Are we surfing the next great wave—or waiting for it to crash?

RiverFront Investment Group’s 2026 Outlook Summary1, titled Riding the Wave, doesn’t just answer that—it frames the question in historical, behavioural, and macroeconomic terms. In a market intoxicated by AI, rate pivots, and recession whiplash, the team argues that we’re not in the throes of a euphoric market bubble—but still very much in a rational, data-supported boom.

Let’s unpack what RiverFront calls “the anatomy of booms & bubbles,” and why they believe investors are misreading the moment.

Sentiment ≠ Speculation: Why This Boom Feels Emotional—But Isn't a Bubble

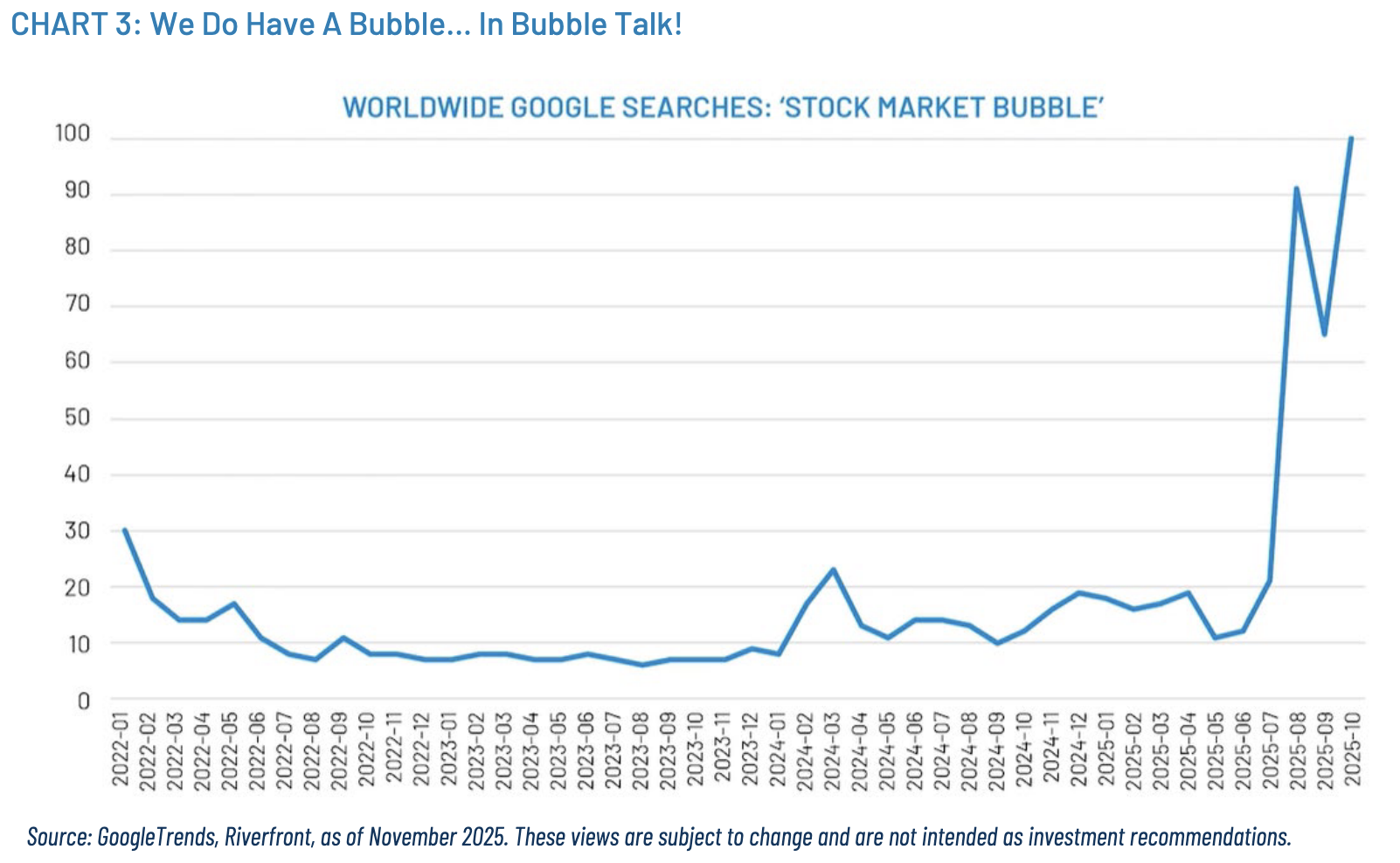

The market, they note, is full of caution—even paranoia. “The question we fielded most often this year was ‘are we in a market bubble?’” they write, before pointing to an ironic twist: a bubble in bubble concerns. In fact, “Judging by the near-record number of Google searches in Q4 for ‘stock market bubble’... we do appear to have a ‘bubble’ in bubble concerns!”

