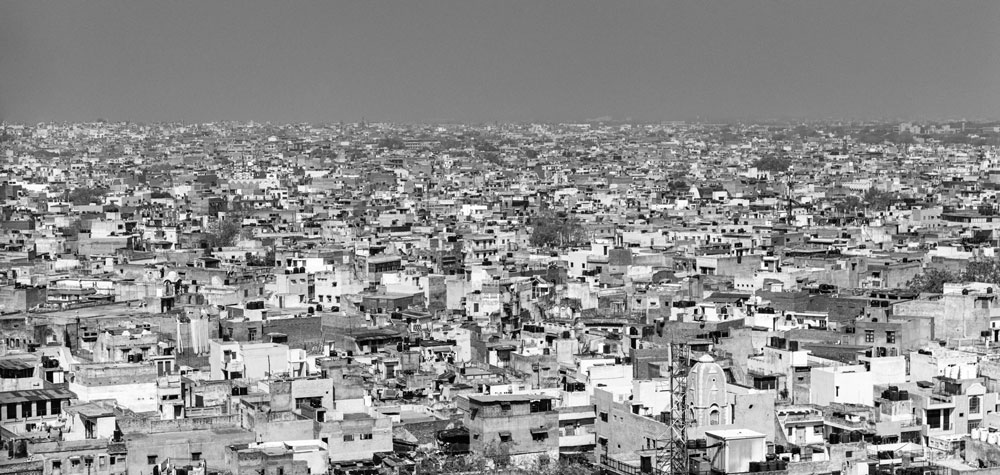

How many toilets do you have at home? Or rather—let me put it this way: do you have a toilet in your home? For most people reading this, the idea of not having one may sound crazy, but in India, over half of all households do not have the luxuries of a toilet and/or bathing facility. As for house ownership itself, the situation is not that much different. In Mumbai, India’s largest city, over half of its 18 million citizens live in informal housing or slums, which cover roughly 6-8% of the city—a population density of about 31,700 people per square kilometre1 compared to say, the 1,342 of Calgary2 (Canada). To put this in perspective, in 2016, there were 280 million households in India, but only 190-200 million permanent-structure houses available. India’s current population is over 1.3 billion and growing at a rate of about 1.1%3 per year.

What does this mean for investors? With India’s economy expanding4, people earning higher incomes, and the government’s provision of housing incentives, many slum and non-slum residents are now buying new, or upgrading their current homes. If people currently living Mumbai slums were to suddenly buy new homes today, there would be a demand of at least 1.8 million housing units. For the entire country? About an extra 10-11 million units per year. In short, there are potentially long runways for companies to compound value in India.

Why does this matter? The first tenet of our equity investment philosophy is to invest in wealth-creating companies; companies that earn a return on capital greater than their cost of capital over time. However, we are also looking for fantastic compounders that not only generate good returns on capital, but also have abundant opportunities to redeploy said capital at those discounted rates. It’s the combination of these elements I broadly refer to as “growth” opportunities.

Imagine two different companies: Low Growth Inc. and High Growth Inc. They both have the same return on capital—30%—but a different set of opportunities to redeploy capital. Low Growth has a 40% redeployment rate and High Growth has 100%. Theoretically, Low Growth Inc. should be able to grow its earning by 12% (30% multiplied by 40%) while the earning of High Growth Inc. should expand by 30% (30% multiplied by 100%). Assuming both companies generate a $1 earnings per share, using a simple price-to-earnings multiple of 10x to determine the value of both companies twenty years from now, Low Growth Inc. and High Growth Inc. would be worth about $96 and $1,900 respectively. In short (and in theory), the combination of a high return on capital and growth should create a wonderful compounder of value for investors.

Nevertheless, I have made an implicit assumption in the above exercise: namely, High Growth Inc. can continuously generate a 30% return and growth every year for the next twenty years. Not an easy feat! For instance, if High Growth Inc. only grew at 30% in the first ten years, and at 15% in the subsequent ten, its value would be $558—or 30% of the original value we calculated. Additionally, High Growth Inc. has to maintain its 30% return in order to yield the value we calculated in the first scenario of $1,900. To do so, the company needs robust competitive advantages to prevent its return being diminished by incumbent or new entrants in the market.

How do we find the companies that capitalize on those long runways and compound wealth for investors? Well, let’s go back to the Indian housing situation and consider HDFC Bank, a leading Indian bank and a holding in our international equity portfolio. Given India’s growing population, government housing incentives, and rising per capita incomes, the additional demand for houses makes HDFC Bank well-placed to capitalize on this growth runway. It has a strong branch network to both take deposits and sell banking products nationwide. Consequently, it has a stable, low-cost funding base to fuel its growth. Its brand is historic, well-known, and trusted, and was ranked the fourth-most valuable brand5 in India. Most importantly in our opinion, HDFC’s banking business is run by a well-respected, prudent management team, resulting in very healthy asset quality. We believe banking business should be boring and conducted with that in mind. From our assessment, HDFC has been doing exactly that and done it better than most.

Ultimately, the ability for a wealth-creating company to also significantly compound its value over time can turn a good investment into a great one.

2 http://forum.skyscraperpage.com/archive/index.php/t-136479.html

3 https://data.worldbank.org/indicator/SP.POP.GROW?end=2016&locations=IN&start=1960

4 The IMF expects India’s economy to grow by about 8% per year during 2018-22, compared to just 2% for advanced economies (e.g., Canada) and 5% for emerging and developing economies.

5 Evaluated by Interbrand—a global brand consultancy firm.

![]()

About Ong (Apichet) Kiatworakun

Ong (Apichet) Kiatworakun is an Equity Analyst at Mawer Investment Management Singapore Ptd. Ltd. He joined the firm in 2013, then relocated from Calgary to Singapore in 2016. Previously, he was a Senior Research Associate at Macquarie Securities in Bangkok, Thailand, where he performed fundamental research on Thai banks, media, hotels, and infrastructure companies. Learn more

This post was originally published at Mawer Investment Management