BMO Global Asset Management (BMO GAM)’s January 2026 Market Outlook1, delivered by Chief Investment Officer Sadiq Adatia, opens not with alarmism or overconfidence, but with an elegant contradiction: this year is “constructive but nuanced.” The conditions that propelled 2025’s remarkable performance persist, he argues, but they’ve evolved—and now demand a more balanced, discerning portfolio approach.

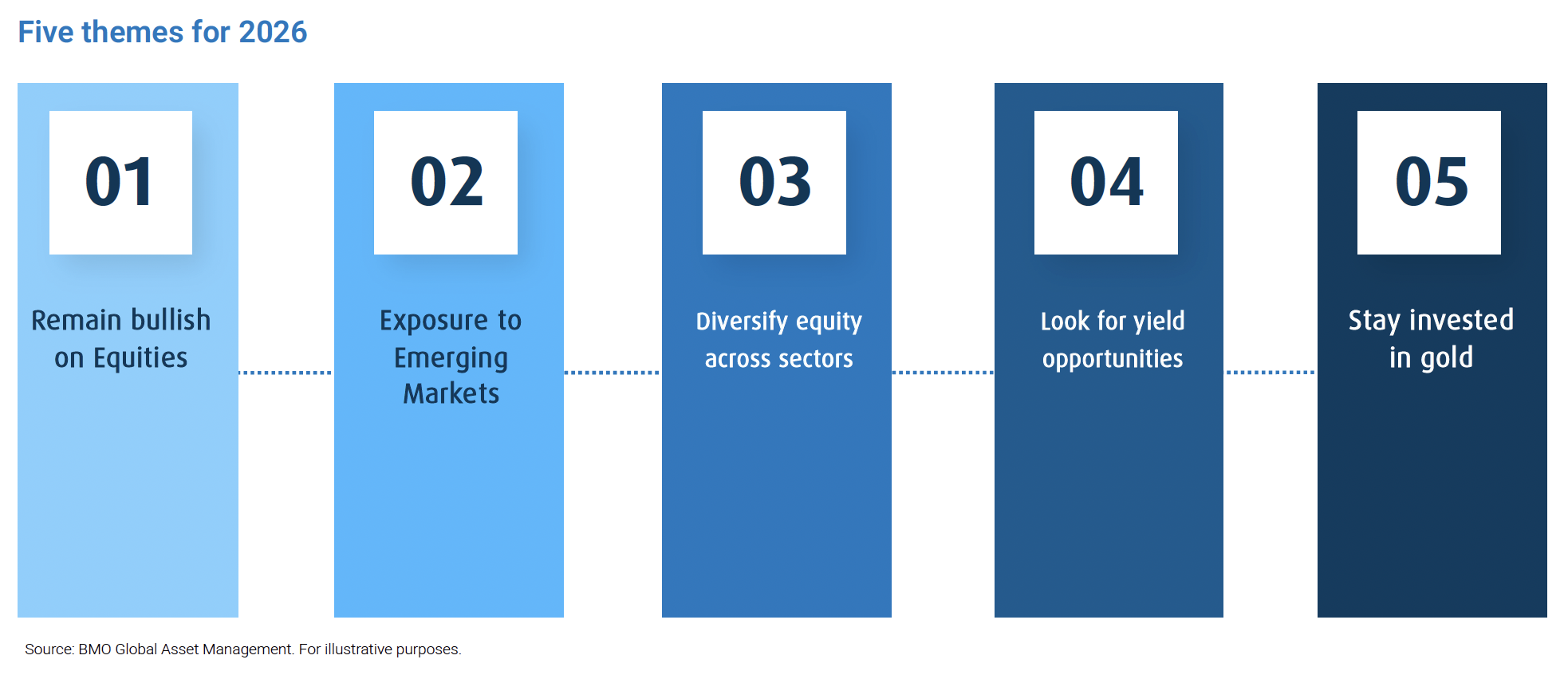

Adatia’s commentary, dense with realism and strategic direction, centres on five structural investment themes he believes will define portfolio performance in 2026. Together, these themes offer a steady lens through which investors and advisors can filter market noise, recalibrate expectations, and make choices that are anchored in fundamentals—yet responsive to volatility and policy drift.