This anxiety is the very reason they remain bullish. They argue that fear and caution are not characteristics of market tops but often precede major upside. In their words:

“Cautious sentiment like this may be one of the clearest indicators that the stock boom still has room to go, in our view.”

Boom ≠ Bubble: The Anatomy of a Cycle

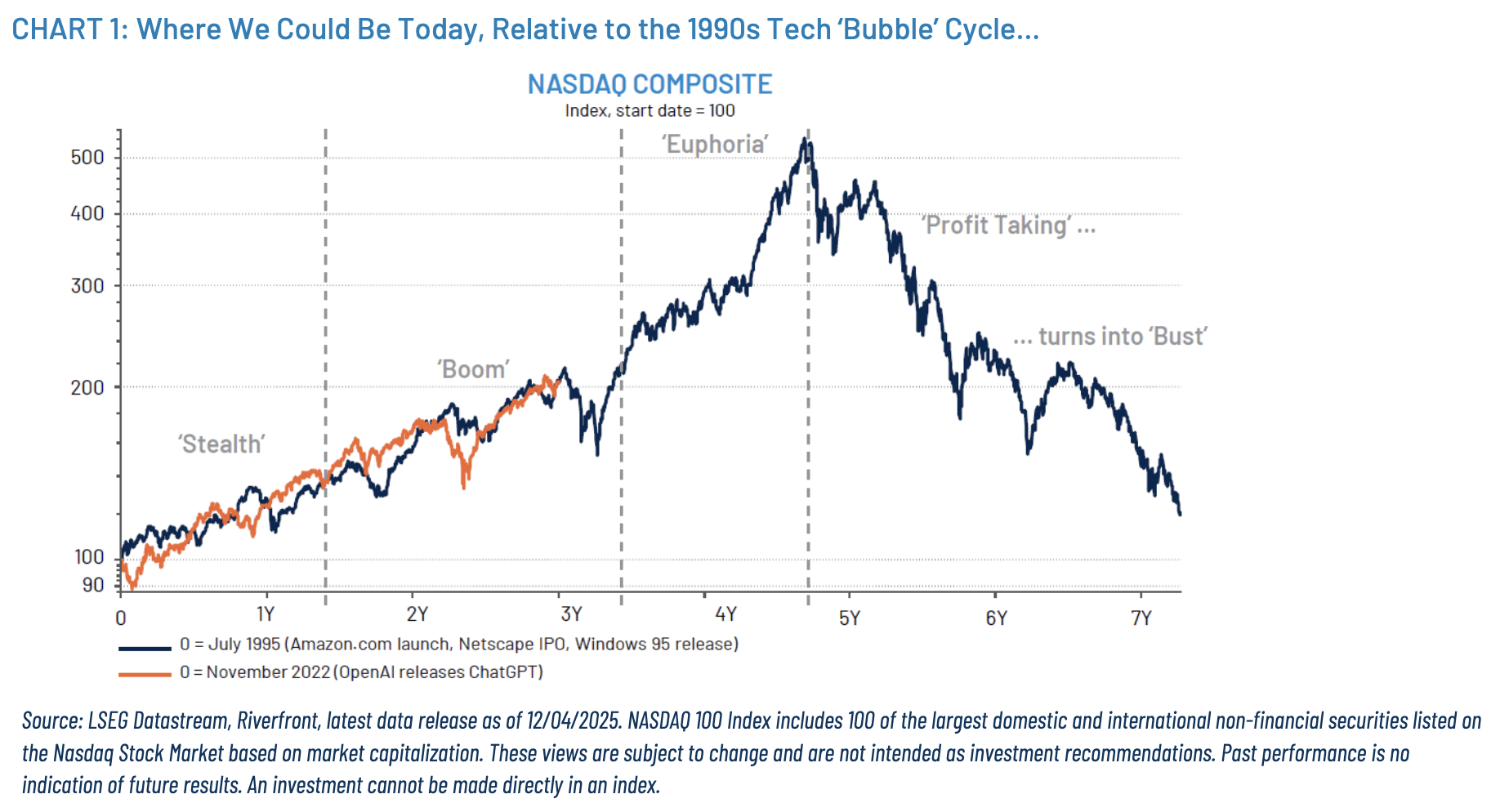

RiverFront’s analysis draws on both history and behavioural finance. They dissect prior episodes of market excess, noting that we’re far from the “Euphoria” phase typical of bubbles:

“In studying classic US bubbles in the 1920s and the 1990s, neither valuation, leverage nor sentiment today resembles ‘Euphoria’-stage bubble behaviour, in our view.”

Instead, they believe we're in the "Boom" phase—a period marked by rapid but rational capital deployment, particularly in AI-related spending. Their base case is straightforward:

“Further upside for US stocks, due to AI spending, an accommodative Fed, and no recession.”

