by Blaine Rollins, CFA, 361 Capital

I always felt that stock trading around the holidays revealed true conviction in the market. Those who wanted to buy or sell something participated and moved prices, while those who didn’t have a bias took the days off and avoided calling in or checking their iPhone. In what should have been a slow four days last week, was anything but. And in those tea leaves, maybe the market tipped its hand in what it wants to do as we approach year end. Clearly there were buyers of risk assets in the equity markets, as well as buyers of ultra-risk assets in the Bitcoin markets. I am taking a close look at the action and noting that investors wanted to pay up to own more International equities, more Small Caps, more Tech, Industrial and Consumer stocks. I would not be surprised if these outperform into year end. As for Bitcoin, I will leave that asset for others to predict.

So, it appears that holiday shopping has gotten off to a ripping start…that is if you have a solid online presence. I didn’t see many lines on the news stations Friday night at the physical stores and even wondered if a physical Black Friday will be a thing next year. If you need proof that online did well, look no further than the 5%+ move in Amazon in the last few days. Now, if you want to see the opposite of ripping momentum, then look to Washington D.C. where all attempts to get the Tax Bill through the House are being slowed down by hallways filled with sex talk. The Tax Bill is believed to be headed to a vote by Friday, but it is still unclear as to whether or not it has the votes to pass. Other important items this week are Janet Yellen’s final appearance before Congress, and the OPEC meeting on Thursday.

To receive this weekly briefing directly to your inbox, subscribe now.

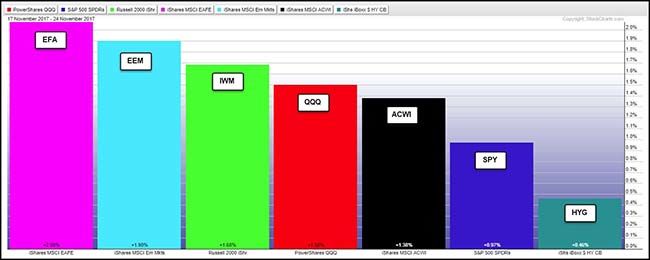

A glance at the returns for the shortened holiday week showed a strong appetite for risk across the board…

Especially overseas as helped by a decline in the U.S. dollar. However, Small Caps and even High Yield Bonds jumped higher.

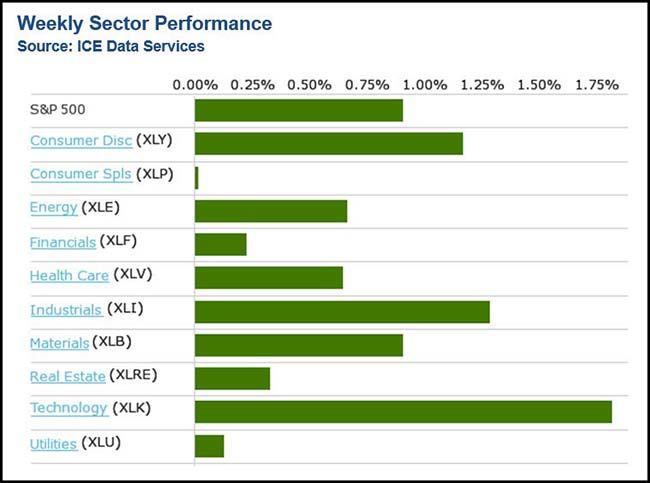

Among sectors, risk again led with Tech, Industrials and Consumer forging ahead, while safety lagged…

(11/24/2017)

