by Jeffrey Rosenberg, Senior Portfolio Manager, Systematic Fixed Income, BlackRock

Key points:

- Before the decline over the past week, underneath the surface of markets, data showed record levels of speculation and stretched valuations that possibly contributed to the recent pullback.

- Investor enthusiasm and abundant liquidity have fueled rallies in unprofitable, highly levered stocks, while volatility in October rose alongside equity prices—an inversion of typical market dynamics.

- As markets grow increasingly concentrated in a handful of mega-cap names, liquid alternatives offer investors a way to reduce concentration risk and uncover differentiated sources of return.

Like ducks on a pond, markets often appear calm on the surface while churning furiously underneath. For financial markets, above the surface, attention has focused on equity market valuations and record-tight levels of credit spreads, but a deeper look reveals even more extreme dynamics below. Beneath the smooth surface, data shows that markets had rarely been this stretched, a factor potentially contributing to the past week’s pullback.

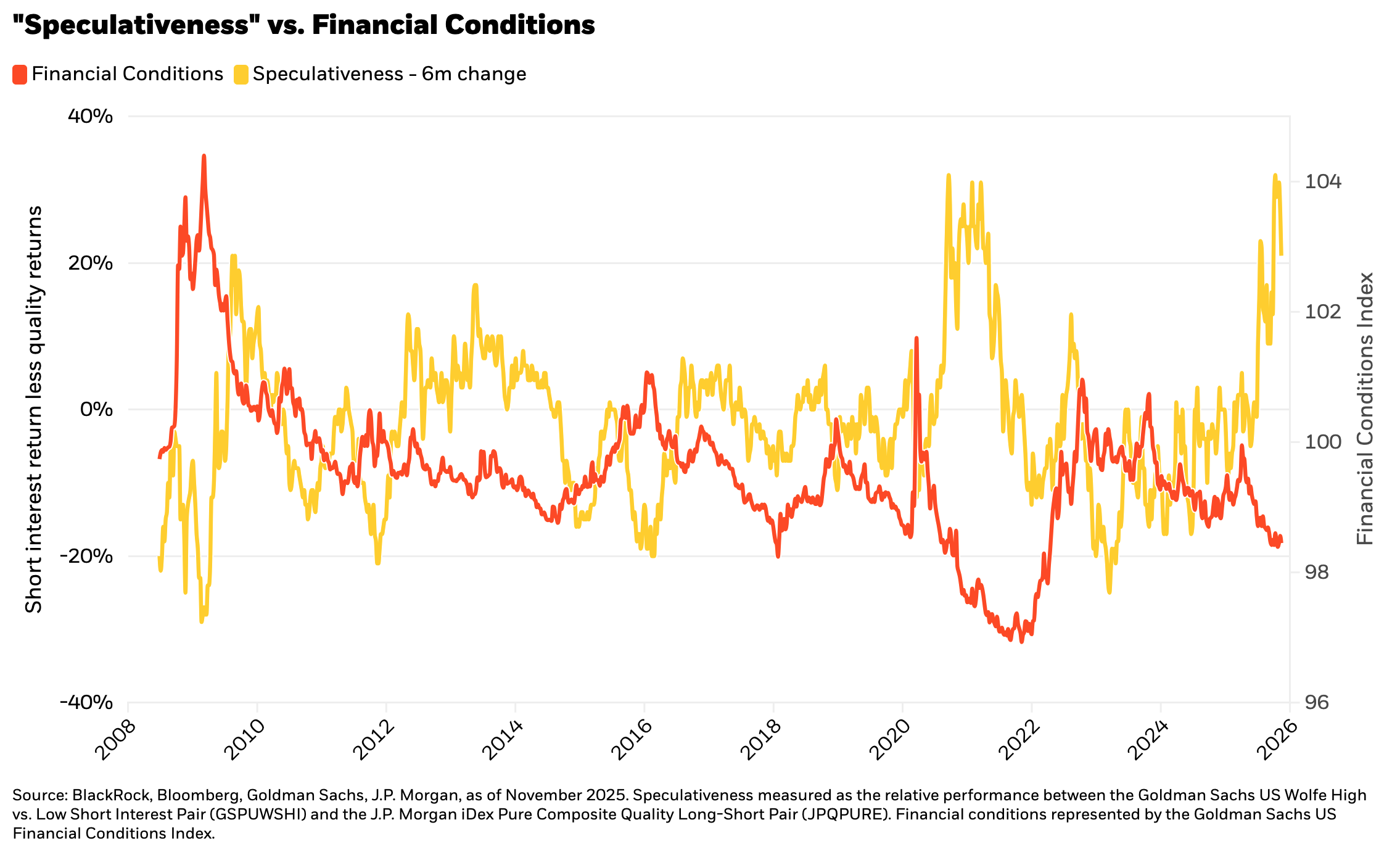

The story of this year’s rally is a familiar one: fear gave way to greed. After markets recovered from “liberation-day” tariff-induced recession worries in June, equities surged as investors piled back into risk. Defensive stocks lagged, high-volatility names soared, and short-sellers scrambled to cover positions. We capture the “speculativeness” of this behavior through the return gap between heavily shorted stocks and high-quality stocks. By mid-July, that return gap had ballooned to an extraordinary 23% over six months—one of the widest stretches in recent memory.

On the macro side, July’s payroll revisions validated the doves’ argument that earlier job gains had been overstated. Fed Chair Powell abruptly shifted focus, signaling a preference for sustaining growth over tamping down inflation concerns. Markets seized on the cue. Expectations for lower rates climbed, financial conditions loosened, and liquidity flooded back into risk assets. The result was a second surge in market speculativeness, pushing our six-month measure to a 32% return gap in early October. This renewed exuberance coincided with the easiest levels of financial conditions seen outside of the COVID response, and before that, not since the run-up to the GFC.

