by Kohei Higashi, Tom Cooney, Cheryl Frank, Lisa Thompson, Chris Thomsen, Capital Group

The world is undergoing significant structural change defined by rising geopolitical conflicts, trade barriers and a more fragmented global landscape. As this multi-year realignment plays out, identifying which companies can best adapt to the new framework is paramount to successful investing.

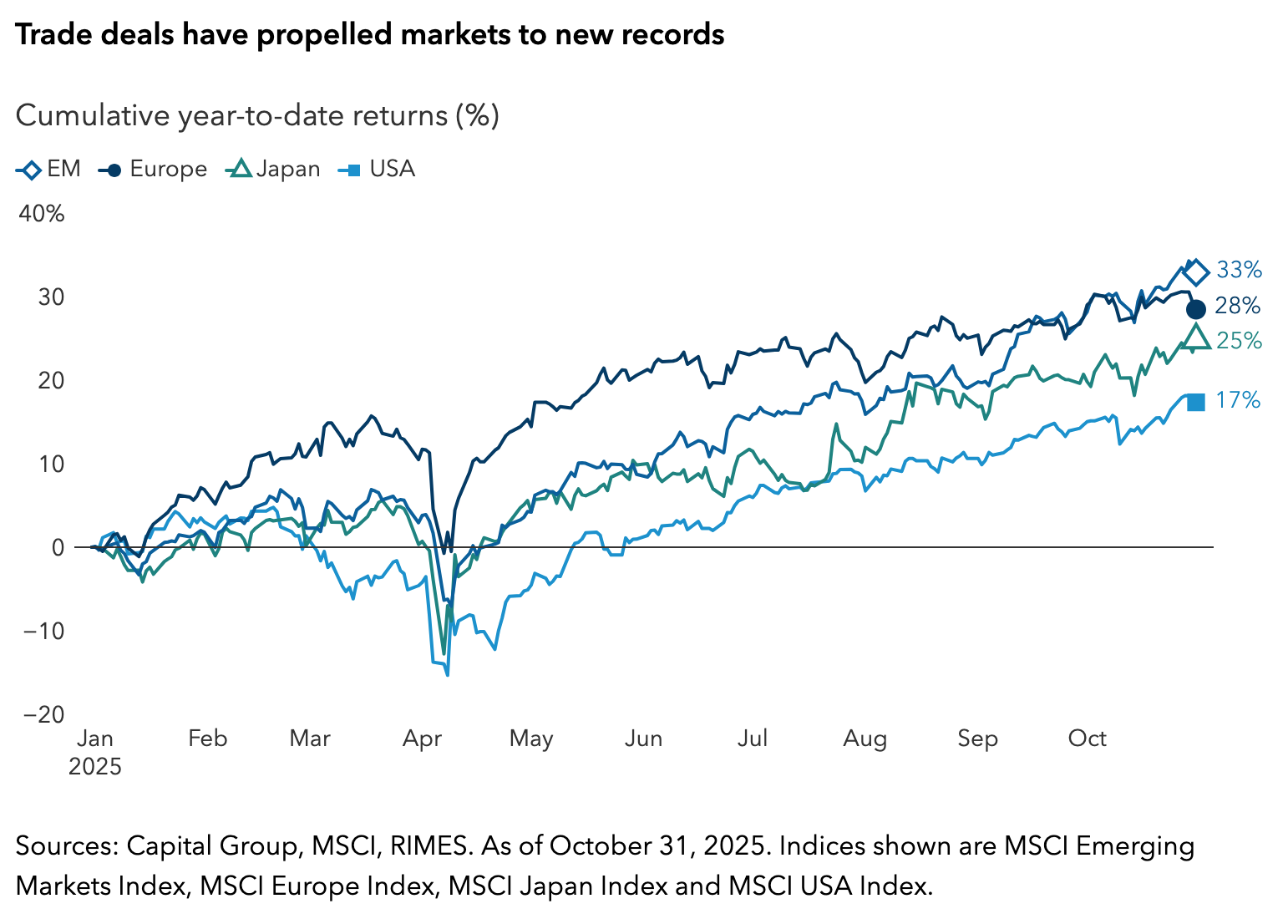

“With trade more restricted, the global economy will be less efficient, forcing companies to innovate to combat higher costs,” says portfolio manager Kohei Higashi. So far, markets worldwide are constructive about the opportunities ahead. Here are three areas in which we see investment opportunities.

