by Guy Barnard, CFA, Co-Head of Global Property Equities, Portfolio Manager, Janus Henderson

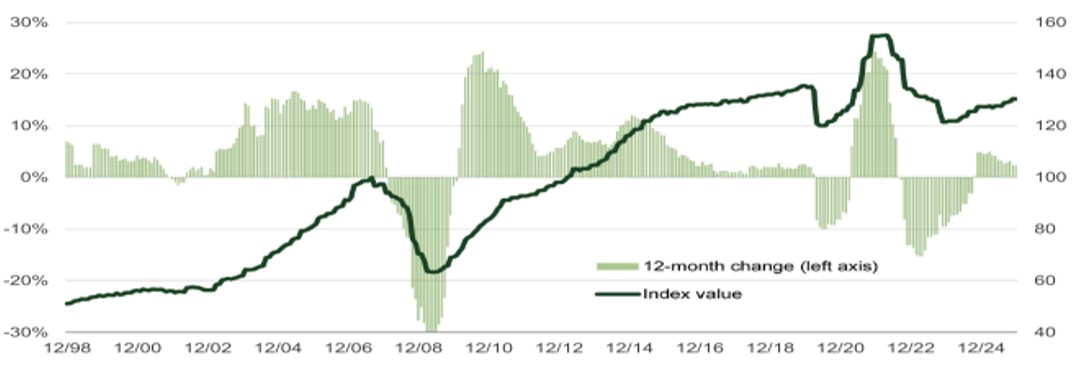

Global listed real estate stocks are off to a positive start in 2026, having delivered a circa 10% return in 2025,1 solidifying an ongoing recovery since late 2023.

Figure 1: Global REITs return on the recovery path since the rate-cycle bottom

Source: Janus Henderson Investors, Bloomberg, as at 31 December 2025. FTSE EPRA Nareit Global Index. Past performance does not predict future returns.

While it was encouraging to see another year of positive returns from the sector, it also marked another year of underperformance versus wider US and global stock markets. The more predictable and defensive characteristics of the real estate investment trust (REIT) sector have, perhaps understandably, been less exciting for generalist stock market investors who are looking to AI, defence and many more cyclical areas to drive returns for their equity portfolios. However, it’s worth remembering that the historical low correlation between global REITs and other asset classes offers diversification benefits to portfolios, something that we believe will become more valuable in a less certain world and one where concerns of investor over exuberance in AI have been percolating.

We believe the equity market is in the early stages of a ‘broadening out’ trade and that REITs stand to benefit from this shift for three key reasons:

1 Strong fundamentals: Multiple factors continue to support REITs

Encouragingly, as active, fundamental investors, we firmly believe that the recovery in underlying direct property markets may very well continue. Lower interest rates and improved lending margins, healthy rental growth across most property sectors, supported by a rapidly reducing level of new property supply, and an ongoing pickup in transaction volumes, should all support the sector’s fundamentals. This leads us to expect in select regions and property types, an acceleration in growth in 2026.

Figure 2: Green Street Commercial Property Price Index

Source: Green Street Advisors, Commercial Property Price Index (CPPI) as at 31 December 2025. Republished with permission. Past performance does not predict future returns.

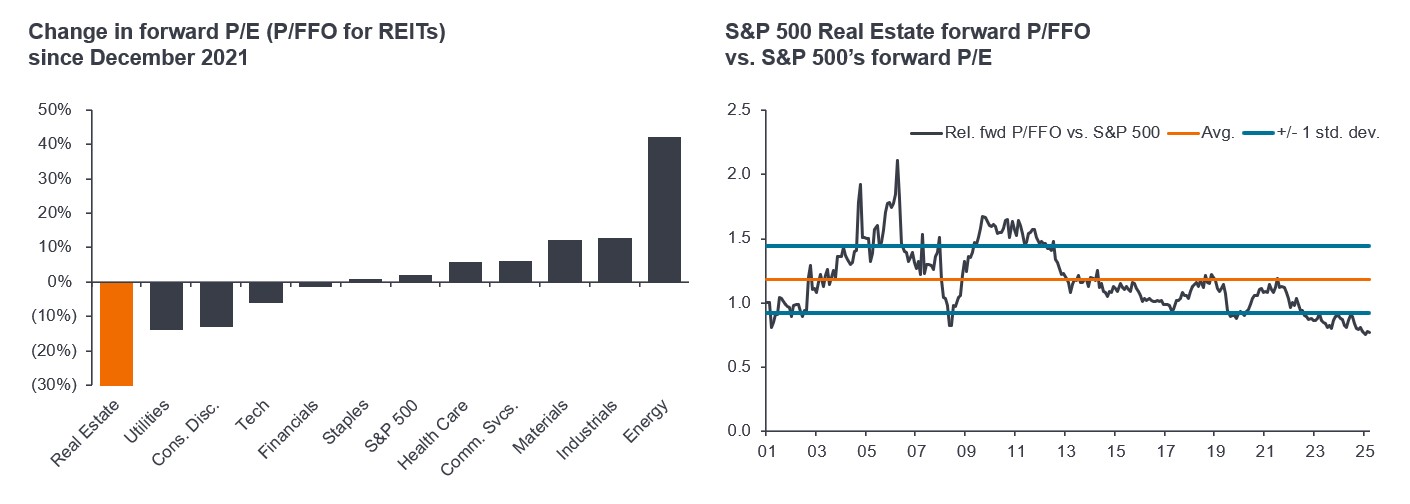

2 Attractive valuations : REITs have never been this cheap relative to broader equities in 25 years

REITs have seen the largest multiple de-rating within the sectors the equity markets in recent years. As shown in the right-hand chart, US REITs are currently the cheapest they have been in 25 years relative to broader equities. This has occurred despite REITs having delivered consistent earnings growth (which we believe can continue in the years ahead), as well as an increasingly attractive dividend yield.

