by Daniel Loewy, CFA, Caglasu Altunkopru, Aditya Monappa, CFA, AllianceBernstein

Active multi-asset strategies should embrace slower growth, monetary easing and a tech-led equity market.

In a turbulent 2025 dominated by US trade policy shocks and geopolitical tensions, the global economy proved resilient. Fears of tariff-related slowdown and renewed inflation proved misplaced, as growth surprised to the upside and inflation continued to soften. The improving backdrop underpinned a strong year for financial markets. Equities, commodities, credit and duration all generated healthy returns, and diversification once again delivered meaningful benefits after several challenging years.

As the year progressed, investor attention shifted from trade tensions to more fundamental questions about the durability of growth, elevated valuations and the forces shaping the next phase of the market cycle. These questions are central to our outlook. US equity valuations are elevated, credit spreads remain tight and record capex on artificial intelligence (AI) infrastructure is climbing. Markets are increasingly focused on whether these investments can produce broad productivity gains and earnings growth—and whether concentration can give way to a more durable, diversified expansion.

We think the outlook is favorable for 2026. It’s still early in the cycle of AI investment and monetization, and new signs suggest market fundamentals support more than a handful of tech leaders. Meanwhile, the US Federal Reserve will likely ease policy more than markets currently expect, as it prioritizes a softening labor market—this policy backdrop should be supportive of risk assets. That said, elevated valuations, market concentration and uncertainty around the pace of AI monetization all point to a more volatile path forward—one in which diversification and active asset allocation regain importance.

How Resilient Is the Economic Cycle?