1. New industrial policy rewires supply chains

Geopolitical tension impacts defence spending, but it’s also pressuring supply chains that underpin the global economy.

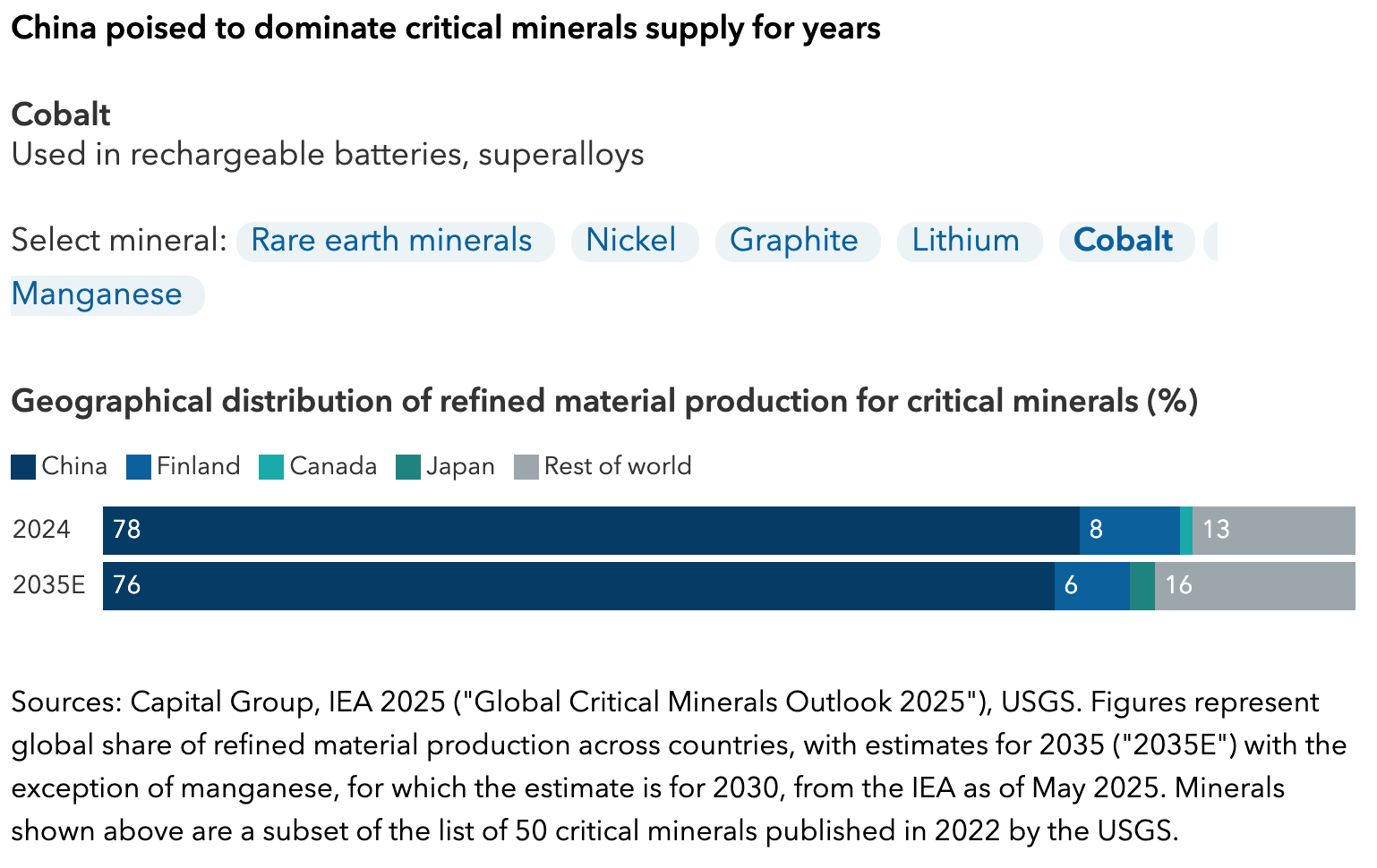

In response, the United States government has taken strategic equity positions in semiconductor company Intel, rare earth producers MP Materials, Lithium Americas, Trilogy Metals and U.S. Steel. Additionally, the administration rolled back pollution rules tied to copper and signed separate deals for a 15% cut of NVIDIA and AMD’s chip sales to China.

