by Michael Lebowitz, CFA, 720 Global Research

In Something Wicked This Way Comes, we provided an in-depth look at how stock repurchases are distorting McDonald’s (MCD) earnings per share and making the company look more profitable than it truly is. When such financial wizardry is considered alongside the growing popularity of passive investment strategies and overall sense of market euphoria, we have a better appreciation for why MCD trades at a valuation higher than fundamentals suggest would be appropriate.

We thought it would be helpful to extend this analysis to the entire S&P 500 to see if we can uncover other companies demonstrating fundamental and valuation divergences similar to MCD.

Who Else?

Similar to the MCD analysis, we evaluated changes in fundamentals, equity price and valuation data over the last five years for most companies that comprise the S&P 500. The data below, summarizing our broad findings, is based on 475 of the 505, S&P 500 companies. 30 companies were omitted from the analysis due to insufficient data.

- 141 companies, or about 30% of the S&P 500, had annualized five-year sales growth rates of 1% or less.

Of these 141 companies:

- The average stock price gain over the five year period was +68%.

- 106 of the companies had a stock price increase of 25% or more that was concurrent with falling revenue.

- The average number of shares outstanding declined by 2%. This data point is misleading as many energy companies within this group issued shares to bolster capital when the price of oil declined sharply in 2014/2015.

- The average amount of debt outstanding increased 70%

- The valuation ratio of market capitalization to sales increased 73%.

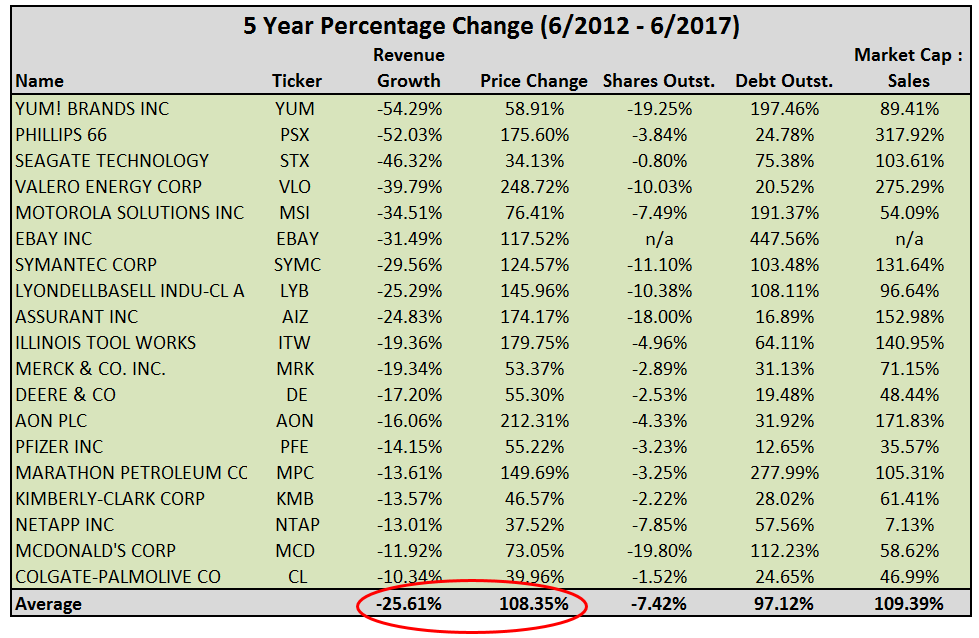

The table below isolates companies which had five year revenue declines of greater than 10%, price increases greater than 20%, declines in shares outstanding and increased debt outstanding.

The company-specific data and the averages for this group highlight the extreme divergences that exist between poor fundamental data and current price and valuation. The list of companies showing these characteristics extend well beyond what we show here, these are just the most egregious examples.

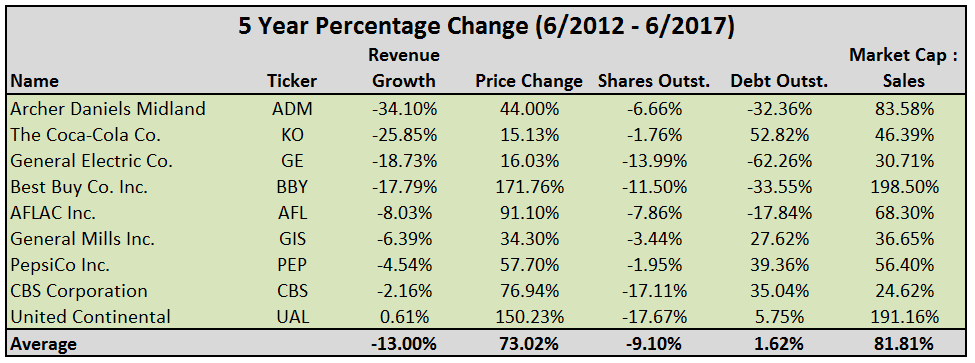

In the table below, we highlight a few other larger, well-known companies. While these companies did not match all of the criteria for the table above, they do have price and valuation changes that are inconsistent with their revenue growth.

Data Courtesy: Bloomberg

A few comments about the tables above:

- Note that all of the companies are large firms from a wide range of industries and thus well represented in many passive indexes.

- Despite flat to negative revenue growth for at least five years, they have all experienced respectable price and valuation increases.

- In most cases, the companies have increased their debt outstanding while decreasing shares outstanding. It is likely the debt in many of these companies is being used to some degree to repurchase stock.

- For the most part, the companies are mature and therefore likely have low to mid single-digit revenue and earnings growth prospects.

Disclaimer: The analysis performed on the companies listed was not as extensive as that from the prior article on MCD. Some of these companies may have new products or promising innovation that justifies their price and valuation increases despite the poor fundamentals. However, we believe the MCD problem is at play in most of these companies.

Summary

There are good companies with bad stocks and bad stocks of good companies. What we lay out here is not an indictment of specific companies but a reality check on stock valuations. This analysis highlights a host of companies that appear to have prices that are well above a fair fundamental value. This does not mean the prices of these companies cannot continue to rise and further defy financial gravity. It does mean that, over time, these companies must either grow revenue and earnings at significantly faster rates than they have or their share prices will fall as their valuations likely revert to historical norms.

The popularity of passive investing and unawareness of the effects of buybacks are complicit in boosting the price of many undeserving companies to eye-watering valuations. We suspect passive strategies will continue to attract a larger than normal percentage of investment dollars as long as these blind momentum strategies work. Given the tremendous financial incentives to executives we think stock buybacks will continue as well. That said, valuations will reach a tipping point and the masking of fundamental weakness will be exposed. When this occurs, those managers and investors employing active approaches will greatly outperform those with passive strategies.

Copyright © 720 Global Research