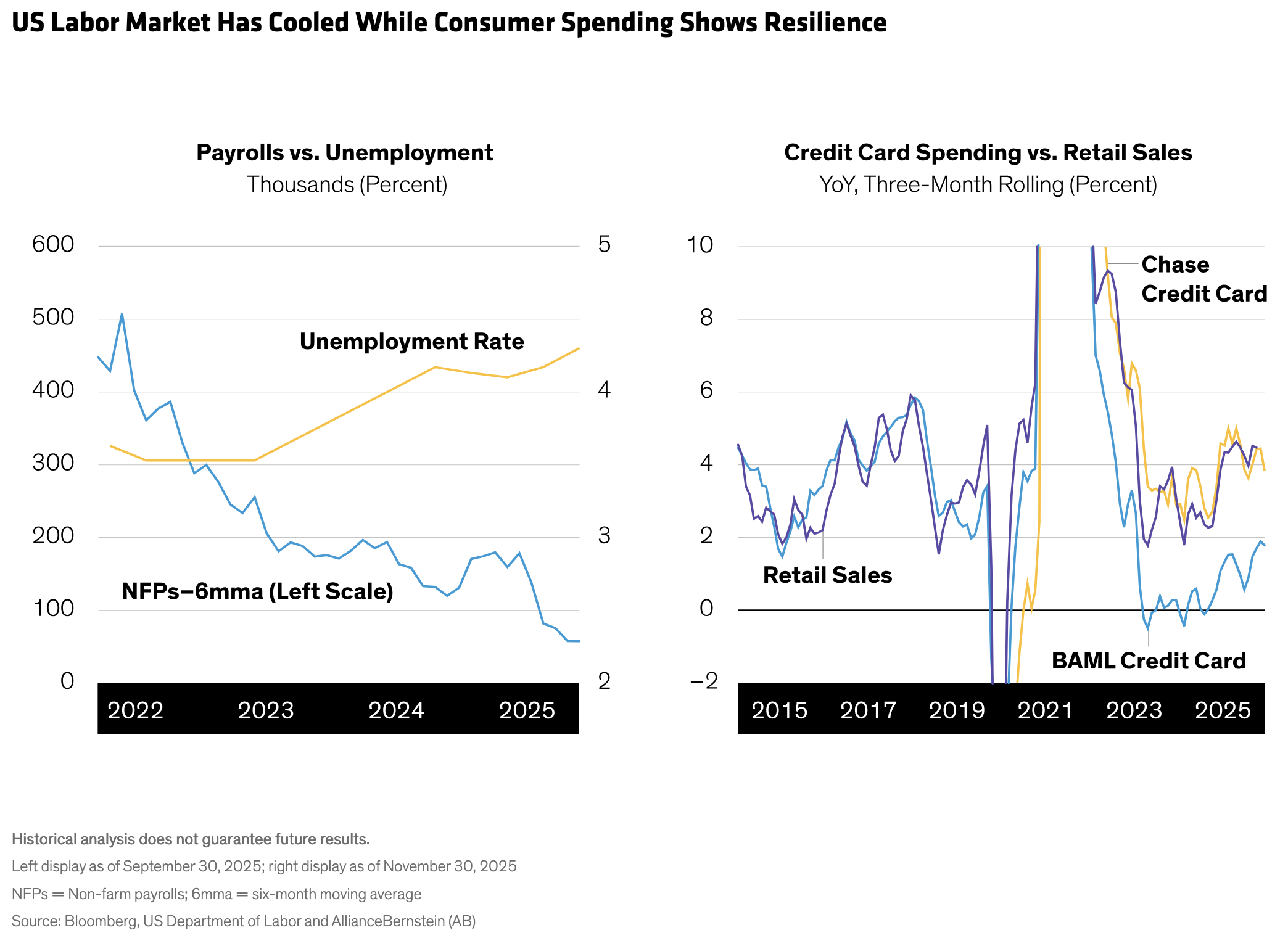

As fears of a sharp downturn fail to materialize, the key question for 2026 is whether the economy can remain resilient as the cycle matures. The US economy remains the primary engine of global growth, but divergences are emerging under the surface. Labor market momentum is softening—hiring is cooling and there are fewer job openings even as other parts of the economy show strength. For instance, corporate capex is robust, earnings revisions are near historical highs and profit growth has broadened beyond tech. The disconnect between labor and corporate fundamentals bears watching, but for now we see few signs of economic stress.

We think the consumer will remain a key source of stability. Household balance sheets aren’t meaningfully stretched, real wage growth remains positive and excess savings are diminished but not exhausted. Inflation is slightly above target, but we expect the Fed to put more weight on employment risk given the recent softening (Display). The central bank is likely to ease policy into 2026, and fiscal policy should be an added near-term buffer, with the front-loaded impact of recent spending measures supporting activity well into the year.

Globally, policy paths will likely diverge but with a broadly similar outcome: slower growth but not recession. In Europe, forces cooling inflation suggest that additional policy easing is more likely than markets currently price. Japan’s firmer inflation dynamics and more expansionary fiscal policy stance point toward continued normalization by the Bank of Japan. We think these distinctions underscore the importance of being selective across markets, without undermining the broader case for cycle durability.

Are We in an AI Boom or an AI Bubble?

AI has become central to the debate on economic resilience and the staying power of the equity bull market. AI–driven tech stocks have soared in recent years, elevating market concentration to historic levels. It’s reasonable for investors to ask whether AI’s advance is a sustainable boom or the early stages of excess.

