by Kent Hargis, PhD, Brian Holland, CFA, AllianceBernstein

For years, investors were penalized for higher allocations to non-US stocks in a US-dominated market. Now, the tables may be turning.

The US is coming off a period of remarkable equity-market dominance. Over 11 of the past 15 years, US equities outpaced their non-US peers—sometimes by sizeable margins. But last year, the pattern reversed dramatically.

In 2025, the MSCI EAFE Index of non-US developed-world stocks surged by 31.2% in US-dollar terms, while the S&P 500 rose 17.9%. Even after this outperformance, valuations are still well below those of the US.

While these returns were buoyed by a weakening US dollar, non-US stocks delivered a strong 20.6% gain in local-currency terms as well. Are we in a new dawn for international stocks? Time will tell, but we believe conditions are favorable for investors looking to diversify US-heavy allocations in 2026.

Concentration Risk Is Lower in Non-US Markets

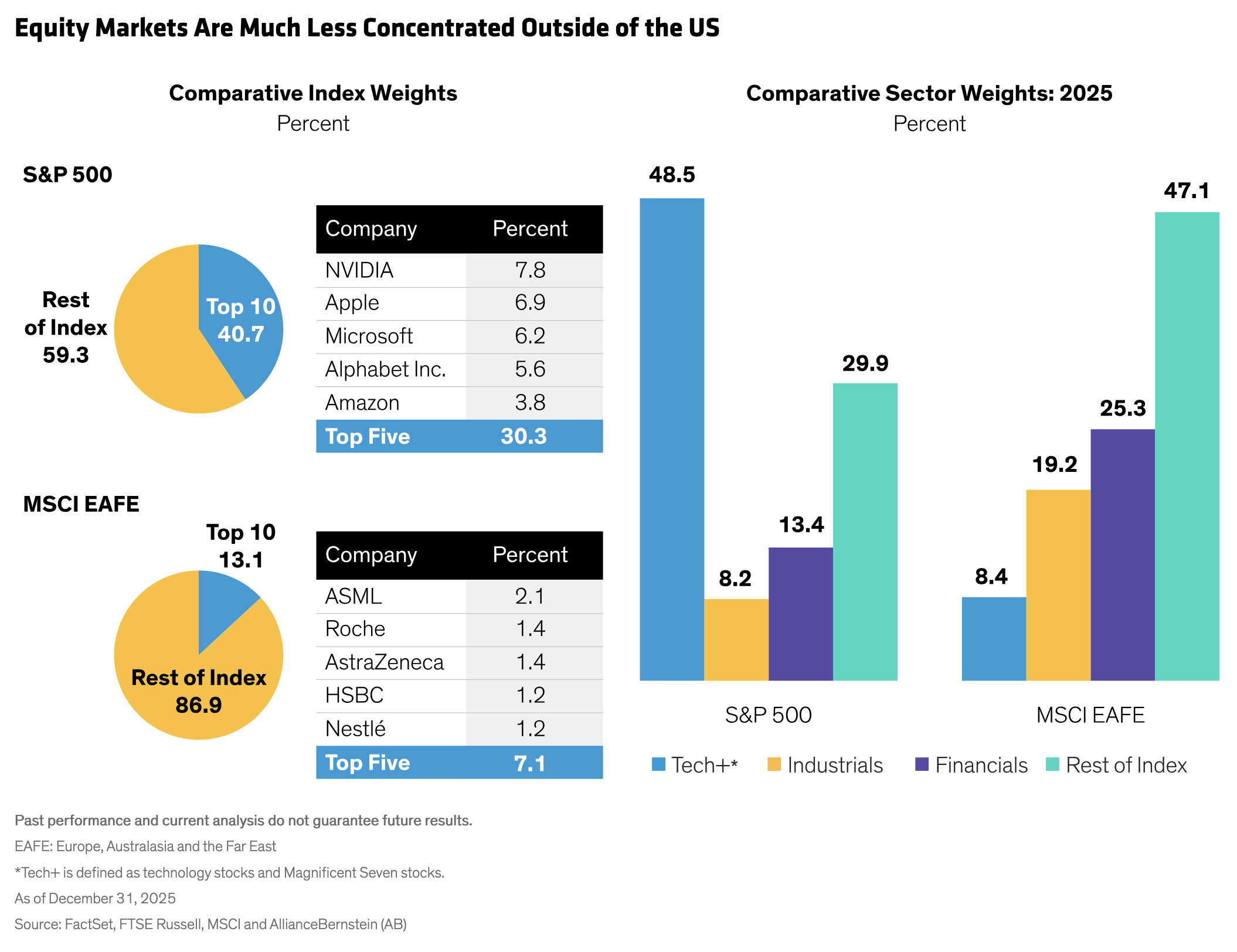

One reason for US dominance in recent years—and a potential risk—is growing market concentration. At the dawn of 2026, the top 10 US stocks made up a near-record 40% of the S&P 500 by market capitalization. That’s double the broader market’s concentration as recently as 2010. Increasingly, the technology sector and so-called Magnificent Seven mega-cap stocks have dominated the market and together now comprise 48% of the S&P 500 by market cap.

Why does this matter? High concentration means relatively few names have the power to drag down returns during periods of market stress. Put another way, high US market concentration dilutes the benefits of diversification, subjecting investors to the whims of a small number of companies in just one sector—resulting in a substantial increase in the volatility of the S&P 500 relative to the rest of the world.

By contrast, the top 10 stocks in non-US markets comprise just 13% of the broader market, which means more sector allocation opportunities and greater diversification potential (Display).

How Much Have US Stocks Really Outperformed?