Volatility Turns Upside Down

Investor enthusiasm didn’t just lift prices; it flipped one of market behavior’s oldest relationships on its head. Normally, volatility rises when stocks fall, reflecting hedging demand. But in late September, volatility increased alongside higher equity prices. During the week ending October 3, implied volatility climbed even as indexes pushed higher, a telltale signature of call-option buying and speculative leverage. The week closed with five consecutive days of this inverted pattern, the longest such streak in the history of the VIX index.

When Quality Falls Out of Fashion

The speculative fever extended well beyond volatility and short covering. Market leadership shifted decisively toward unprofitable and highly levered companies. Investors rewarded balance sheet fragility while selling steady, cash-generating firms. For systematic strategies grounded in quality, stability, and downside protection, this environment proved uniquely challenging. The market’s reward system temporarily inverted—penalizing prudence while celebrating risk.

Credit Markets Reflect a Two-Speed Economy

Credit markets echoed this divide. Pricing now reflects a two-speed economy, often described as “K-shaped,” where high-income consumers’ wealth gains power overall consumption even as lower-income consumers struggle with rising delinquencies, defaults, and auto repossessions.

Corporate balance sheets tell a similar story. The dominant technology giants, flush with cash and supported by fortress-like balance sheets, enjoy record-tight spreads. Meanwhile, weaker firms on the losing end of creative destruction—and some affected by highly publicized weaknesses in underwriting that have led to a recent uptick in defaults—are facing rising defaults and growing investor caution.