These agreements represent a new industrial policy centered on national security, says international policy advisor Tom Cooney. “Big goals such as creating a domestic alternative to China’s rare earth market can only be done within a short time frame via public-private partnerships. Think Project Apollo to beat the Soviets to the moon or Operation Warp Speed to develop COVID vaccines in record time.” China’s rare earth export restrictions highlight what’s at stake given their necessity to smartphones, electricity grids, defence systems and health care.

Globally, commodities remain attractive in this new environment, particularly at current valuations, says portfolio manager Lisa Thompson.

“There’s less slack in the system. Often, commodity prices surge with even a modest uptick in demand because new supply can take years to come online,” she explains. The expected increase in demand could benefit certain mining companies such as Canada’s Barrick Mining, Glencore in Switzerland and U.S.-based Freeport-McMoRan.

“In a bid to tighten supply chains, the Trump administration is also strong-arming companies to reshore manufacturing,” says portfolio manager Cheryl Frank. She believes Apple and chipmaker Taiwan Semiconductor Manufacturing’s promised investments in the U.S. have the potential to spur growth in U.S. industrial sectors over the long term.

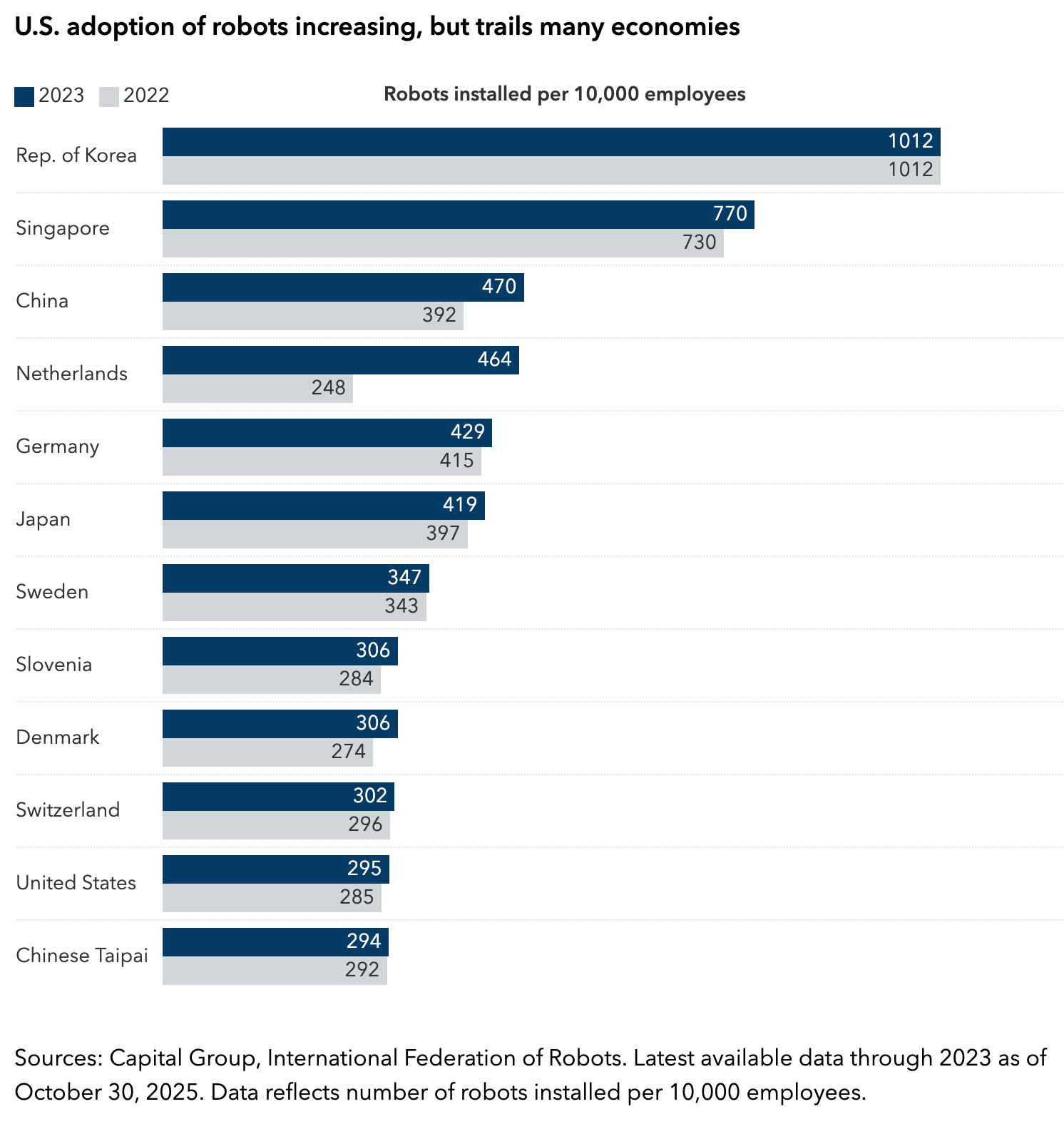

2. U.S. playing catch-up on automation

Tariffs, reshoring and crackdowns on immigration are likely to accelerate automation, Higashi says. That’s because companies may have limited access to low-cost labour and materials — typical areas that allow profit margins to grow.

Reshoring is difficult in part because the U.S. labour market is wired for globalization, a decades-long process that saw workers entering higher paying jobs and white-collar work rather than manufacturing.

Since he began visiting Chinese factories in 2000, Higashi has seen firsthand their transition to efficient, low-cost manufacturers. The U.S. is similarly turning to automation to fill labour and skill gaps in manufacturing. Moreover, advances in AI could accelerate the process and extend automation to services industries.

U.S.-based Applied Industrial Technology, which sells robotic arms and sensors, is well positioned to capitalize on higher demand for automation technologies. German conglomerate Siemens has a sizable market share in China for its automation products and could also experience higher U.S. demand.

3. Multinationals could have an advantage

Some investors might think domestic companies such as steel producers, for example, have the most to gain from shifting trade policies. But according to Higashi, multinationals have certain advantages.

“Very agile and decisive multinationals are better equipped to adapt their resources and respond to constantly changing policy directions,” he explains, citing their familiarity with cross-border regulations.