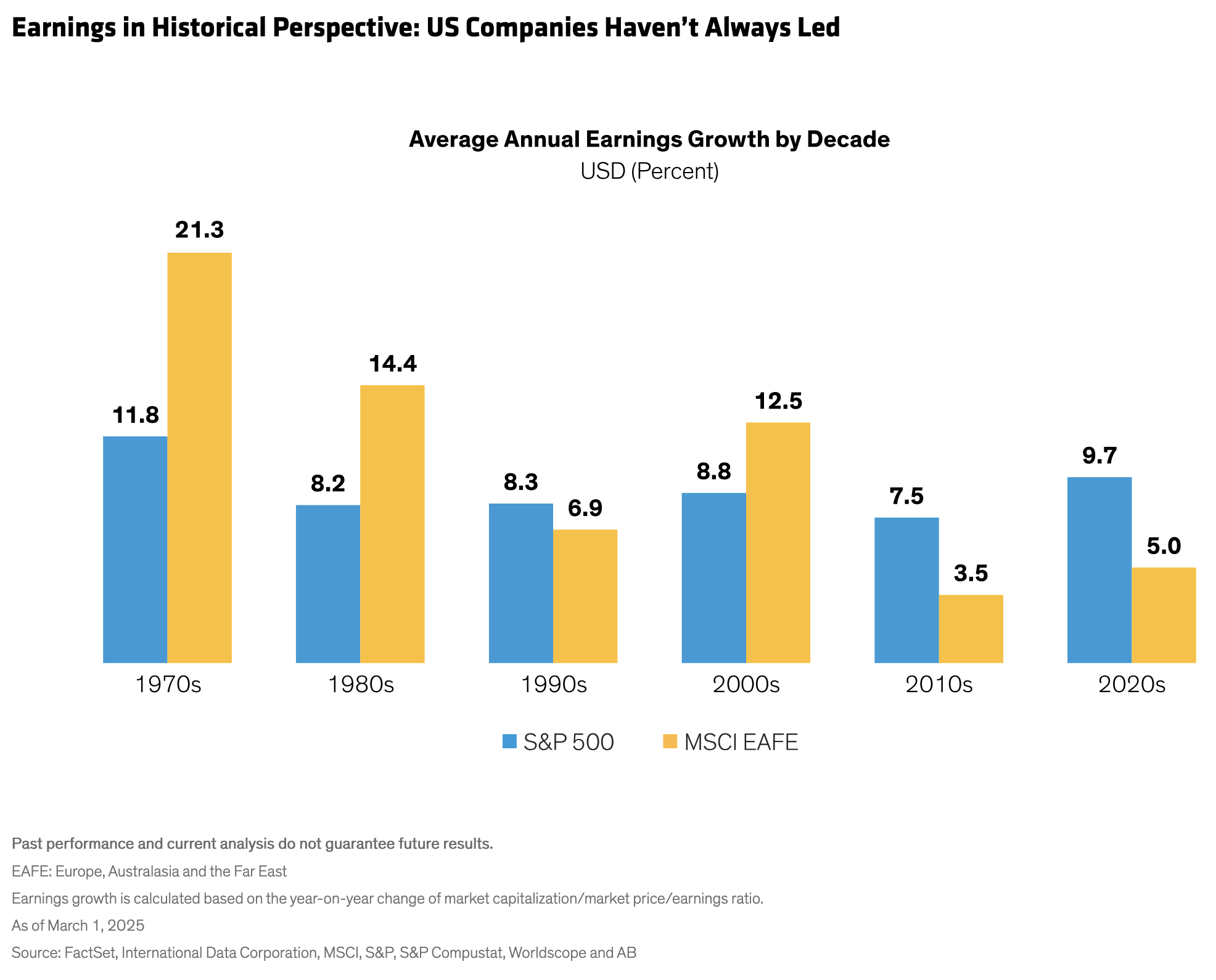

High market concentration can also mask the source of equity performance. Since long-term stock returns are typically driven by earnings growth, you might think US companies generated vastly higher earnings growth than global peers in recent years.

Granted, S&P 500 earnings growth has outpaced that of the MSCI EAFE over the past decade. But this chasm was driven largely by the high-flying Magnificent Seven mega-caps. With these seven companies stripped away, our research suggests that the S&P 500’s earnings growth was similar to the MSCI EAFE’s earnings growth.

This underscores another prescient point: The earnings potential of non-US companies isn’t inherently inferior. Over the last 15 years, US corporate earnings growth outpaced that of non-US companies. However, our research shows that in three of the four decades from 1970 to 2010, non-US earnings of MSCI EAFE companies exceeded US earnings (Display).

