Foreword: Understanding Wealth in a Changing World

In the sixteenth edition of the Global Wealth Report1, UBS offers not just a map of where wealth resides—but a lens into how it's shifting. As Robert Karofsky and Iqbal Khan, Co-Presidents of UBS Global Wealth Management, frame it:

“Understanding the trends and drivers of wealth creation is more crucial than ever... Building on the rebound we saw in 2023, the outlook for wealth remains positive with the world getting progressively richer overall.”

Their optimism is tempered by a reality: while wealth is growing, it is doing so asymmetrically. This year’s report dissects that imbalance and highlights the tectonic shifts underway—from North America's surge to the structural rise of "Everyday Millionaires" and the political weight of generational wealth transfer.

Article follows after the infographic. Download Infographic

The Global Picture: Growth, Yes—but Uneven

UBS reports that global personal wealth rose by 4.6% in USD terms in 2024, exceeding 2023’s growth of 4.2%. But the devil lies in regional disparity. North America and Eastern Europe led the pack with double-digit growth, while Western Europe, Oceania, and Latin America saw contractions in wealth when adjusted for population size.

What explains this? The report is clear: “Strong financial markets in the United States, coupled with a stable currency, are what drove North America’s wealth growth last year”.

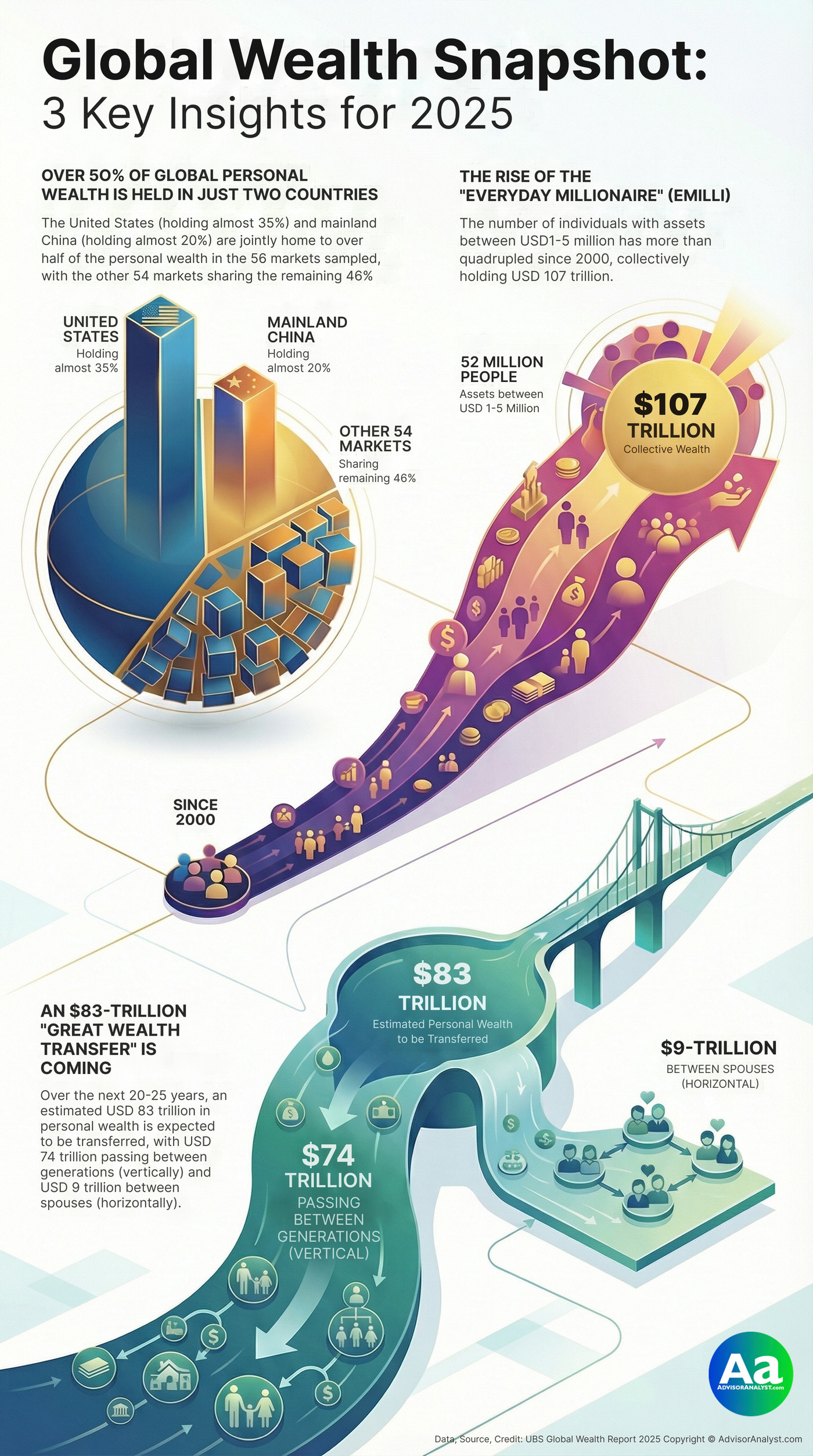

The Americas increased their share of global wealth to 39.3%, edging out Asia-Pacific and EMEA. Yet, two countries still dominate: the US and China jointly account for over half of all personal wealth in the 56 markets analyzed.

Beyond Averages: Wealth by the Numbers

UBS makes a vital methodological distinction: median vs. average wealth. Average wealth often inflates the picture due to ultra-wealthy individuals, while median wealth offers a more accurate portrait of the “typical” citizen.

Take the US: while average wealth per adult is over USD 620,000, median wealth is just USD 124,041, reflecting skewed wealth distribution. The highest median wealth was found in Luxembourg (USD 395,340), followed by Australia and Belgium, indicating relatively stronger middle classes.

Paul Donovan, UBS’s Chief Economist, reminds us:

“Wealth finances investment, making it hugely important economically. But wealth also matters a great deal politically.”

He argues that the great wealth transfer—estimated at USD 83 trillion over the next 20–25 years—is becoming a key political fault line amid “social upheaval born from the fourth industrial revolution, and high levels of government debt”.

The Rise of the EMILLI: “Everyday Millionaires”

In a world increasingly defined by extremes, one cohort stands out: the EMILLIs, or “Everyday Millionaires” (those with USD 1–5 million in wealth). This group has grown more than fourfold since 2000, now comprising around 52 million people, with a combined USD 107 trillion in assets.

