by Craig Basinger, Derek Benedet, Brad Gustafson, Purpose Investments

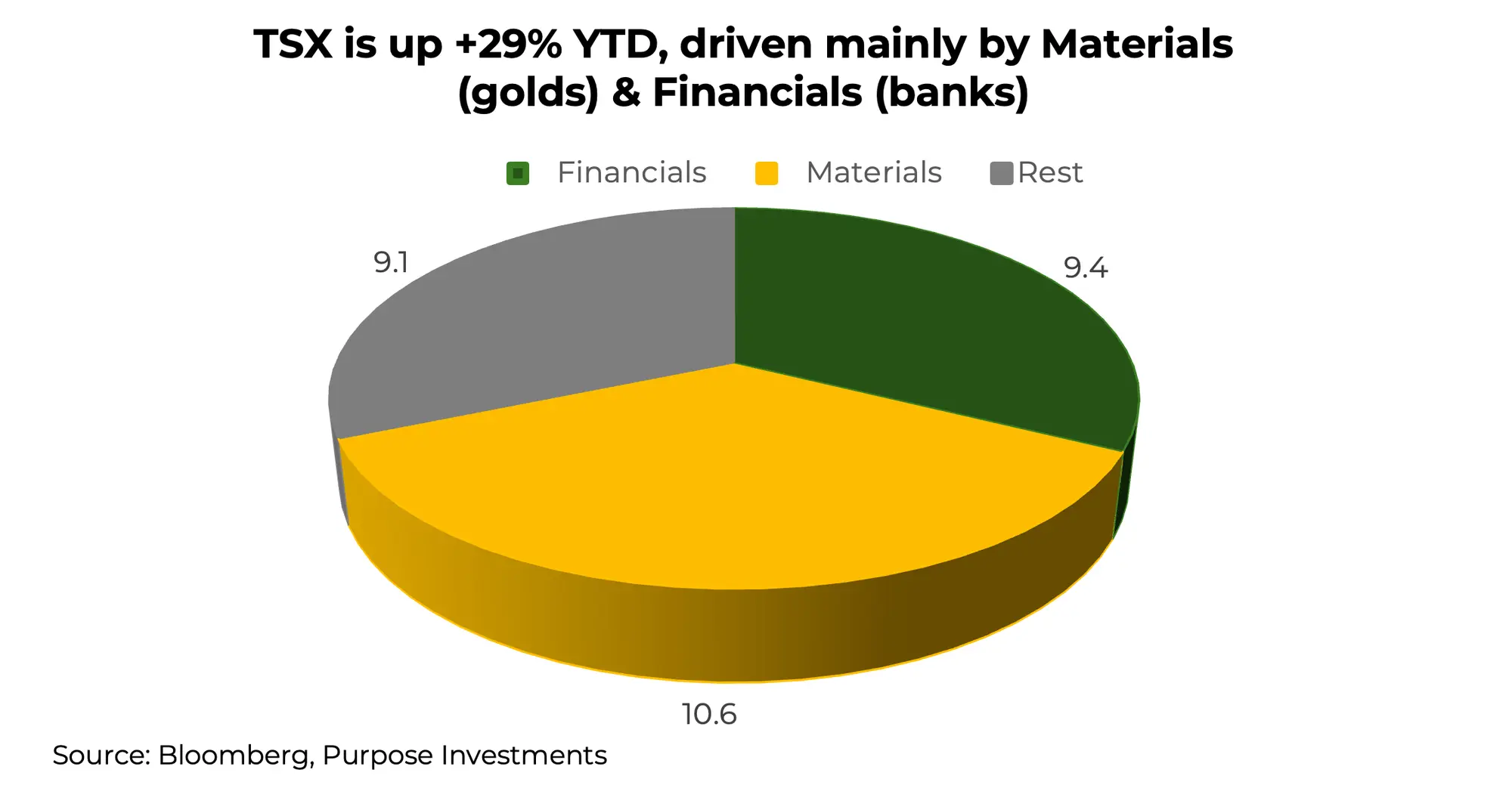

The TSX, up +29.2% as of Nov 26, has enjoyed an amazing year. In fact, this is shaping up to be the third consecutive year with strong double-digit gains (not trying to jinx it). The TSX’s performance in 2025 is perhaps even more impressive than in previous years, given a clearly negative tariff environment, a lacklustre housing industry and oil being down over $10/bbl.