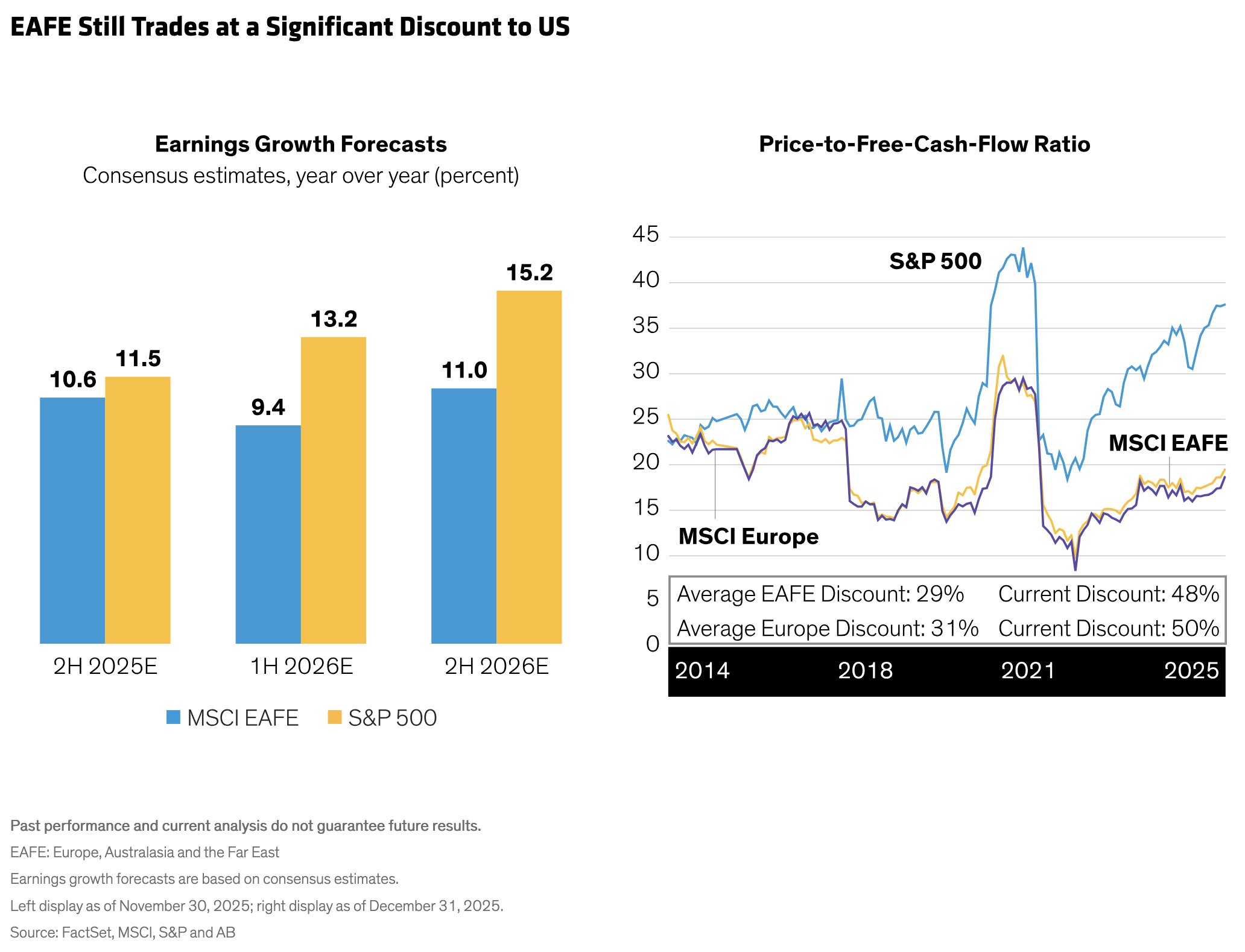

Today, beneath the surface of lackluster earnings growth outside of the US is a more nuanced picture. Although European earnings expectations are mixed, earnings growth forecasts for Japan and emerging markets are trending upward. Eventually, earnings improvements could spur equity multiple expansion and subsequent market gains, especially given the MSCI EAFE’s 48% discount to US shares (Display).

Policy and Structural Tailwinds Could Propel Non-US Shares

The potential for recovery across Europe and Asia in the coming years could be propelled by policy and structural tailwinds, in our view.

