by Jeff Rosenberg, Chief Investment Strategist - Fixed Income, Blackrock

Income seekers have turned to credit, as well as to equity strategies with similar risks. Jeff Rosenberg discusses the potential consequences.

The search for yield has driven many income investors into unfamiliar territory. Low yields on perceived safe assets have led many to embrace more credit risk. And some have ventured beyond the bond markets—not just into dividend-paying equities—but also into options-selling strategies in equities. Such strategies don’t literally turn stocks into bonds, but they do create similar risk profiles: limited upside potential with plenty of downside. We delve into the link between credit spreads and equity volatility in our new Fixed income strategy piece Turning stocks into bonds.

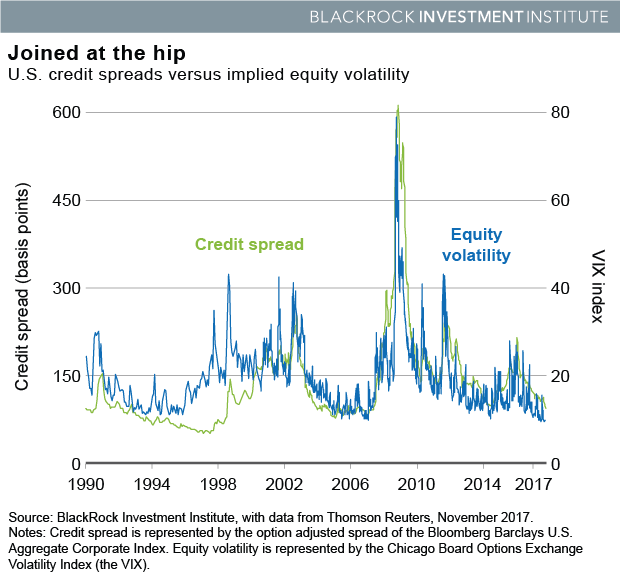

Credit spreads have tightened globally, and U.S. credit spreads are at the narrow end of their 17-year range against government bonds—even after a recent widening. When credit spreads are this tight, even a relatively small selloff can wipe out the income advantage of credit over government bonds. Today’s tight credit spreads reflect low levels of market volatility. Credit spreads historically have shown a close relationship with the VIX gauge of U.S. equity market implied volatility. See the Joined at the hip chart below.

Today’s realized levels of volatility stand at historically low levels—even for a low-vol regime such as the one we see persisting today. This is true across markets. Such calm may mask vulnerabilities; the concentration of income-seeking strategies and their risks is a potential one worth keeping tabs on.

Lower volatility and tighter credit spreads make it harder to generate income from selling related options. In the case of a corporate bond, it’s effectively selling an option on default. In a covered-call strategy—one popular way of generating income in the equity market—it’s selling some of the upside return potential in a stock for income today. That investors have been stretching their risk profiles to meet income goals is evident in rising levels of corporate leverage and fewer protections for creditors—in capital structures that increasingly favor the interests of issuers.

In volatility we see similar dynamics. Consider a covered-call writing strategy that seeks to maintain a 3% annualized yield target. The investor owns a stock and sells call options on that same stock to generate income. In exchange for this income, the writer of the call gives away any potential upside above the option’s strike price. Lower levels of implied volatility mean less income from each call option sold. The investor needs to sell more valuable options to meet the income goal. In this case that means options with strike prices closer to today’s level. This reduces investors’ upside potential while maintaining all the downside risk inherent in owning a stock. The end result: Income-seeking investors in such strategies are accepting much greater risk for smaller gains. This is a similar asymmetry of returns faced by credit investors today.

Bottom line: The credit markets and income strategies in equity volatility are exposed to similar risks. We still see a role for credit in bond portfolios but, overall, prefer to take economic risk in equities, as reflected in our recent downgrade of U.S. credit. We see better prospects for equities in an environment of steady economic expansion, easy financial conditions and strong corporate earnings. Read more in our full Fixed income strategy.

Jeffrey Rosenberg, Managing Director, is BlackRock’s Chief Investment Strategist for Fixed Income, and a regular contributor toThe Blog.

Copyright © Blackrock