by Kate El-Hillow, President & Chief Investment Officer, Russell Investments

Key takeaways

- Investing success now depends less on static allocations and more on active design, manager judgment, and integration across markets.

- Diversification has shifted from asset-class mixing to intentional risk design, sizing, and regime awareness across the total portfolio.

- Structural forces like AI, private capital growth, retail flows, and geopolitical fragmentation are reshaping return sources and portfolio resilience.

The rulebook for sound investing has never been static, but rarely has it evolved so visibly or at this speed. Over my career—shaped by market bubbles, financial crises, and a few humbling moments—I’ve learned that the investors who endure are the ones willing to adapt. We’re at a defining moment, where long-held assumptions about markets and portfolios are being tested, and in some cases, broken.

The first half of the 2020s has altered market dynamics in ways that make building resilient portfolios materially harder. Policy shocks, supply-chain realignment, inflation volatility, and rapid advances in technology and AI have compressed the cycle of change. Old patterns are breaking faster, correlations are less reliable, capital is increasingly raised outside public markets, and structural forces are playing a larger role than cyclical ones.

For allocators, this is a new environment, one that challenges the traditional stock-bond framework and even more recent public and private market mixes. Portfolio outcomes are increasingly shaped through an active lens—by how exposures are selected, sized, and combined across markets and regions. As we look ahead to the second half of the decade, staying ahead will require clarity about which forces are durable, how they interact, and what they mean for capital allocation, manager selection, and portfolio construction.

While many factors are reshaping the investment landscape, five stand out for their durability, their reach across asset classes, and the way they fundamentally change how portfolios are built and managed. These are the forces I believe will most shape investment decisions and portfolio resilience in the years ahead.

1. The AI Advantage and the Great Data Divide

ChatGPT’s rapid adoption marked the fastest mass adoption of a new technology in recent history. AI’s significance is not just technological—it is structural. Its impact shows up in three distinct ways: how investments are made, how managers are differentiated, and where new investment opportunities emerge.

On the investment process side, AI has brought data science and generative modeling once limited to systematic teams into traditional investment teams. The differentiator is no longer access to tools, but the quality of data behind them and the judgment applied to their outputs. As technology converges, outcomes remain highly differentiated. Well-structured inputs, human insight, and clear decision frameworks turn AI-enabled visibility into better security selection, more consistent portfolio construction, and earlier recognition of structural change.

This has raised the stakes for manager selection, particularly in private markets. Unlike public markets where datasets are standardized and broadly available, private markets remain fragmented and opaque. AI can improve visibility, but judgment and context still matter when information is incomplete. Teams that apply consistent, cross-market frameworks tend to produce more durable outcomes.

AI is also shaping the investment opportunity set itself. Many of the most consequential AI-related investments across infrastructure and enabling technologies are originating in private markets and move through the capital stack over time. This makes AI a cross-portfolio consideration rather than a standalone theme, reinforcing the importance of investment processes and strategies that can deploy capital across markets and adapt as opportunities evolve.

Implications for allocators

AI is less a beta allocation decision than a test of manager capability, data discipline, and governance—especially where information is scarce and dispersion is high.