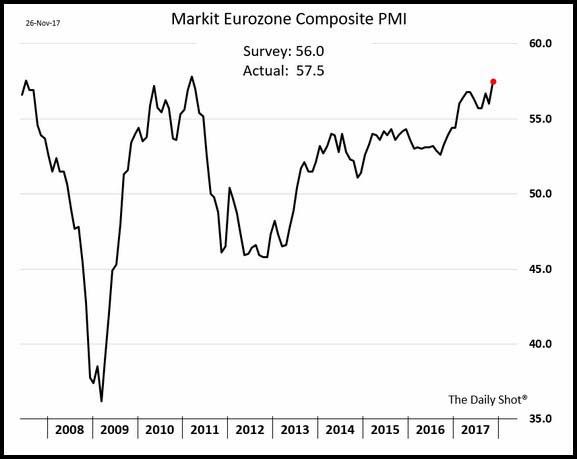

Looking at important economic data, the recovery in Europe is shifting into fifth gear…

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit said:

“The message from the latest Eurozone PMI is clear: business is booming. Growth kicked higher in November to put the region on course for its best quarter since the start of 2011. The PMI is so far running at a level signalling a 0.8% increase in GDP in the final quarter of 2017, which would round-off the best year for a decade.

“Jobs are being created at the fastest rate since the dot-com boom, yet despite this increase in operating capacity firms are struggling to meet demand. Backlogs of uncompleted work are growing at the fastest rate for over a decade, often resulting in a sellers’ market as customers struggle to source goods and services. Prices are consequently rising at an increased rate.

“Manufacturing is leading the upturn, with business conditions improving at a rate only beaten once in the survey’s two-decade history amid record export and jobs growth. The service sector is reporting relatively slower but still strong growth, as witnessed by hiring reaching a ten-year high.

“There are signs that political uncertainty appears to have subdued business optimism a little, but the broad-based nature of the upturn, and the rate at which rising demand is feeding through to the labour market, suggests the eurozone will see a strong end to 2017 and enter 2018 on a firm footing.”

(WSJ/Daily Shot)

The strong European economic data helped relaunch the Euro toward 3-year highs…

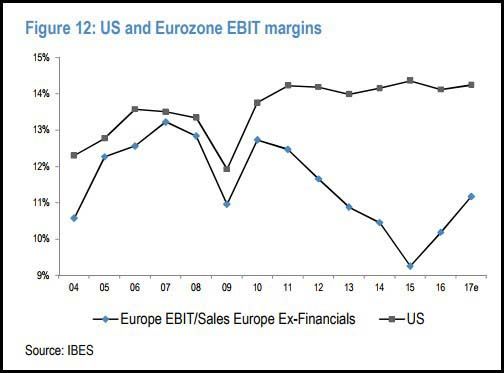

And as European growth moves into fifth gear, guess which region will have the better incremental margin leverage…

(JP Morgan)

Back in the U.S., it is the housing data which continues to lead all series this month…

U.S. purchases of new homes unexpectedly advanced in broad fashion last month, reaching the strongest pace in a decade and offering an encouraging signal for residential construction, according to government data released Monday.

The report showed the U.S. South region continued to recover from a pair of hurricanes. Purchases in other areas of the country, including a 17.9 percent surge in the Midwest, also climbed.

The number of properties sold in which construction hadn’t yet started reached the highest level since January 2007, signaling residential construction will accelerate in coming months.

And housing stock prices are lining up almost perfectly with the backlog statistics…

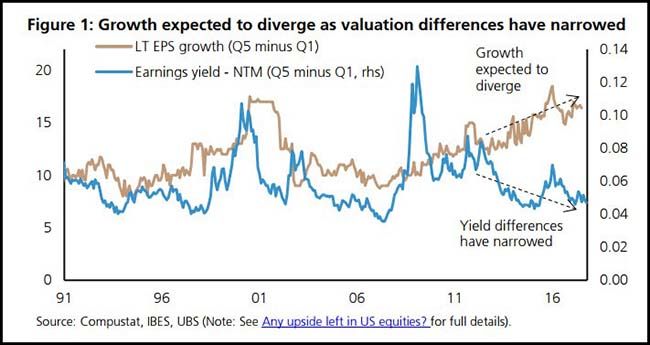

As firms look forward into next year, UBS is beating the ‘earnings growth’ drum in their 2018 outlook…

While they like U.S. stocks for 2018, they believe that you will get paid the most to own earnings growth stories which are being undervalued by the market. So think Tech stocks, Consumer stocks winning from demographic shifts and Industrial stocks that will benefit from incremental margin leverage.

