by Hubert Marleau, Market Economist, Palos Management

Whatever happens in 2026 and beyond will be entirely dependent on whether recent productivity growth, which has registered average gains of 2.2% a quarter since 2023, compared to just 1.2% a year in the 2010s, stemming mainly from fixed capital investments, new business formation and immigration, will hold in 2026 to offset labour market softness.

The latest job report was convoluted but showed that the unemployment rate had shot up to 4.6% in November, up 0.6% from six months ago. In this connection, if it were not for irregularities in the labour market, the rise would trigger the Sahm Recession Rule.

Thus for the US economy to generate another double-digit earnings expansion for a third year - a rare historical occurrence — our current productivity growth track will need to last for a few more years. Unfortunately, there is a lot of controversy on this question, as two completely opposite views are headlining the press, which explain the volatility of the market.

On the one hand, there is a pessimistic view out there that the aforementioned factors which contributed to the productivity surge are now waning, and that AI may not come to the rescue fast enough to boost competitiveness, efficiency, and supply management and new products. The history of technological advancements sides with the pessimists. They argue diffusion is usually too slow in the beginning to quickly or effectively pay off the return on investments, their point resting on the notion that firms need to ameliorate their business processes, reskill their employees and develop new products and services to add value. In this connection, doubts that AI can come good on its trillion-dollar commitments are understandable.

On the other hand, there is also the optimistic view out there, arguing changing labour-market dynamics, business enthusiasm, and particularly AI adoption, have accelerated the overall annual rate of productivity gains above 3.0% in the last two quarters. Inventors should be aware that this kind of productivity growth occurred from 1995 to 2005 and 1918 to 1928 - ten years of outstanding prosperity. So far, AI adoption has had a minimal impact on productivity because it is still in the early stages of development. But this is changing fast, because the hyperscalers are pushing the envelope hard to get a return on their huge investments. According to the Census Bureau’s Business Trends and Outlook Survey, about 10% of businesses use AI, including machine learning, natural language processing, virtual agents, and voice recognition to produce goods and services, compared to only 3.5% in September 2023, when productivity shot up. The reality is that enterprise AI adoption is, indeed, accelerating.

The research of Citigroup’s Heath Terry shows that tens of thousands of individual agents built on model APIs are being deployed in large-scale companies, which should further quicken in aggregate hyperscaler revenue and backlog growth as increased AI use leads to huge cost savings. Put directly, he opines that investors are still underestimating AI’s scale and potential, and consensus estimates for nearly every part of the ecosystem remain low, particularly beyond 2026. He expects that the street will spend the next year raising estimates for most of these companies.

While I recognize that Ruchir Sharma’s concerns about over-valuation, over-trading, over-ownership, over-investment, and over-leverage in the tech sector, I suggest that investors should merely trim over-weight positions, because bull markets only burst when interest rates rise, financial conditions tighten, and money dries up. That is not where we are today. Thus, I still support the bullish thesis but am attaching a bit more weight to warnings. What we have recently had was simply a normal market adjustment.

What Happened in the Week Ended December 19?

On Monday, stocks started the day higher, but faded quickly with the S&P 500 spending most of the session in the red as investors stayed cautious, awaiting a flood of key data points that could signal the direction of interest rates, while suffering tech fatigue, thinking that the AI boom might be more about a rebuild than a roll-out. The benchmark fell only 0.2% because money managers were not selling outright; they were basically rotating out of tech heavy positions into defensive sectors like financials, consumer staples, and industrials.

On Tuesday, U.S. equities dawdled under pressure, with the S&P 500 slipping 0.25% to 6801, despite a pick-up in tech stocks as a flood of economic data points like retail sales, non-farm payrolls, and S&P industry surveys showed that economic growth was drifting lower, due to tariffs, inflation, reduced customer demand and reins on hiring. As a result, the US dollar and bond yields edged lower, signalling that the Fed’s interest-rate and monetary stance easing cycle will remain intact. Traders stuck with two rate cuts in 2026, settling for a range of 3.00% to 3.25% for the Federal funds rate, which would be lower than my neutral rate estimate 3.50%.

Stocks took a turn for the worse on Wednesday after reports of an Oracle Data project issue in Michigan, creating doubts in tech darlings and AI outlays. The S&P 500 fell 1.2%, closing at 6721.

On Thursday, stock futures after suffering four down days in a row on AI jitters, futures pointed to a bold recovery, boosted by blowout numbers from Micron. With the help of a messy, but unexpected fall in inflation to 2.7% in November caused by a strong pullback in shelter inflation, the stock rally kept ongoing throughout the day, generating a 0.8% gain in the S&P 500 to 6775.

On Friday, U.S. futures were ticking higher as traders geared up for a year-end stretch that usually delivers equity gains. The Bank of America reported that investors were pumping money into the stock market all week at a near record pace, believing that lower borrowing costs are in the cards for 2026.

The Near-Term Stock Market Outlook

Last week I wrote: “The most significant takeaway from the Fed’s communique was its admission that the U.S. economy is experiencing a productivity surge set to prop up economic growth, restrain inflation and generate corporate profit. The median forecast of policymakers is anticipating 2.3% GDP growth in 2026 without any meaningful increase in employment. Powell said at the news conference: ‘I never thought I would see a time when we had five, six years of 2% productivity growth.’ He went on: ‘We are definitely seeing higher productivity.’ This is probably stemming from the application of generative AI, more automation, increasing use of computers, post-pandemic investments, and reduced regulations.