2. A New Lens on Diversification

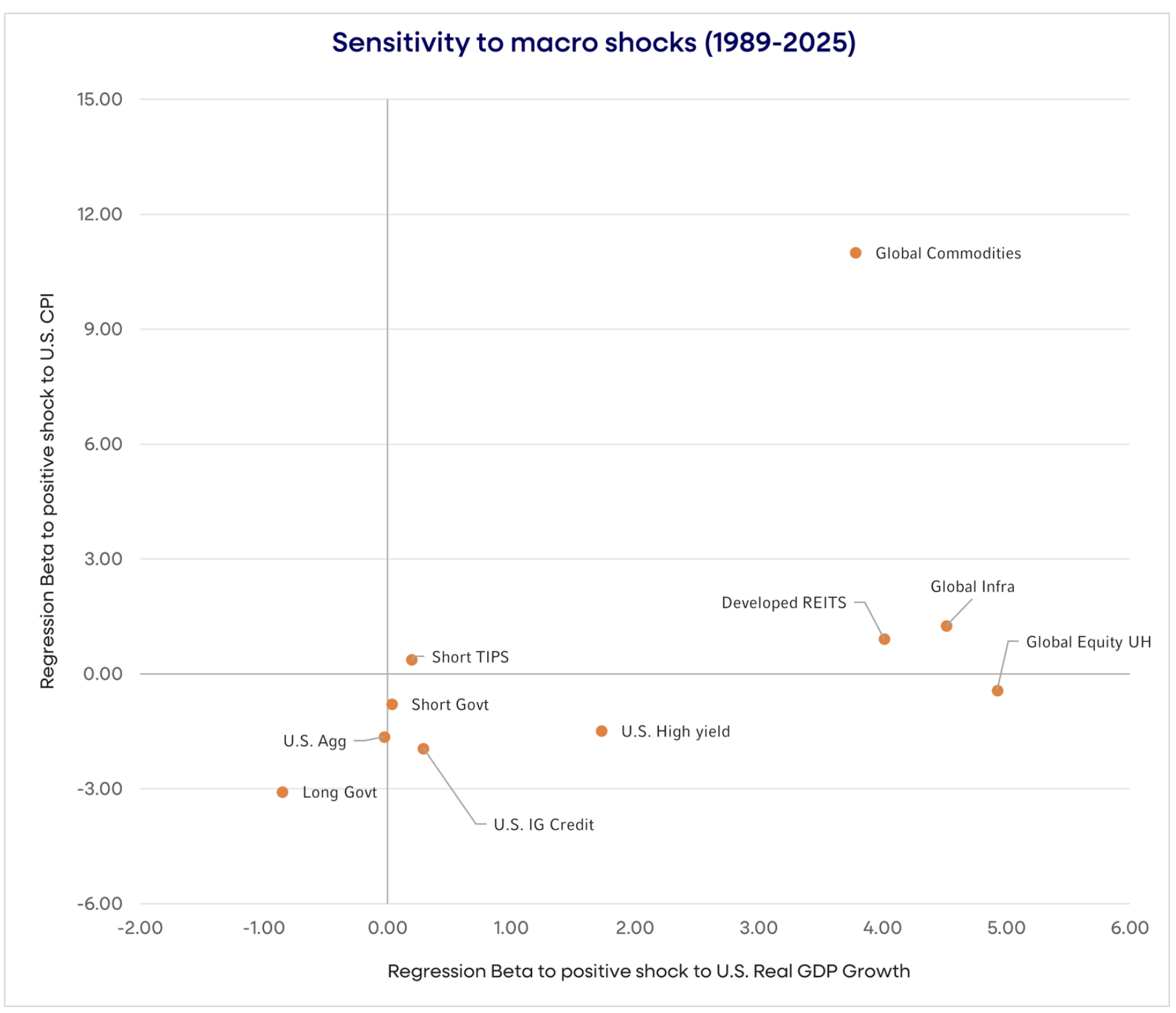

The old assumptions about diversification no longer hold. A simple equity-bond mix can’t be relied on to deliver balance in a world of less predictable inflation, policy, and correlations. Investors are being pushed to think more deliberately about where risk and return truly come from.

Today, effective diversification depends on combining active and passive strategies with systematic, fundamental, and alternative approaches, including private markets. But breadth alone does not create resilience. As traditional anchors such as bonds have weakened, each allocation must earn its place, be sized to matter, and be judged by how it behaves across different market environments.

It is critical now more than ever to understand the underlying risks driving portfolio outcomes. Those risks increasingly cut across markets and asset classes, making it essential to be explicit about exposures, offsets, and unintended concentrations.

This has driven a shift toward a total-portfolio mindset, where diversification is assessed across the whole portfolio rather than within individual sleeves. Resilience now depends on the ability to see how risks interact, adjust exposures as regimes evolve, and reinforce diversification when it is needed most.

Implications for allocators

Diversification is best viewed as a design consideration rather than just an asset-class decision, informed by intentional sizing, regime awareness, and ongoing portfolio oversight.

3. The New Shape of Capital Formation

Public-private market convergence is reshaping how companies raise capital and how investors access growth. What was once a clear divide is becoming a more continuous opportunity set, with capital moving more fluidly across markets and the capital stack. This is especially evident in the AI buildout. Capital-intensive assets such as data centers, power generation, and digital infrastructure are often financed first with private capital, then move through private credit, structured solutions, and in some cases into public markets as projects scale and risks evolve.

