by Michael I. Steingold, CFA, Director, Private Markets, Russell Investments

Key takeaways

- Rising long-term interest rates are reshaping the opportunity set in infrastructure investing.

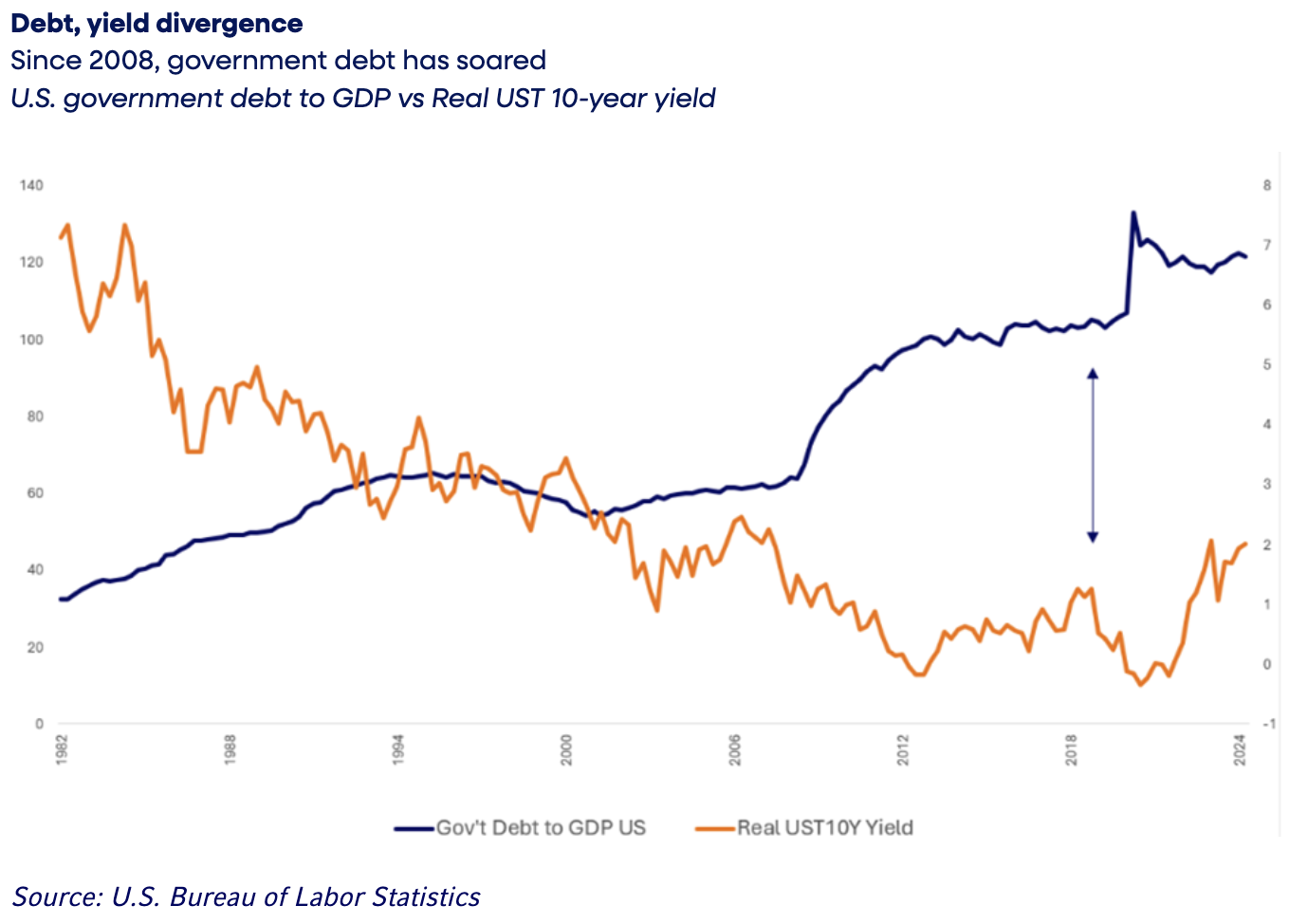

- Mounting government debt is reinforcing the need for private capital.

- We believe core-plus infrastructure may offer a more resilient path, with both downside protection and growth potential.

