by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

In this article, Russ Koesterich discusses recent changes to stock/bond correlations and the impact that inflation, or a lack thereof, can have on this dynamic.

Key takeaways

- Bonds, once viewed as a reliable hedge against risk, took on the role of “risk accelerator” since 2021 as inflation shifted traditional stock/bond correlations from negative to positive. This trend is now showing signs of a reversal.

- As inflation has slowed in recent years, it has also become less volatile. With anticipation of further Fed easing and likely expansion of the central bank’s balance sheet, Russ believes that bonds could once again fill the role of a traditional portfolio diversifier.

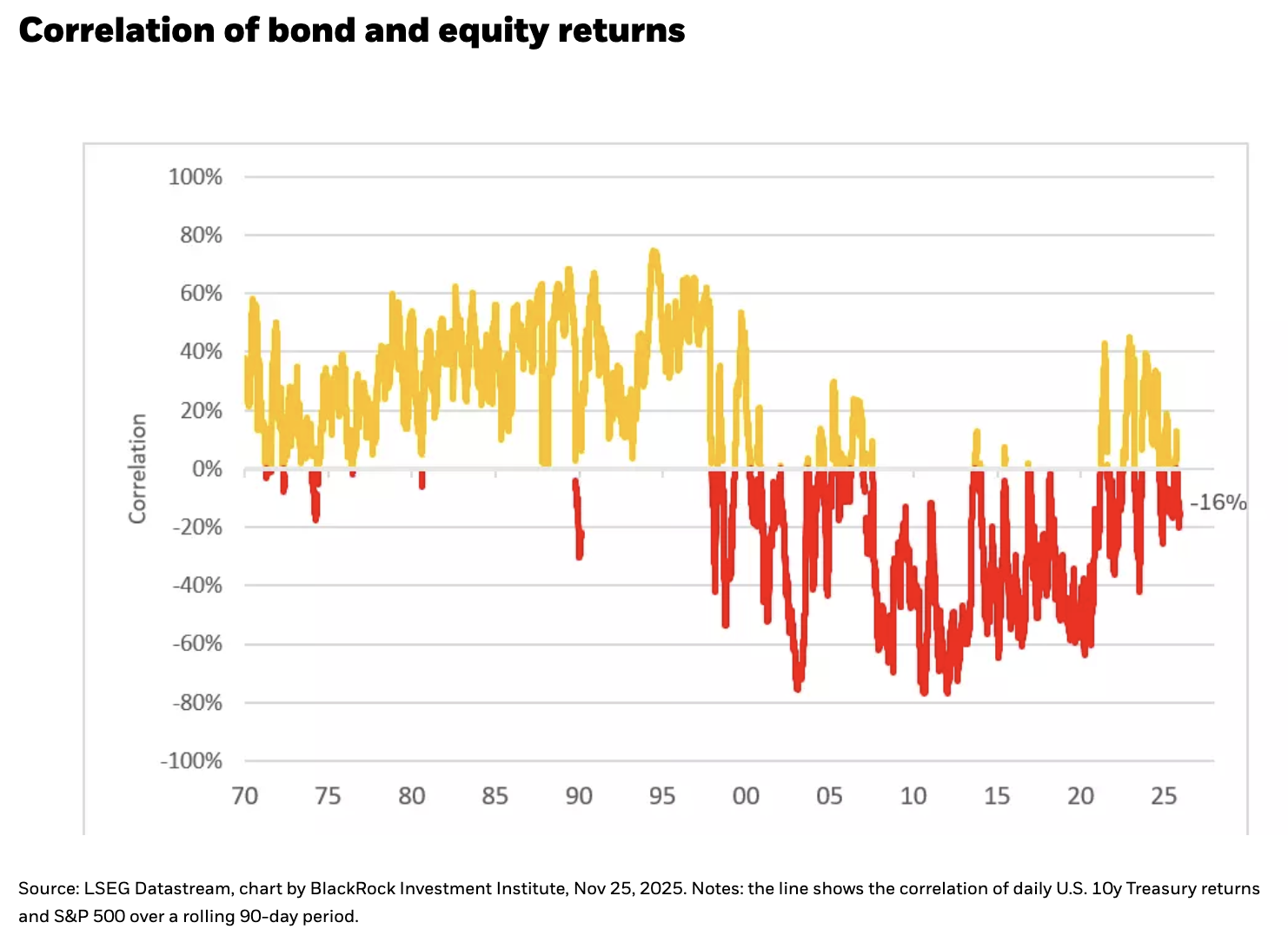

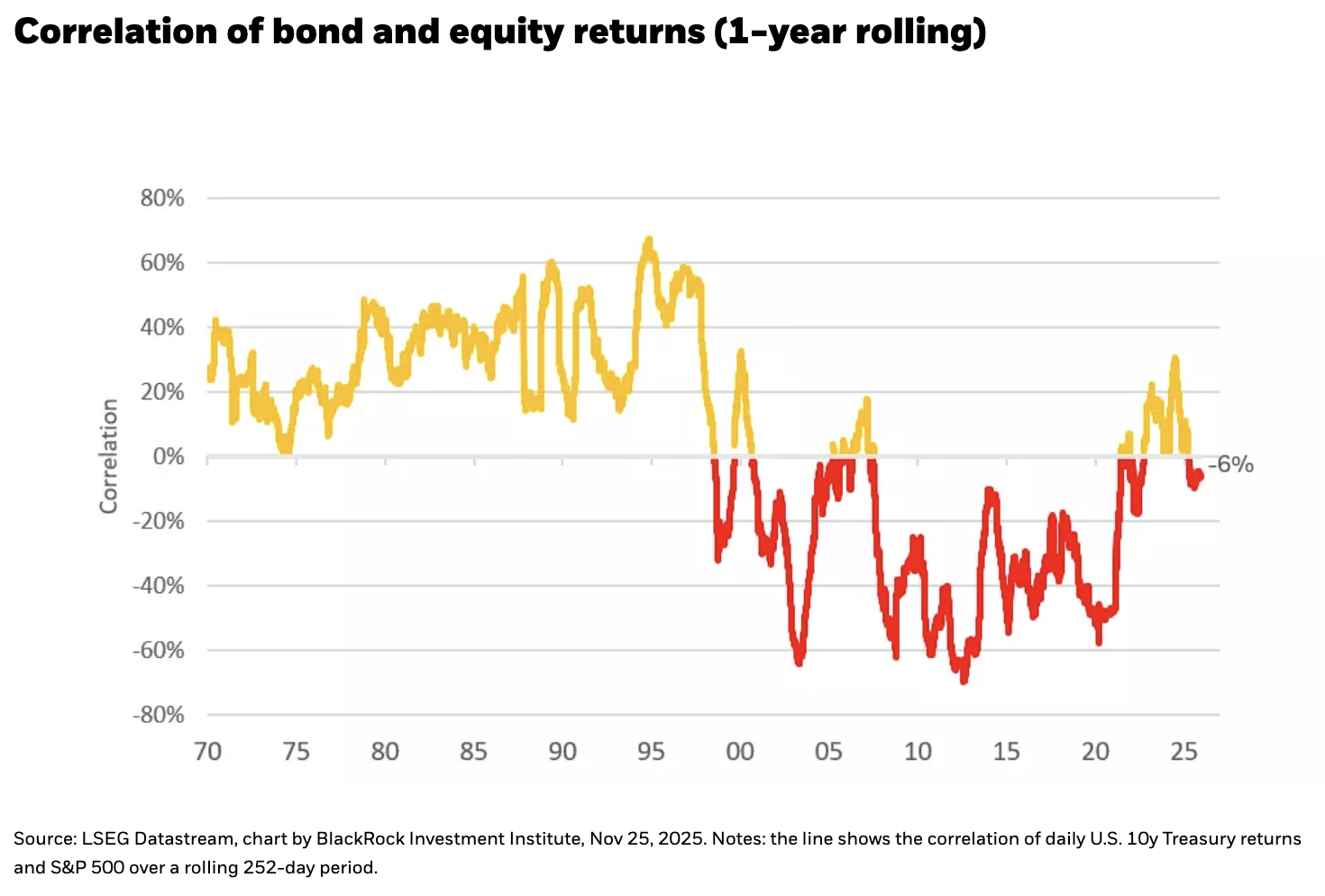

For the better part of 20 years bonds offered little yield but effective diversification. From the aftermath of the internet bubble through the pandemic, stock/bond correlations were consistently negative, making a Treasury bond an effective portfolio hedge.

Unfortunately, starting in 2021 that relationship abruptly shifted. A sharp and abrupt rise in inflation turned bonds from a risk mitigant to a risk accelerator. However, that dynamic may be in the process of changing, suggesting that bonds may once again start to provide some portfolio diversification.

Inflation elevated, but less volatile

As I’ve discussed in previous blogs, shifting stock/bond correlations marked a paradigm shift relative to the 2000-2020 period. What changed? Inflation. The re-emergence of inflation fundamentally shifted stock/bond correlations as higher prices became as much of a risk to markets as slowing growth.