Most are aware of where this performance came from: banks and gold. Of the 29% gain, Materials and Financials provided 20% of this. We don’t want to downplay the contribution from Shopify and Celestica (3.5%). Unfortunately, beyond these groups, gains were certainly hard to come by.

Perhaps the more challenging issue is that, within Materials, the main contributors were gold names, and within Financials, it was mainly the banks. There are 32 gold companies and seven banks in the TSX Composite’s 234 members, which means 17% of the TSX names drove more than half the gains. If you didn’t own enough of these so far in 2025, it has likely not been nearly as enjoyable.

Perhaps the more challenging issue is that, within Materials, the main contributors were gold names, and within Financials, it was mainly the banks. There are 32 gold companies and seven banks in the TSX Composite’s 234 members, which means 17% of the TSX names drove more than half the gains. If you didn’t own enough of these so far in 2025, it has likely not been nearly as enjoyable.

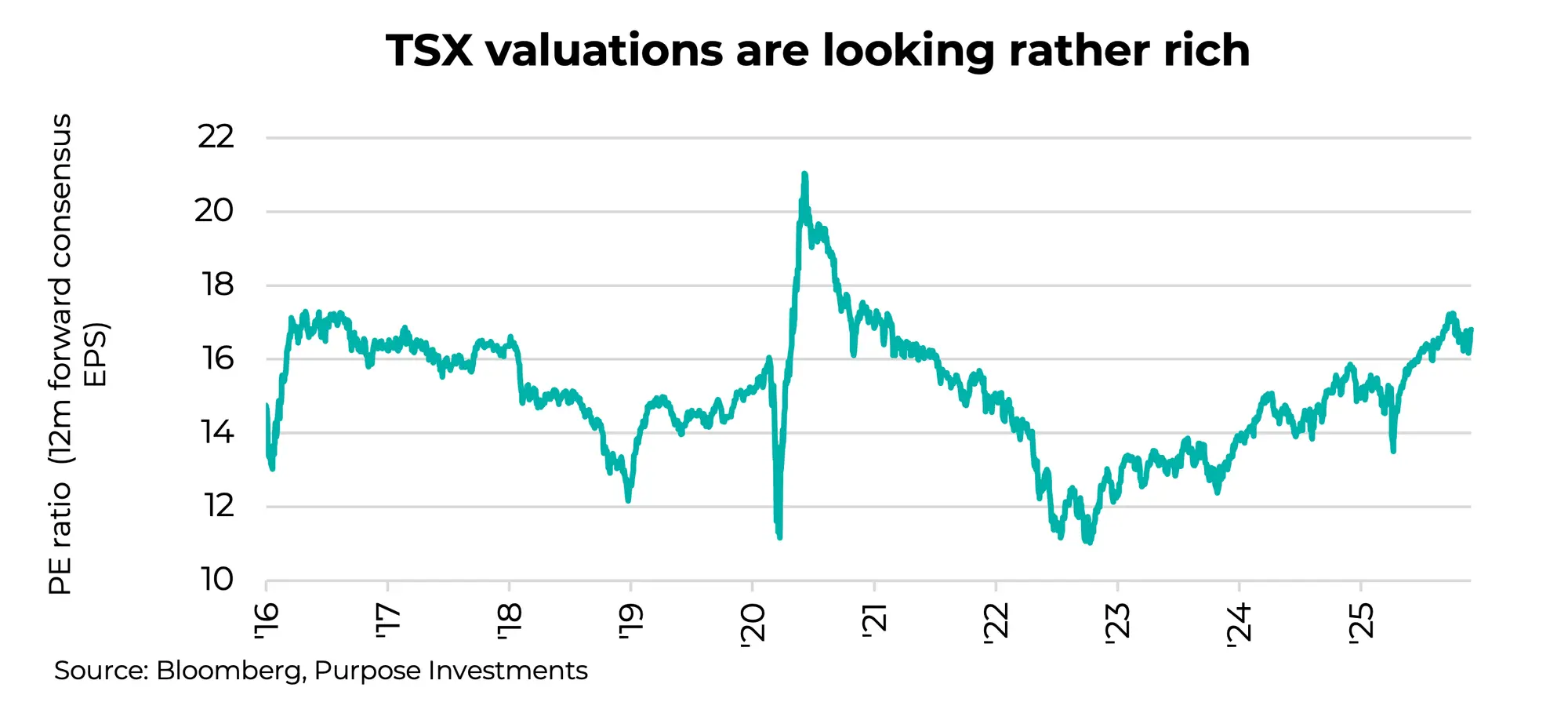

A 29% year-to-date gain is awesome, but this has pushed valuations for the TSX from 13.1x two years ago to 16.8x today. Which raises the question: with elevated valuations, should we expect strong gains to continue into 2026?