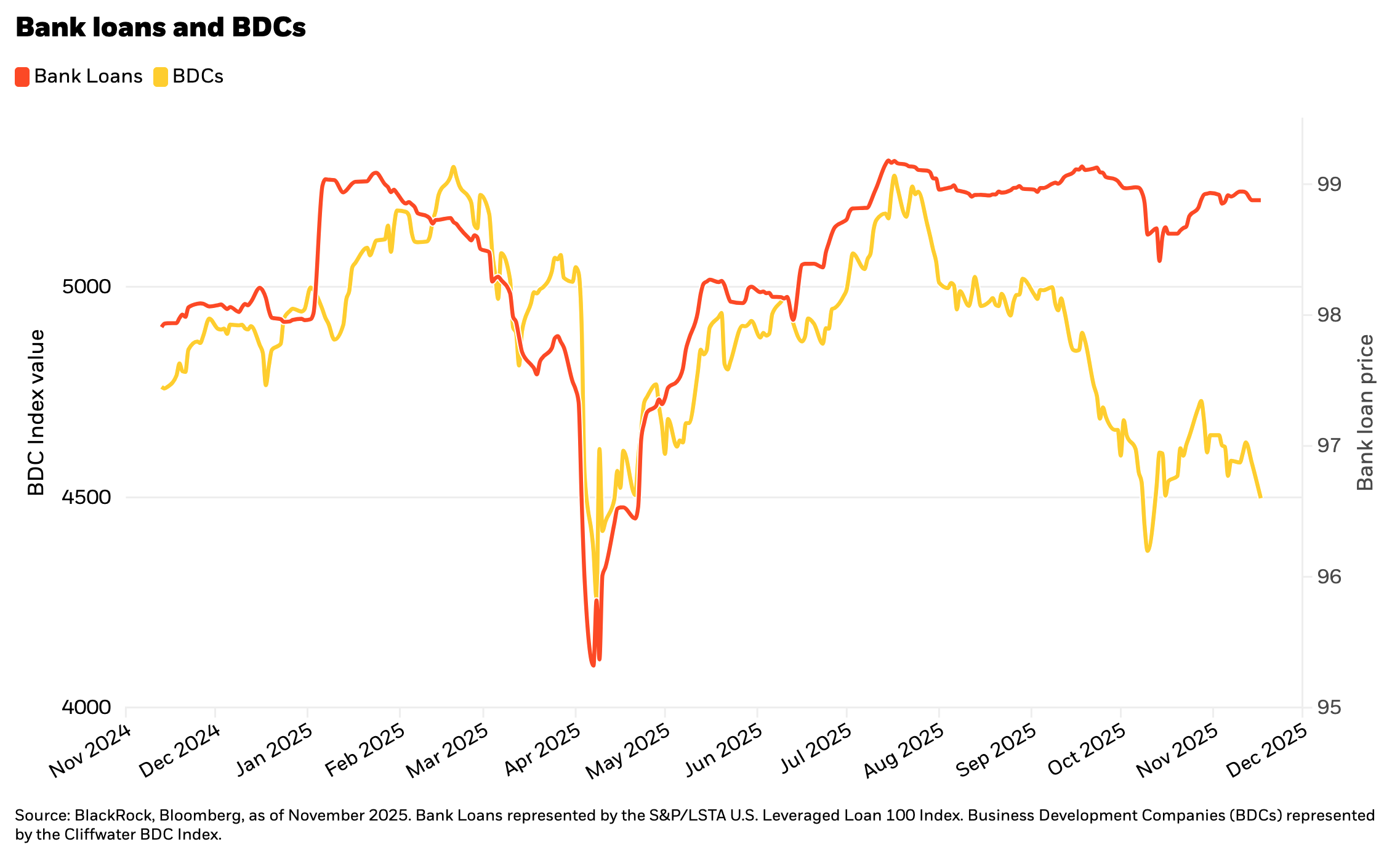

By October, syndicated loan prices had slid, and Business Development Companies (BDCs) exposed to those types of loans also suffered. At the same time, the capital demands of the AI infrastructure build-out are drawing even the strongest issuers back to debt markets, threatening to expand corporate bond supply and potentially widen spreads from today’s compressed levels.

Finding diversification in an increasingly concentrated equity market

As we look ahead, investors face a new kind of challenge—not one of volatility or valuation, but of historic concentration risk. The equity market has rarely been so dominated by a handful of mega-cap names, leaving portfolios more exposed to idiosyncratic risks than at any point in recent memory. At the same time uncertainty surrounds the Fed’s ability to respond aggressively to future shocks.

In this environment, diversification through alpha becomes essential. Our liquid alternatives suite offers investors a way to reduce concentration risk and broaden return sources without making binary calls on the path of AI-driven growth or the direction of interest rates.

Liquid alternatives have never been more relevant as a complement to traditional equity and fixed income exposures, providing balance, adaptability, and differentiated sources of return when markets move as one.