Importantly, their growth has not plateaued. UBS projects 5.34 million new USD millionaires by 2029, with most concentrated in the United States and China.

As the report notes:

“In absolute growth terms, the millionaire population increased the most in the United States in 2024, averaging over a thousand people every single day. In mainland China, the increase exceeded 380 people per day.”

Shifting Structures: The Wealth Pyramid and Transfer

UBS continues to map the global wealth pyramid. As of 2024:

- 60 million adults (1.6% of global adult population) held over USD 1 million, controlling 48.1% of total wealth

- In contrast, 1.55 billion adults (41% of global adults) had less than USD 10,000, sharing less than 1% of total wealth

These disparities reinforce a fundamental truth: wealth begets wealth, especially when anchored in real assets like property or in jurisdictions with favorable tax regimes.

A major driver shaping future wealth will be inheritance. UBS forecasts that USD 9 trillion will transfer between spouses alone, with women poised to inherit an unprecedented share.

Emerging Themes: Women, Data, and Political Economy

Paul Donovan spotlights how shifts in gendered wealth control, especially in markets like the US, are altering the contours of global finance. But he also urges caution:

“Wealth measurement offers analysis of broad trends, not implausible precision... currency moves dramatically distort international comparisons.”

Indeed, the report acknowledges that many countries do not even regularly measure wealth—posing challenges for both policymakers and asset managers.

And that brings us to a deeper point. As Donovan bluntly states:

“Does wealth distribution create social barriers, limiting opportunities for people? Does wealth taxation deter entrepreneurship?”

These aren’t just rhetorical questions. They will define the policy agendas of advanced economies over the next decade, especially as governments grapple with inequality, climate finance, and generational shifts.

Conclusion: Navigating the Coming Transition

The UBS Global Wealth Report 2025 is a sobering reminder that while the world may be getting richer, it is not doing so evenly. Financial markets, generational inheritance, and geopolitical stability will shape not only where wealth resides—but how it is used.

Iqbal Khan offers a final insight:

“Managing wealth in a dynamic environment demands strategic foresight and expert guidance from an advisor you can trust.”

As wealth becomes more concentrated and more politically salient, understanding it—and who holds it—is no longer optional. It’s essential.

Footnotes:

1 UBS. Global Wealth Report 2025. UBS Group AG, 2025

Copyright © AdvisorAnalyst