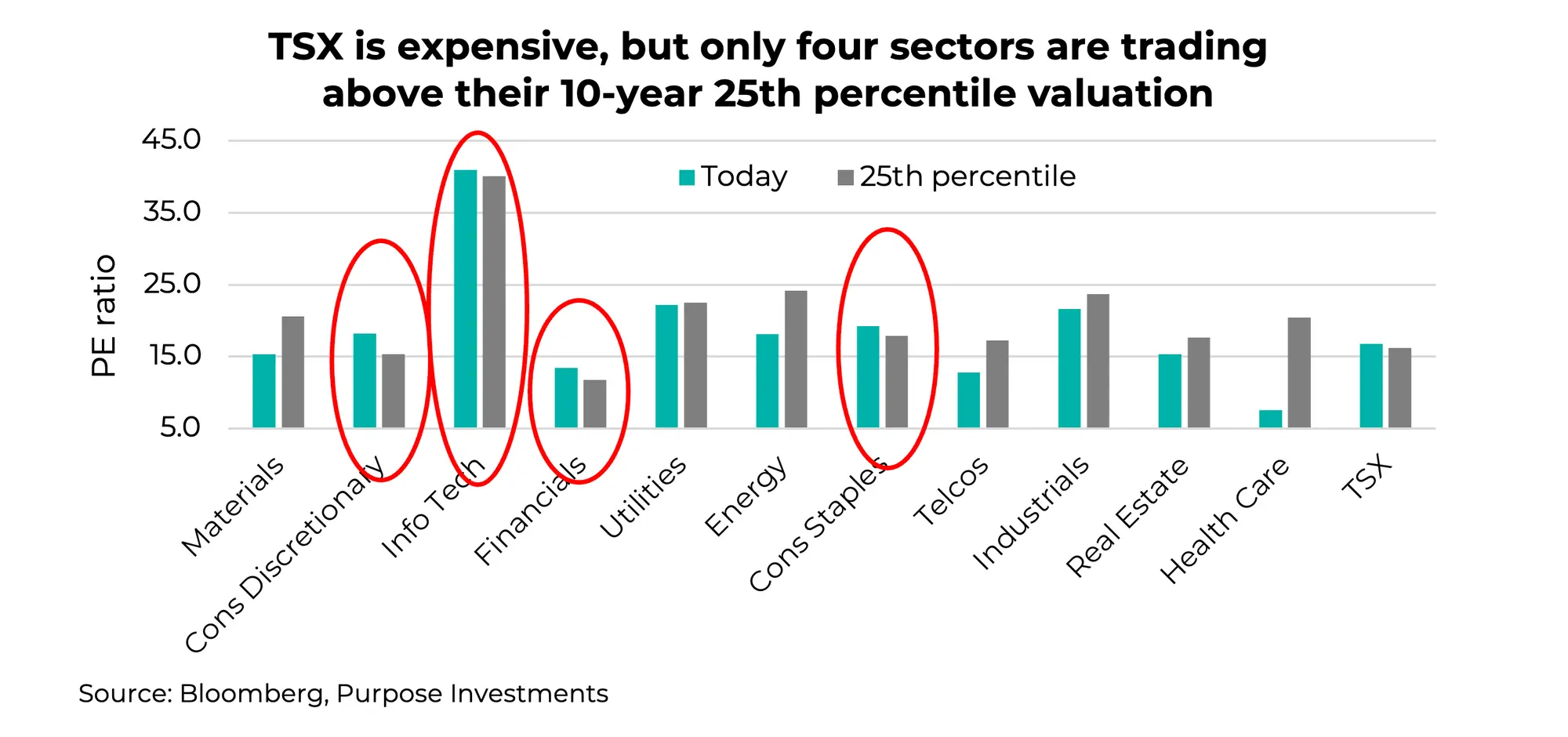

One of the challenges with aggregate market valuations is the composition of the market. The TSX has some pretty big sectors that drive the overall market and valuation. Let’s dig in to see if it really is expensive, looking at individual sectors or companies for better clarity. Are there other areas that could keep these strong returns flowing into 2026?

The valuation story of the TSX does look a bit better under the hood. Looking at the past 10 years of valuations, the TSX is in the top quartile valuation bracket (16.8 vs 16.2x). Unlike with fund performance, the top quartile is not good in this case, as it’s the top 25% of valuation instances over the past decade.

So the market in aggregate is expensive, but this is driven by four sectors. Consumer Discretionary, Information Technology, Financials, and Consumer Staples are the only sectors in their respective highest valuation quartiles. That leaves seven below, including the high-flying Materials sector. Folks won’t pay up too much for the elevated earnings of gold companies because they can disappear as quickly as they appeared.

Here lies the challenge for 2026: while many sectors are still offering attractive valuations, which may be encouraging for future returns, most of these sectors are largely inconsequential for the TSX. For example, Health Care, Real Estate, and Telcos are cheap, but in total, they present a mere 4.3% of the TSX. Health Care is a paltry 0.3%, Real Estate is 1.8%, and even those Telcos are down to 2.3%. They may simply not be big enough to move the TSX in either direction at this point.

The big weights, of course, include Financials (32%), Energy (16%), Materials (14%), Industrials (12%), and Technology (10%). As goes these sectors, so goes the TSX. Financials could be a risk for the TSX given elevated valuations. They may not look overly high in the above table, but the variance in valuations for this sector has historically been pretty narrow. Maybe the better economic data will help; Canada’s GDP looked decent last week. But we do believe it will be hard for Financials to do much heavy lifting in 2026.

