by Dominic Phillips, Equity Investment Analyst, & Mila Yankova Equity Investment Director, Capital Group

If there is any one element that underpins the development of artificial intelligence and reindustrialization of America, it might be electric power.

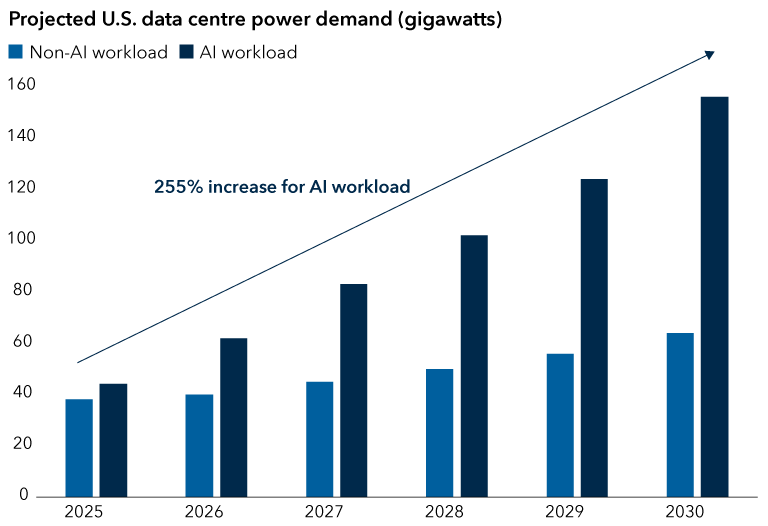

Power demand in the U.S. is set to surge over the next decade, driven by rapid expansion of AI data centres, new manufacturing facilities and electric vehicle networks. Take data centres, which account for about 4% of U.S. electricity use, with estimates suggesting that figure could climb to 9–14% by 2030.

Overall, what’s unfolding is a fundamental shift for the power industry, which has undergone a decade of stagnant consumption. Power providers are transforming into critical enablers of growth as technology giants and others race to secure more energy.

U.S. power markets will experience accelerating demand and structural constraints limiting supply. This will offer a spectrum of potential investment opportunities.

Bracing for data centre power needs

Source: Statista, McKinsey, Gartner, IDC, Nvidia company filings. As of April 2025.

Expect power constraints through 2030

U.S. policy is contributing to increased power demand, with its emphasis on domestic investment, ranging from semiconductor to pharmaceutical manufacturing facilities. For instance, there is over US$3 trillion in planned investments across the U.S. for new capacity.

The last time the U.S. witnessed massive power investments was the late 1990s and early 2000s, which resulted in an overbuild of gas-fired generation plants in newly deregulated markets.

The burst of the dot-com bubble, excessive demand outlooks and natural gas price collapse all helped plunge the market into oversupply, triggering a wave of bankruptcies and stranded assets. Today, there are few signs of this excess and speculative buildout.

With that in mind, here are several structural constraints anticipated to keep power generation tight through at least 2030:

- Equipment delays: Customers are waiting for items such as electrical components and gas turbines from firms such as GE Vernova, Siemens Energy and Mitsubishi. In some cases, turbines may take up to five years to be built and shipped.

- Grid bottlenecks: Potential wait time of five to seven years to connect new generation resources to the power grid.

- Regulatory hurdles: Permitting challenges are slowing both fossil fuel and renewable builds, compounded by federal resistance to large-scale renewable projects.

- Coal retirements: There haven’t been net new coal additions in the U.S. since 2014, and a significant amount of coal may still retire before the end of the decade.

This imbalance is already reshaping the market. Moreover, data centre operators are locking in long-term contracts with nuclear generators to secure carbon-free baseload power. As nuclear capacity is exhausted, expect similar deals with fossil fuel generators, especially those with reliable baseload assets.

Investment opportunities in utilities, industrials and materials

For investors, sectors such as utilities, industrials and materials are at the forefront of a new wave of infrastructure investment in the U.S., with opportunities among smaller and mid-sized firms.

Beneficiaries may include independent power producers such as Vistra and NRG Energy, who operate in power markets like the Electric Reliability Council of Texas (ERCOT) and regional grid operator PJM where demand is booming. NRG, for instance, was the largest contributor to year-over-year earnings growth for the U.S. utility sector during Q3, while the overall group posted the second highest earnings growth rate of all S&P 500 sectors at 23.8%, according to FactSet.

Utilities are experiencing higher earnings growth rates and increased capital investment needs. Regulated utilities typically grew earnings by 5% to 7%, but now some are projecting 7% to 9% or more. While this requires significant growth in capital investment, they can fund expansion by leveraging their statutory monopolies to issue debt and equity. Unregulated utilities, meanwhile, are seeing even higher growth rates due to inflationary power prices and widespread demand.

Regulated utilities including Entergy and Southern Company are making large investments needed to upgrade and expand grid infrastructure to support data centre demand, which may drive earnings growth higher. Entergy for instance is building new gas-fired power plants and expanding transmission infrastructure in an agreement with Meta for a large-scale AI data centre in Louisiana.