At the same time, access to private markets is broadening. Institutional allocators have already built meaningfully larger private allocations, and that pace is accelerating with greater access through new vehicles and platforms. With private exposure growing, portfolios can no longer rely on clean separations between public and private sleeves. Exposures overlap, liquidity varies by structure, and capital moves more dynamically over time.

This raises the bar for portfolio construction. Allocators must be deliberate about the role each exposure plays across return, liquidity, risk, and resilience. Higher interest rates and regulatory changes continue to reshape relative value. In private equity, returns increasingly depend on operational execution and sector expertise rather than leverage. Private credit has become a durable source of financing alongside banks, particularly in asset-backed and infrastructure-linked lending. Real assets provide flexibility to move between listed and private vehicles as conditions change.

Broader participation has prompted questions about whether expanding access could dilute returns. What changes is access, reflected in how the market responds to demands to address barriers (e.g., liquidity and transparency) and how investors develop the discipline to manage liquidity, pacing, and portfolio construction as the investor base and market evolve.

Implications for allocators

Managing private exposure is now as much about integration and liquidity management as it is about return potential.

4. The Rise of Retail

Retail investors are playing a larger role in market dynamics, with wealth channels expected to approach half of global assets under management by 2027. Their growing influence is reshaping product design, trading behavior, and market outcomes.

Digital tools have lowered barriers to participation, making trading easier and more frequent. As retail accounts make up a larger share of marginal trading, flows and sentiment increasingly drive short-term price action. Demand for customization and tax efficiency is also rising, accelerating adoption of tools such as direct indexing and more personalized portfolio solutions.

These dynamics are most visible during periods of elevated retail activity. Options usage and flow-driven trading have fueled sharp rallies in meme stocks and lower-quality assets linked to big themes, widening the gap between price momentum and fundamentals. Similar patterns are emerging in credit and emerging markets, where ETF-driven retail demand can accelerate risk-on/risk-off repricing.

Broader retail participation also helps explain the uneven recovery since late 2022. Households with exposure to equities and housing have benefited from rising asset values and continue to spend, while others remain under pressure. As equity ownership broadens, asset performance has a more immediate impact on consumer confidence and spending—an important consideration when assessing macro conditions.

Implications for allocators

Retail-driven flows increase dispersion and speed, putting conviction in quality, liquidity awareness, and active risk management to the test.

5. A Less Synchronized Global Order

Politics and geopolitics are playing a larger role in shaping markets. Even the policy shifts around “Liberation Day” in April 2025 marked a clear break from a highly synchronized global cycle, pushing markets into a more fragmented, regionally driven environment. With major elections across the U.S., Europe, and emerging markets ahead, uncertainty is likely to persist.

Positioning portfolios now requires separating short-term shocks from their second-order effects and longer-term structural shifts. That includes the basics of moving beyond long-standing home-country biases. As growth and policy paths diverge, concentrating risk in a single market becomes an active choice rather than a default.

Portfolios should focus less on geography and more on underlying exposures—such as inflation persistence, fiscal impulse, energy and defense demand, and supply-chain realignment. These dynamics are already evident. In Europe, fiscal support, defense spending, and industrial policy are supporting activity and earnings. In emerging markets, improving fundamentals—particularly in technology and reform-oriented economies—are creating selective opportunities. In the U.S., leadership is broadening beyond mega-cap growth toward companies translating sustained investment into durable cash flows.

Risk management also needs to adapt. Government spending is raising inflation uncertainty in some regions, while tighter financial conditions constrain others, widening dispersion across assets and sectors. Public markets remain prone to sentiment-driven mispricing, while credit markets continue to differentiate sharply based on balance-sheet strength.

A more balanced mix of private and public assets can help address these challenges. Capital-intensive themes are playing out over multiple years, creating opportunities in private infrastructure, selective private credit, and real assets tied to energy, data, and security.

Implications for allocators

Geographic allocation is increasingly a factor-expression decision, requiring intentional and currency-aware global diversification and flexible capital deployment.

A Shared Inflection Point

We are living through a rare inflection point in investing. Building resilient portfolios is more demanding than it once was, as long-trusted diversifiers behave differently. For allocators, this is also what makes the moment meaningful.

The opportunity is to move beyond prevailing assumptions and design portfolios that are forward-thinking, adaptive, and resilient—grounded in clear views on risk, disciplined manager selection, and an integrated approach across public and private markets. How portfolios are built today will matter well beyond this cycle.