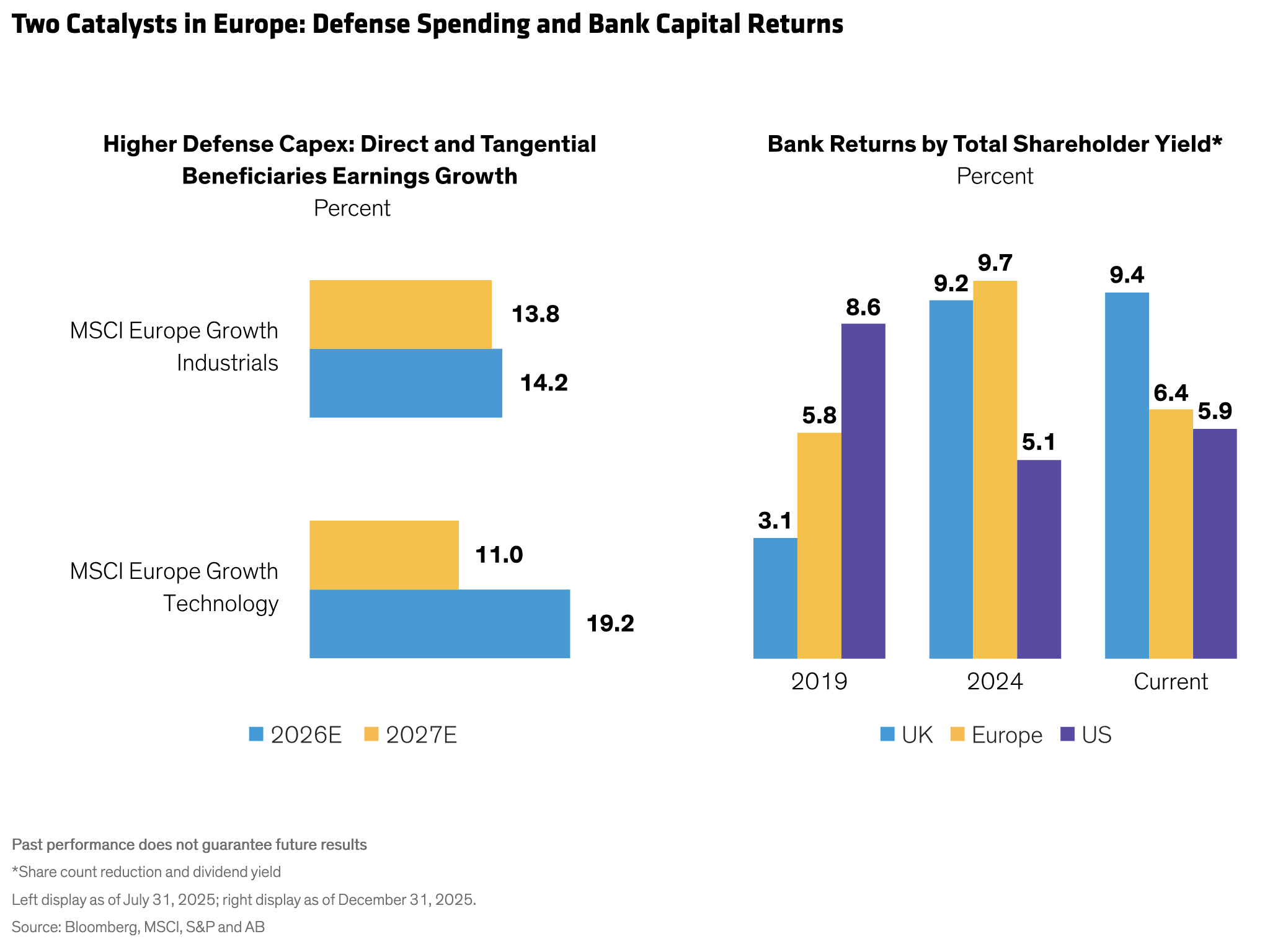

Although trade uncertainty has been both a plus and minus for European companies, Europe is undergoing fiscal stimulus reforms that include more spending on defense and infrastructure. This uptick in capital expenditures could have tangential benefits in several sectors, such as industrials and technology—both of which are forecast to deliver double-digit earnings growth over the coming two years (Display).

Financials are already there. European banks are generating superior returns, as measured by shareholder yield (Display above), which fueled a 40% surge in MSCI EAFE financials during 2025. Nonetheless, European bank shares are priced at a significant discount to US banks.

Meantime, Japan is pursuing a policy of targeted monetary easing while reducing its dependence on cross-shareholding—the long-standing practice of exchanging equity shares between companies. Japan’s “quality up” initiative has reduced cross-shareholdings by more than 50% since the 1990s. More broadly, a multifaceted effort to reform corporate governance practices and improve shareholder return on equity has made Japan an increasingly attractive market for global investors.

Defensive Non-US Stocks Can Complement US Holdings

While things are looking up for non-US stocks, we believe US equities still have an important role to play in global allocations. But following a period in which many investors’ allocations to the US have increased, non-US equities could help balance allocations by tapping into a broader array of return drivers around the world.

Regardless, investors should make sure they don’t place too much emphasis on where a company is domiciled. Some of the largest companies not based in the US may have extensive operations stateside. Similarly, many companies based in Europe, Asia or emerging markets have global revenue streams that aren’t necessarily affected by their home country’s macroeconomic conditions.

Of course, risks abound around the world today. Given the growing list of geopolitical tensions and the potential for economic slowing, a more defensive strategy can help bolster investor confidence in shifting toward non-US stocks in the current environment. We believe shares of high-quality international stocks with relatively stable earnings streams and attractive valuations can help risk-aware investors expand their global allocations while guarding against potential bouts of volatility.

