by George Smith, Portfolio Strategist, LPL Research

Additional content provided by John Lohse, CFA.

Market corrections often present chances to acquire quality assets at attractive valuations. Hence, “buy the dip” has long been a mantra for many investors. Historically, market pullbacks have offered attractive entry points for those willing to lean into volatility. However, following this April’s trade policy induced correction, those opportunities have been scarce. In what’s been characterized as a risk-on, high-beta market rally off the April lows, the brevity of such “dips” has stood out to investors and asset allocators. Here, we examine both the depth and duration of these dips.

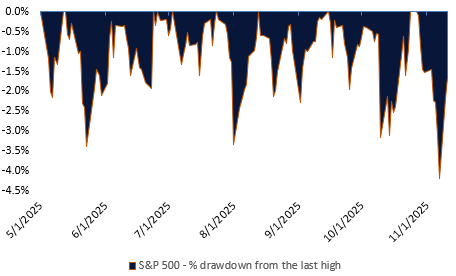

Since the end of April, the largest dip the S&P 500 has offered was just 4.2% off its all-time highs. Said differently, starting May 1, if an investor wanted to get the most optimal buying opportunity off the most recent highs, and was able to time the market perfectly, they’d only receive a 4.2% discount. Not only that, but that 4.2% opportunity only materialized last week, on November 7. If an investor had a buy limit order that was set to trigger at 5% below the last high, they’d still be holding cash. We’re using an index for the sake of this exercise, which of course can’t be invested in directly, but a passive ETF that tracks the index would yield a similar result. The magnitude and length (or lack thereof) of these instances when the index traded below the last high are highlighted in the “Shallow and Short “Dip Buying” Opportunities” chart.

Shallow and Short “Dip Buying” Opportunities

Source: LPL Financial, Bloomberg 11/11/25

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Putting this into context, between 2020–2024, there were three occurrences of the S&P 500 being at least 10% below all-time highs. On average, during that time frame, when discount buying opportunities occurred, the average drawdown was 7.8%, but since April of this year that number has been 1.1%. So, if you were to pick days on which the market traded at a discount to the previous high, and through divine strokes of serendipity, happened to pick the lowest possible entry point on each of those days, you’d get just a 1.1% discount.

Not only has the depth of drawdowns been shallow since April, but the duration has been short-lived. New highs have been ubiquitous. The longest period during which the S&P 500 didn’t register a new high was just 10 trading sessions (as of market close on November 11, 2025), with the average length of drawdowns being just over 3.5 days. Yet, between 2020–2024, there were 14 instances where it took at least 10 sessions for the market to re-capture previous highs, and the average length of drawdowns was over 15 days.

Why Pullbacks Have Been Scarce

Resilient economic data, resilient earnings, easing trade tensions and abundant liquidity have fueled the almost relentless high-beta rally since “liberation day”. Investor sentiment remains risk-on, and technical momentum has amplified gains, leaving little room for prolonged drawdowns. Ironically, retail investor psychology of “dip buyers” may be helping to shorten the dips. Fear of missing out (FOMO) on gains keeps retail buyers engaged, and the quick rebounds condition these investors to “buy immediately,” shortening dips.

Conclusion

So, what can an investor do? The simple answer is to stay disciplined and remain invested with a thought-out approach to asset allocation. The pragmatists among us at this point would have concluded that minimal drawdown pain has meant attractive capital appreciation, if invested, which is exactly right. A regular investment regime may provide some dollar cost averaging opportunities and have a plan in place to execute a rebalance or asset allocation update when the opportunity arises.

Tactical Positioning

LPL Research’s Strategic and Tactical Asset Allocation Committee (STAAC) has positioned our Tactical Asset Allocation (TAA) and tactical model portfolios to remain fully invested, targeting benchmark weight allocation to equities. We prefer large caps over small caps and favor growth over value, and the Committee recommends well diversified regional exposures, with benchmark-level allocations to the U.S., developed international, and emerging markets.

Within fixed income, the STAAC holds a neutral weight in core bonds, with a slight preference for mortgage-backed securities (MBS) over investment-grade corporates. The Committee believes the risk-reward for core bond sectors (U.S. Treasury, agency MBS, investment-grade corporates) is more attractive than plus sectors. The STAAC regularly convenes for discussion and analysis on entry points and opportunities, however elusive they’ve been.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: #825029

Copyright © LPL Research