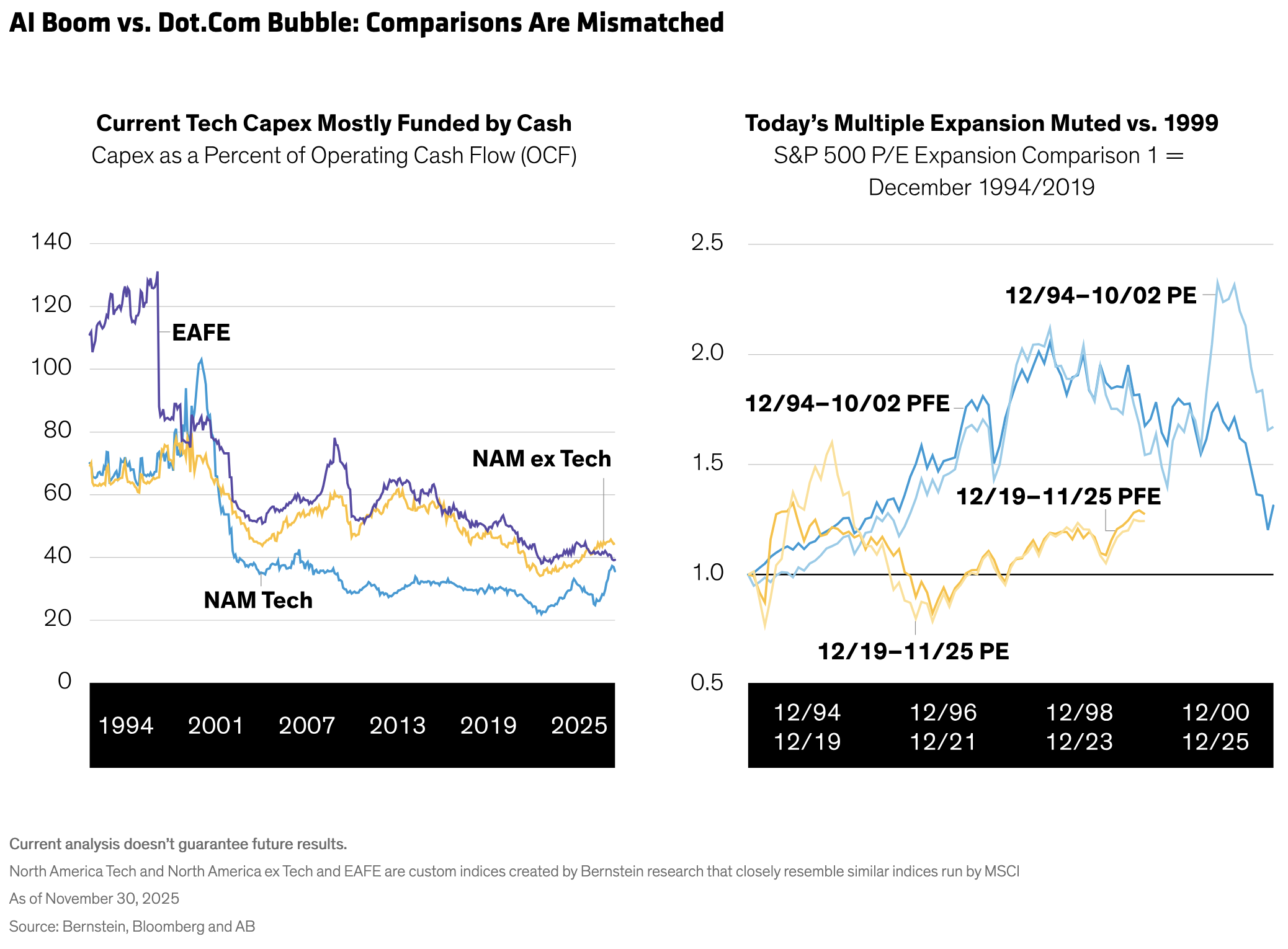

There are other signs of exuberance. Valuations in certain segments have expanded rapidly, and pockets of structural fragility are emerging. Circular financing dynamics—such as repeated cross-investments and strategic deal-making—can amplify cyclicality. Also, early signs of renewed leverage are emerging as some firms use debt to fund ambitious capex. Another key risk is the possibility of an “air pocket” if revenue lags the pace of investment.

These dynamics warrant close attention, but for now we believe the fundamental case for the AI–led rally is intact. Higher capital spending is largely financed by strong operating cash flows, not excessive leverage (Display). And markets appear selective—rewarding firms with durable earnings power while penalizing weaker balance sheets. This suggests rational, not indiscriminate behavior by investors.

Comparisons with the late-1990s dot-com era are inevitable but ultimately misleading. Unlike then, today’s AI leaders are highly profitable businesses generating cash. Equity gains have been driven by tangible earnings growth and investment in physical and digital infrastructure, not by speculative business models or unproven demand. Valuations have risen but remain anchored to real cash flows in a way that was largely absent during the dot-com bubble.

Looking ahead, tech-led US exceptionalism is likely to last, but isn’t the only avenue for AI investment exposure. Companies across emerging markets—particularly China, Taiwan and South Korea—have increasingly critical roles in the global AI value chain. Earnings expectations are beginning to reflect this new reality, offering investors exposure to AI’s secular growth potential at lower valuations and reducing overreliance on US markets.

What All This Means for Multi-Asset Investing

Policy easing and a relatively resilient economy have historically supported risk assets. We think exiting equities now would pose an opportunity cost. While the cycle is maturing and volatility may rise, we believe the balance of risks still favors maintaining an overweight to growth assets, though with more selectivity and disciplined risk management. Here are the key themes we see.