Figure 3: Real estate has de-rated versus broader equities despite consistent earnings growth

US REITs have grown earnings by 20% since 2022

Source: FactSet, NAREIT T Tracker, BofA US Equity & Quant Strategy, as of December 31, 2025. Forward P/FFO is a REIT valuation ratio that compares the current market price of a REIT and its projected funds from operations (FFO) for the next 12 months giving an indication of whether a REIT is over- or undervalued based on expected future performance. Standard deviation measures the variation or dispersion of a set of values/data in relation to a mean. In terms of valuing investments, standard deviation can provide a gauge of the historical volatility of an investment. Past performance does not predict future returns. Investing involves risk, including the possible loss of principal and fluctuation of value.

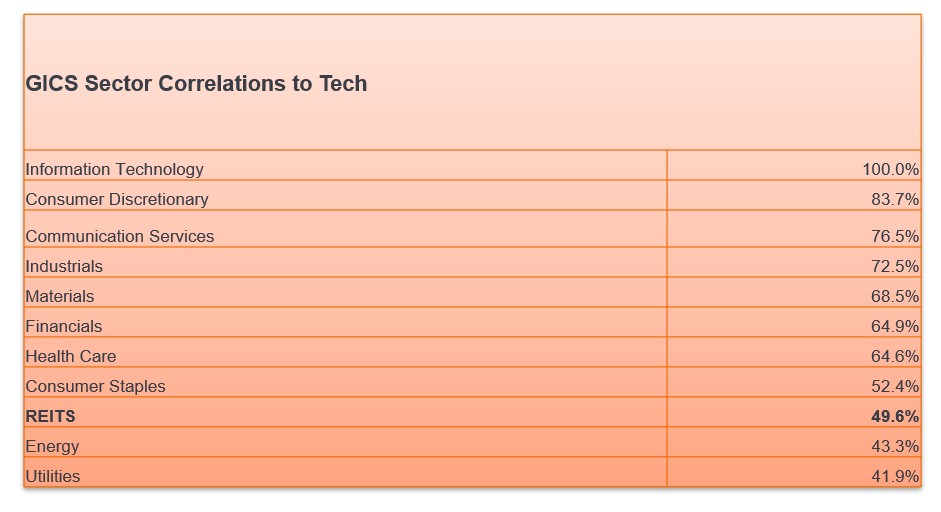

3 Need for diversification: REITs offer low correlation versus other major asset classes

Portfolio diversification has emerged as an increasingly important criteria for investors due to several factors including valuation concerns, geopolitical risks and economic uncertainty.

Specifically, within an equity allocation REITs have among the lowest correlation to the technology sector. REITs could therefore offer a way to diversify away from tech and provide a different source of returns in the form of current income.

Figure 4: REITs’ moderate correlation to Technology can offer portfolio diversification

Source: Janus Henderson Investors, Bloomberg. Daily returns for FTSE NAREIT Equity REITs Index, S&P Level 1 GICS Indices from September 2016 (when REITs was added as a standalone GICS sector) to 31 December 2025. Past performance does not predict future returns.

Where do we see the most attractive real estate opportunities today? Empty heading

2025 marked a year in which international markets led the US, notably stocks in Asia. Here, Japanese property companies benefited from a well-bid property market showing inflation in asset values, alongside corporate reform measures, which are catalysing discounted equity valuations. The Hong Kong property market is also emerging from a period in the doldrums, with discounted shares only recently starting to recover, but offering further to go. Over in Europe, the pickup in merger and acquisition (M&A) activity is shining a lens on discounted equity valuations in a recovering market, opportunities that private equity players are looking to take advantage of.

At a sector level, we have grown more constructive on the US industrial/logistics space, as we see signs of an inflection in occupancy rates. Many companies in the space are also benefiting from the potential to add value through data centre development on the industrial land that they own.

We remain positive on senior housing, with many REITs looking to have the potential to achieve another year of double-digit earnings growth. With a 4%+ compound annual growth rate (CAGR) in the US population aged 80+ through 2030, we see a continued runway for further outperformance in this sector. Meanwhile, the weakness in share prices in data centres is at odds with historically strong fundamentals and a visible runway for high single digit earnings growth in the years ahead. We have also built exposure in more cyclical parts of the property market, such as in US homebuilders, and the property brokerage space.

REIT performance in election cycles: Investors have valued REIT’s defensive characteristics Empty heading

Finally, for those looking to history for clues as to what may lay ahead, US REITs have offered compelling mid-term election year performance. Going back 35 years, US REITs have been the top GICS sector with the highest hit rate (the percentage of positions that have generated positive returns over a given period). Perhaps the currently overlooked defensive characteristics of REITs can be beneficial should there be any potential uncertainty.

So, having flown under the radar in recent years, perhaps it’s worth revisiting a real asset that is still in the early stages of recovery. But don’t take that from us alone, it’s also a view echoed by Blackstone, the largest global private real estate investor:

1Morningstar; FTSE EPRA Nareit Developed Index; 12-month return to 31 December 2025. Past performance does not predict future returns.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.

FTSE EPRA Nareit Developed Index tracks the performance of real estate companies and real estate investment trusts (REITs) from developed market countries.

FTSE EPRA Nareit Global Index is designed to represent general trends in eligible real estate equities worldwide. Relevant activities are defined as the ownership, trading and development of income-producing real estate.

FTSE Nareit Equity REITs Index is representative of listed securities in the commercial real estate space across the US economy, excluding timber and infrastructure REITs.

Green Street Commercial Property Price Index is a time series of unleveraged U.S. commercial property values that captures the prices at which commercial real estate transactions are currently being negotiated and contracted.

S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Copyright © Janus Henderson