1. Stay Bullish on Equities—but Respect Volatility

The tone is clear from the start: “Equities remain the cornerstone of portfolio returns in 2026.” Even with elevated valuations and a less predictable path for rate cuts, equities still present the most compelling long-term opportunity relative to cash, GICs, and bonds. Notably, Adatia points to “ongoing capital expenditure, and productivity gains tied to AI adoption” as drivers of earnings strength, especially in the U.S.

Yet, this is not a carte blanche. Adatia emphasizes that higher valuations and AI-fuelled exuberance may breed pullbacks: “This volatility should be viewed as a feature of a mid-cycle environment, not a warning of an imminent downturn.”

In a sentence that could define the year’s strategic ethos, he warns: “Volatility is not a reason to abandon equities—it is the price of admission for long-term growth.”

2. Emerging Markets: From Afterthought to Allocation Core

The second theme is perhaps the most dramatic shift: after a decade of neglect, Emerging Markets (EM) are back in focus.

“The setup for EM Equities has improved meaningfully,” Adatia writes. Valuations are still compelling, exposure is light, and global AI supply chains now flow through EM players like Taiwan and South Korea. He notes: “India continues to benefit from favourable demographics and structural reform, while countries such as Brazil are rebounding as financial conditions stabilize”.

EM’s appeal lies not just in price—but in position. As trade tensions plateau and innovation accelerates in Asia, EM equities become “not simply a satellite allocation—it stands out as one of the most attractive sources of potential equity returns.”

3. Broaden Sector Exposure: Beyond Tech’s Shadow

If 2025 was dominated by mega-cap tech, 2026 should be about dispersion. “Broadening equity exposure is likely to be both a risk-management and return-enhancing strategy,” Adatia advises. A glance at BMO GAM’s sector scoring system (page 6) confirms the tilt: Industrials, Health Care, and Financials all score positively, while Tech is marked neutral, and Consumer Discretionary slightly bearish.

The AI theme persists, but its application becomes horizontal, not vertical: “Companies across sectors are increasingly using AI to improve productivity, manage costs, and enhance profitability.” Small and mid-cap firms that integrate AI effectively may surprise to the upside.

4. Yield: From Sideshow to Center Stage

In an environment where outsized equity gains may not repeat, yield takes centre stage. “A 3–5% dividend yield or consistent income stream can meaningfully contribute to total return,” Adatia writes. This applies across asset classes: dividend stocks, high-quality corporate credit, and covered-call strategies all deserve renewed attention.

Crucially, he notes a transition point: “Investors who have relied on cash, GICs, or Treasury bills... may increasingly look elsewhere as those yields decline.” For Canadian investors, CUSMA trade uncertainty may inject tactical volatility—an opportunity to secure yield at better spreads.

5. Gold: Strategic Hedge, Not Speculative Bet

While not the shiny headline of years past, gold remains tactically and strategically relevant. Adatia underscores its defensive credentials: “It acts as a hedge against geopolitical surprises, policy uncertainty, currency volatility, and inflation risks.” With structural drivers like central bank purchases and fiscal deficits intact, he suggests, “Gold can be viewed as... portfolio insurance in 2026”.

Notably, this view on gold is not predicated on runaway inflation or crisis scenarios. Instead, it is framed as prudent insurance—quiet resilience against the market’s more unpredictable undercurrents.

A Constructive Year—With Risk Cues, Not Red Flags

Adatia does not shy from the complexities. He outlines four key risk vectors:

- A potential “AI bubble”—irrational sentiment divorced from fundamentals.

- Slower-than-expected Fed rate normalization.

- Geopolitical volatility (Venezuela specifically mentioned).

- A weakening consumer or labor market, which would “challenge the earnings outlook and raise recession risks”.

Yet, none of these justify disengagement. “2026 is not about stepping away from risk. It is about engaging with markets more deliberately.” This sentence may well be the most important one in the entire report. It encapsulates Adatia’s balance: conviction tempered by caution, risk matched with resilience, optimism checked by structure.

