by Tony DeSpirito, Global CIO, BlackRock Fundamental Equities, BlackRock

Are U.S. stocks approaching bubble territory or is the bull run able to press on? Active investor Tony DeSpirito is optimistic but says pockets of bubble-like exuberance could create mispricings ― making it “an exciting time for stock selection.” He suggests three areas that may be ripe for the picking.

With the S&P 500 Index on pace to potentially return 20%+ for a third year running, many market observers are getting nervous. The last time this happened was during the internet bubble in the late 1990s.

Terms like “bubble” and “irrational exuberance” are making headlines. But are U.S. stock prices at or approaching levels inconsistent with their underlying fundamentals? Our view: Not overall, but some spots bear watching. As fundamental-based stock pickers, we see this setting up a favorable backdrop for stock selection.

Not your grandparents’ stock market

Price-to-earnings (P/E) ratios on the S&P 500 Index sat at nearly 24x at the end of October, roughly 50% above their long-term historical average.1 But we are not overly concerned.

Why? Because the index itself is not what it was 25 or 50 years ago. The S&P 500 today is dominated by mega-cap growth stocks. It is as concentrated as it ever has been, with our analysis finding the top 10 stocks accounting for 40% of its return profile as of October. Further review of data back to 1989 shows the index is the growthiest it has ever been, with growth stocks comprising 44% relative to value stocks at less than 8% of total composition.2 Given a historically large share of growth, we would expect the index to have a higher P/E ratio than it has historically. Most of the “Magnificent 7” mega-cap stocks carry what we would consider reasonable valuations for their superior earnings growth outlook.

Beneath the surface, we are finding plenty of very good large-cap stocks at attractive valuations ― bulls with room to run. The top line, dominated by a small group of big names, simply skews the average.

Bubbling up?

That said, we do observe some signs of irrationality, or speculative behavior, in the market today. Our review of factor returns year-to-date shows momentum stocks in the lead, a classic sign of performance chasing. Crowding in these positions can cut both ways, offering potential for above-market returns but also greater risk on a downturn.

We also find that unprofitable companies have outperformed the broader market while low-volatility and dividend-paying baskets have lagged so far this year.3 At the same time, “meme stock” investing among retail investors guided by social media trends has gained popularity.