While Growth has outperformed Value for 2017, it is still underperforming from 2016…

(@AndrewThrasher)

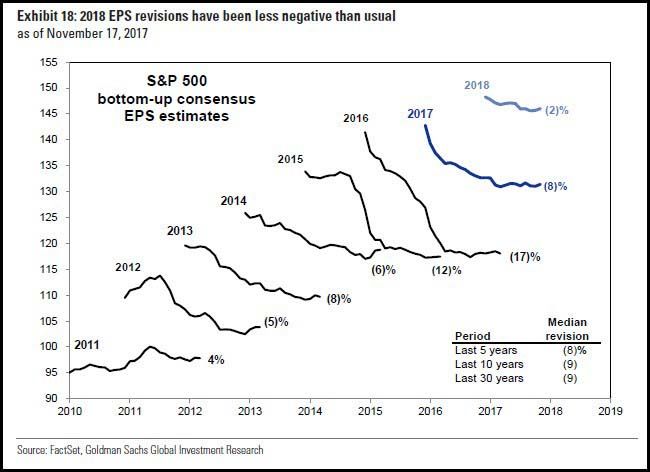

Goldman is also positive in their 2018 outlook. It definitely helps that Corporate Earnings are firing on all cylinders…

Since March, consensus 2018 S&P 500 EPS estimates have been reduced by just 2% compared with an average revision of -8% during the past five years. The below-average negative EPS revisions may be attributable to strong 2017 results, when an average of 52% of companies beat expectations during the first three quarters. Revisions have been positive during the past month, primarily for Energy and Info Tech companies. Stagnant consensus EPS estimates also reflect lingering uncertainty on the outcome and details of corporate tax reform. Our top-down EPS forecast implies positive revisions to full-year consensus EPS estimates for the first time since 2011.

(Goldman Sachs)

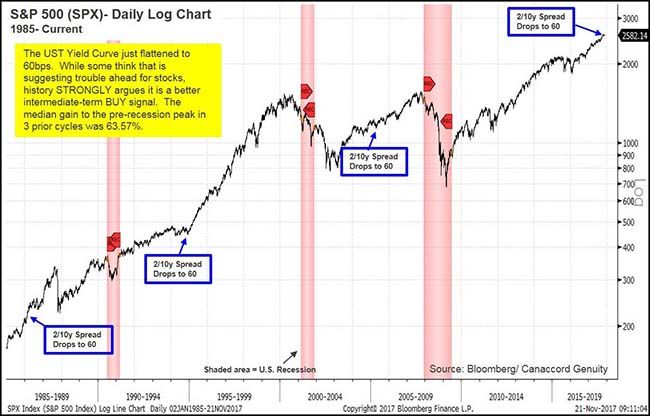

Tony Dwyer would agree with Goldman’s positive outlook for equities and suggests that buying a flattening yield curve is a strong move right now…

@dwyerstrategy: Getting lots of questions about flattening of 2-10/yr US Treasury yield curve to less than 60bp. If you look at last 3 cycles, was great intermediate-term buy signal