Companies producing power generation equipment and energy resource management systems, including Schneider Electric and Hitachi, are also integral to the ongoing power boom.

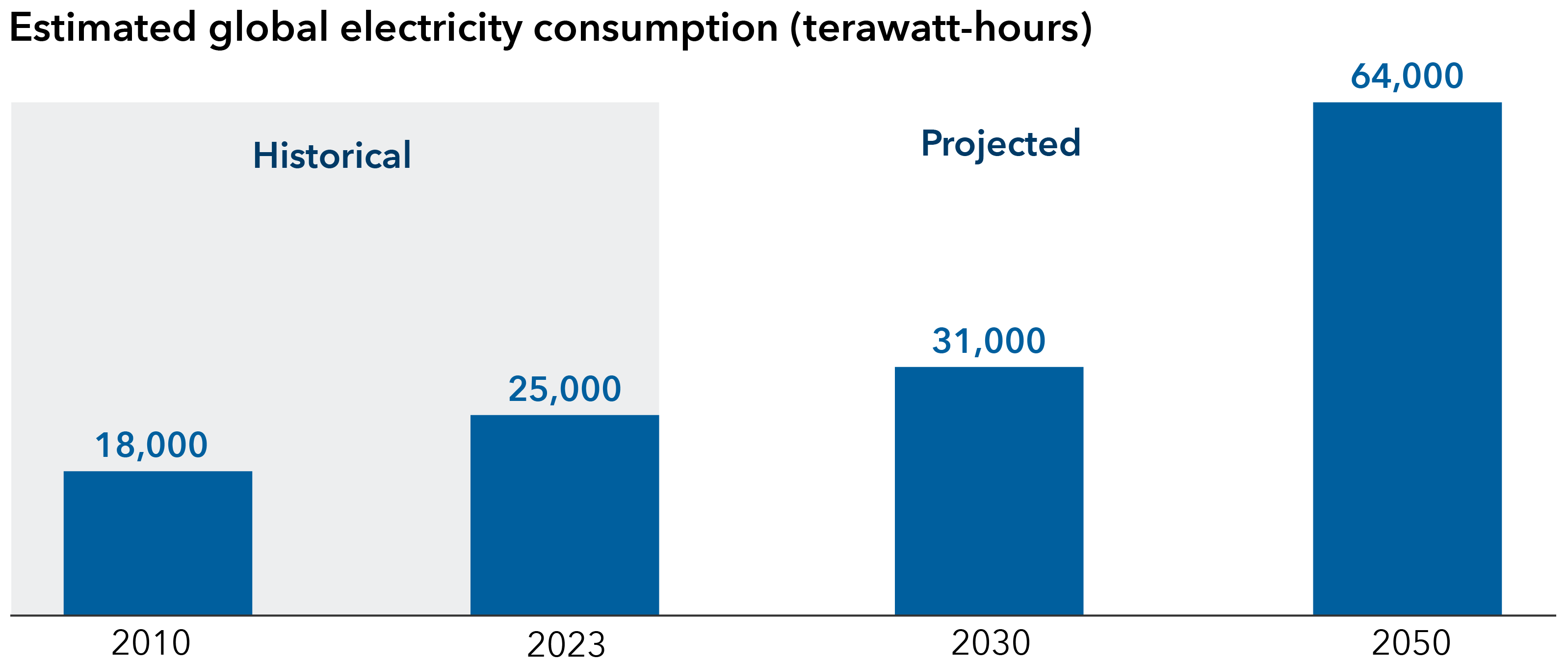

Digital infrastructure is a boon for electricity

Source: Statista, McKinsey, International Energy Agency, International Renewable Energy Agency. As of September 2024.

Outside of power, certain metals are becoming critical to meet increasing electrification needs. Copper demand is increasing as data centres require more of the metal for items such as cooling systems, wiring and connectivity. Parts for electric vehicles along with charging stations also require copper. The metal could face a shortfall of 6 million tons by 2035, according to Bloomberg New Energy Finance. Mining giants such as BHP and Freeport are among key global copper producers.

Industrial giants such as Caterpillar are also participating in the current data centre boom, supplying engines, turbines and generators. Caterpillar’s power generation sales were up 31% year over year in the third quarter. Smaller companies have also reported growing backlogs. These companies range from engineering & construction services firms, providers of high-density power systems and HVAC equipment.

Bottom line

Power is transforming into a critical enabler of growth from what was once a behind-the-scenes segment of the economy. With multiple drivers of power demand, the U.S. should see increased investment in electric infrastructure, utilization of the power generation fleet, and new technologies emerging. We expect these dynamics to offer a variety of investment prospects.

Dominic Phillips is an equity investment analyst. He has 15 years of investment industry experience (as of 12/31/2024). He holds an MBA from Harvard and a bachelor’s from Georgetown.

Mila Yankova is an equity investment director. She has 20 years of investment industry experience (as of 12/31/2024). She holds a bachelor's degree in economics from The University of Chicago. She also holds the Chartered Financial Analyst® designation.

Copyright © Capital Group