Today, while inflation remains above the Fed’s 2% target, it has slowed dramatically, with most measures of core inflation running between 2.5% and 3.0%. This moderation has led to some mean reversion in stock/bond correlations. For much of the past two years, stocks and bonds have traded with a correlation close to zero, suggesting no statistically significant pattern in how they trade relative to each other. Most recently the correlation has reverted to slightly negative (see Chart 1).

What may be changing? Inflation remains elevated but is becoming less volatile. Historically, this has been important for how stocks and bonds trade. In other words, it is not just the level of inflation that influences investor behavior but also the stability, or lack thereof, of inflation.

Today, the volatility of inflation, measured using the standard deviation of monthly readings, is falling fast. The three-year standard deviation is at its lowest level since the spring of 2020 and back near its post-2008 average. In the past, this level of volatility has been associated with modestly negative stock/bond correlations.

Another factor favoring a reversion towards negative stock/bond correlations: Fed easing and the likelihood that it will once again begin expanding its balance sheet. Both developments support easier financial conditions, a dynamic which would also favor a negative stock/bond correlation.

Stabilizing inflation + Fed easing = more negative stock/bond correlations

Following two years of +20% gains and a more than respectable +16% gain year-to-date, investors could be forgiven for not obsessing over hedges. But as we witnessed in October, elevated valuations, crowded trades and lingering AI concerns may make for a more volatile 2026, even if equities continue to advance. Finding ways to effectively diversify a multi-asset portfolio allows investors to maintain their strategic equity allocation while managing risk. We may be entering a period when bonds can, at least in part, start to once again fulfill that function.