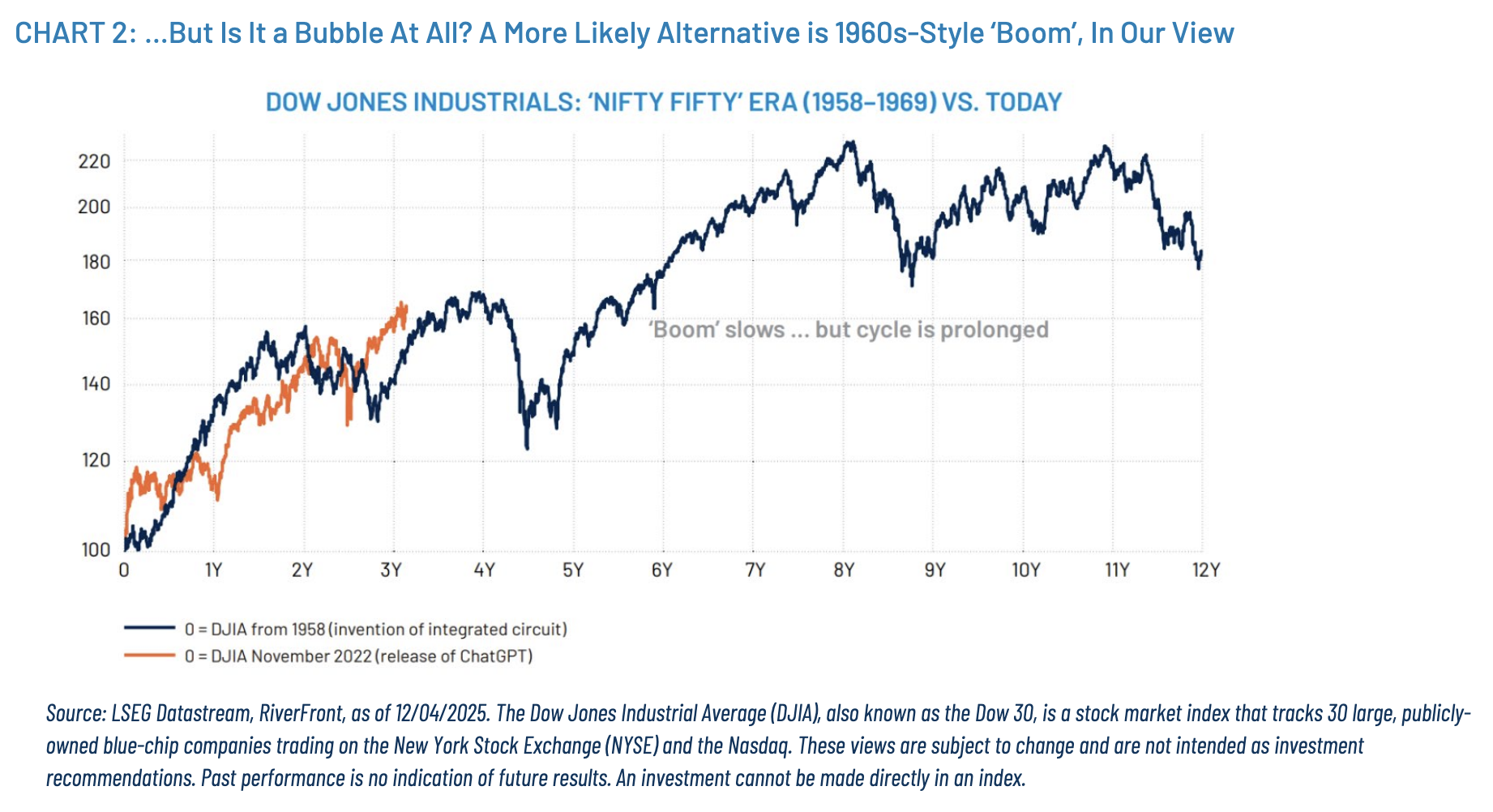

They anchor this view with an evocative comparison: today’s environment mirrors the 1960s boom more than the 1999 bubble. The latter ended in a bust; the former delivered a prolonged expansion. “If the 50s and 60s are any guide, we may only be in the early stages of what could be a less powerful but more sustained stock ‘Boom’… rather than in the midst of a euphoric ‘Bubble’.”

Three Scenarios, One Clear Tilt

RiverFront’s 2026 forecast is grounded in probabilities. Their “Base Case”—AI Boom Continues—is assigned a 60% likelihood. Their outlooks:

| Scenario | S&P 500 Range | US GDP | Inflation | 10Y Treasury |

|---|---|---|---|---|

| Bear Case (15%) | –25% or worse | 1.2% | 2.0% | 3.5% |

| Base Case (60%) | 8–12% gain | 3.0% | 2.6% | 4.2% |

| Bull Case (25%) | 15%+ gain | 3.9% | 2.5% | 4.5% |

They reiterate: “We continue to favour stocks over bonds, and US assets over international.”

Risks on the Radar: 2026 Is a Political Year

RiverFront isn’t blind to risk. Among the red flags they’re tracking:

- Credit conditions

- Sticky inflation

- Federal Reserve policy

- Presidential election volatility

The team cautions that, “2nd years in Presidential cycles are typically volatile.”

This isn’t a call for unguarded optimism. Rather, it’s a conviction that structural and sentiment indicators don’t yet justify panic—or even significant pullback.

Visuals That Reframe the Narrative

The report features three key charts, and each tells its own story:

- Chart 1 (Page 2): Compares the current NASDAQ rally post-ChatGPT to the 1990s tech bubble. It suggests we’re still in the “Boom” stage, akin to 1996, not the “Profit Taking” mania of 1999–2000.