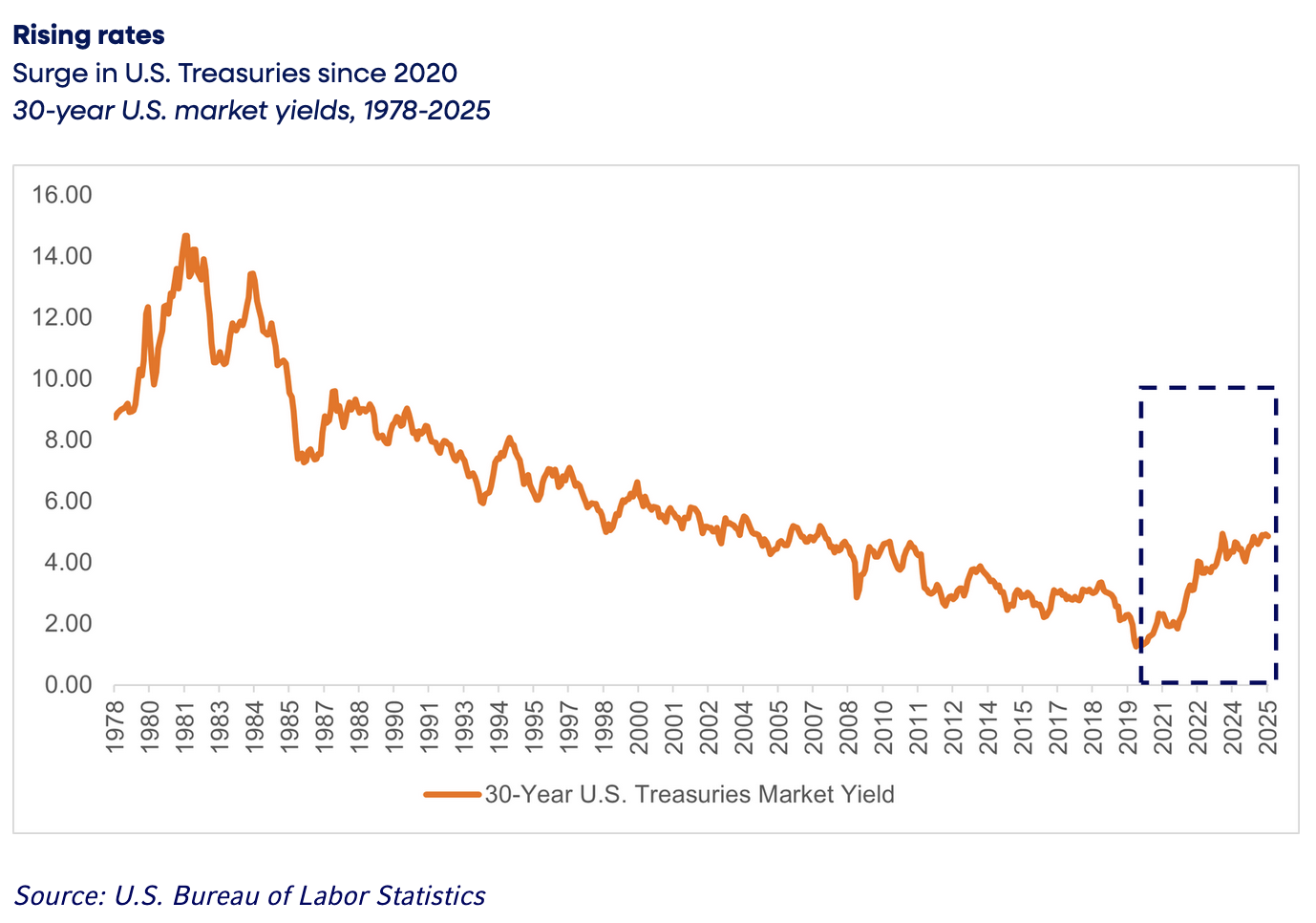

Interest rates are undergoing one of the steepest reversals in half a century. In 2020, governments could borrow for 30 years at just over 1%. Fast forward to 2025 and U.S. 30-year yields have risen above 5% for the first time since 2007.

What does this mean for infrastructure investments? For traditional ‘core’ infrastructure assets, the situation is uncertain. Core infrastructure asset valuations, such as investments in utilities or transport, typically move inversely with interest rates and risk losing some of their attractiveness.

We believe portfolios can benefit by allocating to the Core-plus segment of the infrastructure market, taking advantage of present market dynamics.

What is Core-plus?

Core-plus infrastructure investments are opportunities which have a focus on higher-growth opportunities, which are in turn less sensitive to interest rates, such as data centers or power generation. These assets are more exposed to market forces in their business plans, increasing potential returns, but with higher levels of risk.

We believe Core-plus opportunities are well positioned to absorb today’s valuation headwinds while still offering upside if yields eventually fall. In other words, Core-plus may allow investors to stay defensive and opportunistic.

Debt brings demand

A factor we believe helps to reinforce the Core-plus opportunities and offset the higher level of risk is the rising demand for private capital. Governments from across the globe face rising debt burdens, with the average debt-to-GDP ratio now exceeding 110% in advanced economies, according to the IMF.1 At the same time, long-term interest rates have risen substantially from Covid-era lows.

Governments that once relied on cheap debt to finance new infrastructure projects must now turn to private capital. For governments and other institutions such as hospitals, universities, and transportation networks, private partnerships are becoming not just a choice but a necessity. The same is also true for corporations— as long-term capital costs rise, balance sheet solutions like carve-outs or other strategies become more attractive, which unlocks infrastructure assets for investors.

Here lies a sweet spot for Core-plus investors. Delivering these new, highly rated projects may offer attractive yields—though risk profiles vary by project and structure—giving investors the opportunity to build tomorrow’s core assets.

The bottom line

The world has moved from an era of cheap money to one defined by higher interest rates and fiscal constraints. Core-plus strategies are positioned to carry the baton in this environment, offering resilience and potential growth while providing access to a pipeline of opportunities, as governments and institutions turn to private funding. We believe this creates a powerful backdrop for investors ready to bridge public needs with private capital solutions.

To learn more about how we invest in private markets, visit our webpage or get in touch.

Copyright © Russell Investments