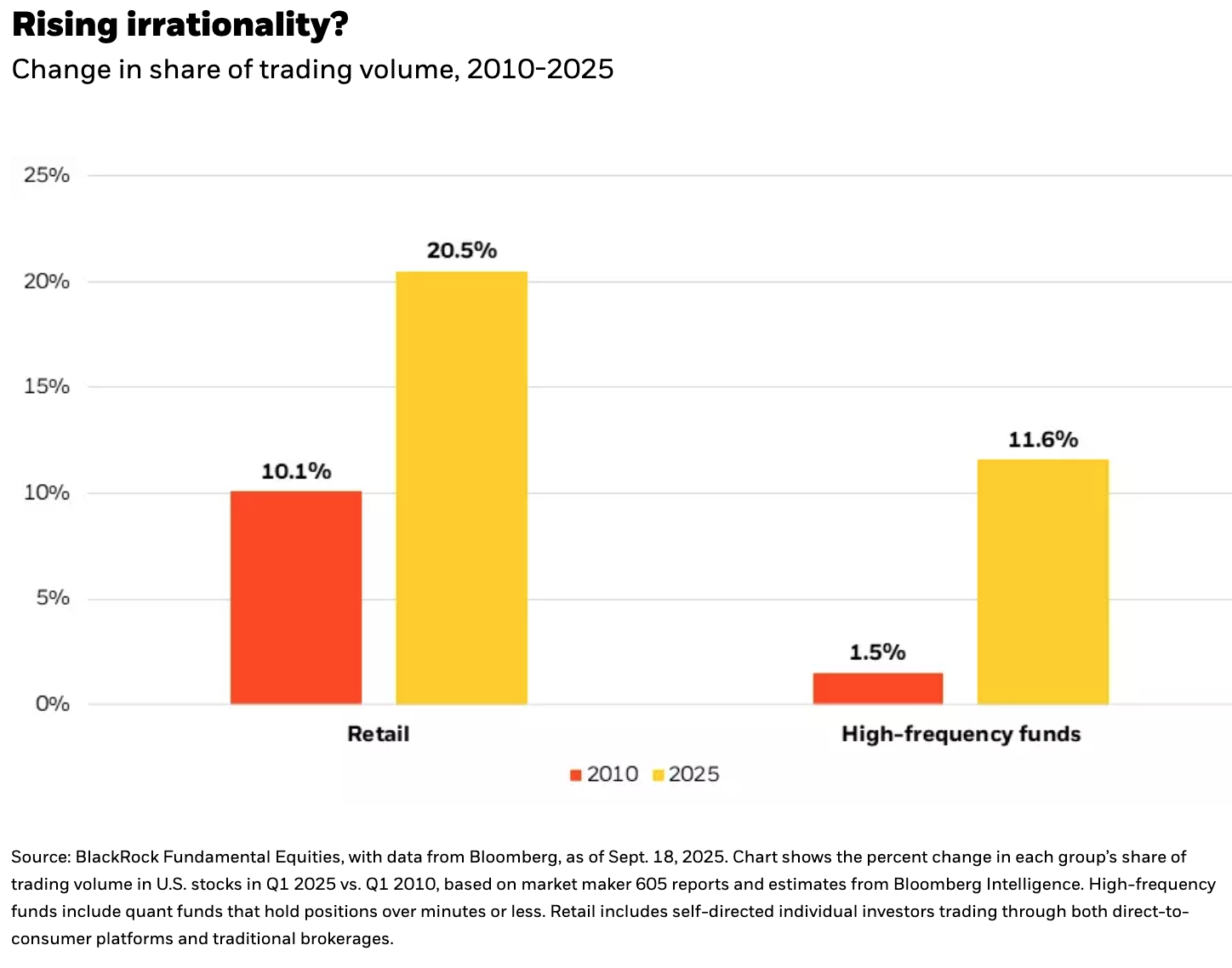

As shown in the chart below, retail and higher-frequency traders represent a much larger share of total stock trading volume relative to 15 years ago, increasing their influence on broad market movements as well as on individual stock volatility and pricing.

While some fret over a trading environment dominated by non-traditional, less fundamentally oriented investors, we see this as an opportunity for skilled stock pickers to generate additional alpha, or above-market return.

Why? Because individual stock mispricings that can arise amid pockets of irrationality often present attractive buying opportunities.

Sectors ripe for the picking?

Against this backdrop, we highlight three sectors we believe may be particularly well suited for alpha generation by fundamental-based stock pickers.

1. Technology

We do not see tech and AI stocks in a bubble. This is not 2000. The earnings of many of the publicly traded AI-leveraged companies today justify their higher prices, in our view. That was not true 25-30 years ago when the dot-com bubble inflated and ultimately burst. Many high-flying companies then were unprofitable. And our review of the top 25 tech and tech-adjacent stocks by market cap in 2000 and 2025 shows the median valuation was nearly 85% higher then versus now.4

On the contrary, we see tech as an area of opportunity for stock pickers. Because AI is an innovation unlike any before, with implications throughout the economy, backward-looking algorithms are unlikely to provide a reliable guide to the next leg of AI earners. But fundamental analysts can look across the AI stack to identify potential sources of alpha as the technology and its use cases evolve. We look for underappreciated beneficiaries whose prospects may be obscured within the larger swell of this market-moving mega force.

2. Healthcare

Despite underperformance in recent years, we believe healthcare is well underpinned by structural tailwinds from aging populations and a growing need for medical care, as well as an innovation impulse. Overall valuations are low relative to the broad market, yet this is not a homogenous sector. Selectivity will define outcomes. Consider one stock in the HMO space that has appreciated 68% year-to-date while a competitor’s stock price fell 32%.5 Portfolios that owned the former and not the latter realized a dual benefit.

3. Financials

An easing regulatory environment for the financials sector is a pronounced shift relative to the regime in place since the 2008 Global Financial Crisis (GFC). This forms a new structural backdrop for stock selection. Companies with lower return on equity (ROE) should do disproportionately well relative to post-GFC outperformers that have less room to increase ROE and expand their earnings and market multiple.

The bottom line

We do not see a bubble in U.S. stocks today. Some areas of the market may be inflated by overexuberance and crowded positioning, but others have room for multiple expansion. As stated in our latest Equity Market Outlook, we believe leaning into the virtues of bottom-up stock analysis and selection can help to avoid the pitfalls of psychological contagion and crowded positioning that typically arise amid pockets of irrational exuberance.

In short, fundamental research focused on deep company analysis lends discipline and rationality to equity investing, virtues we find particularly relevant amid a pick-up in speculative behaviors.