Even after last year’s rally, non-US stocks are trading at steep discounts. Given the market’s recent rotation, the time may be right for investors to augment a US-focused strategy with a more diversified and globally oriented approach.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

About the Authors

Kent Hargis is the Chief Investment Officer of Strategic Core Equities. He created the Strategic Core platform and has been managing the Global, International and US Strategic Core portfolios since their inception in 2011. Hargis has also been Portfolio Manager for the Global Climate Transition Strategy Portfolio since 2022. Previously, he managed the Emerging Portfolio from 2015 through 2023. Hargis was global head of quantitative research for Equities from 2009 through 2014, with responsibility for directing research and the application of risk and return models across the firm’s equity portfolios. He joined AB in 2003 as a senior quantitative strategist. Prior to that, Hargis was chief portfolio strategist for global emerging markets at Goldman Sachs. From 1995 through 1998, he was assistant professor of international finance in the graduate program at the University of South Carolina, where he published extensively on various international investment topics. Hargis holds a PhD in economics from the University of Illinois, where his research focused on international finance, econometrics and emerging financial markets. Location: New York

Brian Holland is a Portfolio Manager and Senior Research Analyst for International Strategic Core Equities. He joined the Strategic Core Equities team as a Senior Research Analyst in 2022 and was appointed Portfolio Manager of International Strategic Core Equities effective January 2023. From 2014 to 2022 Holland was a senior research analyst on the US Small and Mid Cap Value team, responsible for coverage of technology and materials companies. He previously spent three years covering companies in the consumer and technology sectors for a number of value equity strategies and as a generalist supporting the AB Strategic Opportunities Fund. Prior to his role in research, Holland was an associate portfolio manager, responsible for implementing portfolio decisions in value equity portfolios. He joined the firm in 2004. Holland holds a BS in economics and policy and management from Carnegie Mellon University and is a CFA charterholder. Location: New York