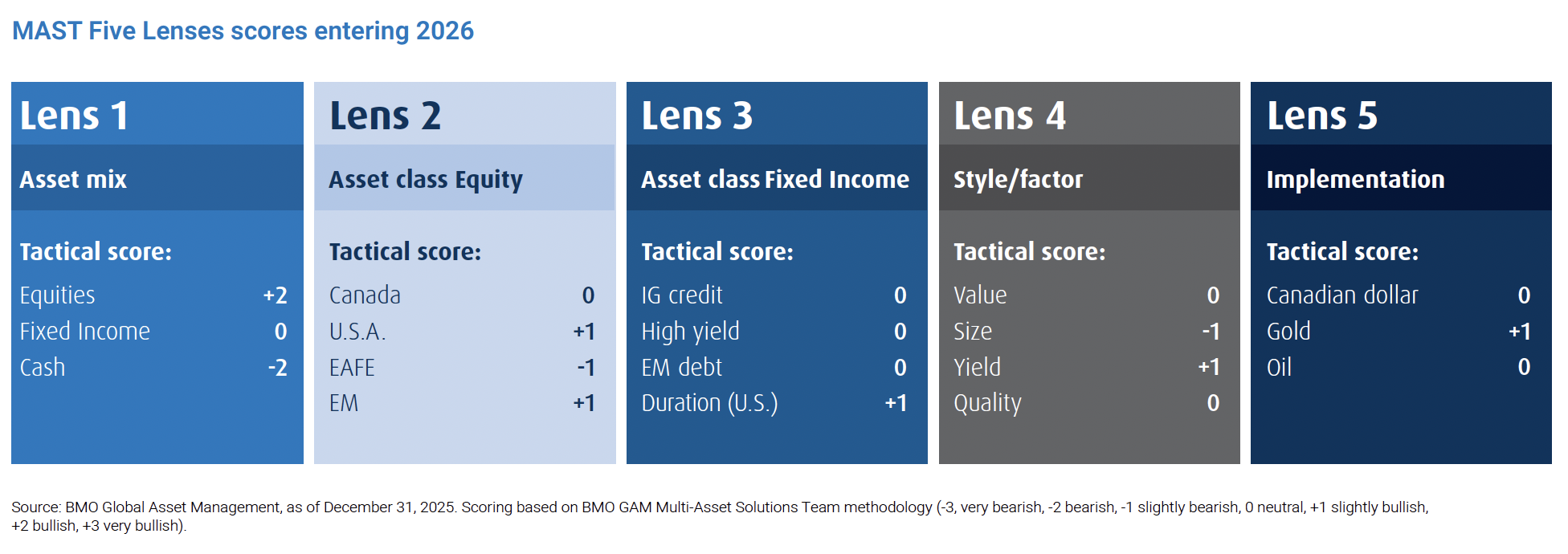

The Tactical Overlay: MAST Scores

BMO GAM’s MAST (Multi-Asset Solutions Team) scoring system offers further precision:

The preference is for quality, yield, and U.S./EM equities, while smaller-cap exposure and cash are underweighted. Fixed income is rated neutral across the board—a quiet nod to its diminishing role in total return composition.

Key Takeaways for Advisors and Investors

- Hold your equity positions. But rotate toward sectors with catch-up potential—Healthcare, Financials, and Industrials.

- Consider EM not as a tactical trade but a core growth allocation. Valuations are attractive, structural themes are in place.

- Don’t chase yield—plan for it. Structure allocations around stable income in equity and credit.

- Use gold strategically. Not to shoot the lights out, but to quietly protect the base.

- Expect more muted returns. Discipline, balance, and diversification matter more than directional bets.

Final Word

Sadiq Adatia’s 2026 Market Outlook is not predictive in the narrow sense. It is prescriptive in the strategic one. His call to action is modest but clear: “Success will depend less on riding a single trend and more on sound diversification, income generation, and risk management”.

In a maturing cycle and a crowded macro landscape, that may be the only enduring edge.

Footnote:

1 Adatia, Sadiq S. 2026 Market Outlook. BMO Global Asset Management, Jan. 2026.