“According to Henry Wu, chief quantitative strategist at Alpine Macro, a reputable, Montreal-based research firm, stocks will climb the AI wall of worries, and the AI narrative will be bullish enough to contain the risk because over time investments are bound to decline as a % of revenue, while debt issuance as a % of the bond market is only 6%.

“Thus, maybe investors should look past the plight of Oracle and, therefore, only trim tech-stock positions and trade the air pockets rather than unload totally because developments like technological breakthroughs, competition and integration will likely be a bet positive for the overall AI ecosystem.

“In this connection, I’m still keeping a target of 7000 for 2025 and 7500 for 2026 for the S&P 500. Stifel, meanwhile, mapped out 2026 S&P 500 scenarios as 9% upside and 5% downside - a corridor of volatility between 6550 and 7500. Tom Lee of Fundstrat also expects a turbulent year ahead: nonetheless, the benchmark should hit 7700 by the end of 2026.”

TS Lombard’s chief economist Steven Blitz wrote a few days ago that the option market was predicting that there was as much as a 10% chance that the S&P could fall by as much as 30% in the coming year. That would clearly be ahead of schedule for this normally happens on average every 12.7 years. Moreover, this runs counterintuitively to the outlook for strong corporate earnings in 2026. Data compiled by Jefferies, a well-known investment banker, shows that the street expects 2026 will produce another year of double-digit earnings. This prediction would translate into three consecutive years of outstanding profit increases - a rare historical development. In the past 35 years, the S&P 500 posted this kind of earnings expansion only in 1993-1995 and 2003-2005 when productivity was as wild as it is now. What is even more exceptional is that both the buy and sell sides on the investment ledger have similar bullish profit numbers, Bloomberg Data Intelligence’s recent survey of analysts having revealed that S&P 500 earnings will rise 13%, 13% and 14% in 2025, 2026 and 2027 respectively. Voila!

P.S. The National Security Strategy (NSS) and the US-Mexico-Canada Agreement (USMCA): The NSS is a document that spells out what should be America's role in the world. One of several objectives is to restore US economic dominance in the Western hemisphere, shifting national security towards its geographic backyard to create a North American Fortress - a “Trump Corollary” of the Monroe Doctrine suggesting more troops, more bases, more military operations and more economic integrations. On this latter point comes the USMCA trade agreement.

A review of the latter will come up in mid-2026 and Trump and his US defence secretary Pete Hegseth are serious about forming a fortress that will be partially used as a deterrent to China through economic strength and burden-sharing with Canada and Mexico, which, incidentally, has recently put tariffs of up to 50% on China at the US’s behest.

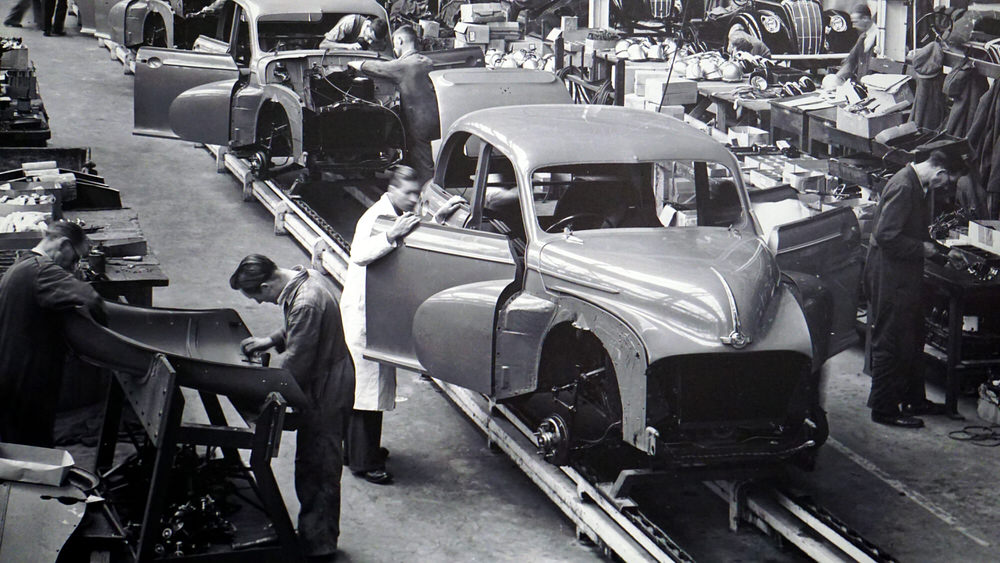

In this connection, I don't think Trump will junk the pact altogether. While I suspect that some sectoral issues in the dairy industry and online news along with steel, aluminium, autos, and lumber, the essence of the deal will likely be preserved. As it happens, USMCA is popular across ideological lines in the US and on Capital Hill, uniting the conservative US Chamber of Commerce and the liberal Progressive Policy Institute. This situation could also encourage the US to de-risk supply dependence on China by aligning tariffs, export controls and foreign investment among the three amigos.

Copyright © Palos Management