Materials are a wildcard as to where gold goes from here. Maybe it will keep driving the TSX, but those gains have already been pretty monumental. Maybe technology, i.e. Shopify, will contribute more.

If the TSX is going to keep pushing higher, it would likely need a lift from Industrials and Energy. Industrials are cheap as the risk of tariffs has hit this sector especially hard. Given that the U.S.-Mexico-Canada Agreement goes into review in 2026, that’s a big wildcard.

We think Energy could be a positive driver in 2026. Yes, there’s a glut of oil on the market, with many forecasters expecting surpluses to rise to one million barrels per day. But there has been a lack of big projects financed over the past few years, which could bring the market into better balance. The stocks would likely move well ahead of this, and they are attractive. More on this in our upcoming 2026 outlook.

Final Thoughts

Put it all together, and the TSX may enjoy solid returns in 2026, but it’s going to be tough given valuations. International fund flows may do the trick, as money is increasingly looking for markets outside the U.S. as the great rebalance continues. That could keep pushing valuations higher, but it’s going to be harder.

We’re a bit more cautious on Canada; it was easier to be bullish when valuations were in the 11-13x range. To keep the party going, some of the laggards, namely Energy and Industrials, will likely have to start contributing.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed; their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions, or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on them. Unless required by applicable law, it is not undertaken, and is specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events, or otherwise.

Copyright © Purpose Investments