- Chart 2 (Page 2): Offers a more nuanced analog: the “Nifty Fifty” era of the 1960s. The boom “slows... but the cycle is prolonged.”

- Chart 3 (Page 3): A near-satirical look at Google Trends shows a vertical spike in searches for “stock market bubble” in late 2025. Market hysteria? Maybe. Market top? Not necessarily.

What To Watch

While not intended as investment advice, RiverFront’s strategy signals a few key moves:

- Stay overweight U.S. equities.

- Remain cautious but engaged in tech and AI names.

- Don’t expect Fed policy to derail growth just yet.

- Monitor inflation and credit for signals of a regime change.

The unspoken message: don’t fight the boom—but don’t pretend it’s a bubble either.

Final Word: Stay Rational, Stay Invested

In an age of algorithmic angst and digital groupthink, RiverFront offers a refreshing position: informed optimism. Their 2026 Outlook doesn’t deny market risk—it simply asserts that risk does not yet equal reckoning.

As they sum up, “Bubbles are only obvious in retrospect.” For now, the evidence suggests the market’s not drunk—it’s just wide awake.

Quoting RiverFront IG directly and verbatim:

- “Neither valuation, leverage nor sentiment reflect ‘Bubble’ behavior yet, in our view.”

- “We do appear to have a ‘bubble’ in bubble concerns!”

- “We may only be in the early stages of what could be a less powerful but more sustained stock ‘Boom’… rather than in the midst of a euphoric ‘Bubble’.”

Let’s not miss the wave because we feared the splash.

Footnotes:

1 ** RiverFront Investment Group, 2026 Outlook Summary. December 2025