by Craig Basinger, Derek Benedet, Brett Gustafson & Spencer Morgan , Purpose Investments

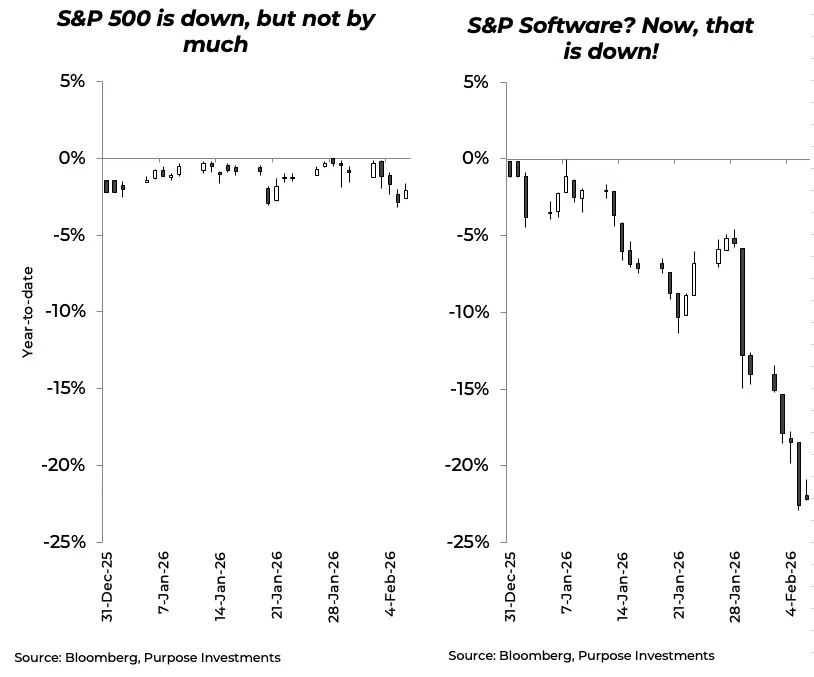

This week, Anthropic launched an updated Claude AI model (Claude Cowork) focused on business solutions. The market has quickly jumped to the conclusion that this will disrupt not just software but businesses from law to advertising. And given the fragility of market sentiment, it was a shoot first and ask questions later. Since making a new all-time high in late October, the S&P 500 software index is down 31%, with half of the drop occurring in the past couple of weeks.

There is increasing numerical evidence that AI is starting to increase productivity, beyond just anecdotes. Anyone who has used Claude Code or other tools for coding is keenly aware of the increased speed of producing solutions (ourselves included). According to FT, there has been a 30% increase in code being pushed to GitHub, a large jump in iOS apps and a big jump in website registrations. All reasonable proxies for output, and given no jump in tech jobs (marginal decline actually), that probably means greater productivity.

So the market is saying Claude Cowork will do the same in other professions, and this will either replace or cause a contraction in the number of software subscriptions (seats) required. Companies that sell seats for their software subscriptions have been hardest hit, even outside pure software. Thomson Reuters, which generates about half its EBTIDA from services for lawyers, is down 30% over the past couple of weeks. FactSet, a financial research provider, is down about the same. Workday, ServiceNow, credit rating agencies, the list goes on.

Maybe. Linear extrapolation of still unquantified productivity gains in coding to other functions is a big leap. Developers often will spend 100% of their day coding, whereas a user of FactSet is likely doing 20 or 30 different functions on a given day. So extrapolation may be harder. Also contributing to this bear market in software was the valuations. Before the drop at 35x forward earnings, the software was priced to perfection, now at least a more reasonable 20x.

Markets often overreact in the short term. This could be the Deepseek moment for software. For those that forgot about Deepseek, the China-based LLM that was developed with less cost, sent North American AI companies into a brief freefall that lasted a couple of weeks. This is a big long-term risk for many software companies, but the reaction appears overdone. Software companies are very good at evolving and adapting, albeit it can be a very painful process. Even Thomson Reuters has CoCounsel, an AI-driven drafting and analysis tool.

Something Is Off

The size of this reaction in software is likely exacerbated by something being off in the markets that goes well beyond our good friend Claude. This may sound odd, but it has been reiterated by many, from market strategists to traders. Not being alarmist, S&P is down about 2%, TSX a bit more, down 4%, International equities barely down at all, but there are some strange things afoot.

We have already discussed this dramatic drop in software stocks, but it is very isolated and has not spread to other parts of tech. The S&P hardware sector has barely moved and is now trending higher. Semis have been more volatile, but up as well. Maybe we can explain this if we attribute it all to AI model upgrades. It is very odd to see such divergence.

The list goes on. There has been a big rotation in the market so far in 2026, with defence winning. The best performing sectors year-to-date are Energy & Consumer Staples for the S&P 500. That is weird to begin with. Also very strange is our relative sector performance monitors (chart on the right). This is a risk-on/risk-off signal. In a risk-on market, Consumer Discretionary usually outperforms Consumer Staple while Industrials outperform Utilities. In a risk-off market, the opposite. Which means those lines should move up and down together, which they do over the long term. But recently, the consumer-based model (purple) is showing risk-off, but the Industrial/Utes line is showing risk-on. Very odd.

And if you still don’t think things are a bit off, let’s talk gold and bitcoin. Gold has changed from a crisis alpha portfolio diversifier to arguably a pure momentum play. $4,500 to $5,500 to $4,500 and now back to $5,000/oz is nuts. The drop in bitcoin as well.

These kinds of strange market moves feel like some level of deleveraging could be occurring, maybe off the yen carry trade. This odd market could simply pass and calm down, or something might break. One challenge is that everyone is long the market, based on the American Association of Individual Investors. In their monthly survey for January, cash is down to 14.4%, and stocks are up to 70%. Last time this extreme was at the end of 2017 and late in 2021. 2022 was the bear market as inflation took off, and 2018 experienced two market corrections. Prior to that, you have to go back to the end of the ‘90s tech bubble.

Final Thoughts

The economy is good, the earnings growth is good, and inflation is fine; this is a good foundation. This is more market structure or market behaviour concerns. This is, or could, create some opportunities, especially if there is an amplified misallocation due to deleveraging or simply due to the large amount of fast money moving around in markets. Now back to portfolio management.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Copyright © Purpose Investments

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed; their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions, or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on them. Unless required by applicable law, it is not undertaken, and is specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events, or otherwise.