Northrop Grumman stands out among defence companies for the technology behind its stealth jets and long-range weapons — and a global footprint that spans the U.S. and its allies. Higashi sees growth potential in the company’s international markets as Japan, Germany and other European countries ramp up defence spending.

There are many attractive non-U.S. companies that are competitive on a global scale, according to portfolio manager Chris Thomsen “Holland-based ASML essentially has a monopoly on machines that make the leading edge AI chips, while China’s Tencent is considered one of the most innovative fintech, gaming and social media companies in the world.”

This doesn’t mean trade dynamics won’t help companies with a strong domestic presence. In fact, companies with established local manufacturing in large economies like China and the U.S. could see increased demand if tariffs make foreign alternatives more expensive.

Amid the debate about where to invest during times of upheaval and structural change, what’s clear is that leadership matters. Management teams that are nimble, have a sense of urgency and are willing to divest large but low-profit businesses to focus on their strategic core businesses tend to be more successful, according to Higashi. One example is Japanese conglomerate Hitachi, which sold several business segments starting in 2009 to concentrate on infrastructure and information technology solutions.

“Investors need to assess each company's unique situation and their management's ability to make decisive changes,“ Higashi adds. “Ultimately, this environment calls for careful stock selection to find the winners.”

Kohei Higashi is an equity portfolio manager with 28 years of investment industry experience (as of 12/31/2024). He holds an MBA from Harvard and a bachelor’s degree from the University of Tsukuba in Japan.

Tom Cooney is an international policy advisor and has 31 years of foreign affairs experience (as of 12/31/2024). He holds a master's degree in international business studies from the University of South Carolina and a bachelor's degree in communications from Cornell University.

Cheryl Frank is an equity portfolio manager with 27 years of investment industry experience (as of 12/31/2024). She holds an MBA from Stanford and a bachelor’s degree from Harvard.

Lisa Thompson is an equity portfolio manager with 37 years of investment industry experience (as of 12/31/2024). She holds a bachelor’s degree in mathematics from the University of Pennsylvania and is a CFA® charterholder.

Christopher Thomsen is an equity portfolio manager with 31 years of investment industry experience (as of 12/31/2024). He holds an MBA from Columbia and a bachelor’s degree in international economics from Georgetown University.

Copyright © Capital Group