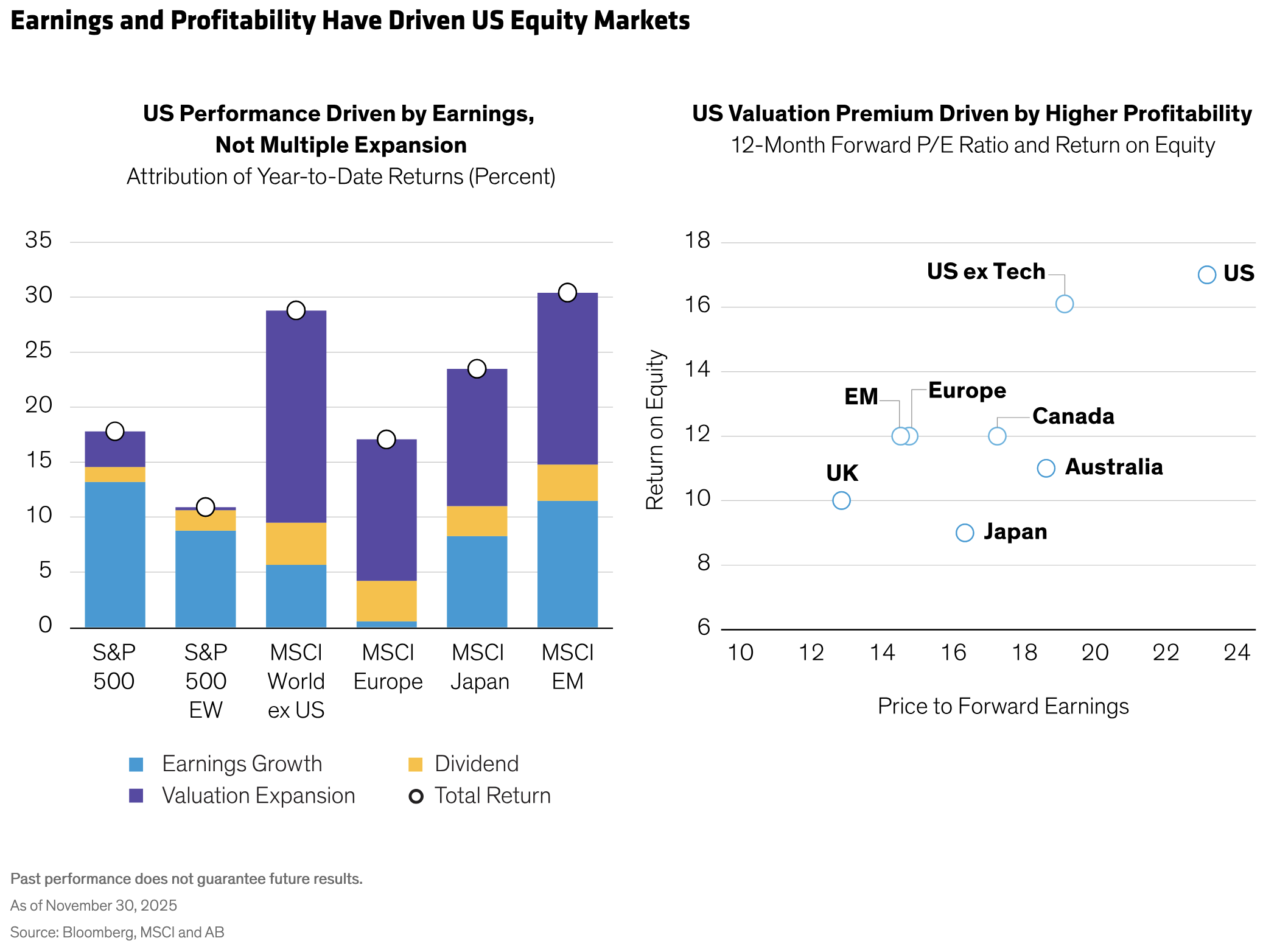

Favor US equities but complement them with emerging markets. Current US multiples reasonably reflect structurally higher profitability and continued above-trend earnings growth, positioning US equities favorably versus other developed markets (Display). Emerging-market equities, meanwhile, offer diversification. Lower local interest rates, improving earnings and a potentially weaker US dollar provide a supportive backdrop, particularly for markets central to the global AI value chain.

Build up sources of portfolio defense. The recent bull market’s strength and concentration argue for adding resilience to equity allocations. For example, low-volatility equities are relatively inexpensive and offer defensive characteristics with potential to outperform if growth moderates. Also, option-based strategies could mitigate some downside while keeping exposure to areas of market growth.

Emphasize quality in credit, be selective with duration. In fixed income, we expect credit to remain a key source of income and total return; we favor higher quality. But with spreads near historic tights, we think it makes sense to remain underweight credit versus equity. Duration remains an important diversifier and source of income, because the interest-rate component offers most of today’s yield. Selectivity is critical—we favor US over Japan, and short-to-intermediate maturities should benefit from the Fed’s easing. We remain cautious on longer maturities, where fiscal dynamics may weigh on performance. To manage this risk, gold may still be a useful ballast—particularly if fiscal concerns resurface or inflation picks back up.

Consider non-traditional return opportunities. For investors who have flexibility, long-short strategies may provide diversification, targeting high single-digit returns with low correlations. Event-driven strategies, focused on major corporate actions, may benefit from a friendlier merger-and-acquisition climate. Regulators are more accommodating, private equity firms are eager to deploy record cash levels, and easing monetary policy is making it cheaper to finance key events. Equity market-neutral strategies exploit relative-value opportunities in sectors beyond the AI boom. And while long-only equity investors face index concentration challenges, market-neutral managers can seek to build more diversified portfolios, which we think could generate steadier alpha.

Overall, a multi-asset approach is well suited to the 2026 environment. Growth should hover near long-term averages, with inflation sticky but well below recent peaks and more monetary policy easing—all supportive of risk assets. But valuations are rich and the range of macro outcomes wide. In this setting, multi-asset strategies have the potential to add value by capturing income and upside through a disciplined, risk-aware approach.

Authors

Daniel Loewy, CFA, Chief Investment Officer and Head—Multi-Asset and Hedge Fund Solutions

Caglasu Altunkopru, Head of Macro Strategy—Multi-Asset Solutions

Aditya Monappa, CFA, Global Head—Multi-Asset Business Development

Copyright © AllianceBernstein