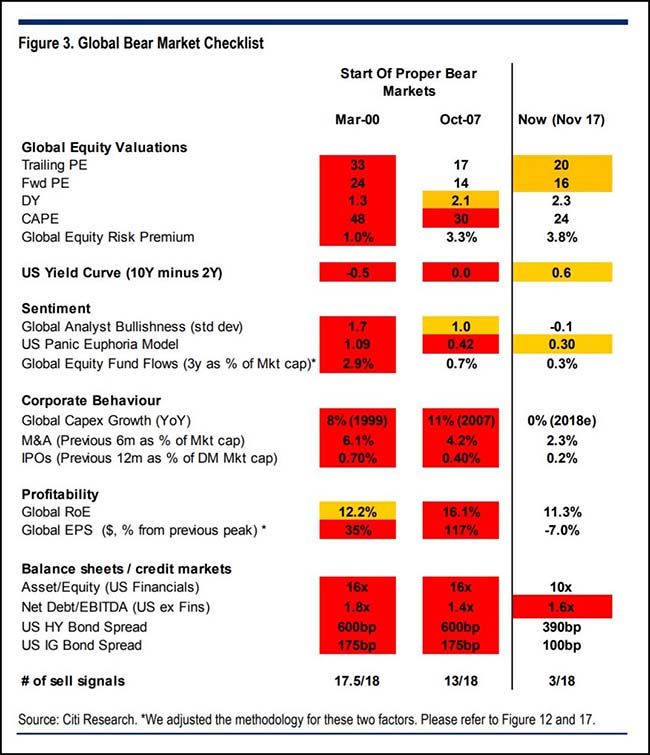

A close look at the Citi Global Bear Market Checklist shows that the market is not too overextended versus previous peaks…

So as Mohammed El-Erian suggested in his weekly Bloomberg piece, dips should continue to be bought until a significant structural event occurs.

(@NickatFP)

It is a big week for Oil as OPEC meets on Thursday…

Expectations are that OPEC + Russia will continue to keep output cut by 1.8m barrels per day for the rest of 2018. Of course, as prices have moved higher some may look to take advantage. Also, if prices rise too quickly, then Elon Musk gets a lift in his step. Think of the negotiations as a circular teeter totter with a pivot in the center and all the players running around the edges trying not to fall off.

The next NFL television contract negotiations are going to be brutal…

There was a time, not long ago, when the NFL was the most unifying public institution we had. No matter your political or demographic persuasion, the one thing you could find to talk about with someone was football. Richard Nixon and Hunter S. Thompson bonded over football, for crying out loud. Over the decades, the Super Bowl grew into the ultimate American spectacle, the last event that everyone in the country watched together, whether you cared about the game, the commercials, the point spread, or just Left Shark. You couldn’t avoid the NFL if you wanted to. Most didn’t.

Now, suddenly, the league that was once for everyone seems to be in crisis. Worse, it has no natural constituency. Liberals think it’s dangerous, classist, totalitarian, and cruel. Conservatives think it’s pandering, too “politically correct.” A lot of this is attributable, like so much else, to the president. Dozens of players were protesting the first two weeks of the season, but no one seemed to care … until Trump’s weekend tweetstorm from his golf club back in September. But the fact that we’re even framing this in political terms — the idea that a game in which people throw a ball and tackle each other has somehow become another thing for us all to yell at each other about from our ideological corners — is a large part of the problem. You can no longer watch the NFL without thinking of everything swirling around it off the field. The bigger problem for the league is: So many people just aren’t watching at all.

(NYMag)

Don’t worry about self-driving trucks. They are already in the lane next to you…

On each trip, a human driver working for Ryder (a major trucking company and Embark’s partner on this venture) heads over to the Frigidaire lot in El Paso, picks up a load of refrigerators, hauls them to the rest stop right off the highway, and unhitches the trailer. Then, a driver working for Embark hooks that trailer up to the robotruck, cruises onto the interstate, pops it into autonomous mode, and lets it do its thing. The truck mostly sticks to the right lane and always follows the speed limit. Once in Palm Springs, the human pulls off the highway, unhitches the trailer, and passes the load to another Ryder driver, who takes it the last few miles to Frigidaire’s SoCal distribution center.

Today, the human doing the highway stretch is there to keep an eye on things. In a few years, Embark hopes to ditch the carbon-based nanny. At that point, the humans doing the work at either end of the trip would be like the bar pilots who guide massive container ships into and out of port. And it should be a lot easier to find drivers if they don’t have to spend days or weeks at a time away from home, instead focusing on local deliveries.

(Wired)

Copyright © 361 Capital